Seven U.S. State Pension Plans Out of Money by 2020

Politics / US Debt Jun 12, 2010 - 06:39 PM GMTBy: Mike_Shedlock

In a system, gone completely loony, pension plans in seven state will be busted by 2020 yet the states keep hiring public workers. Please consider Pension Plans Go Broke as Public Payrolls Expand.

In a system, gone completely loony, pension plans in seven state will be busted by 2020 yet the states keep hiring public workers. Please consider Pension Plans Go Broke as Public Payrolls Expand.

Seven states will run out of money to pay public pensions by 2020. That hasn’t stopped them from hiring new employees.

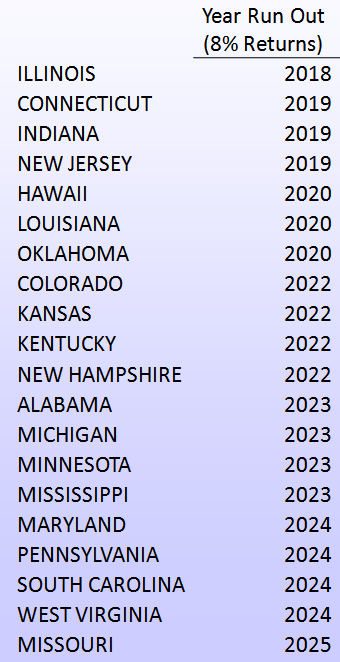

The seven are Illinois, Connecticut, Indiana, New Jersey, Hawaii, Louisiana and Oklahoma, according to Joshua D. Rauh of the Kellogg School of Management at Northwestern University. Combined, they added 9,700 workers to both state and local government payrolls between December 2007 and April of this year, says the U.S. Bureau of Labor Statistics.

Generous and bloated are the terms that have been used to describe them; critics have set up websites to pillory those government retirees who enjoy $100,000-plus annual pensions and other goodies, such as health-care benefits for themselves and their families for life.

“Are State Public Pensions Sustainable? Why the Federal Government Should Worry About State Pension Liabilities” is the title of Rauh’s recent study. It’s a provocative piece of work, especially for one of its tables, titled, “When Might State Pension Funds Run Dry?”

Pension Security Bonds: A New Plan to Address the Pension Crisis

I have covered this before but its worth another look. Please consider Pension Security Bonds: A New Plan to Address the Pension Crisis

As I have blogged previously, states are making financial promises that they cannot possibly keep, and the bills are coming due much sooner than you think. Unless action is taken soon, the federal government will face intense pressure to bail out the affected states, at a price tag of $1 trillion or more.

The outline of the plan is that the federal government should cut a deal with states. They should allow a state to issue tax-subsidized bonds for the purpose of pension funding for the next 15 years — if and only if the state government agrees to take three specific measures to stop the growth of unfunded liabilities:

1. The state must close its defined benefit plans to new employees under a “soft freeze” and agree not to start any new defined benefit plans for at least 30 years.

2. The state must annually make exactly its actuarially required contribution (ARC) left over from the existing underfunded plans; only the amount of that ARC will be subsidized.

3. The state must include its new workers Social Security, and provide them with an adequate defined contribution plan, again for at least 30 years. To this end, the federal government should start a Thrift Savings Program for state workers and operate it alongside the existing Thrift Savings Program for federal workers.

The tax subsidies for these new Pension Security Bonds would work like Build America Bonds, with the federal government paying 35% of all coupon payments directly to the state. The cost of this subsidy will be in large part offset by the gains to the Social Security system of bringing in new state workers.Pension Security Bonds

I am exceptionally leery of new government programs because the programs always cost more than expected. The proposed "Pension security bonds" will prove to be no different.

For starters, I sincerely doubt we see 8% returns on average for a very long time. Indeed it would not surprise me to see negative stock market returns for a few more years.

Japan had two lost decades and it looks like we are headed that way as well. Even flat returns would be a disaster for pension plans.

I exchanged emails with Joshua Rauh on pension bonds. He replied.

Mish,

The employer/employee contributions for the defined contribution plan must be in line with private sector compensation practices.

On the bonds... if we do nothing, we'll be in a situation 8 years from now where states are begging the federal government for a multi-trillion dollar bailout. I'd like a clear "just say no" message, but I fear that message isn't credible. When it comes to down to it, politicians will inevitably cave in and waste loads of money on the bailout... they do it every time.

My plan gives states the incentives to clean up their act now. Pensions are THE thing that is bankrupting states. The choice is a $75 billion federal incentive today (unfortunate) or a multi-trillion dollar federal bailout 8 years from now (catastrophic). I'm going with the incentive.

JoshMain Points of Agreement

I am certainly in agreement with Professor Rauh that [public] pensions are THE number one thing bankrupting states.

I also agree with Rauh that we need to kill defined benefit plans going forward. Moreover, we really need to go the next step and get rid of public unions altogether. They wrecked Europe and they are wrecking the US.

At a bare minimum, the defined contribution plans and wage scales for public unions should be no better than in the private sector.

However, I cannot support pension bonds even though I understand Rauh's point that "politicians will inevitably cave in and waste loads of money on the bailout... they do it every time."

As I see it, pension bonds are nothing more than a taxpayer sponsored bailout (caving in) in advance. If returns come in at 0% for 5 years, exactly what will the bailout cost?

I would like to see some real numbers here and I do not want taxes to go up one dime to pay for this mess.

Instead I would rather pursue legal option to overturn pension benefits or taxing pensions in excess of $40,000 at some very steep rate. If that fails, I fully support bankruptcy except unfortunately there is no provision for states to declare bankruptcy. However, Congress could pass a law allowing it and perhaps that would scare some sense into the unions.

Privatizing everything in sight might also scare some sense into the unions. If all else fails there is always default. I am a proponent of default over higher taxes.

Something must be done and raising taxes to pay for pension bonds is not that something in my opinion.

20 States out of Money by 2025

That clip is a portion of one slide in of Rauh's Powerpoint presentation on pension problems. Please see the above link to view the presentation.

Fantasyland Projections

Given that 8% returns are likely Fantasyland material, I believe states will be out of money long before the dates proposed.

The economic headwinds right now are enormous. Those headwinds include massive debt overhang, boomer demographics, global wage arbitrage, massive housing inventory, massive shadow inventory, rising taxes, rampant overcapacity, and structurally high unemployment.

Those problems are not going away anytime soon, so let's throw away assumptions based on "recent past" when the conditions were dramatically different. There is not another housing boom coming, nor a commercial real estate boom, nor another internet bubble.

Yet, the economy will recover, eventually. It always does. It just may take a lot longer this time. Regardless, the economy and the stock market are not the same thing.

Please note there have been other periods where the stock market went sideways for over a decade, and judging from Japan, a period where stock prices fell for nearly 20 years. 4% annualized returns for the next 5 years might very well be tremendously optimistic. I think they are.

I will ask Rauh to project the numbers at 4%, 0% and -2% rates of return for the next 5 years (numbers I find far more likely than +8%).

In case you missed it, please consider Interactive Map of Public Pension Plans; How Badly Underfunded are the Plans in Your State? based on a report by the American Enterprise Institute showing public pensions are underfunded by more than $3 trillion.

The question Joshua Rauh, myself, and others are addressing is "What do we do about it?"

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.