Stock Market Bulls Try To Take It Up A Notch

Stock-Markets / US Stock Markets Jul 22, 2009 - 07:06 AM GMTBy: Chris_Ciovacco

The financial markets have done a good job of forecasting the slow improvements we have seen in the economic numbers in recent weeks. Even though the economy remains weak, we cannot ignore the steady stream of incremental improvements in the economic data. For example leading economic indicators (LEIs) have increased for three consecutive months. In the June report from the Conference Board , seven of the ten LEI components showed positive improvement.

The financial markets have done a good job of forecasting the slow improvements we have seen in the economic numbers in recent weeks. Even though the economy remains weak, we cannot ignore the steady stream of incremental improvements in the economic data. For example leading economic indicators (LEIs) have increased for three consecutive months. In the June report from the Conference Board , seven of the ten LEI components showed positive improvement.

Since the lows in March of 2009, LEIs have risen 3.1%. As we touch on below, the markets are reflecting the economy’s gradual move off the deck and away from the financial Armageddon scenario. Based on the information at hand, we currently have positive alignment of the fundamentals (they are improving) and the technicals, which results in a more favorable risk-reward climate. The concept of fundamental and technical alignment is covered in more detail in this August 2008 article.

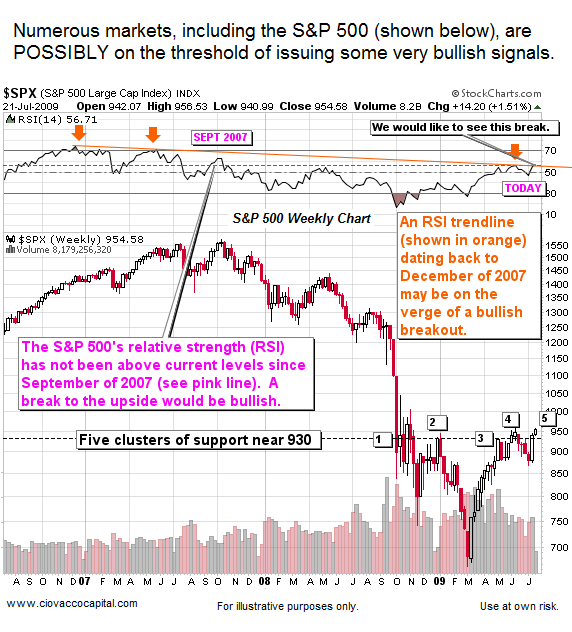

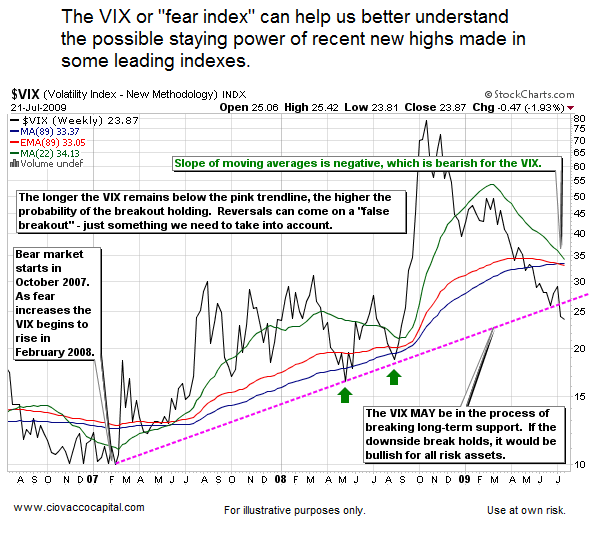

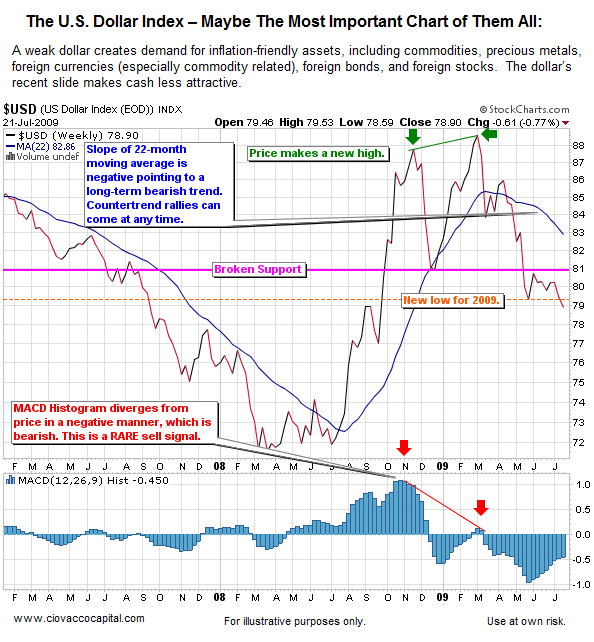

As globalization continues to flatten the world, markets seem to be taking cues from each other on an ever increasing scale. Ultimately, it all comes down to alternating periods between acceptance of risk and risk aversion. Consequently, when markets reach potential forks in the road, the outcomes tend to all go the same way – either risk wins or risk aversion wins. Numerous markets and assets classes are at possible forks in the road. Many of the setups paint a potentially bullish picture (in some cases very bullish). However, it is possible risk aversion could win out over acceptance of risk. Our job is not to forecast but to observe with an open mind. Below we present a few charts which are currently at forks in the road. Like the charts below, most markets seem to be leaning toward the bullish fork, but breakouts and bullish setups often fail. Bullish outcomes would make us more likely to invest additional capital. Bearish outcomes will cause us to remain patient for now. We should have some answers very soon.

Chinese stocks have provided leadership for all risk assets as markets attempt to complete the transition from a bear market to a bull market. This week’s new high in Chinese stocks, if it holds, could indicate that risk assets are ready for another leg higher. If the breakout fails, it would be a negative for all risk assets in the shorter-term. We should know in the outcome in a few days. All charts are weekly.

Some additional charts supporting the current positive technical environment can be found in June 19, 2009 article Bullish Trends and Significant Corrections.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.