What If the Foreigners Stop Buying Our Debt?

Interest-Rates / US Debt Nov 19, 2009 - 07:28 AM GMTBy: Doug_Horning

By Doug Hornig, Senior Editor, Casey Research - “I have always depended on the kindness of strangers,” said Blanche DuBois, in the final words of the play A Streetcar Named Desire. Well, don’t we all.

By Doug Hornig, Senior Editor, Casey Research - “I have always depended on the kindness of strangers,” said Blanche DuBois, in the final words of the play A Streetcar Named Desire. Well, don’t we all.

Many citizens probably still cling to the old saw that public debt doesn’t matter because “we owe it to ourselves.” Wrong. Debt always matters. And as for whom we owe it to, it is a lot of kind (or, at least, not yet unkind) strangers.

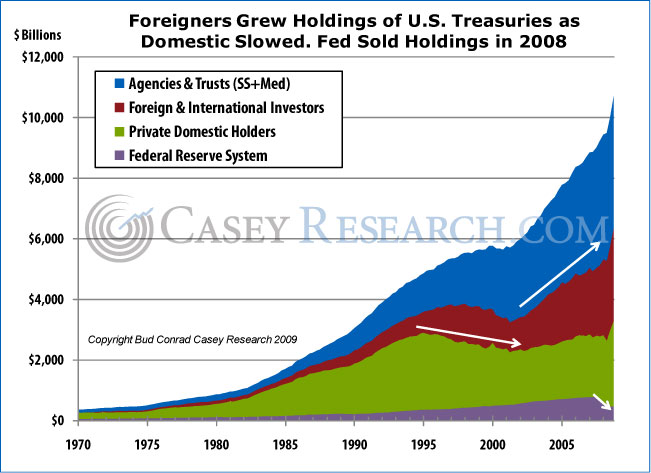

As recently as 1970, foreign holders of U.S. debt were essentially non-existent. But their slice of our obligation pie has steadily increased, especially over the past two decades, until now foreign governments and international investors hold about 35% of Treasuries, as the following chart reveals.

Of about $11 trillion in U.S. debt, foreigners have about $3.8 trillion, with China in the lead at nearly $1 trillion and Japan not far behind at around $750 billion.

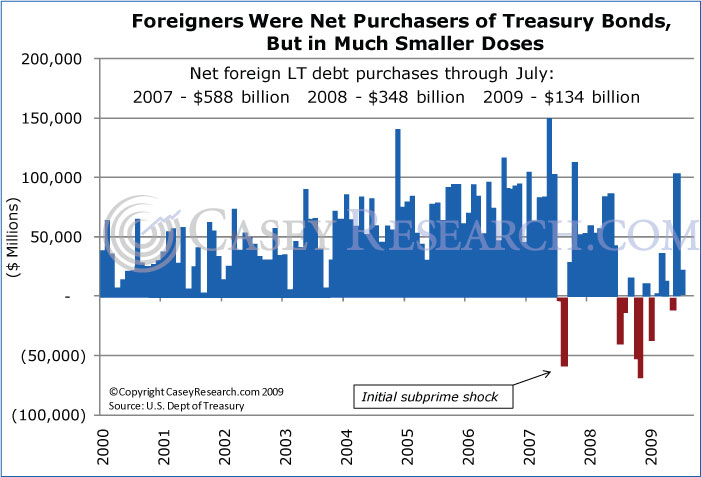

Most likely, though, this trend has already leveled off. The Chinese, Japanese, Russians, and Indians have openly announced their decision to cut back on further purchases and existing holdings of U.S. government debt. Beyond that, the source of funds previously allocated to their purchases -- trade surpluses -- has declined sharply with the recession. As a consequence, going forward, foreign buying is more apt to shrink than increase.

While foreigners are continuing to show up for the record-sized Treasury auctions, it’s due to the dollar retaining its status (albeit shakily) as the world’s reserve currency. But they have become quite cautious, generally investing towards the front end of the yield curve, which is a vote of no confidence in the buck’s future. As the chart below illustrates, sales of long-term bonds to foreigners are way down.

So what does all this mean?

It means that a big chunk of our prosperity during the past twenty years was due to a trade deficit that put billions of dollars into the hands of foreigners, who then turned around and bought Treasuries with them, helping the U.S. government finance its massive deficit spending. That’s over -- and the unwinding process has just begun.

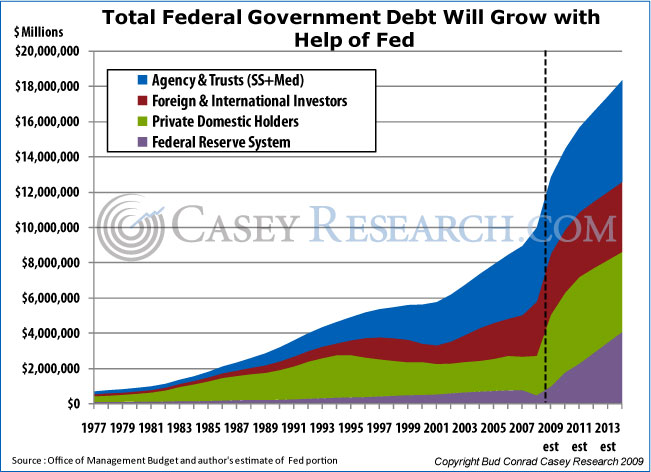

Yet federal deficit spending, far from reflecting this reality, has grown by leaps and bounds. But who will finance it? Let’s extend our first chart out a few years.

As you can see, we project that foreign participation has plateaued. U.S. private domestic investors can probably increase their holdings moderately, now that households are consuming less and saving more, and financial institutions have money to invest in Treasury paper.

The agencies and trusts (like Social Security) are really not a part of the equation, but rather reflect programs on “auto-pilot” and quickly headed to the point where they will negatively impact, not help, the deficits.

Adding it all together, even under the most conservative of assumptions, there are simply not enough buyers to cover the accelerating federal deficits. That leaves the lender of last resort, the Federal Reserve, as the only remaining candidate to satisfy the government’s grotesque appetite for funding. There is no viable alternative.

The Fed will take up the slack in the only way open to it, by printing money out of thin air and exchanging it for promises from the Treasury. That means an escalation of monetary inflation and, somewhere down the road, serious price inflation as well. We don’t know exactly when that will happen, only that it must.

The editors of The Casey Report have been alerting subscribers to this very possible scenario for quite some time. If foreigners stop buying U.S. government debt, the whole house of cards will come crashing down. But you can do a lot to protect yourself financially – run with the trend instead of swimming against it. Find out more about the accurate predictions of trend hunter Doug Casey and his team, and how to profit from them… click here.

© 2009 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.