Britain's Accelerating Trend Towards High Inflation and UK Debt Default Bankruptcy

Economics / UK Debt Apr 13, 2010 - 03:56 PM GMTBy: Nadeem_Walayat

Whilst politicians of all the major parties during the general election campaign continue to ignore the giant debt elephant in the room as the general public continue to prefer to be deluded into thinking that Britain can skip the debt crisis that faces the country as a consequence of Greecesk levels of annual deficits and foreign liabilities that have pushed Britain significantly along the path towards hyperinflation and bankruptcy (debt default to foreigners), as many of the trend projections concerning the looming debt mountain, banking and public sector's liability expectations made in November 2008 (Bankrupt Britain Trending Towards Hyper-Inflation?) have come to pass, against which NOTHING has been done or stated will be done to prevent ultimate national bankruptcy as warned of in November 2008.

Whilst politicians of all the major parties during the general election campaign continue to ignore the giant debt elephant in the room as the general public continue to prefer to be deluded into thinking that Britain can skip the debt crisis that faces the country as a consequence of Greecesk levels of annual deficits and foreign liabilities that have pushed Britain significantly along the path towards hyperinflation and bankruptcy (debt default to foreigners), as many of the trend projections concerning the looming debt mountain, banking and public sector's liability expectations made in November 2008 (Bankrupt Britain Trending Towards Hyper-Inflation?) have come to pass, against which NOTHING has been done or stated will be done to prevent ultimate national bankruptcy as warned of in November 2008.

28th November 2008 Conclusion

Britain is Not bankrupt and not likely to go bankrupt in the immediate future, however Britain is on the path towards Bankruptcy if it goes on the projected borrowing spree that lifts real debt to £3.2 trillion and is forced to take on banking system liabilities of £5 trillion, under such a situation the country would be bankrupt as the currency would collapse, and we would not be able to service the debt much of which would be denominated in foreign currencies given Britain's position in the global financial system. Though the more probable outcome of stagflation for many years (low economic growth, high inflation and interest rates) that erodes the value of domestic debt and savings would in itself be a bad outcome for Britain. The only real solution is to limit the growth of real public debt by cutting back on public spending and bringing public sector pensions inline with the private sector, both of which will be positive signals to the UK debt market and banking system.

Labours Last Budget

Alistair Darling delivered his last budget just prior to the start of the election campaign that contained a few election gifts amounting to a £2 billion giveaway to be clawed back with a few mostly delayed tax hikes. However the key item missing form the budget was how the Government will fulfill its often stated target of halving the budget deficit over the next 4 years.

The chancellor has revised his budget deficit expectations for the financial 2009-10 from £178 billion to £167 billion. The government projects that the annual budget deficit will fall from the last financial years 12% of GDP to under 4% by 2014-15. The forecast annual budget deficits are for 2010-11 £163bn, 2011-12 £131bn, 2012-13 £110bn, 2013-14 £74bn.

The following graph illustrates the revisions in government borrowing expectations since my original analysis and forecast for annual UK budget deficits of November 2008.

Therefore the Labour governments own expectations are for an additional £478 billion of borrowing over the next 4 years that will be ADDED to the existing total debt as of end of the last financial year that is estimated to stand at a total of £870 billion, therefore according to the Labour government total public sector net UK debt by the end of 2013-14 will increase from the current 62% of GDP to 90% of GDP (after allowing for economic growth).

This compares against my November 2008 target that projects an additional £670 billion of net borrowing for the same time period, against Alistair Darlings original projection of £120 billion. I will hold off revising this total lower until later in the year once the the new government has made its true intentions known.

Even if Britain is able to halve the annual budget deficit over the next 4 years it will still mean that the government plans to borrow an ADDITIONAL £478 billion.

Labour Manifesto

With election fever in full swing Labour announced their election manifesto yesterday that in great detail listed a string of promises to increase spending and not to increase income tax.

Key Manifesto Points

- Halve the annual deficit of £167 billion

- NO increase in Income Tax

- An internationally agreed Bank tax

- Sell off nationalised banks

- Health reforms to make the NHS far more accountable to the patients it purports to serve

- A myriad of minor spending promises amounting to at least £2 billion a year.

What's Missing from the Labour Manifesto

Again the key element missing from the manifesto is how Labour will fill the £167 billion black hole in the countries finances. The promise of halving the deficit from £167 billion to about £75 billion and there in lies Labours credibility gap with the Conservatives not much better as I will elaborate upon later.

Debt Fuelled Economic Growth

Taking an average achievable growth rate of 1.5% per annum for the next 4 years implies that Britain will grow GDP by a total of £213 billion. However to achieve this growth and based on the governments own figures, Britain will borrow an additional £478 billion. So Britain is in effect borrowing more than £2 for every £1 of extra economic growth. If that does not illustrate a country that is on the road towards bankruptcy then nothing will. Labour ignited the debt fuelled boom during mid 2009 which I covered at length in articles such as - 03 Jun 2009 - UK Economy Set for Debt Fuelled Economic Recovery Into 2010 General Election, and analysed at length in the Inflation Mega-Trend Ebook (FREE Download)

Nothing has changed as the Labour government looks set to deliver the forecast scorched earth economy to the next Government, something that Britain will have to suffer the consequences of for at least the next 5 years as the country looks set to enter into a prolonged period of stagflation as the government attempts to inflate some of the debt and interest burden away.

Britain Will Eventually Go Bankrupt

Britain will at some point default on its debts to foreigners (as it has done at least twice before), this is INEVITABLE because ALL countries eventually DEFAULT on their debts, it is only a question of when i.e. in the next few years or delay bankruptcy for many decades and therefore results in the relative risks of default which the market prices. INFLATION is a symptom of the trend towards bankruptcy as it is a measure of the continuous COMPOUNDING loss of purchasing power of the currency. The best that governments such as Britain have been able to achieve is the slow stealth trend towards bankruptcy where people don't realise the loss of purchasing and wage earning power over time. However with government debt heading towards 100% of GDP, Britain looks set to leave the stealth trend towards bankruptcy behind and about to accelerate a few notches higher which risks igniting a wage price spiral that ultimately ends in a hyper-inflationary bust.

Where Britain Stands In Terms of the Global Trend Towards Country's Going Bankrupt

All countries are on the path towards bankruptcy, to measure where a country stands along this path it is critical to look beyond official statistics that focus primarily on public sector net debt and the annual budget deficit in terms of % of GDP.

The key item missing from most commentary on this subject matter is debt and liabilities that are denominated in foreign currencies as that can mask a stealth trend towards potentially imminent bankruptcy that can suddenly blow up in the face of a countries citizens who had been previously mislead by official statistics into thinking that the debt situation was under control, much as Icelanders experienced during 2008 where one day they enjoyed one of the highest standards of living amongst westerners to next day wake up to be bankrupt and poorer in terms of purchasing power than many third world countries. The key driver for state bankruptcy and currency collapse is the amount a country owes or is liable to foreigners, as debt denominated in foreign currencies cannot be inflated away as governments can do with domestic debt so it is one of the primary driving forces for a country going bankrupt as it is unable to meet the increasing interest payments due in foreign currency as its own currency falls.

The following graph attempts to paint an accurate picture of the current relative state of the trend towards bankruptcy of the worlds major economies which takes into account public and private debt, unfunded liabilities, budget deficits, and debt denominated in foreign currencies, as well as taking into account the historic track record of the countries in dealing with past debt crisis. The results are shown as a % of the countries risk of going bankrupt where Iceland would be at 100% following its defacto debt default.

Whilst the mainstream press these past two months has been obsessed with the Greek debt crisis, the above graph clearly illustrates that a far larger debt crisis looms in Ireland that could soon transplant Greece in the debt crisis headlines over the coming months, similarly a number of other Euro Zone countries head the risk towards bankruptcy league table with Belgium and Portugal not far behind Greece. The price that these countries pay for being stuck in the Euro single currency is that they cannot devalue to try and gain some competitive advantage for their economies and therefore try and grow and inflate their way out of a high debt burden that stifles economic activity.

However they also benefit from the fact that had they not been in the Euro then many of these countries would also be where Iceland is today as they would no longer be able to service the debt denominated in foreign currencies as their own currencies would have crashed as investors rush to the exit to preserve as much of the purchasing power of their investments into alternative currencies. The consequence of this in ability to devalue is deflationary as the economies contract in an attempt to reduce the debt burden and budget deficit as they attempt to move to a new sustainable equilibrium within the Euro block that demand greater competitiveness by means of reduction in costs i.e. by deflating wages, failure to do this results in higher interest rates and therefore a greater debt interest burden which again risks default.

The above graph puts Britain on a current 20% risk of going bankrupt i.e. defaulting on foreign debt, which whilst lower than the likes of Ireland, Greece, Belgium and Portugal, Britain is deemed to be of greater risk of bankruptcy than that of other oft mentioned PIIGS Spain and Italy, and significantly above that of the other large economies such as Germany, Japan and the United States.

Countries at higher risk of default can also be expected to experience relatively higher inflation rates as they attempt to competitively devalue their way out of the debt crisis, which is what Britain has been doing for the past 2 years that has seen the British Pound fall against the U.S. Dollar from £/$2.10 to £/$1.53 today, which is a devaluation of 30% and a devaluation against the Euro of 22%.

This also suggests that Euro block countries such as Ireland, Greece, Portugal and Spain will increasingly demand some sort of mechanism from within the Euro zone to achieve a similar competitive advantage outcome / debt financing other than suffer the ongoing deflation (latest news is that of a £40 billion Greece bailout). This could take the form of investment and subsidies to depressed regions of these countries, much as transpired when these countries originally joined the Eurozone, including the ECB buying PIIGS debt, the bill for all of which will ultimately be paid for by Germany as it is forced to distribute profits / gains from its competitive advantage as a consequence of the single currency that does not allow other countries to devalue and therefore unable to compete against Germany

One of the suggestions is that some of the PIIGS may leave the Euro. However I do not see how these countries can leave the Euro as that would immediately lead to a loss of confidence in the countries debt as investors would rush for the exit knowing full well that the countries currencies were destined to fall sharply under the weight of money that these countries would seek to print to attempt to inflate their way out of the the debt crisis, which would not work given the fact that a large proportion of the debts are denominated in Euro's against which their new floating currencies would more or less collapse. So, there is no chance of these countries leaving the Euro zone, not unless they are kicked out by the Germans due Germany being sick of bailing them out, which would imply a break up of the E.U., that I do not seek happening.

In terms of overall bankruptcy risk (defaulting on debts to foreigners), many of the smaller euro zone countries stand at the extreme end of the bankruptcy spectrum, with the new emerging giants turning the tables on the western world that puts countries such as China at lower risk of default than even the United States. The graph also shows that much of the doom and gloom commentary in the mainstream press surrounding a debt crisis in the U.S. and Japan is not visible in the overall data, where the actual risk of bankruptcy and default remains low at this point in time. Which is ironic when one considers that Japans public debt stands at 200% of GDP, compared to Irelands of 74%, which is due to the fact that Japan is able to finance its debt domestically due to the high savings rate in Japan which in fact also finances a large portion of U.S. debt, off course in the end Japan will still go bankrupt, even if it is able to continue pumping out more debt all the way up to and beyond 300% GDP.

In conclusion when investing or holding fiat paper such as bonds, investors need to evaluate the risks of a country defaulting as the higher the risk the more likely that countries debt (bonds) will lose value as the market will demand higher interest rates to finance the debt. Whilst countries at a lower risk of defaulting such as the emerging giant of China, represent a better risk for capital appreciation for investments made in that economy, especially for those that are investing from a high risk countries such as Britain i.e. currency advantage as discussed in the Inflation Mega-trend Ebook.

The full implications of the unfolding debt fuelled Inflation Mega-Trend including forecasts trends for major markets for many years are contained within the FREE Inflation Mega-trend Ebook , which includes analysis and precise forecasts for:

Interest Rates

Interest Rates

- Economy

- Inflation

- Gold & Silver

- Emerging Markets

- Stock Markets

- Stock Market Sectors and Stocks, including ETF's

- Natural Gas

- Agricultural Commodities

- House Prices

- Currencies

- Crude Oil

Over a 50 year time frame, I would imagine that 90% of the worlds countries will default on their debts, which probably would include Britain. That is not to say that it would take 50 years to default as debt default does not occur out of the blue but is the end point of a trend and in that respect Britain is firmly on the path towards default along which lies currency depreciation, high inflation, economic stagnation and finally culminating a hyperinflationary crash. Off course we can delay the inevitable default by taking measures to bring the budget deficit under control or we can ignore the deficit and fasten the pace towards bankruptcy.

Whilst Britain is much further along that path then it was back in November 2008, and given the above facts of an additional £478 billion of borrowing over the next 4 years, the price for which will be paid in terms of higher interest payment debt burden on the economy and thus higher inflation the closer we reach the crunch point of high inflation and ultimately a hyper inflationary collapse.

Four years from now total debt (PSND) will be in the region of £1.4 trillion, the market will demand interest rates several % points premium to that of the U.S. and Germany, which would result in a debt interest burden of over £70 billion a year being sapped out of the economy against today's debt interest burden of about £32 billion, more than double today's debt interest burden much of which will be being added to the total debt as well as structural deficit spending which will be pushing the country further along the path towards hyperinflation and bankruptcy.

Unfunded Liabilities.

Whilst the government mainstream press and academic economist focus on the public sector net debt and respond to worthless statements out of discredited ratings agencies that should have been prosecuted for putting phony ratings on junk bonds just as they are putting phony ratings on subprime sovereign debt today. However official net debt still continues to represent just the tip of Britains debt ice-berg, as we also have giant unfunded liabilities that continue to explode ever higher, leaving aside the £1 trillion of bad bank loans, that the government is insuring, we have the unfunded public sector gold plated pension liabilities that even 2 years ago were estimated at over £700 billion. That £700 billion of public sector liabilities has now mushroomed to £1.2 trillion today, which is greater than current public sector net debt total of £870 billion.

The below graph was last updated a year ago which illustrated the total liabilities of £4.7 trillion by 2013-14, if anything given the latest projection for public sector pensions total liabilities look set to be as much as £500 billion higher. All of this is a sitting time bomb that will explode in the government bond markets as illustrated in the Inflation Mega-trend Ebook.

Budget Deficits a Compounding Drain Economy

The larger the deficits and the longer they run for the greater will be the long-term impact on the economy which will continue to sap future growth. This is because the financing of deficits primarily from the government bond market saps investment in industry, technology and innovation i.e. the drivers of future growth OUT of the economy. For instance the government's net borrowing of £167 billion for 2009-10 means £167 billion of cash sucked out of the financial markets including banks that would have gone to investment in industry. This WILL have a direct impact on future growth for EVERY year for a decade. How much ? £167 billion is approx 12% of annual GDP, which taking account of compounding of future growth is impacted by 0.4% per annum over the next 10 years, that is productive output lost, add another £478 billion over the next 4 years as is highly likely then Britain will be in STAGFLATION. Where does the growth come from if there IS little or no investment because the Government like a giant debt hoover has sucked up a large part of the investment capacity of the country to finance the deficits. That is why there is an urgent necessity to get the deficit under REAL control or less Britain faces a LOST decade of economic output, on par with that of the 1970's if not WORSE!.

Public Sector Bankrupting Britain

The government is set to spend an estimated £677 billion on the public sector (2009-10), that is currently running an ANNUAL £167 billion deficit, i.e. the government spends £167 billion a YEAR more than it earns in revenue which is contributing towards igniting Britains inflationary debt spiral that is feeding the accelerating trend towards an hyper inflationary bust leaving savers with worthless paper and the economy in ruins, i.e. bankrupt.

The above Government spending graph illustrates the amount Labour has plowed into the public sector annually over the past 13 years over and beyond inflation. For instance when Labour came to power government spending was at £318 billion which allowing for inflation would today stand at £408 billion. However Labour is spending an extra £270 billion over this as Labour continued to run a budget deficit even during the boom years which has today left the country with an annual budget hole of £167 billion. To say that the public sector has become bloated under Labour is an understatement as it is probably 25% larger than it should be i.e. government spending should be in the region of £508 billion instead of the current £677 billion. Out of control public spending by the Labour government is illustrated by Britains sacred cow, the NHS.

NHS Bankrupting Britain

The NHS budget under Labour has grown from £40 billion in 1997 to £121 billion for the current financial year. NHS budgets increasing in line with inflation (CPI) would have seen the budget under a Conservative regime rise to stand at £51.6 billion, and probably nearer £60 billion to allow for an ageing population. So the Labour government is in effect spending an extra £60 billion a year, more than double that which the Conservative would be spending on the NHS.

Against this extra spending instead of Britain's experiencing the impact from effectively paying for TWO NHS's, the NHS is experiencing year in year out loss in productivity, i.e. the more the government spends on the NHS the LESS output the NHS delivers as more tax payer funds disappear into the NHS black hole. In theory this suggests that the NHS budget could in-effect be halved to £60 billion and still deliver a functional health service that the the country can afford. Off course that is not going to happen, but still a mere 10% cut in the NHS budget would contribute some £12 billion of annual savings from this out of control spending black hole that like a cancer is pushing the country towards bankruptcy.

The government's annual budget deficit is running at £167 billion a year or at 25% of the total budget i.e. the the governments total revenues are £510 billion against estimated expenditure of £677 billion, hence a deficit of £167 billion added to the national debt known as the Public Sector Net Debt (PSND) currently standing at about £870 billion, though excluding the hidden tax payer liabilities that extend to several more trillions of pounds. Nevertheless £870 billion of debt would cost about £35 billion in interest per year to service this debt, as the debt grows so does the cost of servicing the debt, more so as the supply of government bonds increases then so will the market demand ever higher interest rates to buy this flood of debt which illustrates why running anywhere near an £167 billion annual budget deficit is NOT sustainable, as it would ignite the earlier mentioned inflationary debt spiral as interest payments soar which therefore requires urgent action to CUT the deficit to BELOW 6% of GDP / £75 billion, with £102 billion necessary to be cut comprising of tax increases, economic growth and spending cuts in the region of £60 billion.

However, both major political parties have announced that they are not only not going to cut spending on the largest spending departments of Education or the NHS but GROW these budgets over the coming years. Similarly both parties have pledged to grow pensions and neither can I see how welfare can be significantly cut as the unemployed will remain unemployed until they get a job. Furthermore debt interest at £35 billion per year is expected to continue to grow inline with each month the government racks up another large deficit (upto £18 billion per month), which therefore suggests that of the total £677 billion spending budget, the maximum that both parties are making available to be cuts from is only £215 billion.

Whilst both parties continue to lie the electorate as to the amount of public spending cuts needed to fill the £167 billion black hole. However maximum measure of a 10% cut of the available budget heads of £215 billion, which even if achievable would only result in a cut of £21.5 billion, which would not make the necessary dent in the annual deficit in order to prevent the inflationary debt spiral from taking hold and all of the consequences of loss of confidence in sterling.

Government spending at approx 25% more than revenue is not only unsustainable but represents out of control spending that is risking severe consequences, including state bankruptcy i.e. debt default. In response to the urgent need to cut spending the politicians repeatedly fail to identify where and how this deficit will be reduced, instead repeatedly stating for purely electioneering purposes that they will ring fence and not cut the big budget spending heads of NHS and education, which is an impossible outcome as I explained in early January (03 Jan 2010 - British Politicians Lying to the Electorate, NHS Budget 4% Cut (Minimum), that this amounts to politicians lying to the electorate.

Whilst both political parties profess to not only not cut the NHS budget but to increase spending over the coming years. The fact is that the NHS budget under the Labour government has grown to a level that risks bankrupting the country. In nominal terms the budget has increased from £37 billion in 1997 to approx £120 billion for 2009, a more than tripling of the budget.

However a more accurate measure of the increase of the budget is as a percentage of Gross Domestic Product (GDP), in this regard the NHS has grown from 6% of GDP in 1997 to 10% of GDP now, therefore Britain is paying 66% more in NHS spending as a proportion of the economy will little improvement in service delivery due to a near continuous fall in productivity. This and other rampant out of control public spending under the Labour government risks bankrupting Britain as the ANNUAL budget deficit now exceeds 14% of GDP (£180 billion) which requires urgent action to prevent igniting an inflationary debt interest spiral i.e. where the interest paid on accrued debt results in a mushrooming of the countries total debt burden that tips the economy towards an hyperinflationary price spiral economic collapse as the following graphic illustrates.

Therefore both major political parties are lying to the electorate when they state that the NHS budget will not only not be cut but increase spending over the coming years. So far only Labour has actually released their NHS spending plans which show an increase of £3.7 billion / 3% per year for the next 3 years, whilst the Conservatives have pledged to match Labour NHS spending plans.

The next government will have NO CHOICE but to cut NHS spending, as the Labour party current plan for cutting the annual budget deficit by £23 billion a year just do not stand up to scrutiny as it would still result in the budget deficit expanding by £510 billion over the next 5 years, i.e. to more than 114% of Public Sector Net Debt which the financial markets would NOT tolerate, i.e. it would result in a series of bond market auction failures, which would be countered with accelerating money printing to monetize the debt which would culminate in an Iceland style currency collapse as foreign investors panic to preserve the value of their capital by selling out of sterling in favour of other currencies.

NHS GP Pay Illustrates Out of Control Spending

British MP's were humiliated during May and June across all parties as public outrage and indignation oat the abuse of the MP expenses system with MP's responding with how MP pay has failed to keep pace with that of NHS GP's which is one of the key reasons as to why they had resorted to what amounts to legalised theft from the electorate.

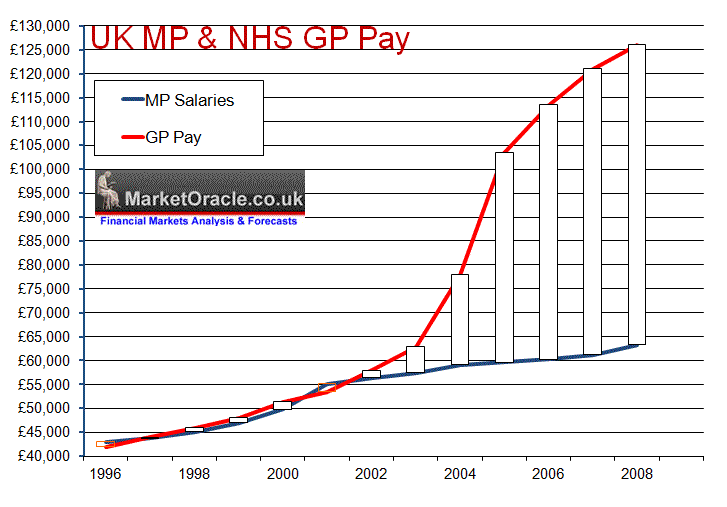

MP - NHS GP Pay Comparison

When Labour came to power in 1997 average MP pay was £43,722 against average NHS GP pay of £44,000, so both were inline with one another at that time. However as the above graph clearly illustrates in 2003 something started to go seriously wrong with GP Pay which took off into the stratosphere as GP's decided to award themselves pay hikes of more than 30% per annum at tax payers expense that has lifted average GP pay to £126,000 per annum against £64,000 for MP's.

How could this happen, unfortunately this was as a consequence of the now infamous GP contracts where to be blunt greedy GP's hoodwinked gullible incompetent Labour government health ministers into signing upto contracts which were meant to deliver greater value for money for the tax payer but were designed to do the opposite and resulted in GP's pay doubling whilst at the same time cutting back on hours worked. This was not only a total fiasco for the nations health and finances but also ignited jealousy amongst MP's that directly led to the adoption of the policy of claiming expenses to the maximum so as to fill the ever widening gap between MP's and NHS GP's, as MP's could NOT get away with awarding themselves pay hikes of 30% per annum without losing their seats at the next general election in response to voter outcry, therefore across the board systematic abuse of expenses started to take place which basically means real average MP pay is currently approx £98,000 per annum.

Cutting the Deficit

Spending Cuts

Labour has already announced £15 billion of efficiency savings instead of cuts. The Conservatives have announced a FURTHER £12 billion of efficiency savings on top of Labours £15 billion. In actual fact there will probably be little if any actual efficiency savings, therefore the word cuts should be exchanged for savings. In plain english Labour proposes to CUT Public Spending by £15 billion and the Conservatives by £27 billion per year. In total Labour cuts of £34 billion over the next 4 years are set against Conservative cuts of £82 billion minus £18 billion NI tax withdrawal for a net of £64 billion.

Whilst Labours cuts of £34 billion might sound like a large amount, however set this against the ADDITIONAL borrowing of £478 billion over the next 4 years. It is just NOT enough. Even the conservatives £64 billion will likely make only a small dent in the exploding debt mountain, what this suggests is that the market WILL force the next government to CUT the deficit and therefore spending by far more than any party is going to even hint at during the election campaign, we are talking along the lines of a £200 billion cut in public spending over the next 4 years, that's 6X Labours electioneering figure and 3X the Conservatives.

Where the NI debate is concerned, on balance the Conservatives have probably a better policy in that the NI hike will result in less people being employed due to the rise in employer contributions and therefore marginally less economic growth and it is ONLY economic growth that can save Britain from the debt crisis, spending cuts are necessary but they will not solve Britians debt crisis, all spending cuts will do is to DELAY BANKRUPTCY.

Also the NI tax rise sends the wrong message to companies, as it will prompt more UK companies to seek to offshore existing and new jobs to China and India. So it IS a tax on Jobs, the sensible thing for Labour to do would be to abandon part of the tax rise on employers, just as they appear to have done with the cider 10% tax hike that was due to come in on the 6th of April but now has been delayed until 1st June.

Clearly the spending cut totals without any breakdown are not credible. Labours average of £8.5 billion a year and the Conservatives £16 billion a year are just not going to be enough, which suggests to me true spending cuts are probably going to be in the region of at least £30 billion, about double that of the Conservative proposed cuts or about 5% of Government spending, whilst not as far as the £50 billion a year that I would prefer, though probably more politically palatable and implementable.

Economic Growth

My existing forecast for the UK economy is on track for 2%+ growth for 2010, therefore this should imply a 3% tax revenue boost to the Treasury and therefore reduction in the annual deficit of an average of £20 billion a year.

Tax Rises

Scheduled tax rises have already come into force during 2010, with the first on 1st of Jan 2010 when VAT went back up from 15% to 17.5%, a new 50% upper tax band on those earning £150k+ and the hotly debated NI tax hike scheduled to follow in April 2011. Add to this the expected VAT hike to 20% that could raise a further £13 billion per year. In conclusion total tax revenues could increase by a sizeable £30 billion a year and contribute to a significant dent in the annual budget deficit.

Budget Deficit Cut Conclusion

A credible plan could be formulated to cut the annual budget deficit by means of spending cuts of £30 billion, tax hikes of £30 billion and increased revenues from growth of £20 billion to total an approx £80 billion reduction in the annual deficit to £87 billion or about 6.2% of GDP. This would still mean that total debt will grow by £348 billion so would require additional initiatives to boost economic growth as I will touch upon later.

1/2 Million Public Sector Job Losses Coming

The politicians public sector smoke screen on job losses continues during the election campaign with both parties stating that there will be no redundancies instead 'natural' job losses in back office jobs. That is another politician lie as 1/2 million public sector jobs or about 8% could go over the next 18 months. That is the only way the spending cuts that have been enumerated above will able to be implemented. In terms of the unemployment forecast, my existing forecast as of October 2008 expires this month that forecast a UK unemployment total of 2.6 million by April 2010, which is set against academic economists and mainstream journoconomists that as little as 6 months ago were forecasting UK Unemployment would hit between 3 and 3.4 million by April 2010.

Public sector job losses of 1/2 million during the next 18 months time will mean a higher unemployment total against where it is today, however as long as the the economy continues to grow as I expect it to do so i.e. add jobs and spreading the public sector job losses out over this time period should mean only a small rise towards a target of 2.75 million.

The Economically Inactive Benefits Culture

Britain spends £106 billion a year on social security on the over 8 million of people of working age who are termed as economically inactive. There exist vast swathes of the country where there exist benefits estates where there is no work ethic and the key strategy is for people to maximise benefits received by producing as many babies as possible. Few of these so called parents intend on performing their parenting duties as children are left to roam feral on the streets, spreading fear and petty crime in neighbourhoods.

The next government needs to seriously get to grip with the benefits culture both in terms of offering incentives for those who have chosen not to work to change their mindset and work for a living rather than rely on the state to pay for everything from cradle to grave, and also to wield a big stick. Labour has failed miserably where there was NO DROP in the number of economically inactive during the boom years as the below graph illustrates. Based on the past trends the Conservatives could bring into force such policies that would change the nature of the perpetual benefits culture as they had succeeded in doing during the past that could turn an estimated 2.5 million of those that could work into productive wage earning, tax payers that would contribute to filling the budget deficit gap, probably to the tune of £40 billion per year.

UK Government Bond Market Ticking Time Bomb being Primed to Explode

The Government have bent over backwards in an attempt to force and keep UK interest rates both at the short-end and the long end as low as possible so as to boost the bankrupt banking sector. This has extended to the unprecedented measure of Quantitative Easing primarily to monetize huge issue of government debt and also forcing the Banks though the raising of capital ratio requirements to buy government bonds again to finance the governments budget deficit.

However the more debt the government issues, regardless of the monetization of debt, the greater is the pressure building up in the bond markets as the price the market demands in terms of interest rate rises. This is reflected in the yield curve where the highly manipulated short-tend allows the government to issue short maturity bonds at low rates at gross redemption yields of 0.65% interest for 1 year debt, whereas the yield charged on 5 year debt is at 2.9%, 10 year at 4.1% and 15 years at about 4.5%, i.e. a steeping in the UK government bond market yield curve that illustrates the real risks that demand a higher rate of interest which is as also reflected in the LIBOR market.

So whilst the government is happily issuing new debt and rolling over maturing debt on short maturity, however this is precisely the mistake that the bankrupt banks made by financing long-term liabilities with short-term borrowings. The Labour Government is making the SAME mistakes, because it sets the country up for a mega-bond crisis where the market baulks under the weight of new and reissued maturing debt at low interest rates, which suggest that the country is heading for a spike higher in short-term interest rates, the trigger for which may be a hung parliament.

We have already seen an example of this happen during the credit crisis where the short-end of interbank market FROZE i.e. instead LIBOR trending close to the base interest rate, it effectively froze where banks would not lend to other banks at ANY price, which resulted in a false interbank market rate that manifested itself in credit crisis spikes of over 1.4% above LIBOR as the below graph illustrates.

When the bond market time bomb explodes, it will hit the short-end and other assets hard. Based on my accumulative analysis of all key trends and fundamentals a bond market collapse is not imminent, however the bond market will show increased volatility as it tries to gauge the difference between the rhetoric from the next government and actual concrete steps to bring the deficit under control.

Artificial Banking System

The bailed out and tax payer supported artificial banking system means that the bill for low interest rates is being paid for by Savers who along with all tax payers are being forced to pay for the bankster's crimes as tax payer bailed out banks such as HBOS pay a pittance on instant access savings accounts of as little as 0.1% against a requirement of 3.6% just to cover CPI inflation of 3% plus the 20% tax charged on interest earned.

The banks are operating under huge profit margins as money is being sucked out of the pockets of savers and being deposited onto the balance sheet of bailed out banks that have no incentive to pay a decent rate of interest when they can borrow at 0.5% from the Bank of England and marginally higher from other UK banks. The artificial banking system is resulting in unprecedented huge profit margins for the banks as market interest rates charged to retail customers continue to rise regardless of the base rate being held at 0.5% which is inflationary in terms of rising mortgage and other debt interest costs as these rising costs will are showing up to varying degrees in the RPI and CPI inflation indices.

UK Interest Rates

The mainstream press says UK Interest rates will be kept at or near 0.5% for many more years.

The Bank of England has alluded to keeping UK Interest rates at or near 0.5% for over a year.

The Academic economists say UK Interest rates will be kept at or near 0.5% for many more years.

As the Bond market analysis illustrates that UK short-term interest rates will be yanked higher by the market AFTER the next election, as the current interbank rate is not reflective of the true rate of interest being born by the market place.

The budget deficit PLUS total debt + total liabilities + debt denominated in foreign currencies, ensures that not only will UK interest rates rise but that they have ALREADY risen, look at the interest rates charged on mortgages now against a year ago, look at the interest rates charged on loans against a year ago, look at the interest rates that the markets demand for newly issued government debt, ALL are already significantly higher than a year ago.

The base interest rate at 0.5% is ARTIFUIALLY LOW. The current market interest rate should be at least 2%, this is generating a great deal of pressure behind the interest rate dam that when it bursts will lead to a swift rise in interest rates over a short period of time. My forecast (13 Jan 2010 - UK Interest Rate Forecast 2010 and 2011) is for UK interest rates to end 2010 at between 1.75% and 2%, and then continue rising towards a mid 2011 target of 3% as the below graph illustrates.

By the way the politicians are behaving, i.e. going by the chancellors debate on Channel 4, it is not clear if the politicians still understand the ticking time bomb that is the government bond market. A mountain of debt is being accumulated at an unprecedented rate. Just like a pile of sand continuously having grains of sand poured onto it will eventually collapse after just after one more grain of sand so it is where Britain's bond market is concerned as more debt is piled on top of the debt mountain so will it eventually collapse, unless urgent action is taken to seize control of the budget deficit to prevent economic collapse, and it really could be imminent especially as it could be triggered by an external factor such as Greece, Spain or Ireland . default on their debt that would send a shock wave around the world which would hit Britain's debt market where what was one day sufferable would next day result in panic as investors head for the exit on fears Britain being next to default.

So it is not a question of so far so good where the bond market is concerned but rather we are literally living on borrowed time where an external credit market event could trigger a collapse in the uK bond market unless it is bolstered by strong and firm ACTION. Even then it may be too late, as the markets have watched the government dither for the past 2 years and seen Osbourne announce an electioneering policy of cutting NI tax instead of reducing the deficit, that's the wrong message to send to a bond market that is primed for a trigger to crash.

UK Inflation

My analysis since November has been warning of a spike in UK inflation as part of an anticipated inflation mega-trend (18 Nov 2009 - Deflationists Are WRONG, Prepare for the INFLATION Mega-Trend ) that culminated in the forecast of 27th December 2009 (UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%). As the below graph shows, today's inflation rate falling from 3.5% to 3% whilst catching the academic economists off guard, is inline with my forecast trend expectations as UK inflation is expected to trend above 3% for most of the year.

Apart from hitting workers in terms of falling pay in real terms, inflation also eats into the real value of savings deposited at virtually ALL British banks and building societies that even now, are engaged in cutting the rates offered to savers to as little as 0.1%, as my earlier analysis illustrated (23rd Jan 2010 - UK Savers Losing Money on Virtually ALL Instant Access Savings Accounts) That virtually all accounts LOSE savers money in real terms AFTER inflation and AFTER the 20% Savings tax. The situation has continued to deteriorate as inflation remains above the BoE 2% target.

China Economic Doomsday for Britain and Other Western Economies

Today we live in the false belief that whilst we cannot compete with China in terms of mass produced cheap goods we have an advantage in premium brands and the high end of the market. However China is investing hundreds of billions into driving competition up the value production food chain that looks set to knock Britain out of the little manufacturing that it already undertaken.

We face Manufacturing armageddon over the next 5 years unless the next Government follows China's lead and pumps hundreds of billions into investing into the manufacturing industry, we need to increase manufacturing to a far greater level than 17% of the economy, or kiss goodbye to our prosperity as year in year out the country becomes poorer, to one day wake up to being along the lines of a south american economy. That is where the future lies unless Britain gets a grip with the economic armageddon poised by China.

The FREE Inflation Mega-Trend Ebook contains in depth analysis of which emerging markets present opportunities for investors, including perspective growth rates and projective returns over the next 10 years.

HOPE - Solving Britain's Economic Crisis Through Micro Business Capital Investments and Credit

Britain had bet its future on the financial sector as the means for delivering economic prosperity and lost. The financial sector over the past 3 decades had mushroomed to an enormous size on terms of over leveraged liabilities extending to more than 5 times UK GDP that has imploded in spectacular style following the start of the Credit Crisis in August 2007 which has now left the country on the brink of bankruptcy under the burden of the liabilities of the banking sector (most denominated in foreign currencies), unsustainable annual budget deficit and the growing public sector debt mountain.

However the future is not all lost as the Government has at it's means the power to diversify the allocation of capital out of the financial sector and into other areas of the economy in an attempt to ignite a more sustainable growth model from large scale projects such as renewable energy to directly investing in new small business start-ups, and financing small and medium sized companies, not on a small scale of a few hundred million scattered around the country, but on a huge scale of between £50 and £100 billion which might sound like a large amount but is tiny when compared against that which is being flushed down the toilet on public sector consumption which contributes towards the annual £170 billion budget deficit. Also not forgetting that the country has committed far more than that in terms of capital injections, Q.E. and bad debt liabilities to the banking sector in an attempt to get the banks to lend to businesses and consumers, much of the money meant for loans is instead being hoarded by the banks in Government bonds or at the Bank of England.

However the future is not all lost as the Government has at it's means the power to diversify the allocation of capital out of the financial sector and into other areas of the economy in an attempt to ignite a more sustainable growth model from large scale projects such as renewable energy to directly investing in new small business start-ups, and financing small and medium sized companies, not on a small scale of a few hundred million scattered around the country, but on a huge scale of between £50 and £100 billion which might sound like a large amount but is tiny when compared against that which is being flushed down the toilet on public sector consumption which contributes towards the annual £170 billion budget deficit. Also not forgetting that the country has committed far more than that in terms of capital injections, Q.E. and bad debt liabilities to the banking sector in an attempt to get the banks to lend to businesses and consumers, much of the money meant for loans is instead being hoarded by the banks in Government bonds or at the Bank of England.

An active government policy to inject capital investments into one million new micro businesses could revolutionize Britains economy by bypassing traditional (frozen) sources of capital. Not only would this ignite a new sustainable boom but Britain would reap the rewards in terms of capital growth and dividend income from new giants of industry that will emerge from this new pool of businesses i.e. both Google and Microsoft were once tiny startups and are now valued in the hundreds of billions employing many thousands, imagine the return if the U.S. government had a 25% stake in these companies from the outset.

Capital Investment of £50bn to £100bn to generate 1 million new micro businesses today would yield continuous returns over the long-run that would not only boost the countries tax revenues and reduce the state benefits bill and unemployment lines but also provide new capital for future investments from return on investments.

Micro business investments and loans (micro credit) is nothing new, as it first emerged as a means of empowering the poor in the third world countries such as India and Bangladesh which has enabled millions of poor to gain access to capital and loans enabling them to lift themselves out of poverty. Micro credit on a small scale has been around in Britain for many years in the form of credit unions and other regional start-up agencies that collectively provide approx £400 million of funding , and it should not be forgotten that Building Societies were originally set up in the credit union traditional, unfortunately over a 100 years of hard work was systematically dismantled by the previous Conservative Government that allowed Britains largest building societies to become banks and gamble on the global derivatives casino and lose everything after bank officers had banked huge bonuses on the basis of fictitious profits.

Unfortunately new start-ups face many additional problems other than access to capital and financing in the form of the huge amount of red tape as well as rules and regulations associated with running a business. However the red tape can be overcome, as a new large scale micro capital investments and credit programme would need to go hand in hand with reform of small business red tape as well as offer new start-up's courses and easily comprehensible information to better understand the plethora the rule regulations that exist.

The alternative to state capital injections and loans is continue to rely on the current FAILED UK Business investment and financing model that has in-built mechanisms that push corporations towards minimising costs to maximise profits by off shoring production abroad to China and India which results in high UK unemployment as the corporations both public listed and private are subject to the short-term interests of the over leveraged private equity funds and city Institutions that are focused on maximising short-term profits regardless of the long-term costs which manifests itself in ever higher leverage deployed regardless of the risk it poses that directly resulted in the bankruptcy of the whole banking sector, as ALL banks were technically bankrupt, which was illustrated by Lehman's bankruptcy where all of the hugely leveraged counter parties were on the verge of a chain reaction spiral of default.

The current banking system is bankrupt, the banks have learned NOTHING from the credit crisis, it is business as usual with most of the politicians firmly in the back pockets of the bankster elite. The banks are still primed to not only gamble on derivatives but increase their exposure and thus set the tax payers up for another financial crisis and subsequent bailout, if anything the banks are BETTING on other banks failing so that they can be bailed out by the tax payers i.e. claiming on the credit default swap insurance. If the government was serious about reforming the banking sector then it would be breaking them up into retail and investment banks and banning them from gambling on derivatives or relying on the interbank market for financing. And also remember this, that given Britains huge debt mountain, we basically do not have the means to survive another financial crisis so it is imperative that the country diversify itself out of the financial sector.

A Government run investment bank would ensure that at the very least new start-ups and small business would no longer fall victim to the banking sector and city of London's misplaced priorities that are NOT in the long-term interests of Britain.

The idea of the State Investment Bank with branches in every town and city that should also be able to make loans on a large scale to new / small businesses at low or even zero interests, after all that is the facility that the bailed out banks are in receipt of, the profits from which they have funneled into the pockets of bankster's in the form of outrageous tax payer funded bonuses.

Off course such an capital injections and loan subsidies from a state run institution would put us at odds with the European Union, which we would need to reject as a failed model as we are witnessing in the deflationary implosion of many of the EU countries that are themselves actively breaking EU competition rules.

Politically, the above change would require a government that is small business centric and not in the back pockets of the bankster elite, unfortunately that would exclude the supposedly business friendly conservative party as they would not be 'allowed' to take bankster's out of the credit and capital investment loop, and the Labour party as we have witnessed over the past decade is useless at business, and has been power for far too long, as its ministers have long since been corrupted by absolute power and therefore remain only focused on piling as much tax payer cash into their back pockets before they get booted out of parliament.

Therefore the party I will most likely vote in the forthcoming election is the one that has a policy that could form the genesis of a national state run micro investment and credit bank.

Economic Recovery

Whilst the mainstream press and academic economists worry over a double dip recession, quietly every few weeks Britain's economic growth keeps getting revised higher, originally Q4 2009 was estimated at just 0.1%, since then a range of revisions has brought it higher to stand at 0.4%.

The first release of Q1 2010 data will follow in just under 2 weeks time, a week or so prior to the UK May 6th General Election which I expect will put a final nail in the double dip recession debates coffin. Far from a double dip recession my forecast (31 Dec 2009 - UK Economy GDP Growth Forecast 2010 and 2011, The Stealth Election Boom ) is for a strong economic recovery this year and into 2011 which has long since been signaled by he stocks stealth bull market.

Debt, Deficit and Election 2010

The Labour government has brought Britain to the brink of bankruptcy. The Labour government's policy is to pander to its public sector voter base and avoid spending cuts which means the Labour party Deficit spending reduction targets are not credible, as after the next election a Labour government would NOT CUT PUBLIC SPENDING. Which means that the deficit over the next 4 years will be much larger than the figures stated earlier, which increases the risk of bankruptcy.

The Conservatives are more likely to actually cut public spending and reduce the deficit. To what degree can only be determined when we find out the nature of a Conservative government beyond the hype, spin and propaganda surrounding the election campaign. Even Conservative proposals for cuts would not dent the budget deficit significantly i.e. the difference between the both parties in terms of deficit reduction is less than £50 billion over the next 4 years, though the Conservatives are more likely to actually follow through on pledged cuts than Labour.

A hung parliament would result in short-term volatility in the financial markets as stocks, bonds and sterling would plunge. The longer term impact would depend on the nature of the government that eventually emerges.

My forecast as of June 2009 and illuminated in the Inflation Mega-trend Ebook is for a small conservative majority, which is contrary to the current strong speculation for a hung parliament.

The UK election will be decided by just 20% of voters that inhabit the 120 marginal constituencies out of a total of 650. The politicians obviously recognise this which is why resources have been plowed into the 120 marginal's with little effort being put into communicating with the voters of the other 530 seats. So as is usually the case, most voters will be ignored by the politicians as they woo the electorate of marginal constituencies with promises of new hospitals, health centres, schools, nurseries and more over the coming 4 weeks, which goes a long way to explain why government spending and services results in aberrations such as the NHS post code lottery which usually penalise Labour constituencies with strong majorities that repeatedly return jobs for life MP's.

Conclusion

The bottom line is that Britain over the next 4 years is projected to borrow an ADDITIONAL £300 to £350 billion to be added to Britain's £870 billion official debt mountain. However this does not mean that Britain will go bankrupt either imminently or during the next 4 years because the bond markets on balance trust Britain's credit worthiness more than the likes of the PIIGS, which does give the country some breathing space to run higher deficits without Greece and Iceland style panics. But there is a limit, we are NOT the United States that has the benefit of having the worlds reserve currency and never having defaulted on its debts before (Britain has at least twice).

However there is a price to pay for the higher debt levels and that is the bond market will charge a higher interest rate that looks set to see the debt burden double from about £35 billion a year today to £70 billion in 4 years time. This has the effect of feeding the inflationary mega-trend as the government deflates the standard of living of people by means of inflation as the cost of financing the debt, which is a continuation of the stealth theft form the population in terms of loss of purchasing power of accumulated savings and earnings in real terms.

There is nothing that suggests that total debt will be brought under control over the next 4 years, instead it looks set to continue to increase in terms of % of GDP and therefore so will the risk of bankruptcy rise and the consequences of higher inflation until the government is able to start reducing the REAL debt burden in terms of % of GDP, until then Britain will continue on its trend towards eventual bankruptcy.

All depositors in UK Banks are protected to £50k, BUT there is NO protection against the trend towards a government default that manifests itself first in high inflation and eventually in a hyper inflationary bust that destroys the value of hard earned savings. Whilst the worst case scenario remains many years away, however savers and investors do need to protect their wealth against Britain's stealth trend towards bankruptcy, don't make the mistake of waking up one morning like the Icelanders did to find out that they had lost everything virtually overnight. The Inflation Mega-Trend ebook that I am sharing for FREE contains 50 pages of how to protect and grow your wealth.

Your wealth protecting, inflation mega-trend investing analyst.

Source: http://www.marketoracle.co.uk/Article18622.html

By Nadeem Walayat

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 500 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 500 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.