Debt, A Simple, but Painful Economic Lesson

Economics / US Debt May 01, 2010 - 03:04 AM GMTBy: Doug_Wakefield

Two years ago, Jim Grant, ofGrant’s Interest Rate Observer, mentioned a book he had just read by physicist Mark Buchanan titled, “Ubiquity: The Science of History…or Why the World is Simpler Than We Think.” I purchased a copy of the book for my own library and have referenced it in several of my writings. The theme, “the world is simpler than we think”, seems to defy the very modern world we live in. Just look at the picture below. Is this a group of college students learning how scientists have solved a complex physics problem, or a group of citizens trying to understand how the billions in TARP (Troubled Asset Relief Program) funds were created and used?

Two years ago, Jim Grant, ofGrant’s Interest Rate Observer, mentioned a book he had just read by physicist Mark Buchanan titled, “Ubiquity: The Science of History…or Why the World is Simpler Than We Think.” I purchased a copy of the book for my own library and have referenced it in several of my writings. The theme, “the world is simpler than we think”, seems to defy the very modern world we live in. Just look at the picture below. Is this a group of college students learning how scientists have solved a complex physics problem, or a group of citizens trying to understand how the billions in TARP (Troubled Asset Relief Program) funds were created and used?

Over the last year, as the markets have climbed higher, so has the use of the word “recovery” in the press. When your current outflow exceeds your inflow by more than $1.3 trillion a year while just three short years ago the overspending level was under $200 billion, how can any sane person say that we are on the road to recovery in 2010?

Anyone with a minimal knowledge of American history and having attained basic math skills can quickly grasp where we have come over the last century and a half. We will use the website, Treasury Direct, a government website, for the status of US government debt in any given year. If we start at the end of the Civil War, 1865, we find that the entire national debt stood at $2.68 billion. Needless to say, we can’t grasp this tiny number for the entire nation today, having just learned recently that Goldman Sachs earned $3.5 billion in just 90 days of business because of their “trading and investment prowess”.

Anyone with a minimal knowledge of American history and having attained basic math skills can quickly grasp where we have come over the last century and a half. We will use the website, Treasury Direct, a government website, for the status of US government debt in any given year. If we start at the end of the Civil War, 1865, we find that the entire national debt stood at $2.68 billion. Needless to say, we can’t grasp this tiny number for the entire nation today, having just learned recently that Goldman Sachs earned $3.5 billion in just 90 days of business because of their “trading and investment prowess”.

When the Federal Reserve System was founded in 1913, the national debt stood at $2.91 billion, approximately 10% higher than the debt level in 1865; 48 years earlier. The generations living prior to the founding of the Federal Reserve (the entity whose purpose according to their own website “provides the nation with a safe, flexible, and stable monetary and financial system”) elected leaders at the national level who believed that if your outflow exceeded your inflow, then that was the signal to stop spending and reevaluate your programs. So what happened in the two generations AFTER the Federal Reserve was founded?

By 1964, the birth of the baby boomer generation was complete. The national debt now stood at $311 billion, more than 100 times what Americans had seen in 1913. Now I ask you, is this a “stable monetary and financial system”?

We had seen that this massive influx of credit, whether government, business, or personal, had created a higher standard of living than any previous generation. How could anything possibly go wrong with this story? Maybe ever expanding debt is a good thing?

If an individual had invested in an index fund, whose objective was to track the movements of the Dow Jones Industrial Average, they would have probably punted their investments before they had made it through the turbulent ‘70s. The DJIA was valued at 868 on the last day of ’64, and 838 on the last day of ’79. The national debt jumped more than 175% between 1964 and 1979, while the median home price climbed 228%, moving from $18,700 to $61,500 in just 15 years. Longer mortgages were needed for the new generation to enter home ownership. The older generation grew to see the home as a great investment, a concept unknown to homeowners just two generations earlier, as they left the final days of the credit boom of the 1920s. Few understood that the next two generations would live through the greatest expansion of global credit, and subsequent build up of debt in world history. The mechanism to start this process occurred in August 1971 when U.S. political and financial leaders “redefined” long-term prosperity again:

Between 1946 and 1971, countries operated under the Bretton Woods System. Under this further modification of the gold standard, most countries settled their international balances in U.S. dollars, but the U.S. government promised to redeem other central banks’ holdings of dollars for gold at a fixed rate of thirty five dollars per ounce. Persistent U.S. balance-of-payments deficits steadily reduced U.S. gold reserves, however, reducing confidence in the ability of the United States to redeem its currency in gold. Finally, on August 15, 1971, President Richard M. Nixon announced that the United States would no longer redeem currency for gold. This was the final step in abandoning the gold standard.” [Gold Standard, The Concise Encyclopedia of Economics]

It took 20 years to move the Dow from its 838 close at the end of ‘79 to 11,497 at the end of ‘99. It was proclaimed the greatest bull market in American history. The median price of a home in the U.S. moved on up from $61,500 in Dec ’79 to $164,800 in Dec ’99. Society, in two generations, had moved from; how much does it cost, to, what are the payments? The US national debt grew to $5,600 billion, up 677% from its $826 billion level in 1979. When one considers the impact of inflating a system with billions, then tens of billions, then hundreds of billions, then thousands of billions in credit, while telling the public repeatedly their purpose as the highest authority of our nations money is to provide “the nation with a safe, flexible, and stable monetary and financial system”, in my opinion proves that the Federal Reserve has created one of the greatest farces in human history. Frankly, it boggles the mind when one considers that during the same period, we have watched the largest explosion of human knowledge in the history of man. Is there a greater oxymoron than “stable money” in modern society?

The problem with the last decade is that the public has been so duped, that most individuals do not realize that while discussions of markets remind us of the strong rally out of early 2009, it would be almost unheard of for a commentary of a major media source to state, “Tonight, April 26, 2010, the Dow Jones Industrial average closed at 11,205, just a few hundred points lower than it stood at the end of the great bull market boom of the ‘90s, where it closed the decade at 11,497.” Even worse, as stated in my last public article, We’re All Speculators Now, the commentary would have to state that the national debt has doubled in the same period.

What the Mind Wants to Believe

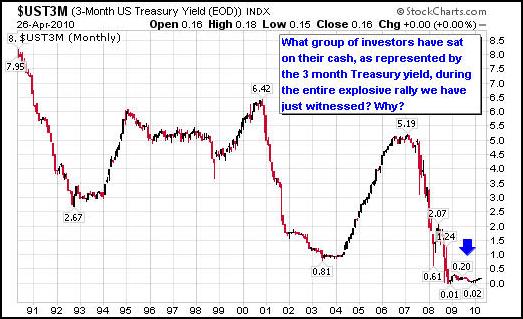

Look at the chart above. Let’s review what took place during these 5 phases. If you find this of value, feel free to print it off and share with anyone you consider to be a “financial expert”, or anyone concerned about their finances.

Phase 1 took us from a low of 2,334 in Oct ’90, right before Desert Storm commenced, through Jan ’00, when the Dow hit 11, 750. As the tech/telecom/equity bubble burst, beginning phase 2, the Dow started its journey down to 7,197 by Oct ’02. In order to bring about a “recovery”, the Federal Reserve lowered the Fed Fund rate (the rate banks use when borrowing from the Federal Reserve) from 6.5% to 1.0% in two years. If “recovery” is synonymous with “bubble”, then it would appear from looking at phase 3 in the chart above, that the Fed’s policies were successful. After the real estate boom topped in ’05, it would take until the fall of ’07 before equity markets worldwide, lead by the China boom story, would blow up. The journey down, as any student of bubbles throughout history would know, has always been faster than the journey up.

The first decline washed away 4,553 points in 33 months; the second cleared off 7,729 points in half the time. Once again, the Federal Reserve would provide the fuel, extremely cheap credit, for the most speculative bubble yet, the “government can rescue anything” bubble. Whereas the 14 months rally from the crash of Long Term Capital in the fall of ’98 until the Jan ’00 top would produce a 58% return in the Dow, the rally from the March 6th ’09 bottom until April 26th ’10 has produced a 74% gain. And while pundits may use the current rally, already one of the most extreme in the history of the Dow, to illustrate why investors should ride out “the dips”, we must remember that the 2007 high of 14,198 was highest level attained since the Industrial Average was launched in 1896.

Why are so many institutions, media pundits, and government officials espousing the “recovery theme” when science proves that a system placed under such long periods of unsustainable pressure will react like an earthquake? The closer in frequency the tremors become and the more violent the tremors, the higher the probability of an earthquake. I think the answer is quite simple. For several generations, the leading worldview for the future has been; more debt just keeps our daily lives chugging along. When our markets collapse, the boys at mission control can expand the powers of the state with more debt, then life will return to “normal”. I believe that anyone moving past the wasteland of daily market hype and political chicanery in April 2010 can gain a very clear perspective regarding the sustainability of phase 5, as shown in my earlier chart of the Dow. Consider the two comments below, and the sources that made these statements:

“To the extent that institutions were previously incentivized to take reckless risks through a “heads, I win; tails, the government will bail me out” mentality, the market is more convinced than ever that the Government will step in as necessary to save the systemically significant institutions…. To the extent that the crisis was fueled by a ‘bubble’ in the housing market, the Federal Government’s concerted efforts to support home prices risk re-inflating that bubble in light of the Government’s effective takeover, either direct or implicit, of nearly all of the residential mortgage market….Stated another way, even if TARP saved our financial system from driving off a cliff back in 2008, absent meaningful reform, we are still driving on the same winding mountain road, but this time in a faster car.” [Quarterly Report to Congress, Jan 30 ’10, Office of the Special Inspector General for the Troubled Asset Relief Program, pg 8]

“The precise nature of a ‘hard landing’ [in the U.S. dollar] of this sort is difficult to predict should creditor nations such as China demand higher interest rates, increasing the perception that the U.S. no longer controls its own financial fate. This dynamic could encourage the establishment of new reserve currencies as global economic actors search for alternatives to the dollar. Changing conditions in the global economy could likewise have important implications for global security also, including a decreased ability of the United States to allocate resources for defense purposes, less purchasing power for available dollars, and shifting power relationships around the world in ways unfavorable to global stability.” [The 2010 Joint Operating Environment, February 2010, United States Joint Forces Command]

Now I ask you, with comments like these, and after watching two of the most destructive bear markets in history unfold during the last decade, why would any investor or advisor still hold to a “hold for the long term” mentality? Simple; millions of individuals are enjoying the illusion, once again, of a short-term mania, and the belief that their lives will not be impacted in a major way as long as they keep finding people with similar views that make them feel emotionally comfortable. But why should we be any different from the individuals who lived through investment and credit manias in the past? If we study history, as painful as this is to do, we can easily see that the U.S. dollar as the reserve currency of the world is coming to an end in the years ahead, and more changes are unfolding than either you or I even want to imagine. What’s the real lesson in this greatest credit mania in history? There is an old saying that has stood the test of time: The definition of insanity is to continue to do the same thing over and over, and expect a different result…

The Worst Hard Time

On Tuesday mornings I pray with a small group of seasoned men from my church. Three of us are under 55, and the rest are over 65. Recently, one of the men shared with me a book he had read about the Dust Bowl that unfolded in the early 1930s. As I read the book, all my research for a report I released in March 2008, titled On Commodities, Debt, and Government Intervention, came to life even more. The massive changes to the lives of so many people brought tears to my eyes. How easy my life has been versus these individuals. How little the individuals living through the 1920s understood that at the root of their new found prosperity were massive amounts of newly developed credit coming into the system due to the Federal Reserve’s new role in American and global banking. They didn’t understand that when the government starts to buy a product in an attempt to drive prices up, whether the product is wheat or mortgages, the game is running on borrowed time. The return to yesterday’s mania is viciously deceptive. In the end, just like those who suffered through the Dust Bowl in the 1930s, so also will America, and the world that has supported and depended on her, suffer. History, science, and human behavior make this painfully clear.

On Tuesday mornings I pray with a small group of seasoned men from my church. Three of us are under 55, and the rest are over 65. Recently, one of the men shared with me a book he had read about the Dust Bowl that unfolded in the early 1930s. As I read the book, all my research for a report I released in March 2008, titled On Commodities, Debt, and Government Intervention, came to life even more. The massive changes to the lives of so many people brought tears to my eyes. How easy my life has been versus these individuals. How little the individuals living through the 1920s understood that at the root of their new found prosperity were massive amounts of newly developed credit coming into the system due to the Federal Reserve’s new role in American and global banking. They didn’t understand that when the government starts to buy a product in an attempt to drive prices up, whether the product is wheat or mortgages, the game is running on borrowed time. The return to yesterday’s mania is viciously deceptive. In the end, just like those who suffered through the Dust Bowl in the 1930s, so also will America, and the world that has supported and depended on her, suffer. History, science, and human behavior make this painfully clear.

The story is not really that complex, even though the political/financial machine has made it that way. It is just easier to deny our current painful juncture, seeking to depend and argue about various points of the enormously ever-increasing complex structure, than face the more gut wrenching pain that lies before us all.

If anyone wants to know my opinion today of where I believe we are headed, I tell them it is simple, but one none of us wants to hear. In the 1930s, at the FINAL bottom, we watched the end of the British Empire, and its reserve currency, the pound sterling as the instrument that had placed them as the lead superpower in the world for 200 years. America would become the leading superpower, supported by the fact that the US dollar, unlike the British pound at the time, would keep its currency on the gold exchange standard for international banking. But this, we must remember, was just a chapter in history. When the US refused to honor its current international debt arrangements in August 1971, by slowing its spending and reducing its debts, it refused to honor its previous promise to exchange those dollars for gold if sought by another nation’s central bank. Shortly thereafter, it brought about the petrodollar as the method of staying in the position of the world’s reserve currency. Even today, all oil contracts in the energy markets in the US and Britain must be traded in the US dollar.

Thanks to last year’s expansion of the IMF’s Special Drawing Rights (a masterful political maneuver of deception), this international monopoly monetary unit is being used to “bailout” government screw ups the world over. It is also a product that has been on the books of the International Monetary Fund since 1969, leaving no doubt that an expansion of power at the global political/financial level is coming about very rapidly.

So now that you have read this missive, what are some suggestions of mine you ask?

- Understand that no one gets out of this storm unscathed. Monetary storms of this magnitude, like the 10,000-foot clouds of dust across the Oklahoma panhandle, will impact everything and everyone in its path. In the days ahead, humility and a listening ear will mean far more than the stacks of defunct investment theories based on the infinite debt to prosperity foundation.

- Talk to others about your fears regarding the world of money with those with whom you are close.

- Take a greater interest in the people of your community who may have different backgrounds than your own. Learn from those whose opinions differ from your own.

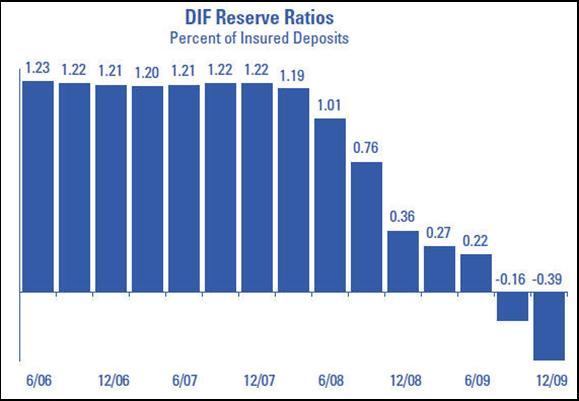

Americans must come to grips with the fact that they have been seduced to believe that there are such things as “risk free” investments when there is no such thing. When investors place their money in bank Certificates of Deposit, they trust the banks to invest their money wisely. If their particular bank closes, the FDIC is expected to always clean up the mess. The Q4 ’09 Banking Profile by the FDIC revealed that the amount of money to insure deposits, as represented by the Insurance Depository Fund (IDF), stood at a negative $20 billion as of 12/31/09, while the amount of bank deposits stood at 5.39 trillion.[pg 17] When one understands that the purchasing power of the US dollar is impacted by the ever expanding trillions in debt, then one understands that investments in banks that are believed to be “risk free”, is yet one more great oxymoron, and a virtual impossibility in real life.

[Q4 ’09 Quarterly Banking Profile, FDIC, pg 17]

We must realize how long we have been living in the “infinite credit” bubble. The great casino we call the markets will require us all too either seek the advice of those who are willing to leave certain areas when the storms set in rather than naively trying to drive through the storm, or learn when to take these actions ourselves when required.

As I close this article, reflect on the lessons we can glean today from Timothy Egan’s work, The Worst Hard Time: The Untold Story of Those who Survived the Great American Dust Bowl:

“The hailstorm [in 1930] crushed much of the wheat crop in Cimarron County, but elsewhere on the High Plains, the grain came in on time. The Germans from Russia brought so much wheat into Shattuck they were told it would soon be burned if they brought any more. Already in Iowa and Nebraska, people were burning grain for heat; one courthouse kept its furnaces burning all winter on surplus corn. In southwest Kansas, the harvest was up 50 percent in a year. In the county around Dalhart, it was up 100 percent. The wheat sat in elevators, in piles; some of it moldered on the ground or blew away. At the start of 1930, wheat sold for one-eighth of the high price from ten years earlier. At forty cents a bushel, the price could barely cover costs, let alone service a bank note. Across the plains, there was only one way out, a last gasp; plant more wheat. Farmers tore up what grass was left, furiously ripping out sod on the hopes they would hit a crop when the price came back….[pg 77]

Later that year [1934], the government men offered contracts to wheat famers if they agreed not to plant next year. This idea seemed immoral and not the least a bit odd to people when they first heard about it. Like the cattle slaughters, it was part of a Roosevelt initiative to bring farm prices up by reducing supply – forced scarcity. In the end, many farmers were not going to plant anyway – what was the use, with no water? – so the idea that they could get money by agreeing to grow nothing was not a hard sell. More than twelve hundred wheat farmers in No Man’s Land signed up for contracts and in turn got a total of $642,637 – an average of $498 a farmer. Thus was born a subsidy system that grew into one of the untouchable pillars of the federal budget. …..For people who had been without income since 1930, a check of $498 was a sufficient enough windfall to keep them on the land, though not enough to run a farm for another year. It allowed them though to exist. They paid just enough of their overdue taxes, and just enough of the outstanding interest on their bank loans, and just enough to get seed, to keep them from closing the door and walking away….[pg 158]

…and the early days of this particular credit boom, which allowed farmers for the first time in history to attain loans for 40 years at 6 percent rates. These loans became possible through the establishment of the Federal Farm Loan Bill in 1916, just three years after the Federal Reserve was founded. The following history comes from James Grant’s work, Money of the Mind: Borrowing and Lending in America from the Civil War to Michael Milken:

“Altogether, the nation was marshaling credit for farmers at what would prove to be a most inopportune moment. Farmland prices had been rising even before the federal government expanded the pool of lendable funds. When World War I furnished the final clinching argument for the American farmer to mortgage himself, he was almost accosted by willing lenders. The competition for loans caused all lenders to relax their standards in order to secure business. This was especially unfortunate in view of the land boom conditions then obtaining….

Not unlike the men they distrusted on Wall Street, farmers became bolder as markets went higher. They did not seize the opportunity of record-high wheat, record-high cotton, and record-high land to reduce their indebtedness. Instead they borrowed more. They did not trim their sails in the wheat market in 1920.” [pg 104]

If history, like a sand pile, reveals long fingers of instability with each successive grain of sand that hits the top of the pile, then one can understand why the Federal Reserve’s actions fostered the bubble and subsequent collapse of the farmers between 1916 and the 1930s, was at the root of the cheap money that ultimately led to one of the worst ecological disasters of the 1930s, and is still at it today, seeking even more power in the current financial reform bill.

The months ahead will prove extremely painful to those who refuse to take a very proactive stance in learning lessons from history, and applying these lessons with those gleaned from the technical and trading community, as our markets become more dangerous to navigate. Best Minds Inc gleans ideas from a wide range of topics and experts. To improve one’s odds of profiting during this time of great deception and confusion, we look at history against the action of financial markets, in a “connect-the-dots” format. If you are interested in our research, consider our publication, The Investor's Mind: Anticipating Trends through the Lens of History

Doug Wakefield

President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2010 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.