US housing market - Subprime lending sector spiraling south !

Housing-Market / Analysis & Strategy Jan 12, 2007 - 05:49 PM GMTContiFinancial ... EquiCredit ... The Money Store ... Southern Pacific Funding. Maybe you've never heard of them, but they were the subprime mortgage lending stars of the mid-to-late 1990s.

They specialized in making loans to borrowers with bad credit, little or no down payments, and a host of other problems. Once they made loans, they'd sell them off to Wall Street firms and other investors, who would help package them together into bonds — a process known as “securitization.” The subprime lenders would use the proceeds to make additional mortgages, and the process would start all over again.

The gravy train seemed unstoppable. The subprime lenders made billions of dollars worth of loans. The Wall Street securitizers got crazy rich. Then, just like that, it all came crashing down.

The major reason: Gunslinging hedge fund Long-Term Capital Management imploded in 1998. As its market bets went south, the firm lost billions of dollars. That, in turn, brought the market for high-risk debt to a standstill.

Investors soured on risky home loans. As a result, the subprime lenders found themselves in a vicious cash crunch — unable to get the funding they needed to keep the mortgage “production lines” running.

Lenders started dropping like flies, either going bankrupt or selling themselves off to larger institutions. Thousands of employees lost their jobs in the process. Delinquencies, loan losses, and foreclosures surged.

It was ugly. It was painful. And it just may be happening again ...

Subprime Market Meltdown, Part Two

The subprime lending collapse took a few years to sort out. Some thought the industry might never come back as strong as it once was. But starting in 2001, the Federal Reserve Board's easy money campaign breathed new life into the moribund sector.

New subprime lenders set up shop. Mortgage standards — which had been tightening — started to ease again. And when home values really started surging in 2002, all memory of the previous carnage seemed to fade away. Lenders fell all over themselves to help homeowners take advantage of their newfound wealth via cash-out refinancings, home equity loans, and more.

Before long, lending standards were completely thrown out the window. I wrote about many of the abuses as far back as April 2005 in a Safe Money Report article titled “How to Wade Through the Mortgage and Real Estate Cesspool.”

Then, this past July, I told you about a bunch of mortgage practices that were setting the stage for a major blow up. I explained that “stated” income mortgages, onerous fee structures, inflated appraisals, and other exotic mortgages were all conspiring to stick borrowers with sharply rising payments.

Now, it's all hitting the fan. The 15th and 16th largest U.S. subprime lenders are collapsing. Mortgage Lenders Network is shutting down its wholesale lending operations and furloughing 80% of its workers. Ownit Mortgage Solutions just filed for bankruptcy.

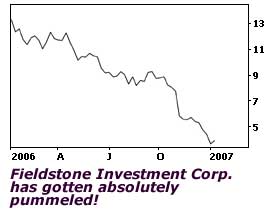

And the companies still doing business? Many of their stocks are freefalling:

- Fieldstone Investment (FICC) dropped 23% in a single day in November, and it's lost about three-fourths of its value in a year.

- Fremont General (FMT) has fallen almost 39% since last January.

- Stocks like HomeBanc (HMB) and NovaStar Financial (NFI) are trading at their lowest levels in years.

Things aren't as bad as they were in 1998 ... yet. But if the steady selling in mortgage bonds turns into panic selling, it could get there — fast!

What This Means for the Housing Market ... and You

The recent action in the subprime industry just underscores what I've been saying for a long time: The housing bust will stretch its tentacles into many related markets.

A lot of people — both homeowners and investors — are going to get hurt. And it has not yet run its course.

Indeed, the nasty fallout in the subprime lending industry could even exacerbate the housing downturn. After all, one force that prolonged the housing bubble was the rash of ridiculously easy lending. Now that subprime lenders are starting to go belly up, the ones left standing are tightening their guidelines.

That's going to make it harder for home buyers and marginal borrowers to qualify for loans. This could weigh on the real estate market as we close in on the key spring home shopping season.

You can see why I think it's too darn early to pile back into housing and lending shares. Wall Street has been talking itself hoarse that the “bottom is in” for these stocks. But if the subprime meltdown spreads, bottom fishers could get filleted.

Meanwhile, if you're in the housing market, don't ignore these developments:

- If you're trying to sell, you don't want to screw around. You have to get your price down to a level that will attract buyers, even if it bruises your ego a bit.

- If you're in the market to buy a home, the ball's in your court. Don't be ashamed to make low-ball bids, ask sellers to pay your closing costs, or make even the smallest home repairs.

- And take note — easy mortgage money will be drying up. Later in the year, buyers will probably need more cash reserves, a larger down payment, and fully documented income, especially if they have low credit scores.

Until next time ...

Mike Larson

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.