Stock Market Trend Confusion and U.S. Dollar Crackdown

Stock-Markets / Global Stock Markets May 24, 2009 - 02:56 PM GMT John Hussman (Hussman Funds): Stock market advance - “leadership by losers”

John Hussman (Hussman Funds): Stock market advance - “leadership by losers”

“As of last week, the market climate for stocks remained characterized by mixed valuations - modestly overvalued on the basis of most fundamental measures except those that assume a sustained return to the record profit margins of 2007, and slightly undervalued if one assumes that a return to those profit margins is a given.

“Market action was also mixed - volume continues to show fairly tepid sponsorship relative to durable market advances. Meanwhile, price action has been very favorable on the basis of breadth, but with the strongest leadership from industry groups with the least favorable balance sheets and financial stability. It is not typical for the industries that suffer worst in a bear market to be the ones that lead the subsequent bull market. That sort of ‘leadership by losers’ however, is very characteristic of bear market rallies.

“That’s not to say that we can immediately conclude that stocks are in a bear market advance as opposed to a new bull market, but as usual, we don’t spend much of our energy making assumptions about things that aren’t observable. At present, the observable evidence is that stocks are priced to deliver modestly sub-par long-term returns, but still in the range of about 8% annually over the coming decade …”

Source: John Hussman, Hussman Funds, May 18, 2009.

Richard Russell (Dow Theory Letters): Characteristics of secondary reactions

“The most difficult and puzzling study of the stock market is that which deals with secondary reactions against the primary trend. Because we’re in a bear market, I’m going to limit the following discussion to (upward) reactions in bear markets.

“Over the weekend I pulled out my volume of Robert Rhea’s ‘The Dow Theory’. I went over some of Rhea’s comments on secondary reaction in bear market.

“‘For the purpose of this discussion, a secondary reaction is considered to be an important advance in a bear market, usually lasting three weeks to as many months, during which interval the price movement generally retraces from 33% to 66% of the primary price change since the last preceding secondary reaction.

“‘Those who try to place exact limits on secondary reactions are doomed to failure, just as surely as would be the weather man who forecasted a snowfall of exactly three and one half inches within a specified time.

“‘In a bear market steady liquidation of securities by those who prefer or need cash reduces quotations day after day, with professionals, realizing there is more room on the bottom than on the top, hastening the decline with short sales. Eventually, the market is forced to a lower level than is warranted by conditions. The short interest is perhaps too extended, with wise traders sensing the fact the liquidation has, for the time, at least, run its course.

“‘Quiet, weak spots in bear markets are generally good ones to short, as they generally develop into serious declines.

“‘In a primary bear market the rallies are apt to be violent and erratic, and always occupy less time than the decline, which they partially recovery. Often the primary movement of several weeks is retracted in a few days.

“‘Rallies in a bear market are sharp, but experienced traders wisely put out their shorts again when the market becomes dull after a recovery.

“‘In bear markets, primary movement has an average duration of 95.6 days, whereas the secondary movement averages 66.5 days or 69.6% of the time consumed in the preceding primary movements.’

“All the above pertains to the price action during rallies in bear markets. But what about business conditions during bear market rallies? My studies show that bear market rallies are technical phenomenons which do not necessarily reflect on business. I’m looking at a chart of the great 1929 to 1930 rally which occurred after the 1929 crash. The Federal Reserve Index turned down in late-1929, and despite the great bear market rally, the Fed Index continued lower into early 1932.”

Source: Richard Russell, Dow Theory Letters, May 18, 2009.

Bloomberg: Birinyi says S&P 500 may reach 1,700 within three years

“Laszlo Birinyi, president of research and money-management firm Birinyi Associates Inc., talks with Bloomberg’s Matt Miller about the outlook for US stocks. Birinyi also discusses his investment strategy and the outlook for the US economy.”

Source: Bloomberg, May 20, 2009.

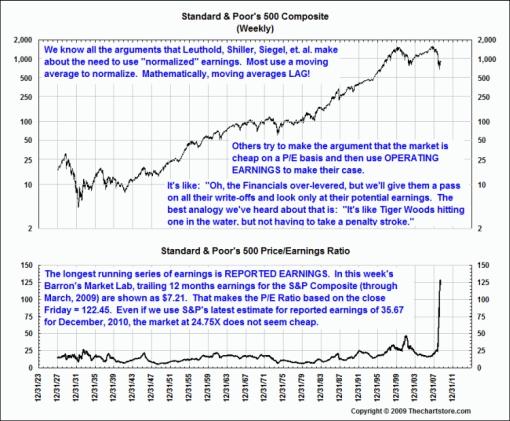

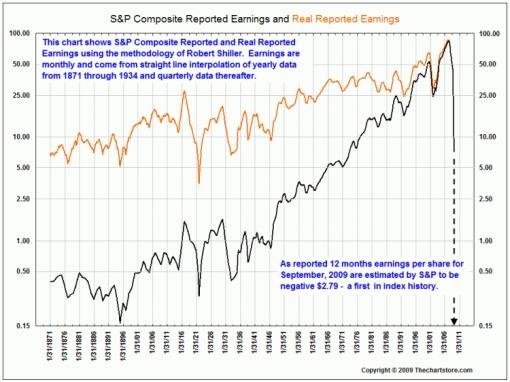

Barry Ritholtz (The Big Picture): Normalizing earnings during profit freefalls

“I am becoming terribly enamored of the charts Ron Griess highlights each week form The Chart Store. Now that earnings season is all but over, Ron looks at a few charts that are revealing of the extent of the damage done to corporate profitability. It is, in a word, breathtaking.”

How cheap are stocks?

How much have profits fallen?

Source: Barry Ritholtz, The Big Picture, May 18, 2009.

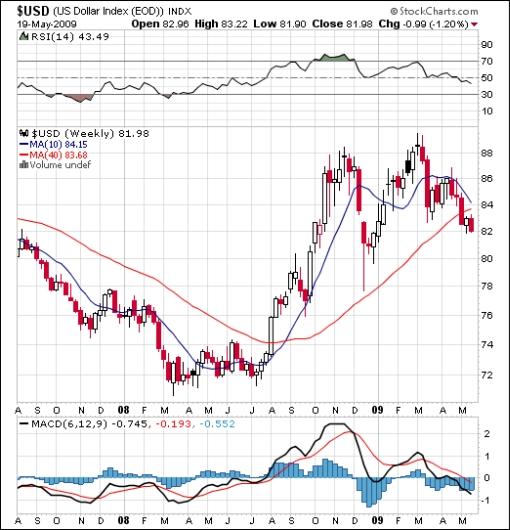

Randall Forsyth (Barron’s): Gain from the greenback’s pain

“The dollar continues to be yin to the stock market’s yang.

“As the perception that the worst of the economic and financial crisis has passed bolsters equities, the greenback is giving back its gains.

“The dollar’s declines are being blamed by the sado-monetarists (to steal once again a terrific turn of phrase from John Liscio, our late friend and colleague at Barron’s) on the aggressive expansion of liquidity by the Federal Reserve.

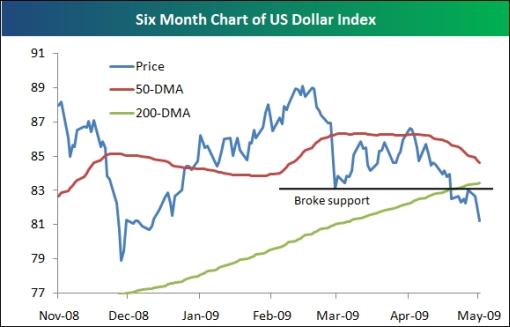

“And, indeed, the US Dollar Index, which measures the greenback’s value against a basket of America’s major trading partners, broke below its 200-day moving a couple of weeks ago. The further drop in the US Dollar Index to below 82 essentially puts it back to where it started the year.

“The dollar’s reversal actually represents a relief of sorts. In the global scramble for scarce dollar liquidity, the dollar’s price was bid up. Borrowers of dollars - nearly the whole world in the global credit crunch - had to pay them back. That made for a classic short-covering rally for the greenback.

“Make no mistake: the fundamentals for the dollar are negative, given the huge US current-account deficit (though it’s shrinking, courtesy of the recession that’s curbed imports) and America’s debtor-nation status. But deflating the economy in a credit crisis to maintain the exchange rate is worse. It was tried in the 1930s; it was one of the things that made the Great Depression ‘great’.

“So we’ve picked our poison, and it is a cheaper currency. For investors, the question is how best to react.

“ISI Group’s Portfolio Strategy Group, led by Francois Trahan, suggests that if you like US equities, you should be buying the big, global companies that may be domiciled outside the US but compete in the same markets as American companies around the world.

“Even though this is supposed to be a global world, there remain many portfolio managers who are restricted to buying “US companies,” an archaic notion.

“… if you’re bullish on US stocks that will benefit from an economic recovery and reflation, why not buy foreign stocks, which should get the added benefit of currency gains from the dollar’s decline?

“You can wring your hands and bewail the demise of the dollar. Or you can take advantage by investing abroad. Never has it been so easy for Americans to do so.”

Source: Randall Forsyth, Barron’s, May 21, 2009.

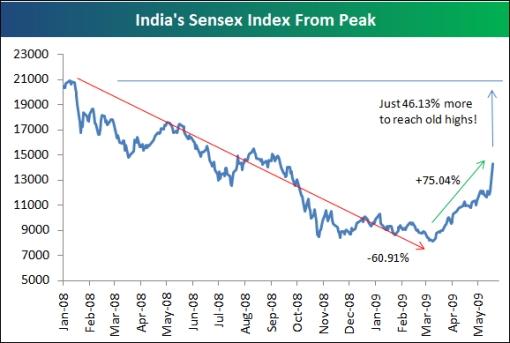

Bespoke: India has biggest one-day change ever

“India’s Sensex rallied 17.34% today on unexpected election results for its biggest one-day gain ever in its 30 year history. The next biggest one-day gain came in March 1992 when the index rallied 13.14%. From its peak in January 2008 to its recent low, the Sensex dropped 60.91%. From its low, however, the index has now rallied 75.04% in just over two months. Even after this 75% gain, India needs to rally another 46.13% to reach its old highs.”

Source: Bespoke, May 18, 2009.

Richard Russell (Dow Theory Letters): US dollar cracking down

“On the edge - below, a weekly chart of the Dollar Index. The 10-week blue moving average is about to drop below the red 40-week moving average in what technicians call ‘the death cross’. As I write the dollar is flirting with a serious break to new lows. The bearish target is 80, below which the dollar could swoon. Is it any wonder that international holders of dollar-denominated securities are white-knuckled?

“The status of the dollar is now so extremely important that I’ve decided to include a daily chart as well. What you see on the daily chart is an enormous head-and-shoulders top with the dollar right on the edge of support. A break below support (the blue line) would be ominous, and would probably send the dollar down to test its December low at 81.41.”

Source: Richard Russell, Dow Theory Letters, May 20, 2009.

Barron’s: New dilemma for the UD dollar

“China isn’t just talking about supplanting the dollar as the center of the international monetary system. It is taking concrete steps away from the greenback for both finance and trade.

“The Financial Times reports China and Brazil have discussed using their own currencies for trade, a marked shift away from the use of dollars, the norm for the conduct of international trade.

“There have been proposals over the years to use currencies other than the dollar for trade, most notably by the Organization of Petroleum Exporting Countries. OPEC has made noises about pricing its oil in a basket of currencies or perhaps the euro to offset the cartel’s currency losses when the greenback would take one of its periodic headers.

“But nothing ever has come of those threats. And even with the introduction of the euro as the first, real potential rival, world trade continues to be conducted overwhelmingly in dollars.

“The global use of dollars has been an enormous advantage to the US, affording the nation the ability to spend and borrow nearly without limit. As long as the rest of the world wanted and needed dollars for trade in goods and financial transactions, America could effectively just reel off greenbacks to pay its bills.

“As noted here previously, the rest of the world quite simply is getting its fill of dollars. The head of the People’s Bank of China, that nation’s central bank, has called for a ’super sovereign’ international currency that would take the place of the dollar. More recently, a Japanese official called on the US to issue Treasury bonds denominated in yen, which couldn’t simply be repaid by the printing of dollars.

“Now, talks between China and Brazil on setting up bilateral trade in their own currencies moves the possible supplanting of the dollar out of the financial realm.

“It is no coincidence that the US has been replaced by China as Brazil’s biggest trading partner. As such those two nations see less of a need to use dollars for their bilateral trade. Moreover, China and Argentina last year entered an agreement to transact trade in their respective currencies, cutting out the dollar as an intermediary.”

Source: Randall Forsyth, Barron’s May 19, 2009.

Eoin Treacy (Fullermoney): Outlook for British pound

“The pound was one of the world’s worst performing currencies from late-2007 through to the end of the 2008. As a major European economy, outside the Eurozone, with a burst housing bubble and a heavy reliance of the City’s financial sector, the UK is more exposed to the effects of the credit crisis than many others.

“The UK took no action to support the currency as it declined, since it helped to make UK exporters more competitive. As short-sellers focused on sterling as a vehicle for taking advantage of the credit crisis, the pound’s fall outpaced that of its trading partners and on a trade weighted basis, it fell over 30% between mid-2007 and late 2008.

“The Deutsche Bank British Pound Trade Weighted Index ranged from 2001 to the middle of 2007. However, it broke emphatically below 95 in December 2007 and fell to 90 where it distributed for four months. It broke downwards again in August and began to accelerate lower from October. The Index found support in December and has posted a succession of higher lows since.

“This action is in contrast to the bearish sentiment towards the UK economy and the pound generally. The fundamental economic condition of the country is still deeply troubling but we should not forget that currency trading is a relative value endeavour. It could be argued that the pound became undervalued relative to its main trading partners too quickly and that rather than the pound being strong, other currencies are now getting weaker.

“If we accept the proposition that the pound is bottoming, then foreign investors looking at potentially making relatively long-term investments in Europe could justifiably start looking at the UK as a preferred destination.”

Source: Eoin Treacy, Fullermoney, May 18, 2009.

Joe Weisenthal (Clusterstock): John Paulson’s big bet on inflation

“Earlier this week we mentioned that hedge fund manager John Paulson, who made his fortune betting against the housing market, is moving forward with plans to pounce on cheap real estate.

“Prior to that Paulson was betting on gold, taking sizable stakes in some gold miners.

“The Pragmatic Capitalist smartly connects the dots: Stringing together the recent SEC filings of John Paulson, the billionaire hedge fund manager, makes one thing clear: he is betting big on the reflation trade. Paulson’s latest 13-F filing shows large positions in Anglogold, Kinross gold, Gold Fields, market vectors gold ETF and the S&P gold ETF.

“More interesting is a recent filing by Paulson to start raising money for a hundred million dollar “real estate recovery” fund.

“At first, the news of large gold purchases early last month were seen as potential Armageddon plays based on Paulson’s big bets on the collapse of the economy last year, but it’s now clear that Paulson is betting big on inflation in the coming years.”

Source: Joe Weisenthal, Clusterstock, May 21, 2009.

Business Intelligence: Gold will ultimately hit US$1,300 on inflation hedging, says JPMorgan Chase

“Jan Loeys, the global head of market strategy at JPMorgan Chase & Co said commodities are going to move higher as investors start to get concerned about inflation.

“Speaking on Bloomberg Television from Hong Kong, Loeys said: “The global recession and the US recession probably is over this month, maybe next month. Commodities, materials in particular, are going to be benefiting right now as investors start to get a bit worried about future inflation.”

“‘Over the next year or so, we think we are going to be crossing US$1,000, probably go ultimately to US$1,200, US$1,300 just for inflation hedging and lack of supply,’ Loeys said.

“Clients ‘are very worried about inflation in two, three years time,’ Loeys said in the interview. ‘The buying we are seeing now in commodities is really hedging, hedging off the potential risk that we will see a spike in inflation.’

“Loeys said crude-oil prices may rise faster than gold in the next few months as energy demand picks up.”

Source: Business Intelligence, May 17, 2009.

Bespoke: Gold breaks downtrend and dollar breaks down

“Gold is up another $12.40 today to $939/ounce. Ever since the metal hit support at its 200-day moving average in April, gold has been rallying nicely. And based on technicals, gold has quite a bit of room to run on the upside before it starts to hit resistance again. As shown below, when the metal broke its multi-month downtrend at the start of May, it turned the technicals from negative to positive.

“Gold’s gain has coincided with the dollar’s demise. The dollar tried to mount a comeback after taking a big hit in March, but it didn’t get close to a retest of its 52-week highs. Once it tested and failed at support levels a couple of weeks ago, the trend turned from neutral to negative. The next area of support for the dollar doesn’t come into play until it gets down to its December lows. For now, investors should play the stocks with high international revenues as a play on the decreasing dollar.”

Source: Bespoke, May 20, 2009.

Bespoke: Oil seasonality

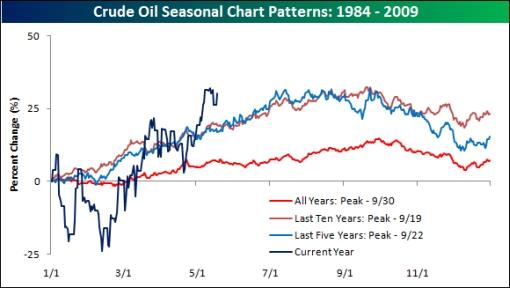

“With gas prices steadily rising in recent weeks, drivers are nervously watching movements in crude oil and hoping that last week’s sell-off is the beginning of a trend rather than a just a quick pullback. Unfortunately, if crude oil’s seasonal pattern over the last 25 years is any indication, we shouldn’t expect any relief until September. The chart below shows the average YTD percent change in the price of crude oil over various time periods. For each period, we also show the date the high was reached. As shown, over the last twenty-five (9/30), ten (9/19), and five (9/22) years, the price of crude oil has typically peaked in mid to late September.”

Source: Bespoke, May 18, 2009.

BCA Research: Oil breaks out - is it sustainable?

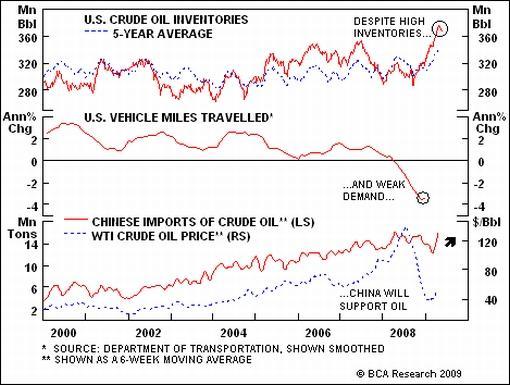

“The rally in oil from the low $30s is technically impressive against the weak global demand backdrop and elevated inventories.

“Oil prices reached $62/bbl this week, despite lofty US oil inventories (notwithstanding this week’s inventory decline) and the fact that Americans are driving much less than last year. The higher price of oil reflects in part the upturn in Chinese oil imports and car sales at a time when oil production is lagging. Russia continues to have difficulty boosting output and oil production has been flat for most OPEC countries. Saudi Arabia has cut production sharply.

“As with other commodities, oil should benefit from both a weaker US dollar and a shift in investor portfolio preference toward real assets as a hedge against inflation. The upturn in our global leading economic indicators is another positive sign for the commodity complex. Bottom line: Our strategists have upgraded commodities to overweight recently, with energy at the top of the buy list. Investors should consider playing the oil bull market by buying North American exploration and production stocks, or by going long the Norwegian krone and the Canadian dollar.”

Source: BCA Research, May 22, 2009.

Financial Times: S&P warns UK over high debt level

“Britain on Thursday became the first big economy to be warned in the financial crisis that it might lose its top-notch credit rating, in a move that raised fears of possible downgrades for other large industrialised nations.

“Standard and Poor’s lowered its medium-term outlook on the triple A rating for the UK’s debt to ‘negative’ from ’stable’ for the first time since the credit ratings agency started analysing the country’s public finances in 1978.

“Though the agency lowered its outlook, it affirmed Britain’s AAA long-term and A-1+ short-term sovereign credit ratings.

“S&P based its warning on a forecast that net government debt risked approaching 100% of national income and staying at that level. ‘A government debt burden of that level, if sustained, would in Standard & Poor’s view be incompatible with a AAA rating,’ the agency said.

“A loss of the top credit rating could raise the cost of financing the national debt, putting further strain on public finances and adding to pressure on Gordon Brown to bring down borrowing faster than the Treasury has planned.

“The agency’s warning sets a precedent for other big economies with triple A ratings whose debt burdens are also approaching 100% of national income. The UK debt burden is forecast over coming years to be similar to that of the US, France and Germany, all of which may now be vulnerable to an S&P downgrade.

“Investors worried that the US - which is also running record government deficits - might be in line for a similar warning. Yields on long-term US government debt rose sharply, the dollar fell to a new low for the year, while gold rallied 1.7% in New York towards $955 an ounce.”

Source: Chris Giles and Dave Shellock, Financial Times, May 21, 2009.

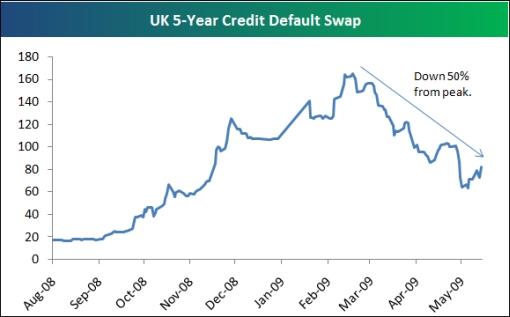

Bespoke: S&P cuts UK’s credit outlook to negative … we’re shaking in our boots

“The fact that the major credit ratings agencies still make news is one of the more peculiar financial topics of the 21st century. After being worthless during the credit crisis and then being labeled worthless after the fact by the media, somehow S&P’s cut of the UK’s credit outlook to negative is reverberating through global markets today. And now investors are wondering if the US is next.

“Without laying out a thousand more reasons why no one in the world should pay attention to this, below we highlight a chart of the credit default swap (CDS) price per year to insure $10,000 of UK sovereign debt for 5 years. Since default risk peaked in late February, the cost to insure UK debt is down 50%! The S&P outlook cut today moved the CDS price from 72 bps to 82 bps. This move barely shows up on the chart and highlights that the bond market surely doesn’t care about S&P’s call. And where the heck was S&P prior to and during the 900% (yes 900%!) rise in UK default risk in 2008 and early 2009?”

Source: Bespoke, May 21, 2009.

Gabriel Stein (Lombard Street Research): Russian stimulus is not working

“Russia’s central bank could once again face a choice between allowing the rouble to weaken and taking steps to support the economy, says Gabriel Stein, chief economist at Lombard Street Research.

“‘According to estimates, Russian GDP shrank by 9.5% in the first quarter from a year earlier,’ he says. ‘There are some ‘green shoots’ of recovery - but even President Medvedev has acknowledged stimulus measures to boost the economy have so far not worked.’

“Mr Stein says Russia is paying the price for its double exposure to the ‘most serious hazards of the modern world - energy and exports to continental Europe.’ The former, he says, is the result of Moscow’s single-minded pursuit of energy control, regardless of the damage to Russia’s business climate.

“The rouble has strengthened this year, partly on optimism about emerging markets, partly due to - but also a cause of - Russian stock market gains and partly on high interest rates.

“‘Rates were cut to 12% last week, but remain attractive - and should provide a barrier to the rouble collapse that the state of the economy seems to call for.

“‘If maintaining the value of the rouble remains the goal, it will be very difficult to ease monetary policy further. Better to act now to moderate a devaluation which represents the loss of income implied by the collapse of energy prices.’”

Source: Gabriel Stein, Lombard Street Research (via Financial Times), May 18, 2009.

Peter Attard Montalto (Nomura): Fears over South African sovereign risk

“Investor fears of heightened sovereign risk in South Africa have been crystalized by the events of the weekend when a Pretoria court threw out a case by the telecoms regulator and unions objecting to the listing of Vodacom, says Peter Attard Montalto, economist at Nomura.

“‘Investors are particularly concerned at the increase in influence of the unions in government now they hold several key seats in the new cabinet,’ he says. ‘Regulatory flip-flopping is embarrassing and adds to investor uncertainty but we are cautiously constructive on the bigger issue of sovereign risk.’

“Mr Attard Montalto believes having Cosatu, the umbrella union organisation, as well as the SACP (communist party) in government with the ANC will be a noisy affair for investors as each jockeys to have its agenda heard.

“‘We put the events of the weekend down to such noise,’ he says. ‘Investors need to look beyond this to the fact the government will find itself heavily constrained in policy terms by the need to maintain investor sentiment in order to raise the funds needed to push forward its social agenda. This is especially true given South Africa already runs a substantial current account deficit.

“‘This is only the first hurdle for President Zuma. To keep investors onside, he must publicly stamp on any cabinet disagreement on the Vodacom issue and assert a continuation of investor-friendly policy in both what he says and prudent policy action.’”

Source: Peter Attard Montalto, Nomura (via Financial Times), May 19, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.