Stock Markets - Hope Floats: Fear Still Distant

Stock-Markets / US Stock Markets Sep 08, 2007 - 08:17 PM GMTBy: Joseph_Russo

Anchors Away: The financial sphere along with the ruling army of entrenched corporate and political elites, deeply committed and harboring inordinate interest in perpetuating an unsustainable war/debt-based prosperity paradigm - are keeping their fingers tightly-crossed that “hope” and illusion, along with a likely forthcoming tsunami of ponzi-rigged bailout schemes will float the right number of boats - rather than sink the good-ship Lollie-Pop. It is in all of our best interest that all such hope truly “float,” unlike the sinking anchor and shackle effects of fiat currency.

Anchors Away: The financial sphere along with the ruling army of entrenched corporate and political elites, deeply committed and harboring inordinate interest in perpetuating an unsustainable war/debt-based prosperity paradigm - are keeping their fingers tightly-crossed that “hope” and illusion, along with a likely forthcoming tsunami of ponzi-rigged bailout schemes will float the right number of boats - rather than sink the good-ship Lollie-Pop. It is in all of our best interest that all such hope truly “float,” unlike the sinking anchor and shackle effects of fiat currency.

Ruling Elites: A multi-generational mutation - spawning oblivious visionary-wizards of social decay, have been slowly digging their own graves for more than one-hundred years now. When the last of them finally finish the job, may those with genuinely good intent R.I.P, and those without R.I.H.

A long, long way to go - in getting to “UNCLE”

Delusion and denial will likely reign supreme for a period. Until fear grips societies at the undeniable and clear visible hand of widespread economic pain, business shall continue virtually unabated, in its usual arcane manner.

Fully intent on staying one-step ahead of the markets:

Absent the noise, predictions, table pounding, speculation, headlines, and government reports, we continue to read price-charts with inordinate impartiality as if they were yesterday's news.

We are the Men in Black: High volatility, low volatility, fresh historic highs, corrections, bull-markets, bear-markets, spikes, 3rd-waves, 5th-waves, 4th-waves, V-bottoms, double tops, turn-dates, super-cycles – whatever… Nothing gets past our radar – NOTHING.

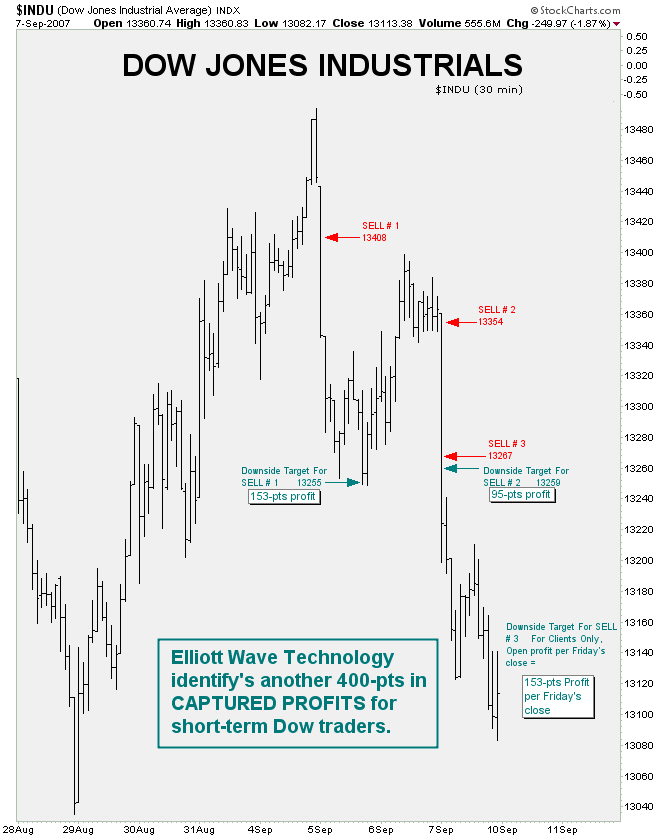

A Dividend Paying Gift to Readers from Last Weeks Article: Last week was unique in that we do not typically post actual price charts that appear in our short-term trading publications. Below is outcome to a chart, originally presented for public consumption in our Wilshire Revisited article published last week, on September 4:

NTO Traders Booking-Profits every which way from Sunday:

Those navigating in and out of broad market indices seeking short-term speculative profits continue to “make-bank” solely adhering to the evolution of price-action as implicitly conveyed through our unwavering branded art of technical analysis.

Last week's short-term trade and profit outcomes:

The following illustration exemplifies effects of our routine practice in identifying clear trade set-ups, and consistent achievement of price-targets, through Elliott Wave Technology's Near Term Outlook .

For active traders of all time-horizons, there is no better edge for navigating broad market indices than the Near Term Outlook .

The Week in Review:

The NASDAQ 100

The NDX:

Stinging like a bee in August - will “hope-float” the NDX back to a new high above 2060?

After three-weeks of unsustainable non-stop rally off the V-bottom low in August, the NDX must now stand-and-deliver into the heart of the “fall” season.

As we ponder such question, let us see how the balance of broad market indices' are floating into the month of September:

Re-testing multi-year lows, The Dollar remains under pressure and has a ways to go before reaching its lower trend channel boundary of support.

Though lagging the NDX in terms of snap-back percentages only, The Dow also maintains a level of “float-status” off the V-bottom low in August.

Gold has spoken – implying imminent anticipation toward a glut of global bailout schemes that will further erode purchasing power of the world's fiat currency's.

Though its trajectory channel is virtually flat in comparison to the Dow, The S&P is in “float-mode” just the same.

Should readers have interest in obtaining access to Elliott Wave Technology's blog-page, kindly forward the author your e-mail address for private invitation.

Visitors to the blog are encouraged to browse all of the page-archives to acquire a better sense of our unique brand of analysis and forecasting services.

Trade Better / Invest Smarter...

By Joseph Russo

Chief Editor and Technical Analyst

Elliott Wave Technology

Copyright © 2007 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.