Emerging Markets Investment - Brazil the Next China Like Miracle

Stock-Markets / Investing Jan 22, 2007 - 12:47 PM GMTJust a few years ago, suppose you had known that China, a backward, deeply impoverished communist country, would quickly transform itself into the fastest-growing capitalist economy on the planet. And suppose you had invested $10,000 in the leading Chinese companies.

That single insight alone — plus a dose of standard due diligence — could have been sufficient to transform your initial investment into $50,000, $100,000, or as much as $200,000 today.

Even if you could go back just 19 months ... and even if you made no effort whatsoever to pick a better-than-average Chinese company ... your $10,000 invested in the Shanghai Composite Index would be worth $28,372 at the close of trading this past Friday.

Needless to say, you can't turn back the clock. But you can do the next best thing:

You can find a country that's almost as big as China ... boasts even more natural resources ... enjoys a broad, modern industrial base ... and is closer to the U.S. culturally, politically and geographically ...

but ...

is still on the launch pad, in the pre-take-off stage, giving new investors an opportunity to catch a ride without overpaying and without a long wait.

That country is Brazil.

Indeed, a few years ago, my staff and I looked at the world's four largest emerging economies: Brazil, Russia, India, and China (the BRIC countries).

We saw the amazing profit potential offered by their vast natural and human resources.

We knew that, despite serious social and political hurdles, they would start to grow by leaps and bounds.

And we picked the one that had the highest level of new investment pouring into the economy — from the government, from domestic enterprises and from foreign investors: China.

Sure enough, China took off. So did India and Russia. But Brazil, despite major fiscal improvements, lagged behind the other three.

Now, I believe that's about to change.

Hard to Imagine Brazil

Growing Like China?

Then just look back to recent history: In the 1970s, Brazil was expanding at the China-like clip of about 9 percent. Each year, Brazil was boosting exports by approximately 20 percent. And within less than a decade, thousands of early investors became multi-millionaires.

But the party came to a premature end for one simple reason: Inflation.

The primary difference today: Brazil's inflation monster has been tamed ...

Twelve years ago, Brazil stopped rampant inflation in its tracks by introducing a new currency, the real.

Ten years ago, it passed a law preventing federal and local governments from spending beyond their means.

And starting four years ago, Brazil's President, Luiz Inácio Lula da Silva (“Lula”), transformed the country from one of the world's most fiscally shaky nations into a model for fiscal responsibility.

Lula was born in a dirt-poor family in one of the most godforsaken regions on Earth — the parched and semi-feudal northeast of Brazil. With his mother, sisters and brothers, he fled to the industrial state of São Paulo on the back of a truck. And five decades later, he was swept into the presidency with a landslide victory.

In his first term, which just ended ...

He reduced consumer price inflation from 12.5% in 2002 to under 3% in 2006.

|

He paid off every penny owed to the IMF.

He slashed Brazil's total domestic debt load.

He boosted the value of the real from $0.28 to $0.47.

And he transformed Brazil's trade balance, formerly a deficit, into a $46 billion yearly trade surplus.

The market's response:

• When Lula first took office four years ago, Brazil's finances were so shaky and foreign creditors so frightened, Brazilian businesses and governments had to pay through the nose to borrow money — a whopping twenty-four percentage points in interest above U.S. Treasury rates.

Today, thanks largely to Lula's conservative fiscal policies, Brazil's finances are so sturdy and foreign creditors so encouraged, Brazilian borrowers are being charged less than two percentage points above U.S. Treasury rates.

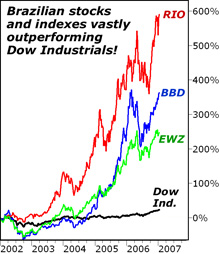

• When Lula came to power, the São Paulo stock market was plunging. But now, it has been booming. Brazil's Bovespa Index rose 15% in 2004, 30% in 2005, 35% in 2006. And over the past five years, the most widely traded Brazil ETF (EWZ) has surged from $13.35 per share to $45.77 at Friday's close, a rise of 243%.

But from everything I can see, this is just the beginning.

Next: The Take-Off Phase

I have deep roots in Brazil. My first trip to Brazil was in 1953, when I was six years old. I attended primary school in the central state of Goiás, where the capital city of Brasília would later be built. I attended high school in the southern state of São Paulo, the industrial powerhouse of Brazil. And I married Elisabeth, whose family owns a sugar plantation in São Paulo.

I've lost count of how many times I've returned to Brazil over the years. But I've been going almost every year since I was 20. So that's easly over 30 trips. I know the country well. I am in close touch with its strengths and fully aware of its weaknesses. And I can tell you flatly: But Brazil is about to take off. Not someday in the future! Not if and when this or that problem is resolved! This year!

The clincher: Lula's second term in office, which began this month, helping to kick off a whole new series of economic reforms. Until now, for example, Brazilian entrepreneurs had to plow through endless amounts of red tape to start a new business and then pay at least eight different taxes to operate one. But starting this year, they will enjoy vastly simplified rules for incorporation ... just one, lower tax instead of eight ... plus double the supply of credit.

Also starting this year, investment in Brazil is likely to accelerate. Already, new projects approved by the national development bank have surged 36%. Ford and GM have committed billions to launch new auto models in Brazil. And most significant of all ...

Investments in new Brazilian projects will reach 25% of GDP this year, similar to the levels that have prevailed in China and India! This investment explosion is key. Without it, China and India would not be where they are today. With it, Brazil is, right at this very moment, revving up for an economic take-off that could rival China's and India's.

It won't happen overnight. Even Lula's forecast of 5% GDP growth in 2007 is being questioned by some analysts. But with surging investment, Brazil's economy has the potential to steadily accelerate to China-like growth levels by the end of the decade.

Your Next Steps

You can either wait for Brazil to take off ... and pay much higher prices for Brazil-based investments. Or you can act now ... and pick up Brazilian companies that are selling for lower price-earnings ratios than the equivalent companies in other emerging markets.

Brazil is best known for its production of agricultural commodities — first coffee ... then sugar ... then soybeans ... and, most recently, ethanol. (For details, see my free report “Ethanol Explosion! How to Profit.” )

But Brazil is also among the leading exporters of aircraft ... mineral ores ... metals and steel.

Brazil makes more automobiles than the U.K., Italy, Mexico or India ... and it is the world's largest maker of cars with flex engines (that can run on either gasoline or ethanol).

No investment is without risks, and Brazil certainly comes with its fair share. But consider some of Brazil's leading companies traded on U.S. exchanges:

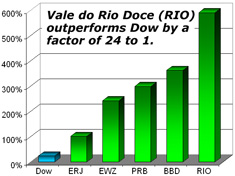

Embraer (ERJ) is a $7 billion company which has steadily risen to the #3 spot among the world's largest aircraft manufacturers — ahead of Canada's Bombardier and surpassed only by Boeing and Airbus. The company is especially strong in the fast-growing market for regional aircraft — like the 50-passenger twin-jet ERJ 345 and the 37-passenger ERJ 135. And it makes military aircraft for transport, training and light attack — sold not only to the Brazilian Air Force but also to 16 countries in Europe and Latin America, including the United Kingdom, France, Greece, and Mexico. Since January 2002, while the Dow Jones Industrials has risen by 24.7% through last Friday's close, Embraer is up 102%, rising four times faster than the Dow.

Petrobrás (PBR) has done even better, rising twelve times faster than the Dow in the past five years. The company has achieved Brazil's long-yearned-for self-reliance in oil and is leading the country's drive to expanding ethanol exports. It supplies oil and natural gas to refineries in Brazil and sells surplus production in foreign markets. It refines, transports, exports oil ... buys crude oil and oil derivatives ... owns petrochemical companies and fertilizer plants ... plus invests in natural gas transportation and distribution, as well as electric companies.

But Companhia Vale do Rio Doce (RIO) puts both Embraer and Petrobrás to shame: Its shares have skyrocketed 591% over the past five years, rising twenty-four times faster than the Dow.

|

It recently bought Canada's INCO copper mines, becoming the largest mining and metals company in the Americas; the second largest in the world. It is the world's largest producer and exporter of iron ore and pellets, the world's second largest producer of nickel, manganese and ferroalloys, and one of the world's lowest-cost integrated producers of aluminum.

Brazil's banks have also been growing by leaps and bounds. And the three key Brazilian-owned banks traded on the New York Stock Exchange — Bradesco (BBD), Itaú (ITU) and Union of Brazilian Banks (UBB) — have also beat the Dow by a wide margin. Bradesco leads the pack, up 362% since January of 2002, or over 14 times more than the Dow.

When I was growing up in Brazil, it was almost impossible for individual American investors to buy these companies. Today, it's as easy as buying U.S. shares: Each is available for purchase as American Depository Receipts (ADRs) right here in the U.S.

Or you can use the widely traded Exchange Traded Fund linked to Brazil's stock market index: iShares MSCI Brazil Index (EWZ), up 243% since January of 2002 (nearly 10 times more than the Dow).

A Final Word

Normally, I spend the holidays with Elisabeth's family on their farm in the interior. But this year, it was their turn to come to Florida. And since Elisabeth's mother doesn't understand English, we subscribed to the Brazilian channels on satellite TV.

That gives her direct access to her favorite soap operas. And as an extra bonus, it also gives me direct access to local news and live events — including Lula's inaugural address this month. I missed most of the speech. But I caught his final words:

“God has been generous to me; more than I deserve.

“I asked for strength, God gave me difficulties to make me strong.

“I asked for wisdom, God gave me problems to solve.

“I asked for prosperity, God gave me brains and muscles to work.

“I asked for courage, God gave me dangers to overcome.

“I asked for love, God gave me people in difficulty to help.

“I asked for blessings, God gave me opportunities.

“I received nothing that I asked for, but I received all that I needed.”

Let's all pray for the same.

Good luck and God bless!

Martin Weiss

P.S. Today's your last day to sign up for Sean's new uranium report, and the timing couldn't be much better: A couple of his favorites have surged 17% - 20% just in the last two trading days, and he believes his new picks are likely to follow very soon. Click here for the details.

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.