This is a Liquidity Driven Stock Market ...

Stock-Markets / US Stock Markets Aug 02, 2007 - 04:41 PM GMTBy: Marty_Chenard

Things have changed since Bernanke took office and M3 was discontinued. This put blinders on what the Fed was doing relative to Liquidity Injections.

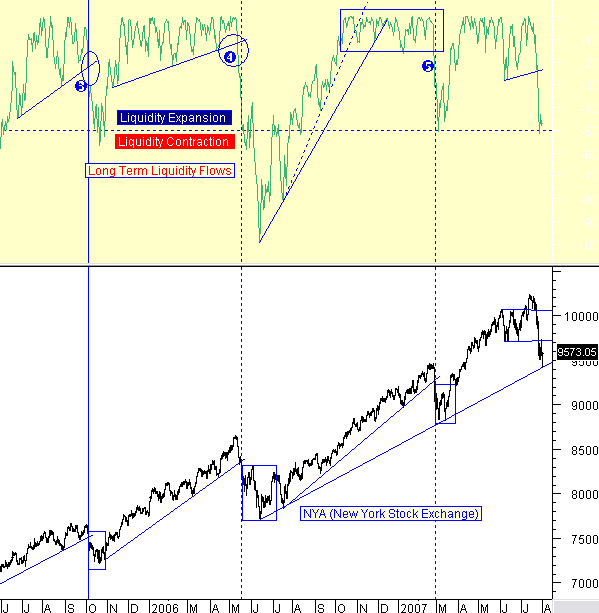

Our Long Term Liquidity measurement is the closest we can get to seeing what Liquidity levels are and when they shift.

Below is our daily chart posted on our paid subscriber sites. When Liquidity decelerates, the market pulls back, and if it goes into Contraction, the market has a prolonged Correction.

Bernanke is closely attuned to the market and how much liquidity needs to be in the system for the market to be supported.

Take a look at this past March. Liquidity was allowed to go all the way down to Neutral and magically, its was halted and reversed back up on liquidity injections. Now look at the current down move ... Liquidity dropped all the way down to Neutral and it magically halted again. If Liquidity is now pumped back up like the last time, the market will find its bottom here and move back up.

It is also interesting that the New York Stock Exchange (NYA) has moved down to a critical support line. Yesterday, that support was held and Liquidity came in very strong at the end of the day. Liquidity is something every investor should keep an eye on with Bernanke being in charge.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.