Consumer Demand Destruction Continues as U.S. Trade Gap Narrows to 9 Year Low

Economics / Recession 2008 - 2010 Apr 09, 2009 - 07:15 PM GMTBy: Mike_Shedlock

Demand destruction continues unabated, and with it the US Trade Gap Narrows to Nine-Year Low .

Demand destruction continues unabated, and with it the US Trade Gap Narrows to Nine-Year Low .

The U.S. trade deficit tumbled in February to the lowest level in nine years as collapsing demand from consumers and companies reverberated around the globe.

The gap narrowed to $26 billion, less than anticipated, from a revised $36.2 billion in January, the Commerce Department said today in Washington. Imports plunged for a seventh consecutive month, leading to declines in the deficits with Japan and China, while exports climbed from a two-year low.

The cost of goods imported into the U.S. climbed 0.5 percent in March, reflecting an 11 percent jump in petroleum, the report from Labor showed. Excluding oil, prices fell 0.7 percent for a third consecutive month as goods from China cost 0.6 percent less and those from Japan fell 0.1 percent.

Trade Gap Highlights

- Imports fell 5.1 percent to $152.7 billion, the lowest since September 2004.

- Demand for foreign-made cars slumped to the lowest level since October 1996, as purchases of Japanese autos were cut almost in half.

- The trade gap with Japan was the smallest since 1984.

- American demand for imported consumer goods other than automobiles fell by $1.4 billion in February as purchases of toys, furniture, clothing, appliances and televisions all declined.

- The trade gap with China decreased to $14.2 billion, the smallest in three years.

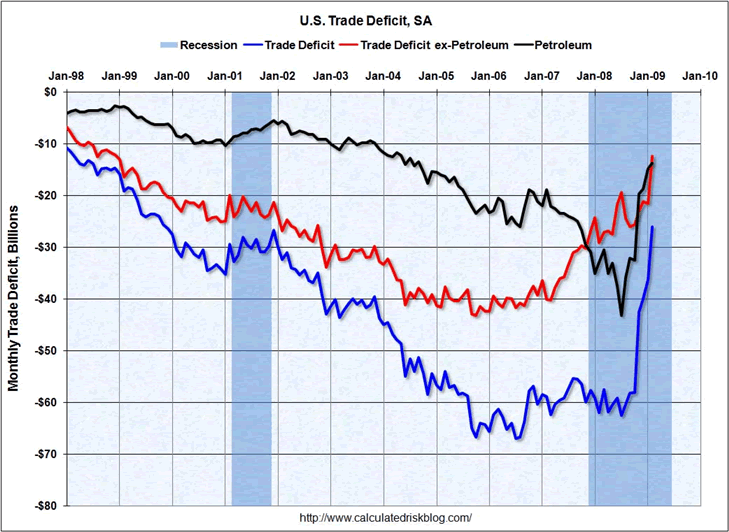

Trade Deficit Seasonally Adjusted

Calculated Risk has an interest chart of the trade deficit and the trade deficit excluding petroleum.

The trade deficit chart shows a couple of interesting things.

1. The shrinking trade deficit is a result of complete demand destruction, not just oil imports.

2. Demand destruction and collapsing imports happened first, oil prices followed.

Falling prices in general and a shrinking US trade deficit are both necessary ingredients to rebalance the global economy. Thus the demand destruction that is leading to Empty Restaurants, Falling Rents, Abandoned Boats, and Collapsing Auction Sales is actually a very good thing.

However, what the recovery process needs most is for Central Bankers to get the hell out of the way instead of attempting to stimulate consumer demand. Unfortunately, that is not happening. Central bank efforts will delay and weaken the eventual recovery.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.