Housing Market Down, Inflation Up

Economics / US Economy Oct 18, 2007 - 04:35 AM GMTBy: Tim_Iacono

Two important economic reports were released just a short time ago. Housing starts and permits for new constuction are way down and inflation is on the rise. Surprise!

Two important economic reports were released just a short time ago. Housing starts and permits for new constuction are way down and inflation is on the rise. Surprise!

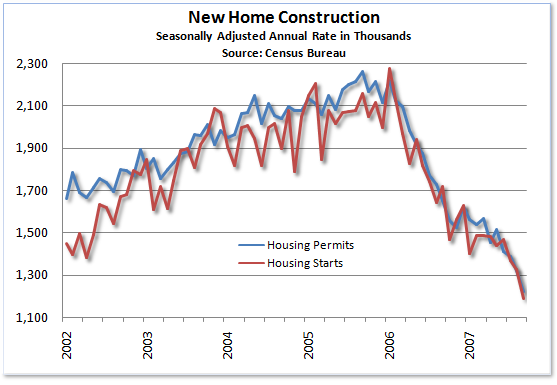

Housing starts plunged to a 14-year low last month, falling 10.2 percent from August, and building permits fell 7.3 percent to the lowest level since 1995. Credit market tightening and increasingly skittish home buyers (for good reason) are likely to put more downward pressure on construction activity well into 2008.

From a Bloomberg report come these comments from Deutsche Bank economist Carl Ricadonna, "Housing continues to get worse and worse. The contraction will go on into at least the middle of next year. There are certainly going to be more rate cuts by the Fed."

It all seems so obvious now...

This follows yesterday's new all-time low for the home builders' housing market index that fell two points to 18 in October. The current level of pessimism exceeds the previous low set in January of 1991 as consumers are showing very little interest in home purchases, many of them opting to wait for prices to fall further - it looks like housing deflation is going to be a problem.

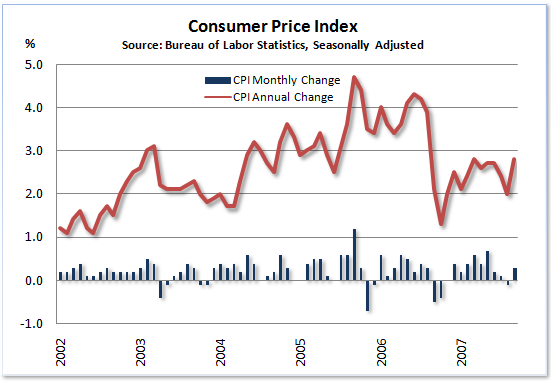

On the inflation front, higher consumer prices across the board lifted the consumer price index 0.3 percent in September putting the year-over-year increase at 2.8 percent. Unless energy prices make a hasty retreat from current levels, this is probably just the first in a series of monthly reports that show sharp price increases.

Recall that last week's wholesale price report showed a full 1.1 percent gain in September and an annual rate of over four percent - at least some of these higher costs will feed through into retail prices in the months ahead.

Food prices rose 0.5 percent in September with a year-over-year gain of 4.4 percent - if you've been grocery shopping lately, even this number might sound low. The energy index rose 0.3 percent last month and is up 5.3 percent from year ago levels - retail gasoline prices have been fairly steady in recent weeks, but that may be about to change as crude oil doesn't appear to be coming down from its new, higher $80 range.

Now would probably be a good time for the Bureau of Labor Statistics to revert to using "real" (i.e., falling) home prices rather than owners' equivalent rent in calculating the consumer price index. These falling prices may help to offset rising prices just about everywhere else and then they could still say that consumer prices are only rising at an annual rate of two percent.

For more on owners' equivalent rent see:

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.