Yen Rising and US Dollar Bottoming - Gold and Liquidity

Currencies / US Debt Jul 25, 2007 - 01:05 PM GMT

In the latest Prudent Squirrel newsletter, we discussed the fact that the Yen is rising and the USD appears to be bottoming. There are a slew of macroeconomic problems also developing for world markets that are heavily leveraged. A rising Yen was heavily involved in the late February global market sell off, and a bottoming or rising USD is precious metals and CRB bearish.

In the latest Prudent Squirrel newsletter, we discussed the fact that the Yen is rising and the USD appears to be bottoming. There are a slew of macroeconomic problems also developing for world markets that are heavily leveraged. A rising Yen was heavily involved in the late February global market sell off, and a bottoming or rising USD is precious metals and CRB bearish.

Not to mention the fact that any news coming out on the US mortgage problems is instantaneously hitting practically every world financial market, as investors appear to be quite a bit more concerned about the prospects of a slowing US consumer than the typical ‘Asia Bull', who buys the line that Asia can withstand a serious US economic pullback. That concept is way premature, Asia's incredible growth aside. Until Asia can get serious traction in their own consumers, they have little chance of replacing a flagging US consumer who is said to account for an amazing 25% of world GDP/consumption.

Asians are willing to speculate (gamble) or save, but are not nearly as willing to spend as freely for personal consumption as the people in the West are.

But moving ahead a little more, the fact is that world markets are heavily leveraged, and two factors are hitting leveraged markets hard right now, one is subprime and even prime mortgage problems in the US accounting for well over $2 to 5 trillion dollars in value accumulated over the recent US housing boom. These pains are causing market sell offs every time there is any major news out about it, as in the case of Countrywide's troubles coming out yesterday, and causing a serious US stock sell off and flight to safer bonds ( flight to safety and cash). The recent Bear Stearns losses leaving two hedge funds basically worthless, and the illumination that cast on how illiquid mortgage derivatives are, is causing great concern world wide, and is a harbinger of things to come. Investors are seriously pulling back from the mortgage sector, and liquidity is quickly becoming a general problem in every world market too. There is so much leverage accumulated in every market – to include the CRB complex – that rising risk premiums (higher interest rates for higher risk) are forcing market liquidations overall. I expect this trend to continue all this year.

The people talking about this ‘World Stock Bull' market are ignoring the clear signs that there are serious liquidity issues developing in general. The US mortgage derivative losses are just one large sector with liquidity problems. But a rising Yen is another source of liquidity trouble, more on that in a moment.

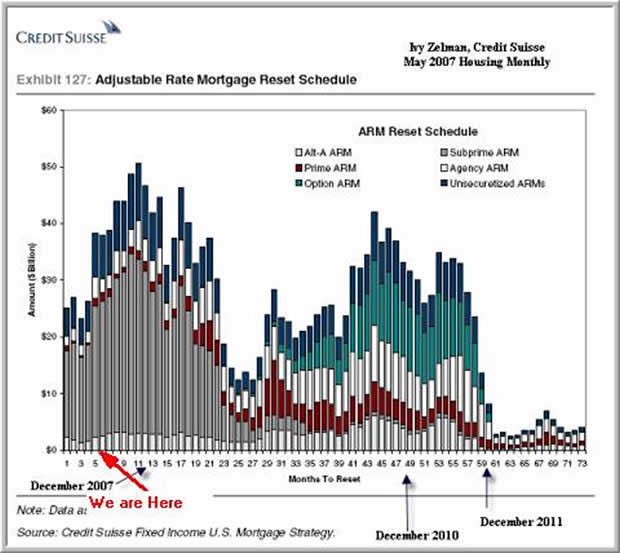

The problems in the US mortgage market are a very hot issue with investors presently, and any major negative news on that comes out as toxic to financial markets almost instantaneously. That clearly indicates how serious big investors view that emerging crisis. There is a very good chart out by Credit Suisse on the impending ARM mortgage resets shown here. Take one look at where we are now, and consider how bad the US real estate market is already, then look ahead a year or two and see that we have only just begun to see the effects of resetting ARM mortgages, and the carnage that is just beginning, and will build relentlessly for the next several years- we have been discussing this chart in the recent NL issues:

After looking at this chart, it is easy to understand how the impending ARM resets have led to severe losses in that sector and will be continuing to lead to more losses. What this means is that the US mortgage market is rapidly drying up, and or risk premiums are returning to the credit markets – and that will affect all manner of credit – and that affects all financial markets as they are heavily leveraged right now – read impending liquidations.

Last year's story

Pending world liquidations is a theme we have been discussing for several months, all the while the various flavors of ‘bull' market proponents are still talking about last year's story – the CRB bull, the ‘world stock bull', and every other bull that has existed in the last several years.

The truth of the matter is that this year's story is emerging forces for market liquidations, that has been directly affecting gold when there are any significant stock/financial sell offs, as in yesterdays US, European and Japanese stock sell offs, and commensurate gold liquidation in the general selling. Gold was down anywhere from 4 to 7 dollars yesterday.

In fact, the continuing US mortgage woes hit gold every time there is a new negative development, and have overridden the USD weakness situation as the USD tests 80 right now. The effect of the US mortgage situation on world financial markets right now cannot be over emphasized.

The other liquidity issue is a rising Yen, which in late February led to, or was directly a part, of the Asian stock sell offs starting February 27, led to two very tense weeks of selling verging on panic – the US Dow falling 500 points one day, and led to Dow Jones falling 2 hours behind on their quotes on that day. But people are still enamored of the ‘World Stock Bull', and you would think that February never happened.

The proponents of the ‘World Stock Bull' are merely looking at the last several years of incredible gains in stocks, but seem to be ignoring the increasing pressure that rising interest rates, US mortgage problems, and – maybe most significantly, the effect a rising Yen has on world market liquidity.

The list goes on, but a rising Yen puts a great deal of pressure on markets to be sold. There is probably over a $trillion in value of borrowed Yen invested in markets of every kind. This is a favorite of speculators who can borrow Yen for about 1%, and speculate with the money. But when the Yen strengthens, that process reverses, as a rising Yen is deadly to people who borrowed a lot of it and now are seeing the prospect of having to pay back that Yen at a higher exchange rate when they do want to unwind those Yen loans. The Yen right now is strengthening significantly.

In addition, the USD appears to be bottoming again, and the one of the only indexes to gain yesterday was the USD which strengthened a little and held 80 on the USDX. The USD right now is at about 80.20. Needless to say, if the USD bottoms here and financial markets continue their selling, we could have another bout of precious metals selling along with general market selling. This happened with a vengeance in late February. I sent out an alert to this fact yesterday.

We at PrudentSquirrel have been closely tracking this general liquidity situation for several months, and have been discussing the prospect of having more liquidity, rather than being heavily invested in the financial markets.

Obviously, the markets world wide could recover in the short term, but there are clear pressures mounting for another serious bout of market sell offs. If speculators can get ahead of the PPT (central bank market support teams in Japan and the US) we could see a real run on ‘the bank' – financial markets heavily infected with leverage. The pieces are in place for this.

By Christopher Laird

PrudentSquirrel.com

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.