American Household Entitlements Balloon U.S. Federal Deficit

Politics / US Debt Sep 20, 2010 - 05:49 AM GMTBy: Money_Morning

Don Miller writes:

As many U.S. citizens continue to rail against the ballooning budget deficit, the reality is that most Americans are unwilling to swallow the bitter pill it will take to tame it.

Don Miller writes:

As many U.S. citizens continue to rail against the ballooning budget deficit, the reality is that most Americans are unwilling to swallow the bitter pill it will take to tame it.

Perhaps that's because nearly half of all Americans live in a household in which someone receives government benefits, more than at any time in history, according to a report from The Wall Street Journal.

At the same time, the number of American households not paying federal income taxes has grown to an estimated 45% in 2010, up from 39% five years ago, according to the Tax Policy Center, a nonpartisan research organization.

More than half of U.S. workers don't earn enough to be taxed. A large segment game the system by taking enough credits and deductions to eliminate all tax obligations. Even though most of us still pay Medicare and Social Security payroll taxes, 13% of all U.S. households pay neither federal income nor payroll taxes.

"We have a very large share of the American population that is getting checks from the government, and an increasingly smaller portion of the population that's paying for it." Keith Hennessey, an economic adviser to President George W. Bush and now a fellow at the conservative Hoover Institution told The Journal.

Number Taking Benefits Increases

The government initiated the first entitlement program in 1935 when Congress passed the Social Security Act, creating the retirement program as well as unemployment compensation as part of Franklin Delano Roosevelt's New Deal.

That was followed by the GI Bill and later Lyndon Johnson's Great Society ushered in Medicare and Medicaid. In the 1970s, Supplemental Security Income was created on top of routine Social Security benefits for the poorest of the elderly, and so-called Section 8 vouchers began subsidizing rental housing.

Other government entitlements include the earned income tax credit, food stamps, and free lunch programs for poor children.

Consequently, the number of Americans who live in households where at least one individual depends on a government safety net is expanding rapidly.

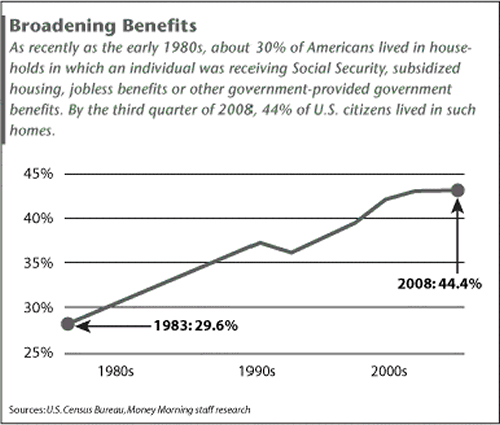

As recently as the early 1980s, about 30% of Americans lived in households in which an individual was receiving Social Security, subsidized housing, jobless benefits or other government-provided benefits. By the third quarter of 2008, 44% of the public lived in such homes.

And that number has undoubtedly increased as the recession has hammered jobs and household incomes. Some 41.3 million people were on food stamps as of June 2010 up 45% from June 2008.

With unemployment high and federal jobless benefits now available for up to 99 weeks, 9.7 million unemployed workers were receiving checks in late August 2010, more than twice as many as the 4.2 million in August 2008.

The baby-boom generation, those born between 1946 and 1964, will continue to add to the ranks of Americans receiving government benefits. Today, an estimated 47.4 million people are enrolled in Medicare, up 38% from 1990. By 2030, the number is projected to be 80.4 million.

Entitlements Balloon Federal Deficit

The cost of these programs is quickly adding up.

Payments to individuals - a budget category that includes all federal benefit programs plus retirement benefits for federal workers - will cost $2.4 trillion this year, up 79%, from a decade earlier adjusted for inflation, The Journal reported. That's over 64% of all federal outlays, the highest on record for the 70 years the government has been tracking it. The figure was 46.7% in 1990 and 26.2% in 1960.

All this entitlement spending has punched a hole in the government budget and ballooned the federal deficit to dizzying heights.

The depth of the budget problem was underscored last week, when the Treasury reported that the government ran a $1.26 trillion deficit for the first 11 months of the fiscal year, on pace to be the second-biggest on record.

And the future looks even worse. For the period from 2011 to 2020, the Congressional Budget Office (CBO) forecasts a budget deficit of $6.047 trillion, while the Obama administration projects a shortfall of $8.532 trillion.

The lowest projected deficit in the next decade is a $706 billion shortfall forecast for the fiscal year that ends in September 2014. That doesn't sound too bad in the context of the 2009-2011 figures, but it's almost $300 billion larger than the highest federal-budget deficit in human history before 2009.

And even that number is misleading. The federal government's Generally Accepted Accounting Principles (GAAP) financial statements show the actual annual fiscal deficit careening wildly out of control.

Including the annual changes in the present value of off-the-books liabilities, including Social Security and Medicare, the annual 2008 deficit was $5.1 trillion dollars. The 2009 actual shortfall likely was around $8.8 trillion, instead of the official cash-based $1.417 trillion, according to Shadowstats.com.

Despite occasional bouts of belt-tightening in Washington and bursts of discussion about restraining big government, the trend toward more Americans receiving government benefits of one sort or another has continued for more than 70 years-and shows no sign of abating.

Medicare and Social Security - The Untouchable "Third Rails"

An ingredient in any credible deficit-reduction program would require cutting spending on Medicare and Social Security -- by far the costliest and most perplexing of entitlement programs.

Frequently called "the third rail of American politics" - touch it and you die - social security reform is an issue that prompts heated debates among its supporters and detractors. Although Social Security has been changed a number of times since its inception in 1935, nothing has kept the cost from continuing to creep upwards.

This year, the system will pay out more in benefits than it receives in payroll taxes, an important threshold it was not expected to cross until at least 2016, according to the CBO. According to the Social Security Board of Trustees, by 2037 the program's trust funds will be depleted.

Some say that means the problem is still years away. But others think the real problem is now, since the government -- already heavily in debt -- will have to borrow more money starting this decade to pay back the Social Security trust fund unless it cuts spending and raises taxes.

Solutions range from decreasing benefits to raising the retirement age, to increasing the payroll tax.

But while there's a long list of answers, the political will to implement them has been missing.

"Everyone knows what needs to be done, but no one wants to do it, " Robert Bixby, director of the Concord Coalition, a nonpartisan, grassroots deficit watchdog group told CNNMoney.com.

Meanwhile, the White House has promised America's new health reform law will generate $575 billion in Medicare cost savings over the next decade, allowing the program to survive until 2029.

But part of those savings will come from reduced "overpayments" to Medicare Advantage, a system that allows Medicare recipients to receive benefits via private health insurance providers. The savings associated with Medicare Advantage efficiencies is expected to rise to $145 billion by 2019.

But this change could prove extremely costly to retirees because most seniors on Medicare Advantage don't have so-called Medigap policies, which pay the "gaps" in traditional Medicare coverage such as hospital deductibles and doctor co-payments.

The change will force many seniors to switch from Medicare Advantage to traditional Medicare where "they will pay much higher premiums than they ever imagined possible for Medigap insurance" according to Joseph Antos, a health care scholar at the American Enterprise Institute.

The new law also imposes about a half-percentage-point cut every year in the increases in Medicare payment rates for hospitals and other institutional providers. Over time, the compounding effect of the cuts will be so large that 15% of the nation's hospitals would have to stop seeing Medicare patients Antos told Daily Finance.

One Congressman's Plan for Change

Cutting federal benefits while the economy is still weak would be a mistake, some analysts say, because it could hinder recovery by giving consumers less money to spend.

But the crushing effect of entitlement programs on the federal budget means they need to be fundamentally redesigned, according to U.S. Rep. Paul Ryan, R-WI.

His proposed bill, "Roadmap for America's Future," calls for reducing the federal deficit and debt by partly privatizing and trimming Social Security and Medicare, freezing most government programs and instituting a simplified, two-tier tax system that would cut taxes for the rich.

Ryan proposes to freeze nondefense discretionary spending--15% of the budget--for ten years. His tax plan would eliminate itemized deductions and set rates at 10% for the first $50,000 of income on an individual return and 25% for income above that and replace the corporate income tax with an 8.5% business consumption tax.

He would wipe out ObamaCare and replace it with a voucher-based system in which adults get a $2,300 refundable tax credit to pay for health care. Similarly, Medicare recipients under 55 today would, on retirement, get vouchers to buy private insurance. He would raise the eligibility age for both Social Security and Medicare to 69 and 70, respectively, by the end of this century.

"People see that this debt crisis is real and right in front of us," says Ryan. They're paying attention to him, he adds, "because, unfortunately, I'm the only person who's put a plan out there."

Only 14 GOP members in Congress have endorsed the plan. In other words, it has no chance of becoming law in its present form.

"My goal was to get other plans launched, to ignite and start a debate," Ryan says.

The congressman blames the inability to put his ideas in motion on "the crowd that runs Washington now." But if Republicans win convincingly in November's congressional elections, Ryan's strategy will be to win over moderate Democrats and, if the GOP takes control of the House, to force change.

"I see dozens of reinforcements coming in the fall to help us take this fiscal situation seriously so we can get this thing fixed," he told Forbes.

Source : http://moneymorning.com/2010/09/20/budget-deficit-2/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.