Will Powell Turn Into Dove and Make Gold Shine?

Commodities / Gold and Silver 2018 Dec 18, 2018 - 02:35 PM GMTBy: Arkadiusz_Sieron

Tomorrow, the FOMC will publish its monetary policy statements and economic projections. How could they affect the gold market? And what about the recent developments in Europe?

Tomorrow, the FOMC will publish its monetary policy statements and economic projections. How could they affect the gold market? And what about the recent developments in Europe?

FOMC Preview and Gold

The market awaits the monetary policy decision of the FOMC and its fresh economic projections. If the Committee surprises on the dovish (hawkish) side, gold will shine (struggle). Our bet is that – given the attitude of the new Board Governors, the stock market correction, and reduced forecast for global growth in the coming years – the December economic projections might be less optimistic than in September. It would be also in line with the previous December meetings when hawkish actions were accompanied by dovish signals.

However, the outcome of the meeting may be more hawkish than many investors expect. After all, the macroeconomic fundamentals have not changed substantially since September. The US economy remains healthy, with strong labor market and inflation on target. So, although the Fed may slow down its pace of further hikes, it should raise interest rates more than anticipated by many market participants. Gold may suffer then.

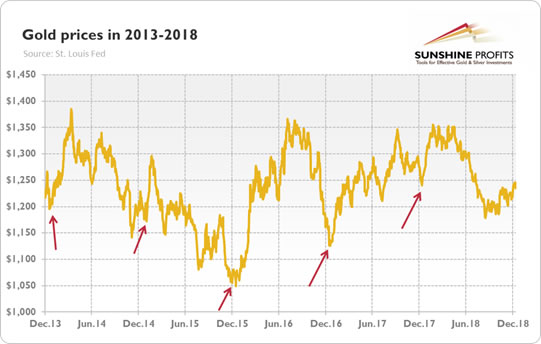

Funny thing. Please take a look at the chart below, which presents the gold prices over the last five years. As one can see, gold struggled each time before the December FOMC meeting, reaching the bottom in the aftermath and then starting its January rallies.

Chart 1: Gold prices (London P.M. Fix, in $) from December 2013 to December 2018.

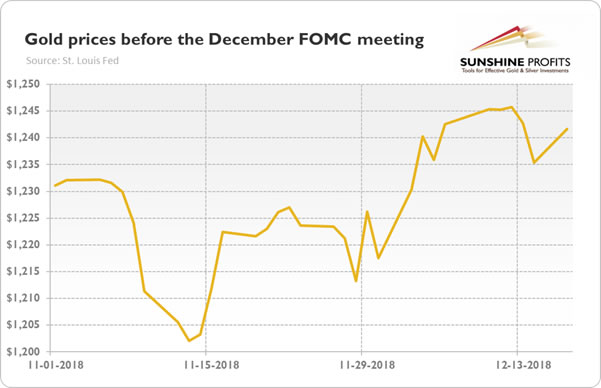

But now it looks a bit different. Although the yellow metal lost somewhat since December 12th, it did not struggle a lot, as one can see in the chart below. It may suggest that the rally after some time from the meeting is not set in stone (in opinion of our trading team, the short position in gold was justified from the risk/reward perspective at the moment of publishing Monday’s alert).

Chart 2: Gold prices (London P.M. Fix, in $) in November and December 2018.

And What About Europe?

The US monetary policy is not the only important thing in the world. We cover it so often, because according to our analysis it’s the key driver of the greenback’s value and, thus, gold. However, we also closely monitor other significant developments all over the world, which could potentially affect the gold prices.

So, let’s discuss briefly the latest developments in Europe. First, the ECB held its December monetary policy meeting last week. The bank kept interest rates unchanged. It will end its quantitative easing this month, but it will continue reinvesting the principal payments from maturing securities “for an extended period of time past the date when it starts raising the key ECB interest rates.” Hence, the ECB ends its asset purchase program four years after the Fed. It means that it significantly lags behind the US central banks in its monetary policy normalization. That divergence in monetary policies should support the greenback against the euro and gold.

Second, the row between Italy and the EU continues. Although the government agreed to cut the deficit forecast from 2.4 percent of Italy’s GDP to 2.04 percent, the budget agreement between Brussels and Rome had not been reached. The EU Commission will meet tomorrow to discuss the situation. The uncertainty about Italy should additionally weaken the euro against the US dollar. It’s bad news for the bullion.

Third, the “yellow vest” protests in France continue, which will also not help the euro and gold, especially that President Macron has already made significant concessions, which would increase the government’s expenditures, ballooning the fiscal deficit above 3 percent of the GDP.

Last but not least, there has recently been another political turmoil about the Brexit. The vote on May’s deal was postponed from December to January. It increases the uncertainty and strengthens the US dollar against the British pound. So we would say that it’s another bearish factor in the gold market right now.

Powell seems to be currently the only potential trigger of the yellow metal’s rally. But he would have to change into a dove. Which is not so simple. Stay tuned – on Thursday we will analyze the implications of the December FOMC meeting on the gold market for you.

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.