Pay attention to the Ratio of Leader Stocks to Broad Market Stocks ...

Stock-Markets / US Stock Markets Jun 20, 2007 - 09:29 AM GMTBy: Marty_Chenard

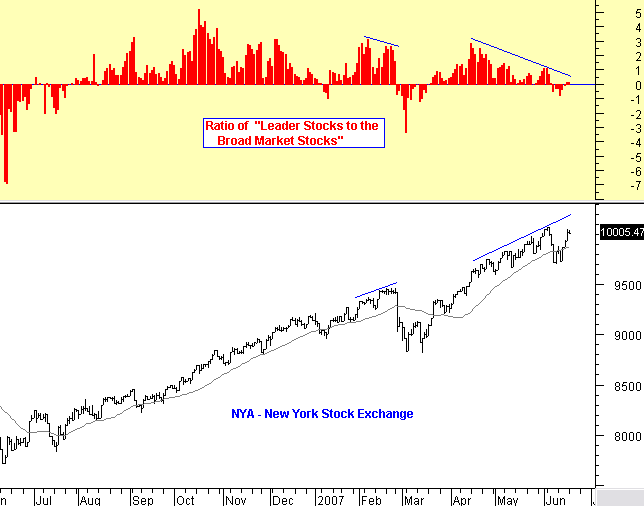

Every night, we measure the percentage "change of direction" of Leader Stocks and the stocks in the Broad Market. We then divide the two to get a Ratio of Leaders to Broad market stocks.

Leader stocks are named that for a very good reason ... they set the pace and direction of the market. When the Leadership Ratio is high, they "pull up the Broad market stocks".

Currently, the Leadership Ratio is positive, but very close to zero and the Ratio is also divergent to the stock market's up movement. Negative divergences can be a warning sign like it was in early February before the sharp drop.

With its current low reading and divergence, this is an "Alert condition" where caution levels should now be elevated. (This information is posted daily on our Advanced subscriber site.)

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.