Downsizing of America - Thoughts on a Vanishing Lifestyle

Politics / US Debt May 26, 2009 - 02:33 PM GMTBy: Mike_Shedlock

In response to Lifestyle Liquidation - Estates of the Fabulously Rich, an article about an aborted move by the Peacock family to sell a 10,000-square-foot home complete with an exotic game room featuring a hyena and the heads of an elephant and wildebeest, along with 6 sports cars and other items, I received this email from "MB".

In response to Lifestyle Liquidation - Estates of the Fabulously Rich, an article about an aborted move by the Peacock family to sell a 10,000-square-foot home complete with an exotic game room featuring a hyena and the heads of an elephant and wildebeest, along with 6 sports cars and other items, I received this email from "MB".

Dear Mish,

I’m a longtime reader and always enjoy your take on things. Your article on the failed auction of the mansion in Florida points out a change I think we are facing: huge, overly ostentatious homes are dinosaurs. I am a builder, not working for the past two years because I don’t like to work and lose money, but I was recently tempted by a “bargain” property here in the Portland area.

The bargain property is a ten thousand square feet home on 1.4 acre lot in the most prestigious gated community around. It is appraised at $3.5 million, has a $2.7 million mortgage, is bank owned by a mortgage company in bankruptcy, and the price has kept dropping until it is now at $900,000.

The home has been empty for two years with no heat or water, the beautiful yard is now out of control, the wood windows are all dry rotted from neglect, and as much as I would love to take on a project like that (I truly do love the challenges of building) I can’t see ending up with a 10,000 square foot home with a tax bill of $41,000 and huge utility bills. Who will ever want to live in a home like this again? I considered offering $600,000, but decided to walk away, not wanting to own it at any price.

The times they are a changing.

"MB"

Those who think the bottom in housing is in, especially luxury housing, need to think again. As pointed out in "Lifestyle Liquidation", attitudes are changing, and those attitudes are not changing back. Peak Credit and Peak Earnings are in. Those expecting otherwise need to consider the Effect of Household Deleveraging on Housing, Consumption and the Stock Market.

Peacock aborted the auction of the cars because he owes more on them than the offers. He aborted the sale of the mansion although he would have walked away with over $2 million. Will the next offer be as good?

Cash strapped boomers will be traveling less, eating out less, and buying fewer toys in retirement than they expected. When they go to downsize, who can afford to buy such mansions. Of those who can afford to do so, who will want to?

Is Housing an Investment or a Consumable?

Note what happens to homes that are not maintained: dry rot sets in. In Florida, mold and termites take over. Those who think of housing as an investment are now finding out the reality, housing is more of a consumption item than an investment.

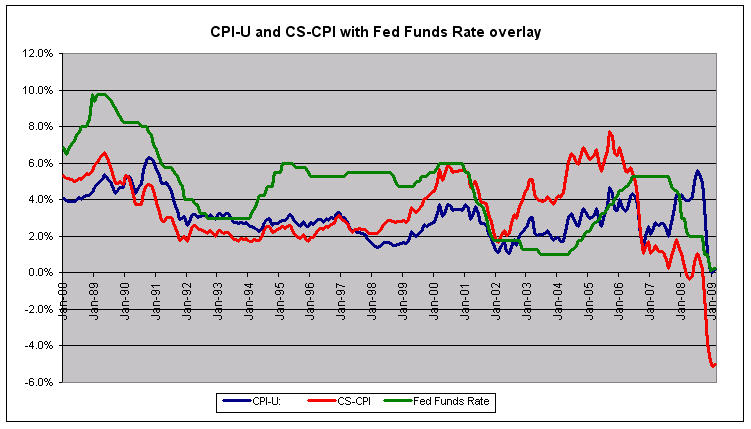

As a consumable, housing prices ought to be reflected in the CPI but officially they are not. Unofficially, I have done so as the following chart shows.

Case-Shiller-CPI (CS-CPI) vs. CPI-U

See CS-CPI Negative 5.0% Third Straight Month for more details.

Greenspan ignored the effects of asset bubble like housing, by failing to take into consideration housing in the CPI. Real interest rates were -5% in mid-2004 and stayed that low for quite some time, spawning the biggest credit boom the world has seen. Now in spite of a Fed Fund's rate that is zero, real interest rates are +5%.

Think the Fed knows how to manage an economy? Think again.

Greenspan had the winds of productivity, credit expansion, and consumer attitudes at his back. Bernanke has the winds of credit contraction, consumer attitudes, and demographics blowing stiffly in his face.

Those betting on Bernake's ability to reflate should take another look at Bernanke's Deflation Preventing Scorecard. He's a perfect 13 of 13 failure and changing consumer attitudes towards debt and banks attitudes towards lending are why.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.