Is Gold The Secret Diversifier?

Commodities / Gold & Silver 2019 Oct 30, 2019 - 02:25 PM GMTBy: Harry_Dent

It’s no secret to you that I am still more bearish on gold than bullish. And it’s no secret to me that a lot of our subscribers still like gold and feel that it is still a safe haven and a good store of value long term.

It’s no secret to you that I am still more bearish on gold than bullish. And it’s no secret to me that a lot of our subscribers still like gold and feel that it is still a safe haven and a good store of value long term.

Despite having argued that gold was one of the largest bubbles and a part of the larger 30-Year Commodity Cycle bubble and crash, I’ve also noted that both it and Bitcoin have weathered the crash much better than other commodities. And by the way, it has been the commodity sector that thus far has proven my view that bubbles don’t have soft landings when they finally burst .

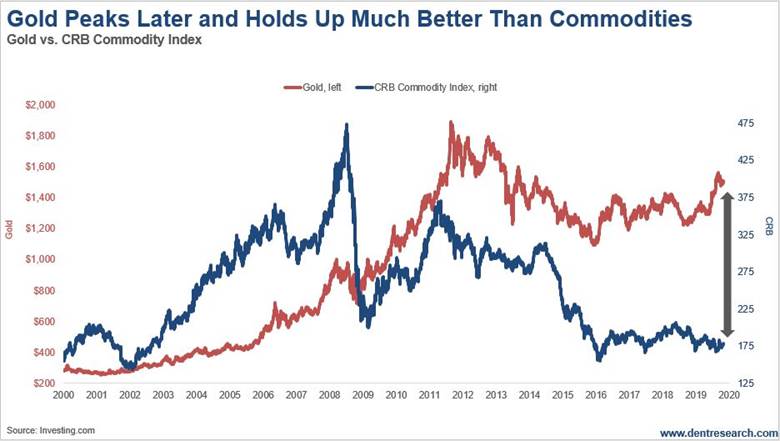

Look at this chart of the CRB broad commodity index vs. gold.

The CRB has already fallen as much as 70% at its last lows in early 2016. The most volatile like oil and iron ore have been down just over 80% at worst. First note that gold both peaked higher and later than the CRB. Second, that it has held up much better: Down only 46% at its low in December 2015.

For Zero Hour, I did an analysis of risk-adjusted returns for commodities in the last bubble. Gold was in the top 1/3 at a killer 34.5%. Despite nominal returns 56% higher for silver, it’s risk-adjusted return was lower at 29.5%.

The Pros…

So, here are the pros of having some gold in your portfolio, outside of when the commodity cycle favors it longer-term, like 2001-11, and ahead, around 2023-38/40:

- Gold does have better risk-adjusted returns than most commodities.

- It is easy to buy, especially with the GLD ETF that is not subject to “contango,” as it is not based on futures, but purchases of physical gold. It is also not hard to store due to its high value to weight.

- It has lower volatility.

- It is a proven store of value, especially in inflationary times.

- It is highly liquid due to broad interest and high trading volume.

- Most of all, it is a more effective diversifier. It doesn’t even correlate with commodities as much as others, and it definitely has low correlation with the stock market.

This diversification quality is the most important. Presently gold, is trading largely opposite

The Cons…

Now, the truth on the other side: Gold correlates very highly with inflation, and thus is a great inflation hedge in times like the 1970s recessionary inflation season…

But, gold long-term has a zero return, adjusted for inflation – and you can’t rent it out like real estate that also correlates with inflation.

We are in a deflationary season since 2008, but central banks are fighting that with fire hoses of QE and financial asset inflation/bubbles. Gold bubbled big time into 2011 with that massive money printing – but collapsed in 2013 forward when it saw no inflation as a result!

Gold Will Fall in Upcoming Recession

Near term, gold still has potential to move towards the highs but not exceed them. It is also a great diversifier until stocks get clear in their bubble burst – which looks very likely for some time in 2020, and most likely by June.

Until then gold looks good with diversification impacts. When the crash begins it will very likely crash to new lows between $700 and $1,000 – still holding up much better than the CRB and most commodities. Hence, I recommend lightening up when stocks look like they are peaking.

In the next commodity boom, I see it as the easiest commodity to buy and the best for portfolio diversification. However, in the next crash I would expect silver to get pummeled much more and be a better buy in the early stages of the next commodity boom and bubble that will last until at least 2038 and perhaps as late as 2040.

Gold will ride again… but it is still disfavored overall until the commodity and economic cycles bottom around 2022-23 or so.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.