A Wiser Use of Borrowed Money

Economics / US Debt Nov 20, 2009 - 02:04 PM GMTBy: Andy_Sutton

It nearly slipped through the cracks this week as mediastocracy marveled at the apparent lack of inflation as the PPI and CPI reports his the wires. However, just beneath the surface, the financial and economic metamorphosis continues unabated. I am talking about Qatar and its very successful bond sale.

It nearly slipped through the cracks this week as mediastocracy marveled at the apparent lack of inflation as the PPI and CPI reports his the wires. However, just beneath the surface, the financial and economic metamorphosis continues unabated. I am talking about Qatar and its very successful bond sale.

This tiny emirate nation-state is 164th in total landmass, 159th in population, and 123rd in population density. Oddly enough, Qatar is 65th globally in terms of GDP, but is number two in per capita GDP (on a purchasing power parity basis) at over $86,000 per annum. They are second only to Lichtenstein.

This past week, this small country, known primarily for its exporting of natural gas managed to garner $28 Billion in orders for a $7 Billion bond auction. Given the still partially fractured state of global credit markets, this level of interest borders on remarkable. The $28 Billion bond sale is the largest by an emerging market player to date.

What is not so remarkable, however, is why this level of interest was present in this bond auction. The small nation state listed among its purposes for proceeds from the auction infrastructure projects, international oil and gas investment, and the purchase of stakes in companies such as Volkswagen. Perhaps we in the Unites States should take notice as the seats at our own bond auctions continue to empty and we edge further down the dangerous path of overt monetization.

This situation shines a good deal of light on the proven economic principle that capital formation comes from foregoing of consumption and the resulting investment. Even though credit has gotten a bad name recently, it plays a vital role in any healthy economic system. Borrowing money to build productive capacity and to make strategic acquisitions that will produce cash streams to pay for themselves is a wise use of credit. This is where the US has departed from the tenets of economic common sense and descended into the depths of absurdity.

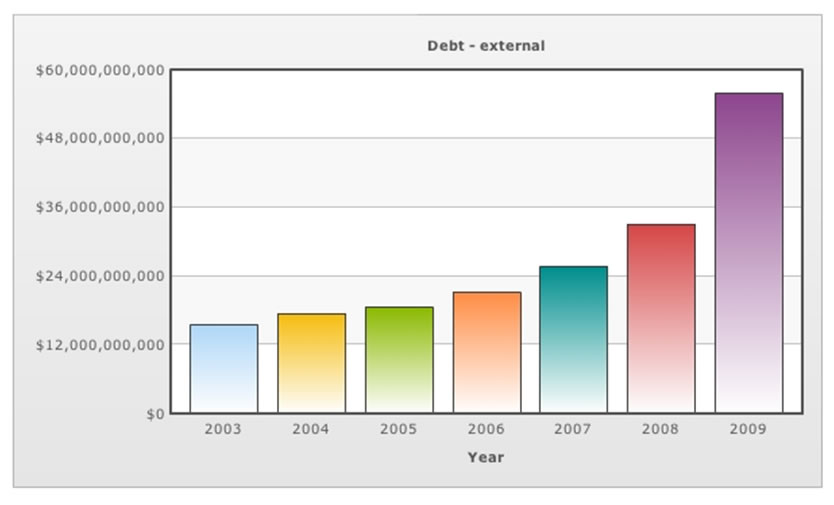

What makes a place like Qatar such an obvious choice for foreign direct investment is the fact that the government has 8 consecutive years of budget surpluses. The citizens are extremely productive in terms of per capita GDP. There is no income tax, which results in lower societal debt burdens. Qatar’s external debt obligations are $55.79 Billion as of 12/08, which translates to 55% of GDP. While 55% is rather high, compare it to the over 90% here in the US. Furthermore, Qatar is unencumbered by unfunded future liabilities. Strategically, Qatar is in an excellent position as the vast majority of its national wealth comes from its natural gas reserves. The country also has approximately 15 billion barrels of crude oil in reserve according to the IEA. Perhaps more importantly, Qatar is positioning itself for the inevitable time when its income from energy exports dwindles. These are clearly carefully calculated long-term moves. The debt growth is disturbing, but at least for now, the borrowings are being put to productive uses. Time will tell if Qatar maintains fiscal discipline or opts for the same path as many Western nations.

The borrowing news from the Middle East is not all productive however. Dubai, decimated by the simultaneous bursting of multiple asset bubbles along with the crash in energy prices in 2008 was able to raise nearly $2 Billion. The Dubai Tourism Development & Investment Co. was able to raise $1 Billion. Given that its primary focus is the development of hotels, it would indicate that there is still a good deal of foolish money out there searching for a place to live.

Still, adapting the old saying, a lousy hotel investment is still better than a good US Government debt obligation apparently. If these recent developments don’t demonstrate the ongoing metamorphosis of the global financial structure, then nothing will. Maintaining reckless fiscal behavior here at home will continue to have a deleterious affect on our currency, our ability to finance future activities legitimately, and ultimately our standard of living.

The lesson in this week’s news is a simple one: use credit wisely and for productive purposes and there will be demand at your bond auctions. Behave foolishly and you’re going to have empty seats and the need to monetize.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.