Saturday, February 16, 2019

"Mi Amigo" Sheffield Bomber Crash Memorial Site Fly-past on 22nd February 2019 VR360 / Local / Sheffield

By: Anika_Walayat

2019 marks the 75th anniversary of the crash of a US B17 Flying Fortress bomber in Endcliffe Park, Sheffield on the 22nd of February 1944 costing the lives of the 10 member crew of the "Mi Amigo". In commemoration of which a fly past will take place on the 22nd of February 2019 at 8.45am at Endcliffe Park that will include an F15 fighter jet from RAF Lakenheath, other aircraft to include Ospreys, Typhoons and a Dakota.

Here's a unique view of the memorial site in VR 360.

Read full article... Read full article...

Friday, February 15, 2019

Plunging Inventories have Zinc Bulls Ready to Run / Commodities / Metals & Mining

By: Richard_Mills

On Tuesday zinc inventories in London Metal Exchange (LME) warehouses sunk into territory that one metal analyst believes could signal a major price kick for the base metal, used mostly for galvanizing steel to prevent corrosion.

On Tuesday zinc inventories in London Metal Exchange (LME) warehouses sunk into territory that one metal analyst believes could signal a major price kick for the base metal, used mostly for galvanizing steel to prevent corrosion.

The one-year chart below shows LME inventories falling steadily, touching the 108,425-tonne mark as of Feb. 11 - a 52-week low. It’s a long way from the annual high of 256,175 tonnes reached in August.

Cormark Securities mining analyst Stefan Ioannou said last fall that if zinc supply drops 2,000 to 3,000 tonnes a day it would be a very bullish price signal, especially if inventories go as low as 100,000 tonnes. The one-week chart shows zinc inventories dropping from 112,750 tonnes on Feb. 5 to 108,500t on Feb 11 - a fall of 4,250 tonnes, and within only 8,000 tonnes of Ioannou’s100,000t target zone.

Read full article... Read full article...

Friday, February 15, 2019

Gold Stocks Mega Mergers Are Bad for Shareholders / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The world’s two biggest gold miners both announced mega-mergers over the past 5 months or so. These huge deals briefly garnered some interest in the usually-forgotten gold-stock sector, and fleeting praise from Wall Street analysts. But gold-stock mega-mergers are bad news for gold-miner shareholders on all sides. They reveal the serious struggles of major gold miners, and really retard future upside in their stocks.

The world’s two biggest gold miners both announced mega-mergers over the past 5 months or so. These huge deals briefly garnered some interest in the usually-forgotten gold-stock sector, and fleeting praise from Wall Street analysts. But gold-stock mega-mergers are bad news for gold-miner shareholders on all sides. They reveal the serious struggles of major gold miners, and really retard future upside in their stocks.

For decades the largest gold miners in the world have been Newmont Mining (NEM) and Barrick Gold (ABX). These behemoths have long dwarfed all their peers in operational scope. While the gold miners are in the process of reporting Q4’18 results now, their latest complete set remains Q3’18’s. As after every quarterly earnings season, I analyzed them in depth for the major gold miners of GDX back in mid-November.

The GDX VanEck Vectors Gold Miners ETF is the world’s leading and dominant gold-stock investment vehicle. In Q3 alone NEM and ABX mined a staggering 1286k and 1149k ounces of gold! To put this in perspective, the average of the next 8 largest gold miners rounding out the top 10 was just 508k ounces. Newmont and Barrick have long been in a league of their own, with commensurate market capitalizations.

Read full article... Read full article...

Friday, February 15, 2019

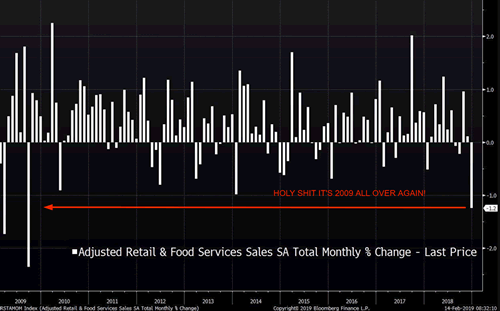

Retail Sales Crash! It’s 2008 All Over Again for Stock Market and Economy! / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

On a slow moving day for the U.S. stock market, today’s big news is that “Retail Sales crashed, just like in 2008/2009!!!”. Financial media jumped all over this – nothing sells like bad news.

On a slow moving day for the U.S. stock market, today’s big news is that “Retail Sales crashed, just like in 2008/2009!!!”. Financial media jumped all over this – nothing sells like bad news.

Friday, February 15, 2019

Chinese Lunar New Year Sales in line with Expectations / Economics / Retail Sector

By: Dan_Steinbock

According to some international observers, the Lunar New Year sales indicate a plunge in Chinese consumption. Economic realities tell a different story.Chinese Lunar New Year can be seen as a barometer for Chinese private consumption, due to gift-giving and family reunions. Consequently, both holiday data and its international coverage are of great interest.

Here’s the bottom line: During the Lunar New Year holiday in early February, Chinese retail and catering businesses generated a record over 1 trillion yuan ($148 billion). Sales by retail businesses rose 8.5% from a year earlier.

Read full article... Read full article...

Friday, February 15, 2019

Is Gold Market 2019 Like 2016? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Have you even wanted to travel in time? You can, at least when reading about the gold market. Many analysts claim that this year is like 2016 for the gold market. We invite you to read our today’s article about the similarities and differences between the precious metals market then and today and find out what do they imply for the gold prices.

Have you even wanted to travel in time? You can, at least when reading about the gold market. Many analysts claim that this year is like 2016 for the gold market. We invite you to read our today’s article about the similarities and differences between the precious metals market then and today and find out what do they imply for the gold prices.

Finally, the scientists have invented the time machine! This is at least what we hear from many people: that we went back in time to 2016. Indeed, there are certain similarities between the precious metals market then and today. What are they – and what do they imply for the gold prices?

Let’s look at the chart below, which shows the price of the yellow metal since December 2015. As one can see, gold has rallied since December 2018, just like three years earlier.

Read full article... Read full article...

Friday, February 15, 2019

Virgin Media's Increasingly Unreliable Broadband Service / ConsumerWatch / ISP's

By: N_Walayat

The following map says it all of what to expect as a customer of Virgin Media. Where once livable outages of an hour or so are turning into near 24 hour losses of service.

Read full article... Read full article...

Friday, February 15, 2019

2019 Starting to Shine But is it a Long Con for Stock Investors? / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

Yes, 2018 ended with a drop – almost a CRASH. Yet, 2019 is starting off on a terror rally that is beginning to lay the grounds for a very dramatic Q1 and possibly Q2 recovery for many in the managed and passive funds. Remember the news in early January 2019? Hedge funds losing 12~22% or more for the 2018 end of year returns? Remember the feeling that these firms just couldn’t find any means of success when almost the entire 2018 year was mired in deep price rotations and sideways trading?

Read full article... Read full article...

Friday, February 15, 2019

Gold is on the Verge of a Bull-run and Here's Why / Commodities / Gold & Silver 2019

By: Umer_Mahmood

The majority of gold traders are very bearish on the gold market currently. The sentiment could signal a start of a possible jump in price for the precious metal.If you are also expecting such a price shift, you might want to consider buying the SPDR Gold Shares ( a fund holding bullion bars).

Read full article... Read full article...

Thursday, February 14, 2019

Capitalism Isn’t Bad, It’s Just Broken / Economics / Economic Theory

By: John_Mauldin

The Soviet Union’s collapse ended the socialism vs. capitalism argument.

The Soviet Union’s collapse ended the socialism vs. capitalism argument.

Semi-free markets spread through Eastern Europe. Collectivist economies everywhere began turning free. Capitalism seemingly won.

Even communist China adopted a form of free market capitalism. Although, as they say, it has “Chinese characteristics.”

With all its faults and problems, capitalism generated the greatest accumulation of wealth in human history. It has freed millions of people from abject poverty.

Thursday, February 14, 2019

Will Stock Market 2019 be like 1999? / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

As the stock market pushes higher, the year “1998” keeps popping up in our market studies recently. 1998 saw a rapid stock market crash, a retest (something we have yet to see today), followed by a massive nonstop rally. Everyone at the time thought that the 1998 crash was the start of a much bigger crash. To their surprise, the bull market (already late-cycle) surged for another 1.5 years before topping.

As the stock market pushes higher, the year “1998” keeps popping up in our market studies recently. 1998 saw a rapid stock market crash, a retest (something we have yet to see today), followed by a massive nonstop rally. Everyone at the time thought that the 1998 crash was the start of a much bigger crash. To their surprise, the bull market (already late-cycle) surged for another 1.5 years before topping.

There is indeed the possibility that today is similar to 1998. There are fundamental and technical parallels.

Read full article... Read full article...

Thursday, February 14, 2019

KitKat "Make a Break for It" Proving Impossible to Win 100 Travel Holiday Goodies Per Day Promo / Personal_Finance / Freebies and Comps

By: Anika_Walayat

KitKat's new promotion for 2019 that went live on the 1st of Feb, which apart from the top prizes of 10 holidays worth £8,000 each, supposedly has 100 holiday getaway goodies to be won EVERY DAY by just entering the codes found on the inside of kitkat wrappers. Thus this 'should' be a relatively easy to win promotion. Unfortunate, that is not our experience after having entered 20 codes to date and not having won a single prize! Which makes us skeptical of the deployment of this promotion.

Read full article... Read full article...

Thursday, February 14, 2019

3 Charts That Scream “Don’t Buy Stocks” / Stock-Markets / Stock Markets 2019

By: John_Mauldin

In World War II, Nobel laureate Ken Arrow was assigned a team of statisticians to make long-range weather forecasts.

In World War II, Nobel laureate Ken Arrow was assigned a team of statisticians to make long-range weather forecasts.

These people were some of the biggest math geniuses on the planet.

And yet, Arrow and his team soon realized that their forecasts were no better than a blind guess.

Seeing no value in their models, the team asked to be relieved of the duty.

The superiors replied: “The Commanding General is well aware that the forecasts are no good. However, he needs them for planning purposes.”

This story holds an important lesson about investing.

Thursday, February 14, 2019

How To Find High-Yield Dividend Stocks That Are Safe / InvestorEducation / Dividends

By: John_Mauldin

BY ROBERT ROSS : Investing is all about making the right choices. And one of them is owning dividend stocks.

BY ROBERT ROSS : Investing is all about making the right choices. And one of them is owning dividend stocks.

Let’s look at two companies as examples: Berkshire Hathaway (BRK.B) and JPMorgan Chase (JPM).

Since the 2008 financial crisis, both stocks have more than doubled:

Thursday, February 14, 2019

Strategy Session - How This Stocks Bear Market Fits in With Markets of the Past / Stock-Markets / Stock Markets 2019

By: Plunger

Question: Plunger you keep insisting that we are in a bear market. Really? The averages have done nothing but go straight up since December 24th. At this rate we will be at new highs within a month. I thought prices go down in a bear market! That’s not happening.

Question: Plunger you keep insisting that we are in a bear market. Really? The averages have done nothing but go straight up since December 24th. At this rate we will be at new highs within a month. I thought prices go down in a bear market! That’s not happening.

Answer: The most reliable method of forecasting the eventual outcome of the market over the past 118 years has been Dow’s Theory. It has withstood the test of time. It is not a short term predictor, instead it has been likened to a weather barometer. An instrument that forecasts changes in business conditions and market cycles. It is not useful in predicting short term fluctuations just like a weather barometer shouldn’t be used to forecast the amount of rain or snow to fall in an upcoming storm.

It is my contention that if one gets the big cycles right he has enabled the basic setup for success in the market. If you don’t understand the cycle and position yourself wrong in it, good luck trying to make money. So we stick to Dow Theory, it has proven to work in the past under all market conditions. What it says now is a bear market was triggered on December 14th 2019 which began on October 3rd 2019. The present 8 week rally is a secondary reaction which remains uncorrected. All rallies are corrected. We must be patient and observe the price action of the upcoming correction. In order to reverse the downward primary trend, the Dow and Transports must complete a downside correction of the existing rally then rally back above today’s present reaction high.

Read full article... Read full article...

Thursday, February 14, 2019

Marijuana Stocks Ready for Another Massive Rally? / Companies / Cannabis

By: Chris_Vermeulen

Our research team has been actively discussing the potential that the entire Marijuana stock sector could be setting up for another upside price rally. Since the bottom set up in the US stock market near December 24, 2018, many of the cannabis-related stocks and ETFs have seen incredible upside recoveries (of 25% or more). We believe the current setup in MJ, the Alternative Harvest ETF, is indicative of a new bullish momentum breakout.

Our research team has been actively discussing the potential that the entire Marijuana stock sector could be setting up for another upside price rally. Since the bottom set up in the US stock market near December 24, 2018, many of the cannabis-related stocks and ETFs have seen incredible upside recoveries (of 25% or more). We believe the current setup in MJ, the Alternative Harvest ETF, is indicative of a new bullish momentum breakout.

The upside potential for this move is likely 12~25% or more over a short span of time. Watching MJ move from $34 to $39 over the next few weeks could result in a 14%+ move where a breakout of $39 to the upside could see MJ retesting recent highs near $45 (a +32% upside move).

Read full article... Read full article...

Thursday, February 14, 2019

Wage Day Advance And Why There is No Shame About It / Personal_Finance / Debt & Loans

By: Sumeet_Manhas

...

Wednesday, February 13, 2019

Will 2019 be the Year of the Big Breakout for Gold? / Commodities / Gold & Silver 2019

By: Michael_J_Kosares

In each of the last three years, gold has gotten off to a strong start only to fizzle as the year moved along. Will 2019 be the year gold finally breaks the pattern? A good many investors, fund managers and analysts think that 2019 might very well be the year when gold breaks the restraints and pushes to higher ground. One of those is Carter Worth of Cornerstone Macro in New York who CNBC’s Melissa Lee refers to as “the chart master.” In a recent interview with Lee, Worth referred to the long-term chart below saying that there is “a well-defined set-up and a lot of tension” which he says is going to resolve to the upside – “a breakout to all-time highs.” With respect to gold’s relationship to the dollar, Worth says “Gold’s got its own momentum now. . .It is all setting-up for higher gold prices and trouble for equities, trouble for the economy.”

In each of the last three years, gold has gotten off to a strong start only to fizzle as the year moved along. Will 2019 be the year gold finally breaks the pattern? A good many investors, fund managers and analysts think that 2019 might very well be the year when gold breaks the restraints and pushes to higher ground. One of those is Carter Worth of Cornerstone Macro in New York who CNBC’s Melissa Lee refers to as “the chart master.” In a recent interview with Lee, Worth referred to the long-term chart below saying that there is “a well-defined set-up and a lot of tension” which he says is going to resolve to the upside – “a breakout to all-time highs.” With respect to gold’s relationship to the dollar, Worth says “Gold’s got its own momentum now. . .It is all setting-up for higher gold prices and trouble for equities, trouble for the economy.”

Wednesday, February 13, 2019

Earth Overshoot Day Illustrates We are the Lemmings / Politics / Climate Change

By: Richard_Mills

What were you doing on August 1, 2018? Likely it was just like any other day, with your thoughts on work, your spouse, your kids, money, what to make for dinner, etc. What you should have been thinking about though, was the Earth.

What were you doing on August 1, 2018? Likely it was just like any other day, with your thoughts on work, your spouse, your kids, money, what to make for dinner, etc. What you should have been thinking about though, was the Earth.

August 1 was Earth Overshoot Day. What does that mean? Well, Earth Overshoot Day is the day of the year when humanity has used more resources from nature than can renew in that entire year. The date is moving closer to January, meaning every year we use up more natural resources, faster.

That’s a problem, because without a way to replace all the resources we consume - harvested food, fertilizers, energy, metals, etc. - we are gradually depleting nature’s bounty, at a rate that is unsustainable, long-term. If we keep going, and economies keep growing, we’re eventually going to run out. The problem is made worse by the global population increasing, along with the continuing wants of people in the developed world (“the West”) and in less-developed countries (who are demanding houses, cars, fridges, cell phones, etc.), putting more pressure on our finite resources.

Read full article... Read full article...

Wednesday, February 13, 2019

A Stock Market Rally With No Pullbacks. What’s Next for Stocks / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

In a rally with no pullbacks, the S&P 500 has finally closed above its 200 day moving average (slightly).

Read full article... Read full article...