Global Stock Markets Extend Gains on Encouraging Earnings Pre-announcements

Stock-Markets / Financial Markets 2009 Apr 12, 2009 - 07:44 AM GMT

Five in a row! Notwithstanding sentiment for equities waxing and waning for most of the Easter-shortened week, bourses closed strongly on Friday and capped a five-week winning streak - the first since October 2007 for the major MSCI and US stock market indices.

Five in a row! Notwithstanding sentiment for equities waxing and waning for most of the Easter-shortened week, bourses closed strongly on Friday and capped a five-week winning streak - the first since October 2007 for the major MSCI and US stock market indices.

An encouraging pre-announcement of first-quarter results by Wells Fargo (WFC) provided some confidence for the nascent earnings season and gave a healthy boost to the financial sector and overall market.

On a related note, the Treasury Department is expected to announce the expansion of the Troubled Asset Relief Program (TARP) to aid ailing life insurance companies within the next few days, adding a third industry to the banks and automakers that have already received bailouts from the government.

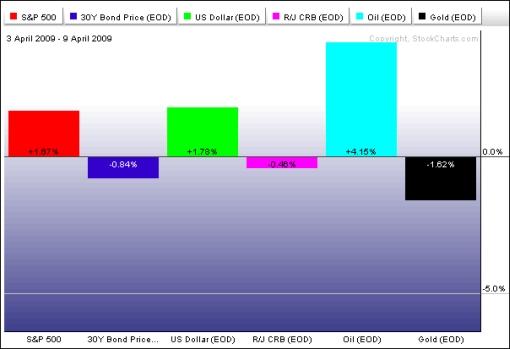

Not only did global stock markets extend their gains last week, but the US dollar reclaimed a stronger footing as a result of heightened risk aversion during the earlier part of the week. Holiday-thinned trading in commodities ended with a mixed performance among the 19 constituents of the Reuters/Jefferies CRB Index. Government bonds, under threat of large-scale issuance in the coming months, also had a relatively quiet period.

The performance of the major asset classes is summarized by the chart below, courtesy of StockCharts.com.

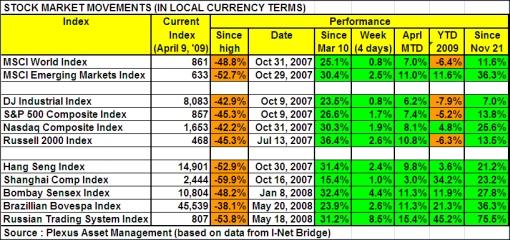

Stock markets, led by financials, added to the gains of the rally that commenced on March 10 (see table below). The MSCI World Index gained 0.8% (YTD -6.4%) and the MSCI Emerging Markets Index 2.5% (YTD +11.6%). These indices have risen by 25.1% and 30.4% respectively since the low of March 9.

Returns around the globe ranged from top-performers Ukraine (+19.4%), Egypt (+9.7%) and Russia (+8.5%) to Côte d’Ivoire (-4.3%), Macedonia (‑4.1%), Norway (-3.9%) and the United Kingdom (-3.4%), which were languishing in the red. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

Among the major US indices, the Nasdaq Composite Index (+4.8%) is the only index in positive territory for the year to date. Although not yet claiming this feat, US small caps have also been running hard over the past few weeks, as can be seen from the rising trend line of the S&P 600 Small Cap Index relative to the S&P 500 Large Cap Index since the March 9 lows. The fact that small companies are now outperforming the larger ones is an indication that investors are becoming less risk averse - a positive sign for equities in general to improve further.

Source: StockCharts.com

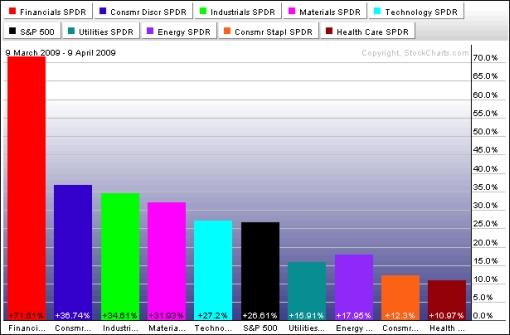

As far as leadership since the start of the five-week old rally is concerned, the rebounding Financial SPDR (XLF) is by far the top performer among the economic sector exchange-traded funds (ETFs). Interestingly, cyclical sectors such as the Consumer Discretionary SPDR (XLY), Industrial SPDR (XLI), Materials SPDR (XLB) and Technology SPDR (XLK) all outperformed the S&P 500, whereas the traditional defensive sectors like the Utilities SPDR (XLU), Energy SPDR (XLE), Consumer Staples SPDR (XLP) and Health Care SPDR (XLV) were all lagging the broader market. This is the type of pattern one would typically expect to emerge during a market base formation development.

Source: StockCharts.com

John Nyaradi (Wall Street Sector Selector) reports that the strongest ETFs on the week were the Merrill Lynch Regional Bank Holders (RKH) (+16.2%), iShares Cohen & Steers Realty (ICF) (+15.8%) and Financial Select Sector SPDR (XLF) (+14.2%). On the other end of the performance scale the Market Vectors Gold Miners (GDX) (-10.9%), iShares Silver Trust (SLV) (-4.7%) and United States Natural Gas (UNG) (-4.6%) performed poorly - in tandem with natural gas and precious metals retreating.

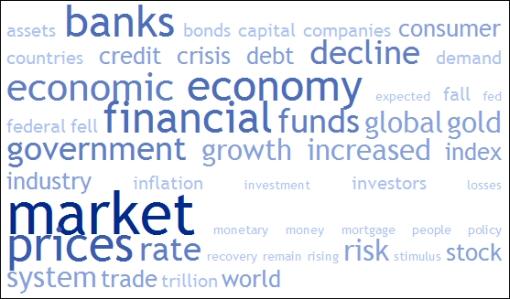

Next, a quick textual analysis of my week’s reading. No surprises here with key words such as “market”, “prices”, “economy”, “financial” and “banks” featuring prominently.

On the question of whether the current rally has more steam left, Kevin Lane, technical analyst of Fusion IQ, said: “It is a very fine line between a rally extension call and a retest call, though we are leaning towards the former after a pullback/pause. However, since both calls - rally or retest - are plausible we continue to suggest investors tighten up stops and portfolio VAR (Value At Risk) until more evidence unfolds. Until more clarity occurs either technically or fundamentally, I can think of worse things in the world than locking in some gains or getting stopped out at a profit on trailing stops.

“So over the next few sessions watch the skew of decliners to advancers and down to up volume. As long as we don’t get ratios of 5 to 1 or higher on both indicators the likelihood of a retest in the near term is lessened.”

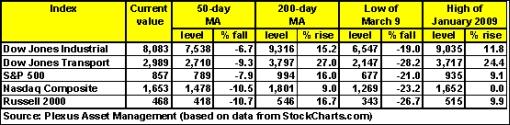

As shown in the table below, the 50-day moving averages have been cleared comfortably by all the major US indices and the early January highs are the next important targets. As a matter of fact, the Nasdaq Composite Index is already one point above this level and has to rise by a further 9.0% in order to reach the key 200-day moving average - an indicator often used to distinguish between primary bull and bear markets. On the downside, the levels from where the nascent rally commenced on March 9 should hold in order for the upward trend to endure.

Although he still maintains that stock markets are witnessing nothing more than a bear market rally, Richard Russell, doyen of newsletter writers and author of the 50-year old Dow Theory Letters, on Friday said. “I was wrong. It looks as though this rally has legs. Lowry’s Selling Pressure Index has stopped rising and now appears to be topping out. At the same time, Lowry’s Buying Power Index is in a rising trend. The look of the Lowry’s chart suggests that the [short-term] direction of least resistance is up.”

From London, David Fuller (Fullermoney) opined: “… consistent and persistent trends, such as we have seen over the last five weeks, are often important trends. This continues to look like the first psychological perception stage of a new bull market - lows are rising over time, indicating that demand has the upper hand, but most people do not believe in the market’s recovery. Consequently, the perception is of high risk, while it is actually low, given all the cash available to fuel an additional advance.

“… Asian emerging and South American resources markets are currently carrying our preferred secular themes higher. The tech and telecom cyclical theme is also performing well. These look like new bull markets.

“Europe and the USA, T&T excepted, continue to underperform, not surprisingly given the economic problems. Wall Street still has the capacity to be a spoiler because we do not yet have confirmation that the early March lows will hold. Technical confirmation of a new bull market, as we have often said, comes later and requires a break above the 200-day moving average, which then also turns upwards.”

The CBOE Volatility Index (VIX) (green line in the chart below) is another indicator heading in the right direction for equity bulls, having declined from the 80s in October and November to 36.5 on Friday - its lowest close since late September, just ahead of the stock market meltdown. This is comforting as the VIX is the market’s main gauge of fear and usually moves in the opposite direction of the S&P 500 (red line).

Source: StockCharts.com

Bill Fleckenstein, well-known perma-bear who announced late last year that he was closing his short-only hedge fund as a result of the reduced number of attractive shorting targets, said: “Now that stocks have rebounded as far as they have, the upcoming earnings season will be particularly interesting - and potentially dangerous - but it will offer information as to the sustainability of the recent advance. If stock prices can shrug off the news, then the market may be headed higher still.”

On the topic of earnings, in the coming week all eyes will be on announcements by Goldman Sachs (GS) (Tuesday), JPMorgan Chase (JPM) (Thursday) and Citigroup (C) (Friday), especially with Goldie mulling a multi-billion dollar equity offering.

For more discussion about the direction of stock markets, also see my recent posts “Video interview: ‘The tide is turning,’ says Prieur du Plessis“, “Emerging-market equities show leadership“, “Technical talk: Sentiment review“, “Video-o-rama: Five in a row for stock markets“, and “Picture du Jour: It’s earnings, stupid!“.

Twitter

I regularly post short comments (maximum 140 characters) on topical economic and market issues on Twitter. For those not doing so already, you can follow my “tweets” by clicking here. The Twitter posts also appear on my Facebook page and in the sidebar of the Investment Postcards site.

Economy

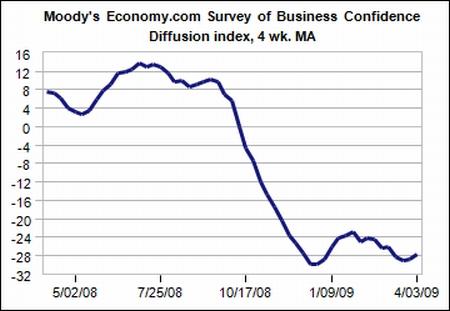

“Business pessimism remains deep and widespread across all industries and regions of the globe,” said the latest Survey of Business Confidence of the World conducted by Moody’s Economy.com. “Sales remain extraordinarily soft and pricing power continues to weaken.” However, it is encouraging that the Survey found that businesses were becoming steadily less negative about the economy’s prospects later this year and that the index had inched up very recently, as shown in the graph below.

But although the rate of decline in a number of economic indicators seems to be moderating, the fallout of the financial crisis has clearly not been fully arrested as gleaned from the International Monetary Fund’s (IFM) new forecast that toxic debt racked up by banks and insurers could spiral to $4 trillion. According to Times Online, the IMF said in January that it expected the deterioration in US-originated assets to reach $2.2 trillion by the end of next year, but it is understood to be looking at raising that to $3.1 trillion in its next assessment of the global economy, due to be published on April 21. In addition, it is likely to boost that total by $900 billion for toxic assets originated in Europe and Asia.

Turning to the US, a snapshot of the week’s economic data is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

April 9

• Significant improvement in trade balance a big plus for Q1 GDP

• Initial Jobless Claims - glimmer of hope?

April 8

• Minutes of March 2009 FOMC meeting - highlight concerns that led to further expansion of Fed’s balance sheet

• Wholesale inventories - drop in inventories-sales ratio a positive signal

April 7

• Consumer credit - households are parsimonious, not a surprise

April 6

• Price-to-rent ratio - pace of decline in home prices to moderate

The minutes of the Federal Open Market Committee’s (FOMC) March 17-18 meeting show that members downgraded forecasts for GDP growth in the second half of 2009 and into 2010, adding that they expect growth “to flatten out gradually over the second half of this year and then to expand slowly next year as the stresses in financial markets ease.”

George Soros is more pessimistic on the outlook (as reported by CNBC), saying: “I don’t expect the US economy to recover in the third or fourth quarter so I think we are in for a pretty lasting slowdown.” He added that there might be “something” in terms of US growth in 2010. The recovery will look like ‘an inverted square root sign’, Soros said. “You hit bottom and you automatically rebound some, but then you don’t come out of it in a V-shape recovery or anything like that.”

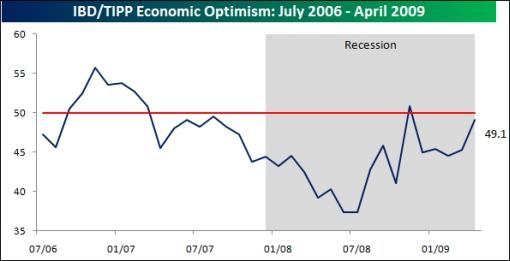

On a more upbeat note, Bespoke highlights that the Investors Business Daily’s survey of economic optimism has increased for the second month in a row and is now at its second highest level (49.1) since the start of the recession. Although the indicator has shown steady improvement since the July low, the current level of below 50 indicates that consumers remain pessimistic on a net basis.

Another glimmer of hope is the ECRI Weekly Leading Index that has leveled off since the beginning of the year. “Since 1970, a significant upturn in the index has preceded the end of a recession by an average of two months. While the Index has dropped more than during any other period on record (since peaking in June 2007), the Index has been relatively flat since early December and has been moving up over the past four weeks,” said Chart of the Day. We’ll be watching this space.

Pulling it all together, BCA Research commented: “Now the focus has shifted to whether or not positive second-half growth will provide the base for a solid recovery next year. There is plenty of fiscal and monetary stimulus in the pipeline, but the headwinds and risks highlight that the recovery will be fragile. Much will depend on the apparent success or failure of the bank stress tests and the Treasury’s plan to relieve banks of their legacy assets. Both are wild cards that could reverse the recent improvement in investor sentiment. Moreover, consumer fundamentals remain grim due to high debt levels, falling home prices and massive payroll cuts.

“Bottom line: A bottoming in growth suggests that we have seen the lows in the equity market, but a sustainable uptrend may take time to develop and could be very choppy.”

Back to the global economy, according to George Soros, China will be the first country to emerge from recession, probably this year, and will spearhead global growth in 2010. He said world policymakers are “actually beginning to catch up” with the crisis and efforts to fix structural problems in the financial system.

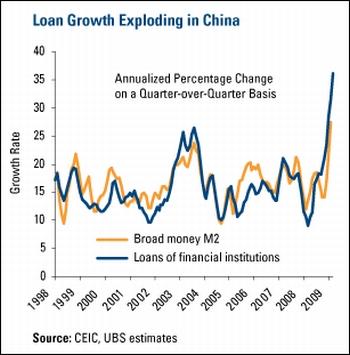

Meanwhile, China’s passenger car sales increased by 10% year on year in March, thanks to sales tax cuts and other government subsidies. Also, as reported by US Global Investors, explosive new loan growth in China has prompted its banking regulator to review whether it is necessary to restrain lending practice. “According to the latest unofficial estimate, new bank loans may have reached 1.87 trillion yuan in March. This makes the first quarter’s total lending almost as much as the government’s full year target.”

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Apr 7 | 3:00 PM | Consumer Credit | Feb | -$7.5B | unch | -$3.0B | $8.1B |

| Apr 8 | 10:00 AM | Wholesale Inventories | Feb | -1.5% | -0.6% | -0.7% | -0.7% |

| Apr 8 | 10:30 AM | Crude Inventories | 04/03 | +1645K | NA | NA | +2840K |

| Apr 9 | 8:30 AM | Export Prices ex-agriculture | Mar | -0.3% | NA | NA | -0.1% |

| Apr 9 | 8:30 AM | Import Prices ex-oil | Mar | -0.7% | NA | NA | -0.7% |

| Apr 9 | 8:30 AM | Initial Claims | 04/04 | 654K | 650k | 660K | 674K |

| Apr 9 | 8:30 AM | Trade Balance | Feb | -$26.0B | -$37.0B | -$36.0B | -$36.2B |

| Apr 10 | 2:00 PM | Treasury Budget | Mar | - | NA | -$160.0B | -$48.2B |

Source: Yahoo Finance, April 10, 2009.

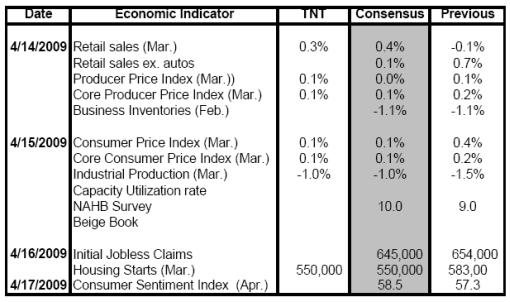

In addition to Fed Chairman Ben Bernanke speaking at the Fed Conference (Friday, April 17), the US economic highlights for the week include the following:

Source: Northern Trust

Click the links below for the following reports:

• Wachovia’s report on the “State of the Global Economy”

• Wachovia’s Monthly Economic Outlook (April 2009)

• Wachovia’s Global Chartbook (April 2009)

Markets

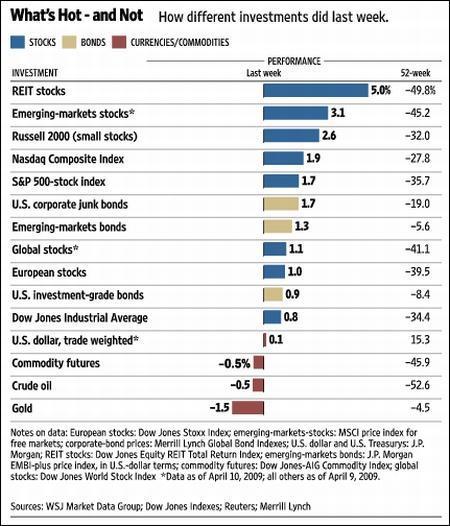

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online, April 10, 2009.

Friend Kevin Lane said: “Hope is a slippery slope and greed is not a trustworthy steed (i.e. horse), so work on removing emotion and bias from your investing/trading as much as possible. Hopefully the “Words from the Wise” reviews will assist Investment Postcards readers with taking well-informed and unemotional investment decisions.

Wishing you and your families a pleasant time during what remains of the Easter weekend.

That’s the way it looks from Cape Town (where I will be spending the next two weeks before heading back to America for a brief visit).

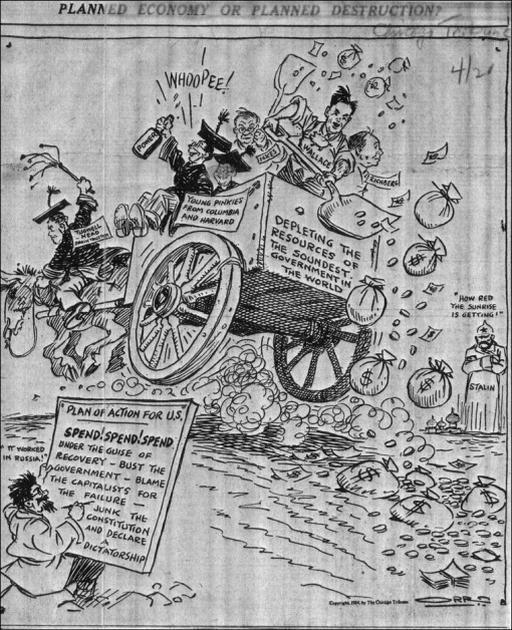

Cartoon from 1934 Chicago Tribune - looking familiar?

Hat tip: Charleston Voice

CNBC: El-Erian - investors be wary of stocks, Treasurys

“Investors can still lose a lot of money in the stock market, but US government bonds aren’t the solution either for those seeking safe havens, Pimco’s co-CEO and co-chief investment officer Mohammed El-Erian told CNBC. ‘Certain bonds aren’t worth owning, like government bonds for instance,’ El-Erian said, adding that gaping deficits will force governments issue more debt.

“I am very underweight equities,” he said, adding that he has cut his exposure to stocks to 30% compared with around 60% in normal market conditions. Pimco is the world’s biggest bond fund.

“‘Fundamentally we are in a volatile journey to what we call the new normal, the new destination. The world is changing,’ El-Erian said.

“People have to adjust to the fact that wealth has been destroyed, and the fact that there are more than 5 million unemployed in the US shows how serious the situation is, he added.

“‘The American consumer will return but will be a saner consumer … worried about their savings, worried about their retirement. That is a good adjustment. The problem is that it doesn’t happen overnight,’ El-Erian said.

“Asked whether he believed the stock market can re-test the March lows, he said: ‘The intellectually honest answer is we don’t know. I have a fear right now that people are sucked into the equities market … go in as long as you can afford to lose that money,’ he added.

“Two out of four conditions need to be met for an economic recovery to begin, according to El-Erian: house prices need to stabilize, banks must start lending again, the consumer must start spending again and the rest of the world must pick up.

“For the moment, only the fourth condition is partly fulfilled, with timid signs of recovery in China emerging, he said.

“Asked about attractive areas of investment, El-Erian listed mortgages, municipal bonds and corporate bonds, especially instead of stocks.

Source: CNBC, April 7, 2009.

CNBC: Pimco’s power player

“The markets are on a volatile journey to a ‘new normal’, says Mohamed El-Erian, Pimco CEO.”

Source: CNBC, April 7, 2009.

Times Online: Toxic debts could reach $4 trillion, IMF to warn

“Toxic debts racked up by banks and insurers could spiral to $4 trillion, new forecasts from the International Monetary Fund (IMF) are set to suggest.

“The IMF said in January that it expected the deterioration in US-originated assets to reach $2.2 trillion by the end of next year, but it is understood to be looking at raising that to $3.1 trillion in its next assessment of the global economy, due to be published on April 21. In addition, it is likely to boost that total by $900 billion for toxic assets originated in Europe and Asia.

“Banks and insurers, which so far have owned up to $1.29 trillion in toxic assets, are facing increasing losses as the deepening recession takes a toll, adding to the debts racked up from sub-prime mortgages. The IMF’s new forecast, which could be revised again before the end of the month, will come as a blow to governments that have already pumped billions into the banking system.

“Paul Ashworth, senior US economist at Capital Economics, said: ‘The first losses were asset writedowns based on sub-prime mortgages and associated instruments. But now, banks are selling ‘plain vanilla’ losses from mortgages, commercial loans and credit cards. For this reason, the housing market will play a crucial part in how big the bad debt toll is over the next year or two.’

“The IMF’s jump will come as little surprise to economists who have suggested that the bad debts will be much higher than anticipated. Nouriel Roubini, chairman of RGE Monitor, expects bad debts from US-originated assets to reach $3.6 trillion by the middle of next year. This figure is expected to rise when bad debts from assets elsewhere are calculated, he said.”

Source: Gráinne Gilmore, Times Online, April 7, 2009.

Guardian: US watchdog calls for bank executives to be sacked

“Elizabeth Warren, chief watchdog of America’s $700 billion bank bailout plan, will this week call for the removal of top executives from Citigroup, AIG and other institutions that have received government funds in a damning report that will question the administration’s approach to saving the financial system from collapse.

“Warren, a Harvard law professor and chair of the congressional oversight committee monitoring the government’s Troubled Asset Relief Program (Tarp), is also set to call for shareholders in those institutions to be ‘wiped out’. ‘It is crucial for these things to happen,’ she said. ‘Japan tried to avoid them and just offered subsidy with little or no consequences for management or equity investors, and this is why Japan suffered a lost decade.’

She declined to give more detail but confirmed that she would refer to insurance group AIG, which has received $173 billion in bailout money, and banking giant Citigroup, which has had $45 billion in funds and more than $316 billion of loan guarantees.

“She said she did not want to be too hard on Geithner but that he must address the issues in the report. ‘The very notion that anyone would infuse money into a financially troubled entity without demanding changes in management is preposterous.’”

Source: James Doran, Guardian, April 5, 2009.

The Wall Street Journal: US to offer aid to life insurers

“The Treasury Department has decided to extend bailout funds to a number of struggling life-insurance companies, helping an industry that is a linchpin of the US financial system, people familiar with the matter said.

“The department is expected to announce the expansion of the Troubled Asset Relief Program to aid the ailing industry within the next several days, these people said.

“The news will come as a relief to a number of iconic American companies that have suffered big losses made worse by generous promises to buyers of some investment products. Shares of life insurers have fallen more than 40% this year. Their troubles led to a string of rating-agency downgrades that, in a vicious cycle, made it more difficult for some insurers to raise funds.

“The life-insurance industry is an important piece of the US financial system. Millions of Americans have entrusted their families’ financial safety to these companies, so keeping them on solid footing is crucial to maintaining confidence. If massive numbers of customers sought to redeem their policies, it could cause a cash crunch for some companies. And because insurers invest the premiums they receive from customers into bonds, real estate and other investments, they are major holders of securities. If they needed to sell off holdings to raise cash, it could cause markets to tumble.”

Source: Scott Patterson, Deborah Solomon and Leslie Scism, The Wall Street Journal, April 8, 2009.

Financial Times: Derivatives sector answers critics

“The financial industry will on Wednesday overhaul how it writes contracts in the credit derivatives world - an effort to rebuff criticism that the vast sector could pose a systemic threat.

“More than 1,400 banks and asset managers will adopt a new ‘big bang’ protocol, which will make it easier for investors to know what will happen to credit derivatives contracts if debt defaults occur.

“The US market will also introduce a standardised pricing system for CDS contracts, which have hitherto been run on an unregulated, freewheeling basis.

“The moves follow mounting criticism of the credit derivatives world, which some regulators claim contributed to problems at AIG. The pressure for change was underscored at last week’s meeting of G20 leaders, which reiterated calls for more standardisation and transparency.

“Robert Pickel, head of the International Swaps and Derivatives Association, argued that the reforms showed the industry was responding to these calls. ‘These measures provide a framework - it will bring more order. It is a significant step,’ he said.

“Separately, TriOptima, a trade processing group, said it had removed $5,500 billion of redundant contracts from the market in the first three months of the year because banks had cancelled deals that offset each other. This process of ‘tearing up’ - or offsetting contracts - has already cut the estimated size of the sector to below $30,000 billion, less than half its level 18 months ago.”

Source: Anousha Sakoui, Michael Mackenzie and Nicole Bullock, Financial Times, April 7, 2009.

Forbes: The recovery begins

“The Federal Reserve is following possibly the most accommodative monetary policy of its 96-year history. The economy and stock market are floating on a sea of liquidity. That’s all that really matters right now.

“Through Friday, April 3, this sea of liquidity had lifted the Dow Jones Industrial Average by 22.5% in less than a month, with the NASDAQ up 27.8%, and the S&P 500 up 24.5%.

“For us, this is the real deal. But pessimism is so rampant that it is hard for many investors to believe that this rally can last. When it was reported on Friday that the US lost 663,000 jobs in March, it was almost too much for many investors to take. Since December 2007 the US has lost 5.1 million jobs. These job losses have pushed the unemployment rate up from 4.9% to 8.5% - the highest since 1983.

“The horrible jobs data have many asking: How can any kind of economic recovery take hold? How can stock prices continue to rise? The thinking is that with people losing jobs, spending will fall, which will lower production causing more layoffs, sending the economy down again.

“But this is not the way the economy works. If jobs were the catalyst for all economic change, then the economy would never stop expanding as jobs increased, nor would it ever stop contracting as jobs fell.

“Don’t take this as a sign that we do not care about job losses - they hurt. They are personal. And when unemployment rises above 7% or so, just about everyone knows someone who has lost a job. But in the past the unemployment rate has been much higher than it is today, and yet the economy recovered and the stock market boomed anyway. Unemployment is a lagging indicator.

“In fact, the best historical precedent for what the US economy is living through today is the mid-1970s. Between December 1973 and May 1975, the unemployment rate jumped from 4.9% to 9%. This recession included a 43% drop in the S&P 500 during the bear market of 1973 to 1974.

“But the stock market bottomed in December 1974, and even though the unemployment rate increased from 7.2% to 9% in the first five months of 1975, the S&P 500 jumped 34%.

“The major factor behind all that volatility in the economy and the stock market was the Federal Reserve’s monetary policy. The Fed hiked the federal funds rate from 3.3% in early 1972 to 12.9% in July 1974. Then the Fed reversed course and cut the funds rate to 5.2% by May 1975. This roller-coaster monetary policy caused a bust and then a boom.”

Click here for the full article.

Source: Brian Wesbury and Robert Stein, Forbes, April 7, 2009.

CNBC: Soros - US recovery is far off, banks are “basically insolvent”

“The US economy is in for a ‘lasting slowdown’ and could face a Japan-style period of relatively low growth coupled with high inflation, billionaire investor George Soros said on Monday.

“Soros, speaking to Reuters Financial Television, also warned that rescuing US banks could turn them into ‘zombies’ that draw the lifeblood of the economy, prolonging the economic slowdown.

“‘I don’t expect the US economy to recover in the third or fourth quarter so I think we are in for a pretty lasting slowdown,’ Soros said, adding that in 2010 there might be ‘something’ in terms of US growth.

“Soros’ view contrasts with the majority of economists, who expect the US economy to stop contracting in the third quarter and resume growing in the fourth quarter, according to the latest monthly poll of forecasts conducted by Reuters.

“The recovery will look like ‘an inverted square root sign,’ Soros said. ‘You hit bottom and you automatically rebound some, but then you don’t come out of it in a V-shape recovery or anything like that. You settle down - step down.’

“The healing of the banking system and housing markets is crucial to recovery. ‘The banking system, as a whole, is basically insolvent,’ Soros said.

“What’s more, the Treasury’s Public-Private Investment Fund is going to work but it won’t be enough to recapitalize the banks in a way that they are able to or willing to provide credit.

“‘What we have created now is a situation where the banks who will be able to earn their way out of a hole, but by doing that, they are going to weigh on the economy,’ he said. ‘Instead of stimulating the economy, they will draw the lifeblood, so to speak, of profits away from the real economy in order to keep themselves alive. This is the zombie bank situation.’”

Click here for the full article.

Source: CNBC, April 6, 2009.

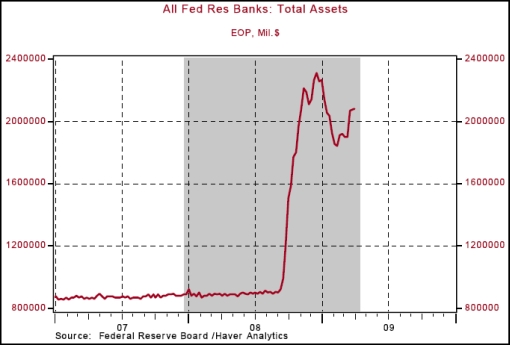

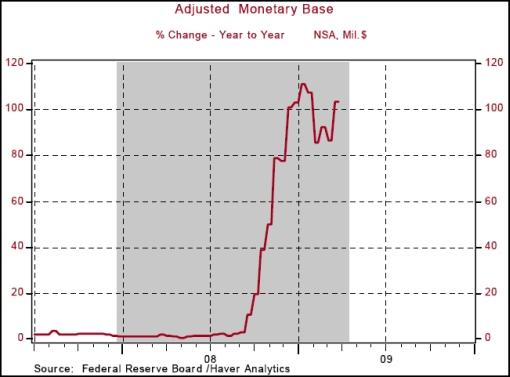

Asha Bangalore (Northern Trust): FOMC minutes highlight concerns that led to further expansion of Fed’s balance sheet

“The March 17-18 FOMC meeting concluded with the federal funds rate left unchanged - no surprises there. However, the policy announcement indicated that the Fed would increase its balance sheet by another $1.15 trillion ($750 billion MBS + $100 billion agency debt + $300 billion Treasury securities) - this was the surprise.

“The minutes succinctly state the reason for the bold and outsized move: ‘In light of the economic and financial conditions, meeting participants viewed the expansion of the Federal Reserve’s balance sheet that might be associated with these and other programs as appropriate in order to foster the dual objectives of maximum employment and price stability. Several members felt that the significant deterioration in the economic outlook merited a very substantial increase in purchases of longer-term assets.’

“In addition, ‘participants expressed concern about downside risks to an outlook for activity that was already weak.’ The precise quantity and types of securities purchased appears to be a compromise because the minutes note that members had different preferences about both aspects.

“As part of the extensive discussion about the Fed’s balance sheet, ‘members agreed that the monetary base was likely to grow significantly as a consequence of additional asset purchases; one, in particular, stressed that sustained increases in the monetary base were important to ensure that policy was consistently expansionary.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, April 8, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.