Stock Market Rally Looking Tired, Some Technical Indicators Improving

Stock-Markets / US Stock Markets Jun 01, 2009 - 03:32 PM GMTBy: Richard_Shaw

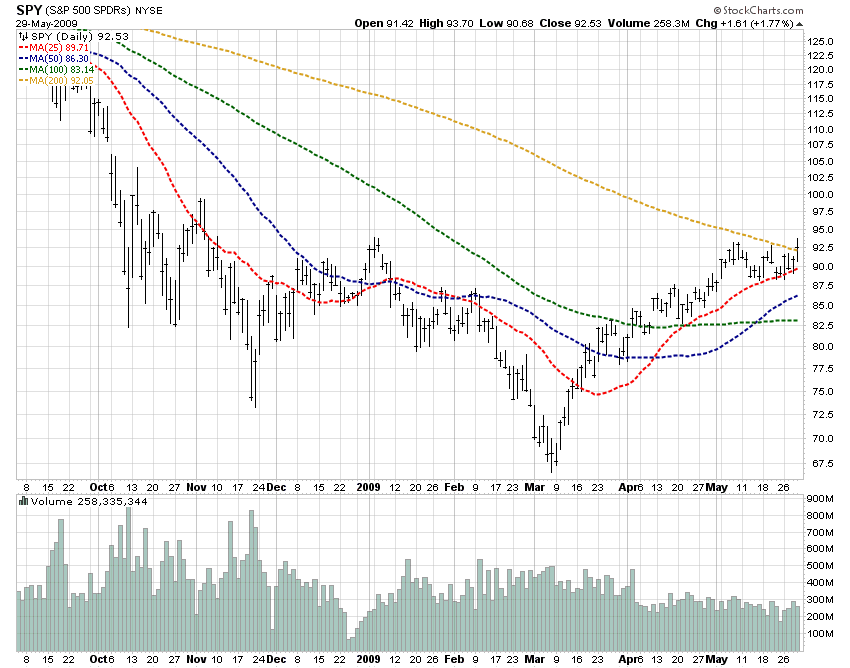

The S&P 500 rally is beginning to look a bit tired. The price action is more sideways than up and the volume is declining. That may just be the pause that refreshes, or it may be the pause before a retracement.

The S&P 500 rally is beginning to look a bit tired. The price action is more sideways than up and the volume is declining. That may just be the pause that refreshes, or it may be the pause before a retracement.

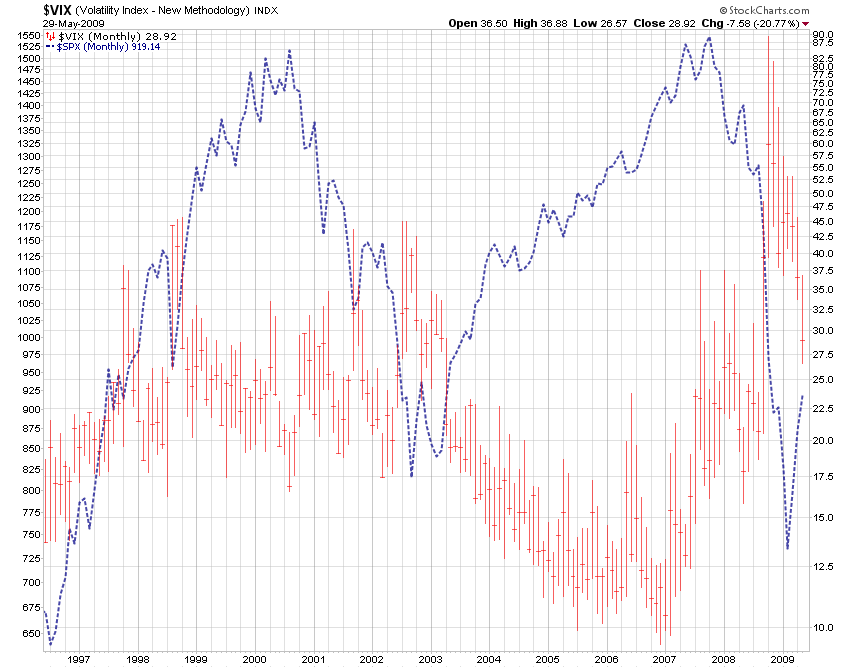

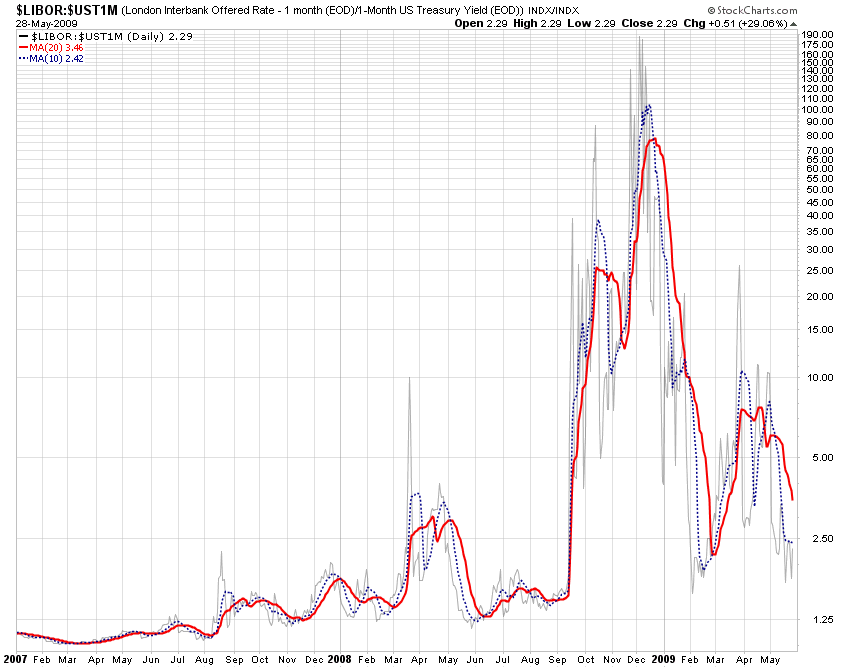

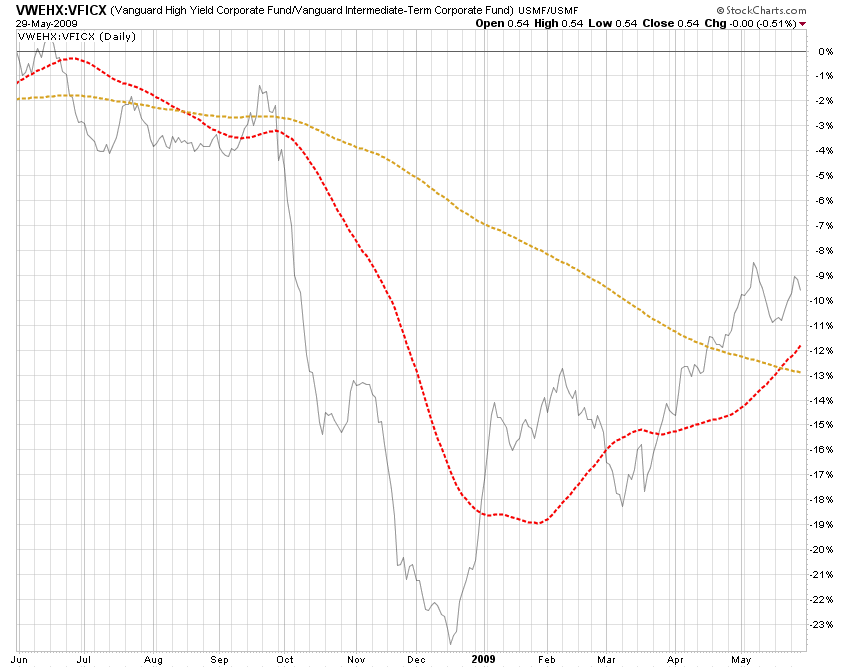

Some important indicators, such as the VIX, the rate spread between LIBOR and Treasuries, and the relative performance of high yield and investment grade corporate bonds are supportive of the positive S&P 500 direction.

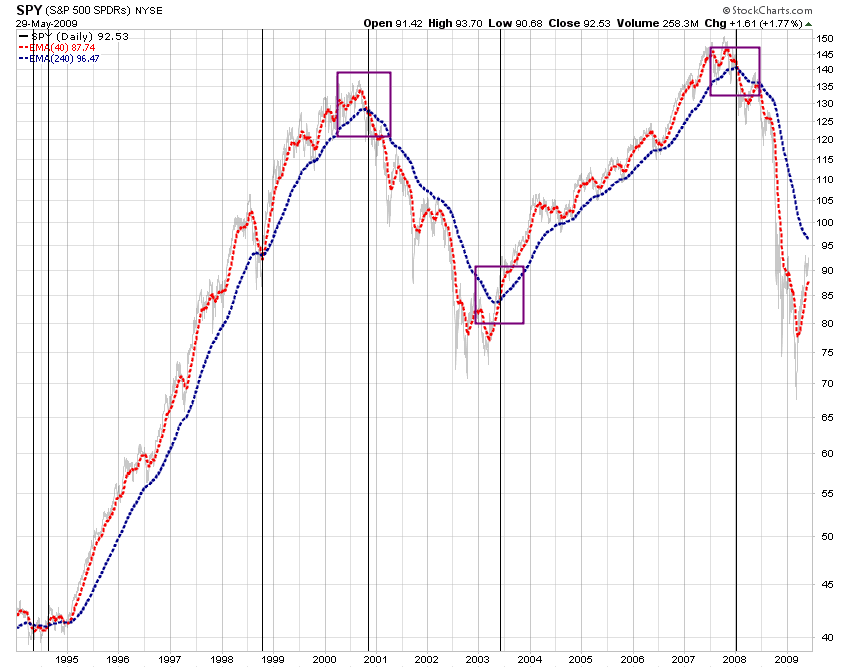

On the other hand, the cyclic price action demonstrated in the past 15 years, which is well tracked by trend following methods, suggests that we are not yet in a bull phase.

Of course there is more upward movement somewhere in the future to get us to a bull phase, and we could be in that transitional period now. It’s just that we have a hard time looking past the the economic situation which really stinks once your strip away of the rosy predictions of US officials who are hardly objective.

Nobody can really say what the next 6 months or 2010 will look like. So many things have yet to work through the pipeline. It could be better. It could be worse.

World Bank President Robert Zoellick said “Right now, the international system appears to have a sufficient amount of stimulus … The danger is if you spend too much government money, you create a different problem.” He said the stimulus alone is “like a sugar high” unless the credit markets are functioning properly.

The World Bank forecast in March that the global economy will contract 1.7 percent in 2009 and increase 2.3 percent in 2010. Note that results in an average growth of 0.25% for 2009-2010.

The American Association of Individual Investors weekly poll shows more bears than bulls; more bears and fewer neutral investors than normally.

Price Curve Flattening & Volume Declining

VIX Down, S&P UP

LIBOR/Treasury Spread Lower, But Still High

Junk Rising More Than Investment Grade Corporates

Moving Averages Not Yet Converged

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.