United States Government Picking Up the Borrowing Slack

Economics / US Debt Sep 26, 2009 - 06:57 PM GMTBy: Mike_Shedlock

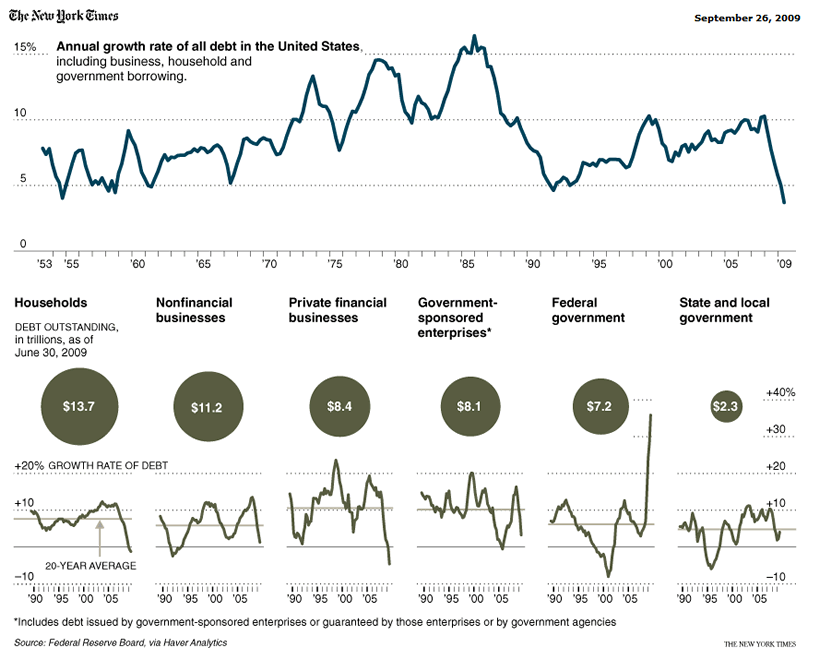

With consumers and businesses not only cutting back but actually reducing debt, A Rich Uncle Is Picking Up the Borrowing Slack.

With consumers and businesses not only cutting back but actually reducing debt, A Rich Uncle Is Picking Up the Borrowing Slack.

The United States government is borrowing money like never before. The national debt rose by more than a third over a one-year period, far more than it ever did at any time since World War II.

Rather than crowding out the private sector, Uncle Sam is now standing in for it. Much of the government borrowing went to investments in financial institutions needed to keep them alive. Other hundreds of billions went to a variety of programs aimed at stimulating the private economy, including programs that effectively had the government pick up part of the cost for some home buyers and some auto buyers.

Summary Statistics From The Article

- Total domestic debt — the amounts owed by individuals, governments and businesses — climbed just 3.7 percent from the second quarter of 2008 through the second quarter of this year. That is the smallest increase since the Fed started these calculations in the early 1950s.

- Over the 12-month period, nonfinancial businesses increased their debt by just 1.3 percent. Since that number is well below the interest rate most of those companies pay, it indicates that they paid back more in old loans than they took out in new ones.

- Over the year, total household debt fell by 1.7 percent, and mortgage debt — the largest component of household debt — fell a bit more, at a 1.8 percent pace. This is the 10th recession since the Fed began collecting the numbers, but the first in which the amount of home mortgage debt fell.

Inflationists will no doubt quickly point out that total debt is still growing. However, government bailouts, health care schemes, lending money to corporations to keep them alive, are low-velocity debt that subtract rather than add to real economic growth.

Moreover, Domestic debt declined in the second quarter, falling 0.3 percent to $50.8 trillion.

The article states "Until this recession, the idea that American individuals would ever cut their overall debt levels seemed as likely as an August snowfall in Miami."

Yes, that was exactly the prevailing view. However, those who saw the buildup of consumer and corporate debt as unsustainable correctly reasoned that private spending would sink, unemployment would rise, bank lending would contract, and treasury yields would plunge.

Those focused on the CPI or money supply failed to see this set of outcomes.

Following the Footsteps of Japan

The US is following the Footsteps of Japan, including the growth of government debt. It is now undeniable.

It is also undeniable that building bridges to nowhere did nothing to overcome Japanese deflation, presuming of course one takes a practical look at what deflation really is.

For further discussion as to a practical way of thinking about deflation in a fiat regime, please see Daniel Amerman vs. Mish: Reflections on the Great Inflation/Deflation Debate.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.