U.S. Stock Market Remains Strong

Stock-Markets / US Stock Markets Aug 11, 2009 - 03:57 AM GMTBy: Frederic_Simons

The US Stock bonds has shown remarkable resiliance during the last few days. One could get the feeling that it just does "not want to go down". During the trading days, it has become visible however that the Nasdaq is now somewhat underperforming the S&P. Traditionally, this tends to be a signal that a reversal might be happening soon, as the Nasdaq usually outperforms the S&P during upmoves.

The US Stock bonds has shown remarkable resiliance during the last few days. One could get the feeling that it just does "not want to go down". During the trading days, it has become visible however that the Nasdaq is now somewhat underperforming the S&P. Traditionally, this tends to be a signal that a reversal might be happening soon, as the Nasdaq usually outperforms the S&P during upmoves.

Having said this, this traditional view is - well, traditional, as the Nasdaq tend to contain the more risky investments, so that its outperformance was a signal that investors did not mind investing in the riskier stocks. Today, this might actually be different, as the S&P with all its banking and financial services stocks has actually more risky ventures in its index than the Nasdaq. Personally, we would consider a major Bank much more likely to blow up than Google or Microsoft.

Honestly, we have no idea what the market may think about this Nasdaq/S&P/risk-aversion relationship. Our approach is to look at the numbers, prices, observe where the line of least resistance is pointing to, and check the price levels where a possible change in trend might occur.

In our last stock market commentaries (click here) we have written:

"In fact, for those not in a long position and waiting for pullback to jump aboard, any further increase in prices adds to the existing psychological pressure to join the party. This could be a reason why every little pullback during the day is bought, pushing prices to new highs every day. Secondly, there may well be several consecutive weeks of rising equity prices. Rising prices tend to result in a positive feedback that leads to prices climbing even higher.

We are also still of the opinion that

"...if a sizeable pullback should finally occur, it might not be a pullback that you should buy, but the next powerful downleg in this bearmarket. So be very careful with trying to "buy the dip". Imagine how many "sitting on the sideline investors" would be hit if they try to buy a "healthy pullback", which then turns out to be the downleg to new bear market lows in the S&P.

During the last days - we cannot recall where - we have read in a market commentary that some investors we obviously waiting for a pullback in order to invest into this rally that they had missed so far. This is exactly what we mean in what we have written above.

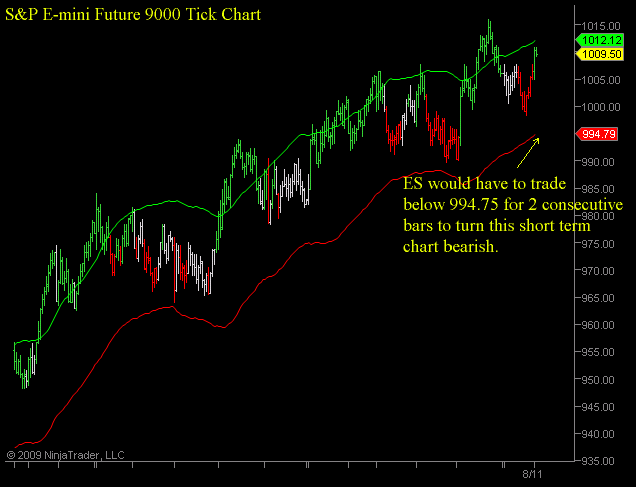

The short and longer term chart of the S&P 500 E-Mini Future is still looking bullish.

[Please click here for additional information about the trading system and how to read the charts]

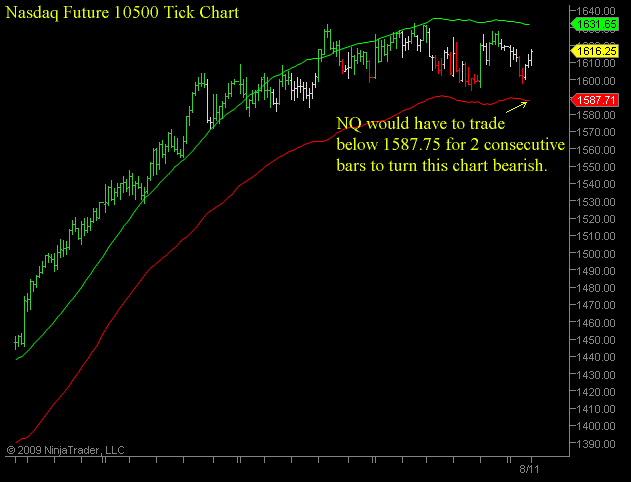

The Nasdaq is also bullish on the longer term chart:

As a conclusion, the US stock market is still looking pretty bullish, and one should not attempt to lean to the short side before the levels indicated above are broken to the downside. On Wednesday afternoon, there will be the Federal Reserve interest rate decision. While a change in interest rates is not likely, these dates are always prone to mark either a turn in the markets or be the start of an acceleration of a persisting trend. As always, we will not be biased. Download our free Crossroads FX toolbar, where we will send an alert if something important happens.

If you have any questions, please do not hesitate to contact us by writing an email to

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.