What Do the ADP Employment Reports and CDO2s Have in Common?

Economics / Employment Jun 04, 2010 - 06:05 AM GMTBy: Paul_L_Kasriel

The ADP National Employment Report estimate for May is an increase in private nonfarm payrolls of 55,000. Before revision, the April ADP estimated an increase in private nonfarm payrolls of 32,000, subsequently revised to an increase of 65,000. (Why does ADP revise its data? Does not the company know with certainty how many payrolls it processed in a month?) The first guess by the BLS for April private nonfarm payrolls was 231,000.

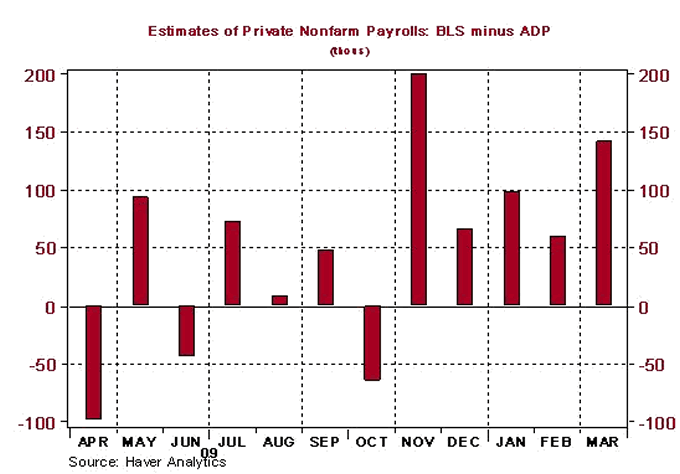

The chart below shows the difference between revised BLS and ADP estimates changes in private nonfarm payrolls in the 12 months ended March. Over these 12 months, the average absolute difference between revised BLS private nonfarm payrolls and revised ADP private nonfarm payrolls has been about 83,000 - not insignificant from an economic "truthiness" perspective.

Chart 1

So, the ADP estimates of employment, even after revisions, do not provide much guidance in forecasting BLS estimates of employment. Just as CDO2s do not add much to the benefit of soceity, neither do ADP estimates of employment. I find it amusing that the various pollsters of economic data forecasts bother to ask economists for their forecasts of a useless estimate of something that purports to forecast a BLS estimate, which, in itself, borders on useless what with its birth/death adjustments etc. As CDO2s are just another trading vehicle, the ADP Employment Reports are just another "stat" to bet on.

Now, I think the ADP employment estimates could actually provide valuable economic information if their estimators did not try to replicate the BLS estimates of nonfarm payrolls. Just as the weekly state unemployment insurance data represent real people collecting real unemployment benefits, the underlying data in the ADP employment estimates represent real people on real payrolls. I would find the ADP underlying unadulterated data more important than the adulterated BLS nonfarm payroll data.

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.