Stock Market Technical Analysis : Anyone Hearing Bells?

Stock-Markets / US Stock Markets Oct 08, 2007 - 07:43 AM GMTBy: Dominick

You know what they say, they don't ring a bell at the top. This is not my top call, and readers should know I actually take great pride in having had the discipline to not call a top back in July, particularly since those levels were just taken out this week. But still, I know for the short term, at least, I'm going to be watching closely to see if there is anything getting started on the downside. Seems a bit like going against the trend, I know, but isn't that what we always do?

You know what they say, they don't ring a bell at the top. This is not my top call, and readers should know I actually take great pride in having had the discipline to not call a top back in July, particularly since those levels were just taken out this week. But still, I know for the short term, at least, I'm going to be watching closely to see if there is anything getting started on the downside. Seems a bit like going against the trend, I know, but isn't that what we always do?

Of course, all it means is I have specific levels which have to be taken out before I'll enter a full short position, and then certain targets and stops that, if they find support, will get me out. It's called trading the charts – if there's still some more wiggles higher, which there very well could be, they won't catch me short. And this week didn't catch me short either.

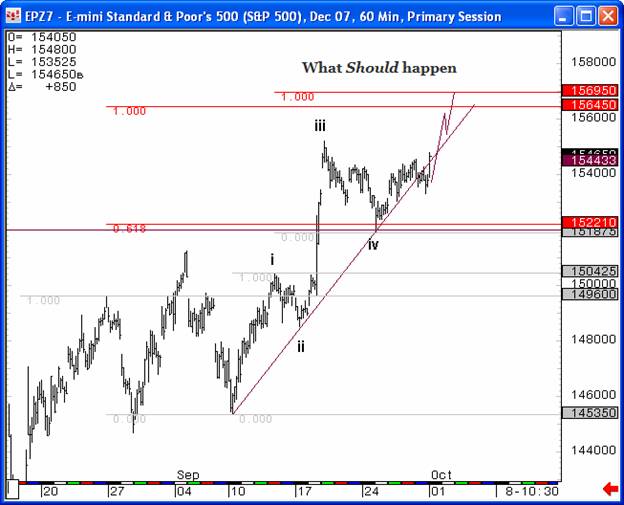

In fact, as I wrote in last week's update , there was no reason to be buying puts last Friday, even if everyone on the street seemed to be doing exactly that. The evidence simply did not support a bearish attitude, though as usual if the bearish attitude is already there just about anything can look like a sell. Well, not only did the markets not go down Monday morning, they punished the shorts and launched a rally that saw all-time new highs. We got long 1542 and had 1560 as the target for a market pause, as you can see from the chart I posted as soon as our 42 long trigger hit:

The high on Monday was 1561, making this trade alone worth $4500 on a single S&P futures contract. Not bad for only the first day of the month!

So if anything, the bells I'm hearing are wedding bells, because, whereas over the summer we had to stick solely to our numbers, trading this week required the perfect marriage of Elliott wave theory and our proprietary target numbers. As the chart above shows, a consolidation period is the natural follow-up to a fat, juicy rally. But not a crash. We actually had two primary patterns in which the consolidation could unfold, shown below, but generally, since the ultimate target for the move was higher, at 1569.5, members were advised not to exert too much effort chasing the downside.

As it played out, the consolidation ate up most of the week with the market spending long hours bouncing from and vibrating around our 1552 number. But the whole time, while it seems plenty of traders must have been loading up on puts for the big crash, we knew we were just biding time before the fifth wave advance to my 1569.5 target. The idea to get us through those sleepy days in the middle of the week was simply this: if it ain't broke, why fix it.

Members knew about 1569.50 even before Monday, and it had been an upward battle convincing most of them we were setting up to take out the previous highs. It just wasn't supposed to happen. But like I said, going against the trend is just something we do when the evidence supports it. Maybe they should have known better since, after all, we bought the three wave decline into 1375, refused to call a market top, and called the entire selloff from the June highs a correction . And so, with our pattern before us, Friday was a no-brainer. We had targets at 61 and 67.5 - 69.5. When the early morning rally stalled at 61, we looked for a breakdown to short, but it never materialized. The market not only hit the 69.5 target that looked impossible a few weeks before, but charged four points higher before finally reversing in the final hour.

In the end, the week was a triumph for unbiased trading of the charts – particularly our special blend of Elliott wave wedded to proprietary target numbers. After the third wave that supposedly surprised the street on Monday, the rest of the week played out as a picture perfect fourth wave consolidation that vibrated around our target number before the final fifth wave brought in the new highs we'd expected for weeks. If the street wanted to hold out for Friday's jobs numbers and make them into a big deal, we weren't going to fight it. But this isn't to say, as some probably think, that I consider the market fundamentals to be worthless, and news garbage. Far from it.

Readers of this update who aren't also members may doubt that our consistent results come from pure technical analysis. They may roll their eyes when I say to turn off the TV. But my question for them is: what happened to the CDO's, and the runs on the banks, and the next hedge fund blow up? It was really supposed to be the end of the world out there, so why are we back to record highs? Why is the only remnant of the August crisis a long wick on a weekly hammer? How did we go from negative for the year to up over 10% in less than two months? My answer is that those fundamental problems are not gone, that even if they've been shipped to Europe they will likely come back to haunt us – but that they were never going to be allowed to do so without first completing the pattern. When the count is done, who knows, maybe then the bears and the fundies guys can have their way.

So, to make a long story short, if you thought last week was painful, you might not have seen nothing yet. As I've been saying for the past few weeks, we're watching several markets that are at or near target highs, but, just as in June, I'm not willing to say an absolute top is in on this market – and waiting for confirmation is just one of the reasons. What I can say for sure is there are two possibilities from here depending on whether we're going to complete an Impulse soon, or whether this was a b wave rally – and we have the numbers for both. IF a short term decline becomes another corrective wave, don't rule out Dow 15k by year end!

As I told you last week, the beauty of unbiased trading is seeing your account growing week after week whether the market goes up or down. The fact is that when you combine conventional wave analysis with our unique target numbers, and add the flavors of all the unique contributions coming from our community of full time traders, it's not difficult to take advantage of the delicious setups the market offers week after week. But as much as I'd like to write a tell-all article every weekend detailing the patterns and targets for all the markets, there're several reasons I don't. For one thing, one of our specialties is what I call “rolling analysis”, which basically means we can alter or update our targets or outlook in real time based on situations as they develop. It would hardly be fair to give a roadmap on Saturday and then totally turn a corner in the middle of the week if something new comes to light, leaving all you readers in the dark. And, of course, all the details of what we do know now are not listed here simply out of respect to our paying members, and the members of all market advisories, who make the investment month after month and reap the reward.

As I write this, a member of only 4 days just posted the following,

“Hey Dom. This is the end of my first week at ttc. And I can say 2 things: first congratulations, second I'll be a member until I stop trading!

I read your free newsletter during 6 months before my effective subscription, but i have to admit it would have been much more profitable for me to subscribe earlier.

Thanks a lot for your great job.”

That's usually the attitude of our new members.

The monthly membership fee at TTC is currently $89 and, frankly, if we couldn't help you make at least that much in a month, well, we'd certainly be out of business by now. But if reading this article whets your appetite and makes you curious for more, consider joining now and getting a taste of what true unbiased trading can do for you.

ave a profitable and safe week trading, and remember:

“Unbiased Elliott Wave works!”

By Dominick

For real-time analysis, become a member for only $89

If you've enjoyed this article, signup for Market Updates , our monthly newsletter, and, for more immediate analysis and market reaction, view my work and the charts exchanged between our seasoned traders in TradingtheCharts forum . Continued success has inspired expansion of the “open access to non subscribers” forums, and our Market Advisory members and I have agreed to post our work in these forums periodically. Explore services from Wall Street's best, including Jim Curry, Tim Ords, Glen Neely, Richard Rhodes, Andre Gratian, Bob Carver, Eric Hadik, Chartsedge, Elliott today, Stock Barometer, Harry Boxer, Mike Paulenoff and others. Try them all, subscribe to the ones that suit your style, and accelerate your trading profits! These forums are on the top of the homepage at Trading the Charts. Market analysts are always welcome to contribute to the Forum or newsletter. Email me @ Dominick@tradingthecharts.com if you have any interest.

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Dominick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.