U.S. Employment is Main Focus of Fed QE Policy

Economics / Employment Oct 28, 2010 - 04:00 PM GMTBy: Asha_Bangalore

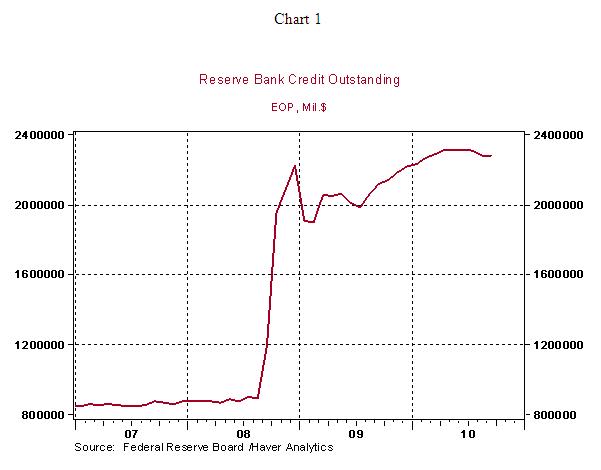

The Fed is widely expected to announce the details of the second round of QE (quantitative easing) following its 2-day meeting ending on November 3. There are more questions than answers about the nature of QE2 at the present time. Let's start with QE1 to put things in perspective; QE1 was in place from December 2008 to March 2010. The Fed purchased a sum of $1.725 trillion worth of agency bonds ($175 billion), mortgage-backed securities ($1.25 trillion) and Treasury securities ($300 billion). The outcome was a larger Fed balance sheet reaching $2.3 trillion as of March 2010 (see chart 1).

The Fed is widely expected to announce the details of the second round of QE (quantitative easing) following its 2-day meeting ending on November 3. There are more questions than answers about the nature of QE2 at the present time. Let's start with QE1 to put things in perspective; QE1 was in place from December 2008 to March 2010. The Fed purchased a sum of $1.725 trillion worth of agency bonds ($175 billion), mortgage-backed securities ($1.25 trillion) and Treasury securities ($300 billion). The outcome was a larger Fed balance sheet reaching $2.3 trillion as of March 2010 (see chart 1).

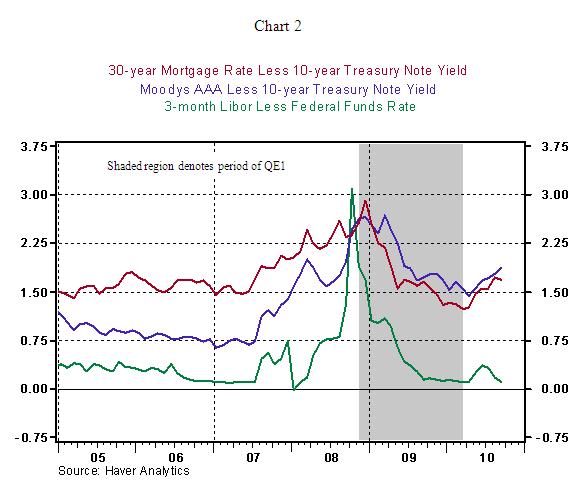

The major objective of QE1 was to restore the working of the financial system which had stopped functioning. To this extent the Fed has been successful. As shown in chart 2, financial market spreads narrowed significantly, largely, as a result of QE1.

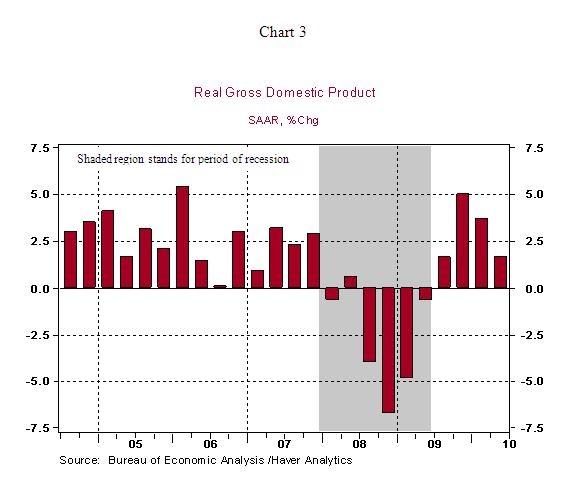

The recession officially ended in June 2009. The economy has registered four quarters of economic growth, with forecasts pointing to a continued growth momentum in the rest of 2010 and all of 2011.

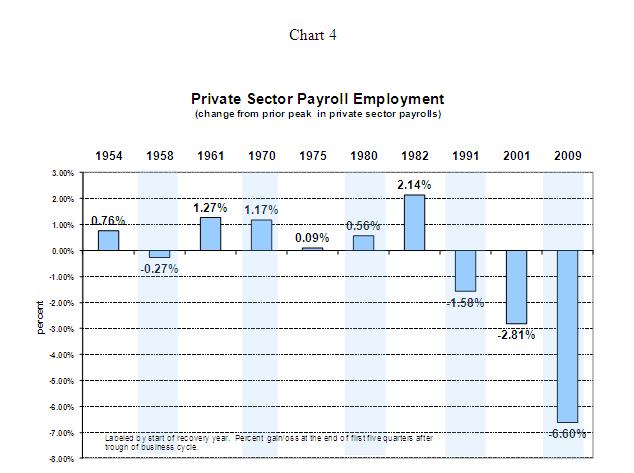

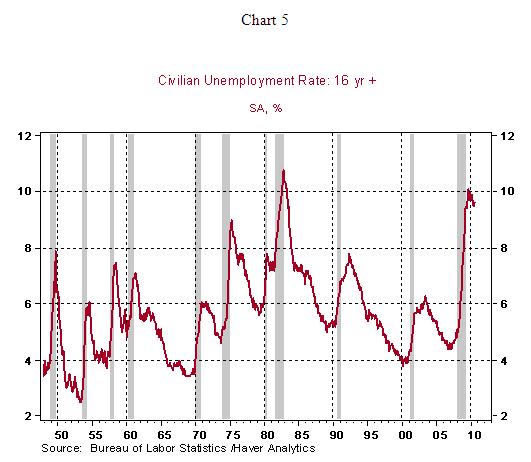

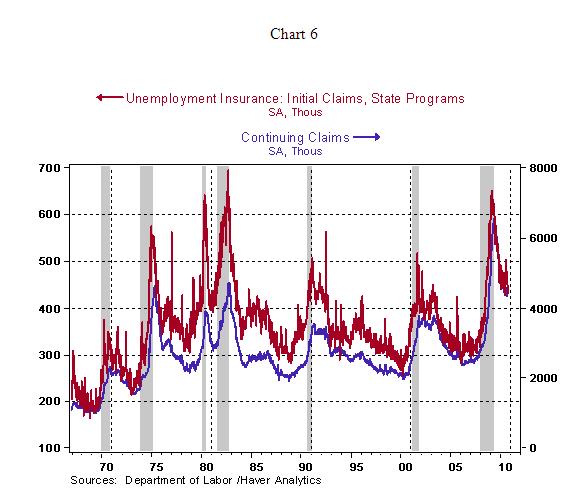

Why is the Fed engaging in the second round of QE, if the economy is expected to show continued growth? Chairman Bernanke and other Fed officials have pointed out in the past few weeks about the dissatisfaction with respect to "low inflation and high unemployment" after a full year of economic recovery. In other words, current economic conditions are not consistent with the dual mandate of the Fed - full employment and price stability. As chart 4 indicates, private sector payrolls remain 6.6% below the peak registered in the fourth quarter of 2007. Historically, it is the weakest recovery on record in terms of private sector job growth. The 1991 and 2001 recoveries have been coined as jobless recoveries also, but the staggering loss of jobs this time around leaves the Fed with little choice. Alternatively, the persistent high unemployment rate also presents a similar picture (see chart 5). The sheer lack of robust hiring is the predominant concern of the Fed, for now

The weekly jobless claims report for the week ended October 23 shows a decline of 21,000 initial jobless claims to 434,000. Continuing claims, which lag initial claims by one week, fell 122,000 to 4.356 million. The historical mean of initial jobless claims is roughly 360,000 and that of continuing claims is about 2.7 million. On a historical basis, the current readings of jobless claims are more than troubling. Needless to say, the dismal picture of the labor market is the main reason for QE2.

The size and period of QE2 are awaited when the policy statement is published on November 3. The impact of QE2 is also under scrutiny. The advocates of QE2 expect a positive impact from lower interest rates lifting all interest sensitive areas of expenditures such as home purchases, refinancing of mortgages, and increased business expenditures, at the margin. In addition, bankers should be induced to lend given the alternatives of paltry earnings from excess reserves and Treasury securities. Also, the benefit of increased exports from a depreciation of the dollar should be seen in headline GDP. The current projected pace of economic growth is inadequate to lift payrolls and lower the unemployment rate. Therefore, from the FOMC's standpoint, QE2 is the least costly policy option to shake off the sluggish economic conditions in place.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.