U.S. Debt Pie, A Nation of 300 Million Suckers

Interest-Rates / US Debt Oct 16, 2010 - 10:10 AM GMTBy: Seth_Barani

Lets analyze what is happening to the fixed-income instruments, mainly Treasury Bonds. There are two likely scenarios. One is, (scenario #1) Bernanke tries to salvage the economy. The other is (scenario #2), he only cares for US government's ability to service its debt.

Lets analyze what is happening to the fixed-income instruments, mainly Treasury Bonds. There are two likely scenarios. One is, (scenario #1) Bernanke tries to salvage the economy. The other is (scenario #2), he only cares for US government's ability to service its debt.

Bernanke assumed that by lowering short-term yield curve end to zero investors will be forced to choose between saving at 0% and spending. But savvy investors had a third choice. They went and bought long-term bonds and gold. Now Bernanke is trying to pull the long-term yield curve end down to reduce that choice. Savvy investors once again move their investments to commodities for safety and high yielding currencies for gains. The net result is it has benefitted the Treasury to issue securities at low rates. Beyond that there has been no visible effect on economy. Bernanke missed an important point - the yield curve is a consequence of economic conditions, it is not a tool for altering the course of economy. The Fed is putting the cart before the starving horse and wanting the wagon to move. Either that, or the Fed knows this fact and still doing it because it is trying to serve the US Government on one hand (scenario #2), while pretending to care for economy on the other (scenario #1).

Because he is time and again wrong on economic front, it leaves one to believe that Bernanke only cares for how to help the government in its spending festival. The formula is simple - lower the short-term interest rates, refinance (for want of better word), the long-term bonds with short-term bills; then lower the long-term rates, refinance the short-term bills with long-term bonds before raising interest rates, so that it hedges against interest rate increases that could hurt Government's ability to pay interest on the debt. Nice little swap trick without raising the suspicion of long-term bondholders!

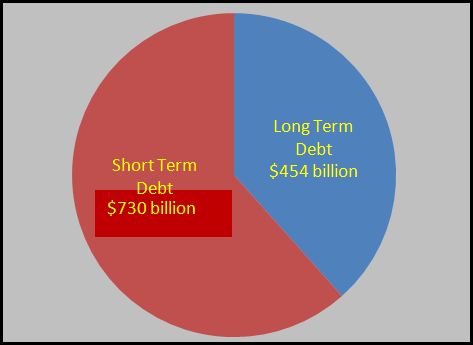

To verify whether the above is happening, lets look at how short and long-term bonds have been issued this year.

The pie-chart shows that in the first six months of 2010, nearly 2/3rd of Treasury sales were short-term notes (that fetch under 2.5% interest and under 5 years to maturity). We have even excluded the weekly or 56 day issuances from counting into the short-term notes, since they don't give the necessary time-cushion for swapping to long-term bonds later. In fact, the amount raised by 30 year bonds is below 10% of total. (Contrast with 2009 when nearly 2/3rd of issues for $1.6 trillion have been long-term bonds/notes.) Once the long-term rates are brought down, the debt will be refinanced using the low rates locked in for 30 years. Until that refinancing scam is complete the interest rates will be kept low. Of course, Fed couldn't lower the long-term rate directly without going through the short-term route because an inverted yield curve would send wrong signals to the markets.

Artificially lowering the interest rates on long-term bonds will only propel gold higher as investors bide their time. They are not going to invest elsewhere in worsening economic conditions. They will not take that risk. Narrowing the yield curve especially with short end near zero is going to bring down the half-life period of fixed-income instruments and move commodity prices even higher. This is not a commodity-price-bubble. A bubble is always built on irrational foundation. In this case the commodity-prices reflect the shifting balance of choice between low yielding bonds vs asset-protection methods. Counting on the money released from long-term bonds by investors to go into economy is dumb. That money is not available for flow. It is a lockbox fund. The transition barrier for that money to move from any safe-haven sector into a risky sector is very high.

One thing is clear: The nay sayers were right - money handed over to the banks did not go into the economy. Bernanke turned out to be wrong. He is trying to sing a different tune now and telling the government to spend more and drive money into the economy (because the mortgage fraud is going to cut open the bottom from the housing market). With the green signal from Fed, the Spending Cartel at DC already feels it like Christmas. I wish I had the luxury of making such colossal errors in judgment and yet be the chairman of some top agency.

It is not even the full story to say Bernanke was wrong. He was knowingly wrong. He is facilitating the debt refinancing of Treasury securities and nothing else. If the Fed wanted money supply to expand, all it needed to do was stop paying for bank reserves, penalize them for excess reserves and order them to lend. The banks can then do similar to what telecom carriers did ten years ago, namely, cold-calling everyone and offer them good deals, low rate 5 year personal loan at 0.25%, low rate credit card refinancing at 0.2% for 9 years, low rate home mortgage at 0.10% for 15 years, low business loans at 0.15%, startup loans at 0.28%, autoloans at 0.10%, student loans at 0.05%, and numerous other ways to "walmartize" the lending sector. The consumers will restructure their debt which will quickly fall to manageable levels and the disposable money on their hands will increase. This can be done in less than one month! The important point to note is that the retail sector hasn't had the same opportunity to low interest rate loans that banks got. It will be naive for anyone to assume that the Fed and Ben don't know this little secret.

Neither the Fed, nor the Treasury is interested in doing what it really takes to redirect the money and move the economy. They are busy with this little scam of sovereign debt refinancing at the cost of bondholders (aka soon-to-be-suckers). As the gap narrows between long-term and short-term yields, the stock market also may reverse primarily from the fear of seeing an inverted yield curve, leaving behind many million more suckers who lose their 401K and other investment plans. Make no mistake about it - when 299 million suckers are bankrupt, the remaining 1 million will financially cannibalize each other with Level-1-rich devouring the Level-2-rich.

Author Seth Barani is a PhD in physics and is a freelance capital market researcher and trader. He can be reached at s.barani@gmail.com.

© 2010 Copyright Seth Barani - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.