Stock Market Investor Sentiment Turns Bullish, Technical Sell Signal

Stock-Markets / Financial Markets 2009 Apr 10, 2009 - 02:29 PM GMT

Another cover-up? The U.S. Federal Reserve has told Goldman Sachs Group Inc., Citigroup Inc. and other banks to keep mum on the results of “stress tests” that will gauge their ability to weather the recession, people familiar with the matter said.

Another cover-up? The U.S. Federal Reserve has told Goldman Sachs Group Inc., Citigroup Inc. and other banks to keep mum on the results of “stress tests” that will gauge their ability to weather the recession, people familiar with the matter said.

The Fed wants to ensure that the report cards don't leak during earnings conference calls scheduled for this month. Such a scenario might push stock prices lower for banks perceived as weak and interfere with the government's plan to release the results in an orderly fashion later this month.

Banks sitting on inventory of foreclosed homes.

A vast "shadow inventory" of foreclosed homes that banks are holding off the market could wreak havoc with the already battered real estate sector, industry observers say.

Lenders nationwide are sitting on hundreds of thousands of foreclosed homes that they have not resold or listed for sale, according to numerous data sources. And foreclosures, which banks unload at fire-sale prices, are a major factor driving home values down.

The problem is that no one knows how extensive (the shadow inventory) is," said Patrick Newport, U.S. economist with the Massachusetts research firm Global Insight. "It's a wild card. If it's a really big number, you'll see prices drop a lot more and deeper problems for the financial system."

The Bulls are back!

-- Investors turned optimistic for the third time since the credit crisis started in 2007, gauges of sentiment among individual investors in the U.S. show, a pattern that technical analysts says is a signal to sell. The difference between the American Association of Individual Investors Bull Index and Bear Index surged to 5.6 as of April 2. When the reading rose to 11.5 in November and 13.6 in January it coincided with the end of “bear-market rallies” of 20% or more by the major indices. Note: The difference on April 9 appears to be at all-time highs again. Watch the 50-day moving average, since it may provide support for the rally. It is also a well-defined stop if the rally fails.

-- Investors turned optimistic for the third time since the credit crisis started in 2007, gauges of sentiment among individual investors in the U.S. show, a pattern that technical analysts says is a signal to sell. The difference between the American Association of Individual Investors Bull Index and Bear Index surged to 5.6 as of April 2. When the reading rose to 11.5 in November and 13.6 in January it coincided with the end of “bear-market rallies” of 20% or more by the major indices. Note: The difference on April 9 appears to be at all-time highs again. Watch the 50-day moving average, since it may provide support for the rally. It is also a well-defined stop if the rally fails.

Treasury bonds pull back again.

-- Treasury yields climbed near the highest since the Federal Reserve started buying back debt as the economy showed signs of stabilizing and the U.S. sold $59 billion in debt this week, diminishing its haven appeal. U.S. government securities lost investors 2.2 percent this year, according to Merrill Lynch & Co.'s Treasury Master index. Treasuries dropped 0.8 percent in April, extending their worst first quarter since 1999, according to the Merrill indexes. U.S. debt gained 14 percent last year.

-- Treasury yields climbed near the highest since the Federal Reserve started buying back debt as the economy showed signs of stabilizing and the U.S. sold $59 billion in debt this week, diminishing its haven appeal. U.S. government securities lost investors 2.2 percent this year, according to Merrill Lynch & Co.'s Treasury Master index. Treasuries dropped 0.8 percent in April, extending their worst first quarter since 1999, according to the Merrill indexes. U.S. debt gained 14 percent last year.

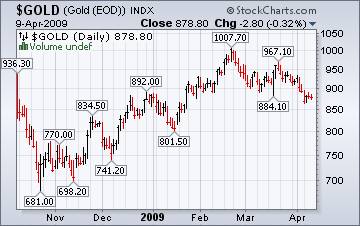

Gold takes a back seat to the stock rally.

( Bloomberg ) -- Gold fell in New York, capping a third straight weekly loss, as equities rallied worldwide, reducing demand for the precious metal as an alternative investment. Silver also declined. “The resiliency of the stock market recently suggests that gold prices should continue to remain under pressure in the short term,” said Tom Pawlicki , a metals analyst at MF Global Ltd. in Chicago.

( Bloomberg ) -- Gold fell in New York, capping a third straight weekly loss, as equities rallied worldwide, reducing demand for the precious metal as an alternative investment. Silver also declined. “The resiliency of the stock market recently suggests that gold prices should continue to remain under pressure in the short term,” said Tom Pawlicki , a metals analyst at MF Global Ltd. in Chicago.

Is the Nikkei ready for a pullback?

( Bloomberg ) -- Japanese stocks climbed, capping a fifth weekly advance, as higher commodity-transport fees raised the earnings outlook for shipping companies. On the positive side, the global economy is showing signs that the crisis is becoming less severe. On the negative side, banks are still selling securities into the rally to raise more capital. The rally seems a bit overdone, so investors should soon brace themselves for some profit taking.

( Bloomberg ) -- Japanese stocks climbed, capping a fifth weekly advance, as higher commodity-transport fees raised the earnings outlook for shipping companies. On the positive side, the global economy is showing signs that the crisis is becoming less severe. On the negative side, banks are still selling securities into the rally to raise more capital. The rally seems a bit overdone, so investors should soon brace themselves for some profit taking.

Chinese investors believe that stimulus will launch markets higher.

-- China's stocks rose to the highest in almost eight months, led by developers on speculation the central bank will lower borrowing costs for the first time this year, and as investors expect corporate earnings to improve. The Shanghai Composite's 34 percent gain this year makes it the second-best performer among 88 key stock gauges tracked by Bloomberg globally. Stocks rallied on optimism the government's 4 trillion yuan ($585 billion) stimulus package and record new lending will spur a recovery in the world's third-largest economy amid the global recession.

-- China's stocks rose to the highest in almost eight months, led by developers on speculation the central bank will lower borrowing costs for the first time this year, and as investors expect corporate earnings to improve. The Shanghai Composite's 34 percent gain this year makes it the second-best performer among 88 key stock gauges tracked by Bloomberg globally. Stocks rallied on optimism the government's 4 trillion yuan ($585 billion) stimulus package and record new lending will spur a recovery in the world's third-largest economy amid the global recession.

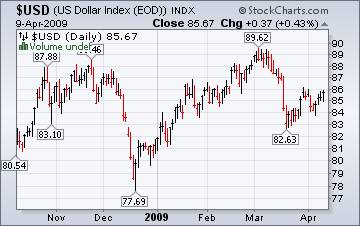

The dollar advances on optimism.

-- The dollar advanced against the euro, posting the biggest weekly gain in three months, on speculation the worst of the financial crisis in the world's largest economy is over.

-- The dollar advanced against the euro, posting the biggest weekly gain in three months, on speculation the worst of the financial crisis in the world's largest economy is over.

The Dollar Index advanced on optimism that the worst of the economic crisis is over. This was precipitated by the earnings announcement of Wells Fargo that net income had surged by 50%.

Hunkering down at home.

Families around the country are weathering out the recession by hunkering down with relatives and friends. It's not just a lower-income phenomenon either. The homeward bound are former white-collar and blue-collar workers who believe they might have a better chance finding work in their hometown because they know more people, who, in turn, know still more people. But with jobs scarce, that doesn't always work, and rumors of jobs are just that. At home, though, they can at least get help with food, shelter and clothing.

Families around the country are weathering out the recession by hunkering down with relatives and friends. It's not just a lower-income phenomenon either. The homeward bound are former white-collar and blue-collar workers who believe they might have a better chance finding work in their hometown because they know more people, who, in turn, know still more people. But with jobs scarce, that doesn't always work, and rumors of jobs are just that. At home, though, they can at least get help with food, shelter and clothing.

Refinery maintenance may lead to price spikes.

Energy Information Administration Weekly Report suggests that, “ As winter ends, we all see various signs of spring, including the first crocuses blooming, robins returning, and in Washington, D.C., the breathtaking emergence of the cherry blossoms. But there is a less visible rite of spring of which most people are unaware – the peak refinery maintenance season. As winter heating oil demand winds down and before summer driving demand picks up, refiners undertake their heaviest maintenance season. By April, refiners are typically coming out of maintenance and are ramping up production of gasoline for the summer driving season.”

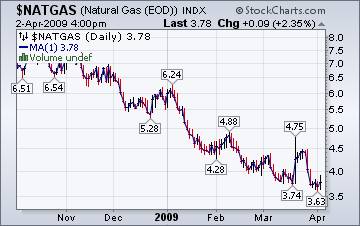

Warmer weather and lower industrial demand keep prices low.

The Energy Information Agency's Natural Gas Weekly Update reports, “Robust supplies and relatively weak demand continue to characterize natural gas markets. Natural gas prices experienced slight rallies in trading on Thursday, April 2, and on Monday, April 6, but moderating temperatures in the ensuing trading days eased heating demand. The price declines after each rally were sufficient to offset the increases, and prices at most market locations posted week-on-week declines. The price declines reported this week continued the general downward price trend that has prevailed since July 2008.”

The Energy Information Agency's Natural Gas Weekly Update reports, “Robust supplies and relatively weak demand continue to characterize natural gas markets. Natural gas prices experienced slight rallies in trading on Thursday, April 2, and on Monday, April 6, but moderating temperatures in the ensuing trading days eased heating demand. The price declines after each rally were sufficient to offset the increases, and prices at most market locations posted week-on-week declines. The price declines reported this week continued the general downward price trend that has prevailed since July 2008.”

Will you invest in “bailout bonds?”

As part of its sweeping plan to purge banks of troublesome assets, the Obama administration is encouraging several large investment companies to create the financial-crisis equivalent of war bonds: bailout funds .

The idea is that these investments, akin to mutual funds that buy stocks and bonds, would give ordinary Americans a chance to profit from the bailouts that are being financed by their tax dollars. But there is another, deeply political motivation as well: to quiet accusations that all of these giant bailouts will benefit only Wall Street plutocrats.

Is the Bernanke Path a glide-path to destitution?

Bernanke's approach to the crisis has been wrongheaded from the get-go. It makes no sense to commit nearly $13 trillion to prop up a grossly oversized financial system while providing less than $900 billion stimulus for the real economy. The whole plan is upside-down. Its consumers, homeowners and workers that create demand (consumer spending is 72 per cent of GDP) and yet, they've been left to twist in the wind while the bulk of the resources has been directed to financial speculators who are responsible for the mess. Middle class families have seen their retirements slashed in half and their home equity vanish, while their jobs become increasingly less secure. The Fed and the Treasury should be focused on debt relief, mortgage cram-downs, jobs programs and open-ended support for state and local governments.

Our Investment Advisor Registration is on the Web .

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.