Ben Bernanke's Next Parlor Trick on U.S. Debt Financing

Interest-Rates / US Debt Jun 13, 2009 - 06:20 AM GMTBy: Mike_Whitney

Ben Bernanke is getting ready to pull another rabbit out of his hat and he's hoping no one figures out what he's up to. Here's the scoop; the Fed chief needs to "borrow up to $3.25 trillion in the fiscal year ending Sept. 30" (Bloomberg) without triggering a run on the dollar. But, how? If the stock market keeps surging, investors will turn their backs on low-yielding US Treasuries and move into riskier securities hoping for better returns. The only way to attract more buyers to US debt is by raising interest rates which will kill the "green shoots" of recovery and make it harder for people to buy homes and cars. It's a conundrum.

Ben Bernanke is getting ready to pull another rabbit out of his hat and he's hoping no one figures out what he's up to. Here's the scoop; the Fed chief needs to "borrow up to $3.25 trillion in the fiscal year ending Sept. 30" (Bloomberg) without triggering a run on the dollar. But, how? If the stock market keeps surging, investors will turn their backs on low-yielding US Treasuries and move into riskier securities hoping for better returns. The only way to attract more buyers to US debt is by raising interest rates which will kill the "green shoots" of recovery and make it harder for people to buy homes and cars. It's a conundrum.

In the next year, China will buy roughly $200 billion T-Bills while the oil producing states and the rest of the world will add about $300 billion to their cache. That leaves more than $2 trillion for the domestic market where cash-strapped investors are likely to avoid government debt like the plague. So, who's going buy that mountain of low-yield government paper?

In the next year, China will buy roughly $200 billion T-Bills while the oil producing states and the rest of the world will add about $300 billion to their cache. That leaves more than $2 trillion for the domestic market where cash-strapped investors are likely to avoid government debt like the plague. So, who's going buy that mountain of low-yield government paper?The banks.

The Fed has been helping the banks raise reserves for the last year. In fact, excess bank reserves have skyrocketed from $96.5 billion in August 2008 to $949.6 billion by April 2009. Nearly a trillion bucks in less than a year. But, why? Are the banks expecting to expand lending at the fastest rate in history in the middle of a depression?

Of course not; Master illusionist Bernanke is just arranging the props for his next big trick. The fact is, Bernanke anticipated the current wave of deflation and set up a straw man (the banks) to deal with it so it wouldn't look like he was simply printing more paper to finance the deficits. As soon as rates on 10 year notes hit 4%, the banks (that are borrowing money at 0%) will probably start to purchase Treasuries and keep the housing and retail markets from crashing even faster. It's called "the old switcheroo" and no one does it better than the Fed.

Bernanke pulled a similar stunt after Lehman Bros flopped and he and Paulson decided that it was time to dump 700 billion worth of garbage assets on the public. The Fed chief and Treasury figured out the only way they could hoodwink congress was to foment a crisis in the credit markets and then moan that if they didn't get $700 billion to buy up toxic assets in the next 48 hours "there wouldn't be an economy by Monday".

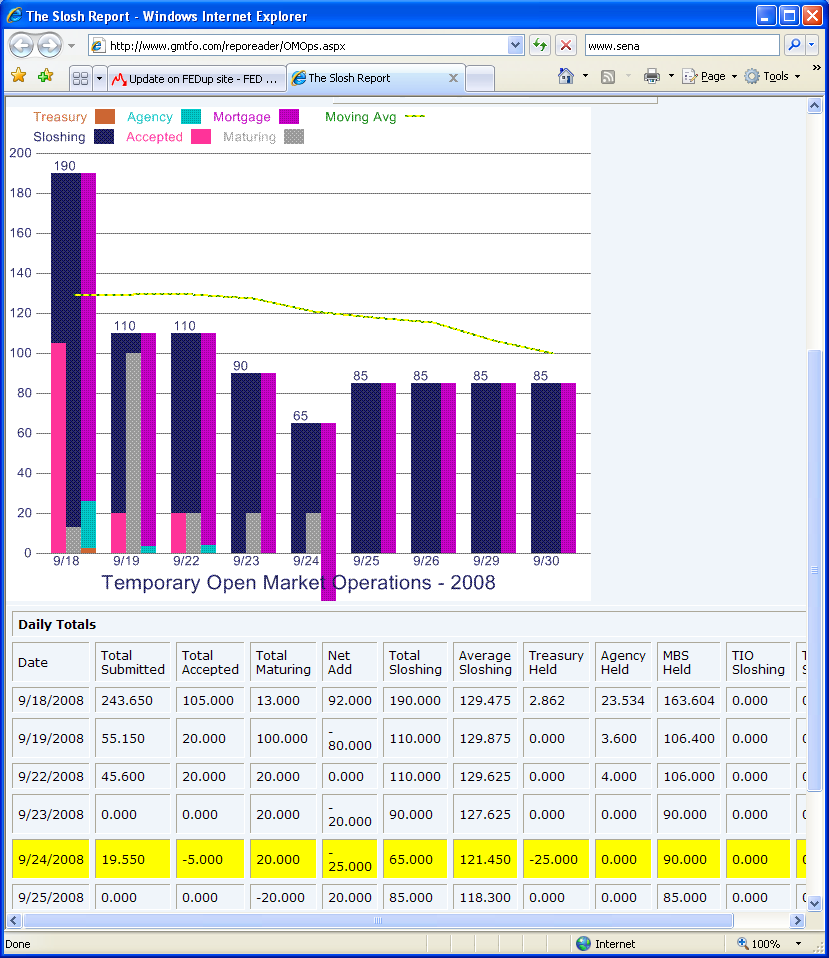

Congress swallowed it hook, line and sinker, and weeks later funds were allocated for the Troubled Asset Relief Program (TARP) Of course, no one in the financial media noticed that the storm in the credit markets was NOT caused by "troubled assets" at all (for which TARP funds have NEVER been used) but by skyrocketing LIBOR and TED spreads and other indicators of market stress. Market Ticker's Karl Denninger was the only blogger on the Internet who figured out that Bernanke had deliberately caused the crisis by draining over $100 billion from the banking system just 10 days after Lehman defaulted. Here are Denninger's comments on September 24, 2008 along with the damning chart which proves the Fed was scuttling the ship to extort money from congress:

As soon as Paulson and Bernanke had pulled off their multi-billion dollar heist, the Fed chief created lending facilities (completely unrelated to the TARP) which provided government guarantees on money markets and commercial paper. This lowered LIBOR and TED spreads immediately and relieved the stress in the credit markets. The crisis had nothing to do with toxic assets; it was a cheap parlor trick by a professional charlatan. To this day, none of the junk securities have been purchased from the banks under the TARP program. $700 billion has vanished in a puff of smoke. Poof!

Market Ticker: "Note that this is an intentional drain of "slosh", or liquidity, from the banking system. $125 billion in the last four days drained? ("Congress must Excise the Bernanke Cancer", Market Ticker)

"It appears to me that he (Bernanke) both orchestrated the crash of the market in the fall of 2008 as a leverage tool to force the passage of the EESA/TARP and may have been responsible for Washington Mutual's collapse and forced dismemberment.Let us remember that on September 20th, four days prior to Bernanke's action, Henry Paulson pitched TARP (along with Bernanke) to Congress." (Market Ticker)

By Mike Whitney

Email: fergiewhitney@msn.com

Mike is a well respected freelance writer living in Washington state, interested in politics and economics from a libertarian perspective.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.