Crude Oil $200, the Price for Wasting Financial Crisis Opportunity

Commodities / Crude Oil Apr 07, 2009 - 10:42 AM GMTBy: James_Quinn

Rohm Emanuel's famous quote regarding the current financial crisis, "Never let a serious crisis go to waste...it's an opportunity to do things you couldn't do before." was ignored last summer when oil prices reached $147 a barrel. The Obama administration has taken advantage of the financial crisis to ram through their socialist agenda which will add trillions to the National Debt. It will stimulate unions, bureaucrats, government employees, and defense contractors. It will do nothing to address the looming energy crisis which will sweep over the country shortly. Again, politicians and pundits will be shocked and astonished when oil soars. They will vilify oil companies, OPEC, and the dreaded speculators. They ignore the old fashioned supply and demand equation that even a dimwitted Congressman should be able to comprehend.

Rohm Emanuel's famous quote regarding the current financial crisis, "Never let a serious crisis go to waste...it's an opportunity to do things you couldn't do before." was ignored last summer when oil prices reached $147 a barrel. The Obama administration has taken advantage of the financial crisis to ram through their socialist agenda which will add trillions to the National Debt. It will stimulate unions, bureaucrats, government employees, and defense contractors. It will do nothing to address the looming energy crisis which will sweep over the country shortly. Again, politicians and pundits will be shocked and astonished when oil soars. They will vilify oil companies, OPEC, and the dreaded speculators. They ignore the old fashioned supply and demand equation that even a dimwitted Congressman should be able to comprehend.

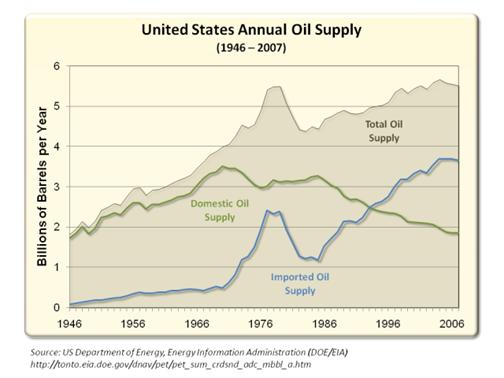

Instead of addressing the crucial issues that have led to the U.S. being dependent on foreign oil to the tune of $500 billion per year, Congress decided to spend your tax dollars on the following vital items (compliments of Casey Research ):

- $200,000 for tattoo removal for gang members in California .

- $98 million for a Coast Guard ice breaker closing an ice-breaking gap. (what about global warming)

- $950,000 for a bikeway in Kentucky .

- $2 million for astronomy awareness in Hawaii .

- $190,000 for a Buffalo Bill Historical Center.

- $650 million for the digital to analog converter box program.

- $1.8 million to study the effect of swine odor on the environment. (rumor has it the study will be conducted in the halls of Congress)

When oil prices collapsed from $147 a barrel in the summer of 2008 to $35 a barrel in January, American drivers, Congress, government bureaucrats, and the mainstream media refocused on other more pressing issues like executive bonuses, Michele Obama's wardrobe, and the tax law knowledge of Obama's cabinet. The attention span of the average American is shorter than a gnat's. As they text and twitter through life, the energy infrastructure continues to rust away, decades old wells are closer to depletion, and alternative energy projects have been scrapped by the thousands. Peak oil likely occurred between 2005 and 2009. The production of oil will now embark on a long slow decline. The world is not prepared.

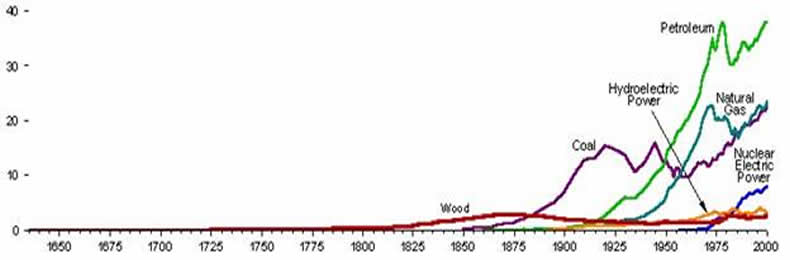

The history of energy in the United States is really only 160 years old, with coal being utilized starting in 1850 and oil only becoming a viable fuel beginning in 1900. Essentially, the world has found lakes of oil under the crust of the earth. If you pump 82 million barrels of oil from a lake per day, the lake will eventually go empty. New lakes are found every year, but the easy to get to lakes have all been found. The new lakes are deep under the sea or in tar sands and shale deposits. These sources take as long as a decade to reach and billions of infrastructure investment. With petroleum in permanent decline, the U.S. needed to have a plan 20 years ago.

Source: Department of Energy

Matt Simmons, the brilliant energy analyst and author of Twilight in the Desert , recently told Reuters, "We are three, six, maybe nine months away from a price shock. We are not talking about three to five years away -- it will be much sooner. These prices now are dangerously low. The lower prices fall, the less oil will be produced and the greater the chance of an oil spike."

In this scenario, low oil prices will continue to take oil fields out of production and reduce exploration. Once prices recover, companies will have trouble gearing back up due to the credit crunch, resulting in production increase delays.

Simmons describes what will happen. "Unless oil demand falls by 10 or 15 percent per annum, which it is not going to do, then we don't need to wait for oil demand to come back before we have a supply crunch." This is on no one's radar.

Peak Oil

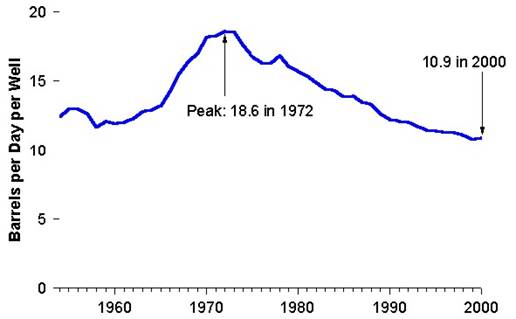

When pundits on CNBC speak authoritatively about peak oil being a fallacy, their misleading blather is believed by supposedly intelligent people. They expound that we are not running out of oil. There are billions of barrels left inside the earth. Peak oil does not mean that we are in imminent danger of running out of oil. Peak oil is the point in time when the maximum rate of global petroleum extraction was reached, after which the rate of production enters terminal decline. The aggregate production rate from an oil field over time usually grows exponentially until the rate peaks and then declines—sometimes rapidly—until the field is depleted. This concept is derived from the Hubbert curve, and has been shown to be applicable to the sum of a nation's domestic production rate, and is similarly applied to the global rate of petroleum production. M. King Hubbert created and first used the models behind peak oil in 1956 to accurately predict that United States oil production would peak between 1965 and 1970.

Source: Department of Energy

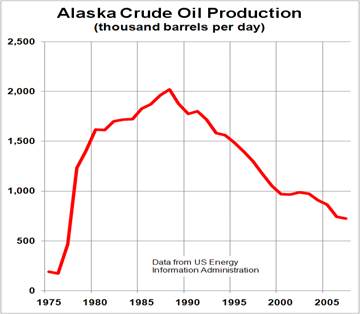

The depletion of existing sources is more rapid than any new sources that can be brought online. Production in the United States is in relentless decline. The view of Alaskan oil production from 1975 until today clearly shows how rapidly oil fields can decline. What has happened in the United States is now happening on a worldwide basis. The U.S. Department of Energy published a report from some of the top energy minds in the world in 2005. The lead author Robert Hirsch produced a comprehensive report on the peak oil issue called, Peaking of World Oil Production: Impacts, Mitigation, and Risk Management . The conclusions were frightening. What has the U.S, government done in response? NOTHING

The overwhelming majority of industry petroleum geologists, scientists, and economists who worked on the report projected global peak production being reached between 2005 and 2010. The report's disturbing conclusions are as follows:

- World oil peaking is going to happen, and will likely be abrupt.

- Oil peaking will adversely affect global economies, particularly those most dependent on oil.

- Oil peaking presents a unique challenge (“it will be abrupt and revolutionary”).

- The problem is liquid fuels (growth in demand mainly from transportation sector).

- Mitigation efforts will require substantial time.

• 20 years is required to transition without substantial impacts

• A 10 year rush transition with moderate impacts is possible with extraordinary efforts from governments, industry, and consumers

• Late initiation of mitigation may result in severe consequences.

- Both supply and demand will require attention.

- It is a matter of risk management (mitigating action must come before the peak).

- Government intervention will be required.

- Economic upheaval is not inevitable (“given enough lead-time, the problems are soluble with existing technologies.”)

Considering that global oil production peaked or is peaking between 2005 and 2010, we are destined for the 3 rd scenario of severe consequences. Economic upheaval is now inevitable. It is the American way to not do anything until it is too late. The Hirsch Report urges a crash program of new technologies and changes in manners and attitudes in the US and as well implying more research and development. The urging has gone unheeded. The worldwide global recession is the only reason you are not paying $5.00 a gallon for gasoline today. Supply did not increase, demand leveled off.

World demand “plummeted” from 87 million barrels per in early 2008 to 84 million barrels per day in early 2009, a full 3.5% decline. If the world economy levels off and resumes growth, demand will immediately surpass previous levels. The problem is that production has peaked and will likely drop below 80 million barrels in 2010. When demand is rising and supply is declining, only one thing can happen – higher prices.

The peaking of hydrocarbon supply is vital not just to our country's future, it is enormously critical to our global economic conduct. Optimists argue that oil has not peaked, and will not peak for decades. They base this on widely held beliefs, including the extent of the world's energy resource endowment, the ability of technology to recover larger amounts of oil once left behind, the lag time between high oil prices and the ramped-up drilling they kindle, the remarkable amount of unconventional oil that has become commercially feasible because of high prices, and undetermined technology advancements. Those who ridicule peak oil, think the term means "running out of oil" instead of the true definition: "oil production can no longer grow."

The optimists dismissed the fact that oil prices reaching $147 a barrel had anything to do with constricting market fundamentals. Instead, they argued that lofty crude prices were merely a by-product of a weak dollar, hedge fund speculation, geopolitical trepidation, downstream log jams, the Iraq war, Nigerian political turmoil and the craving for high prices within OPEC, which kept enormous spare capacity shut in. When prices skyrocket again, these optimists will produce new excuses. Facts are facts. Easily found cheap sources of energy are in terminal decline.

Matt Simmons explains the long and winding road to our current predicament:

• Between 1970 and 1979, world oil demand grew from 47 million barrels per day to 65 million barrels per day, a jump in 10 years of an astonishing 18 million barrels per day. This is how we ate up the world's spare capacity and at the same time caused U.S. supply to peak. Thus, the price of oil skyrocketed.

• From 1979 through 1983, demand fell four straight years, retreating back to 59 million barrels per day. Most of this change came as oil ended its role as a prime feedstock for power generation. This probably would have happened even if oil prices had not gone so high, as the world was finally rolling out nuclear fuel.

• Once demand hit bottom in 1983, it quietly began to grow again, though the growth was masked by the beginning of a prolonged collapse of oil use throughout the USSR . Nevertheless, total world demand grew from the 59 million base in 1983 to 69 million in 1994, an increase of 10 million barrels per day. This increase, interestingly, came at a time when most of the oil pundits were wringing their hands, declaring that oil demand was so stagnant that low oil prices were the new world order.

• In 1995, global oil demand finally edged over 70 million barrels per day for the first time in history. Between 1994 (the last time it was under 70 million barrels per day) and the end of 2008, demand grew to 86 million barrels per day – a jump of 16 million barrels per day in 13 years. This explains why we used up every last pocket of spare productive capacity and ran out of drilling rigs.

Saudi Arabia is Lying

Saudi Arabia has been claiming that they are capable of ramping up oil production from its many oil fields. The chart below tells a different story. The largest Saudi fields have entered permanent decline. The largest field in the world, Ghawar, was discovered in 1948 and peaked at 5.6 million barrels per day in 1980. It now produces 5.0 million barrels per day. The 3 rd largest field in the world, Safaniyah, was discovered in 1951 and peaked at 2.1 million barrels in 1998. It now produces 1.3 million barrels per day. One third of global oil supply comes from 20 large fields discovered prior to 1970. They have all peaked. 94% of global supply comes from 1,500 wells. If Saudi Arabia had the ability to ramp up production, they most certainly would have in 2008 when prices rose over $100 a barrel. They did not, because they could not.

Source: Oil Drum

“World reserves are confused and in fact inflated. Many of the so-called reserves are in fact resources. They're not delineated, they're not accessible, and they're not available for production.” - Sadad I. Al Husseini , former VP of Aramco, October 2007 .

Worldwide reserves peaked in 1980, when production first surpassed new discoveries. Total worldwide reserves are reported to be 1,200 billion barrels. Much of the increases in reserves since 1980 are lies. Al Husseini argues that 25% of the proven reserves in the world are speculative and not accessible. The following chart tells a fascinating story. Amazingly, each of these OPEC countries had dramatic leaps in their proven reserves, with Saudi Arabia having a 50% increase in one year with no major new discoveries. These self reported figures are not audited or verified in any way. Since production quotas are based on total reserves, the higher your reserves, the bigger your piece of the pie. Since 1988, Saudi Arabia has pumped at least 44 billion barrels of oil, but still has proven reserves of 264 billion with no major new discoveries. If you believe that, I have a package of 1,000 subprime mortgages that is rated AAA I'd like to sell you.

Declared reserves of major OPEC Producers (billion of barrels) |

||||||||

| BP Statistical Review - June 2008 | ||||||||

| Year | Iran | Iraq | Kuwait | Saudi Arabia | UAE | Venezuela | Libya | Nigeria |

| 1980 | 58.3 | 30.0 | 67.9 | 168.0 | 30.4 | 19.5 | 20.3 | 16.7 |

| 1981 | 57.0 | 32.0 | 67.7 | 167.9 | 32.2 | 19.9 | 22.6 | 16.5 |

| 1982 | 56.1 | 59.0 | 67.2 | 165.5 | 32.4 | 24.9 | 22.2 | 16.8 |

| 1983 | 55.3 | 65.0 | 67.0 | 168.8 | 32.3 | 25.9 | 21.8 | 16.6 |

| 1984 | 58.9 | 65.0 | 92.7 | 171.7 | 32.5 | 28.0 | 21.4 | 16.7 |

| 1985 | 59.0 | 65.0 | 92.5 | 171.5 | 33.0 | 54.5 | 21.3 | 16.6 |

| 1986 | 92.9 | 72.0 | 94.5 | 169.7 | 97.2 | 55.5 | 22.8 | 16.1 |

| 1987 | 92.9 | 100.0 | 94.5 | 169.6 | 98.1 | 58.1 | 22.8 | 16.0 |

| 1988 | 92.9 | 100.0 | 94.5 | 255.0 | 98.1 | 58.5 | 22.8 | 16.0 |

| 1989 | 92.9 | 100.0 | 97.1 | 260.1 | 98.1 | 59.0 | 22.8 | 16.0 |

| 1990 | 92.9 | 100.0 | 97.0 | 260.3 | 98.1 | 60.1 | 22.8 | 17.1 |

| 1991 | 92.9 | 100.0 | 96.5 | 260.9 | 98.1 | 62.6 | 22.8 | 20.0 |

| 1992 | 92.9 | 100.0 | 96.5 | 261.2 | 98.1 | 63.3 | 22.8 | 21.0 |

| 1993 | 92.9 | 100.0 | 96.5 | 261.4 | 98.1 | 64.4 | 22.8 | 21.0 |

| 1994 | 94.3 | 100.0 | 96.5 | 261.4 | 98.1 | 64.9 | 22.8 | 21.0 |

| 1995 | 93.7 | 100.0 | 96.5 | 261.5 | 98.1 | 66.3 | 29.5 | 20.8 |

| 1996 | 92.6 | 112.0 | 96.5 | 261.4 | 97.8 | 72.7 | 29.5 | 20.8 |

| 1997 | 92.6 | 112.5 | 96.5 | 261.5 | 97.8 | 74.9 | 29.5 | 20.8 |

| 1998 | 93.7 | 112.5 | 96.5 | 261.5 | 97.8 | 76.1 | 29.5 | 22.5 |

| 1999 | 93.1 | 112.5 | 96.5 | 262.8 | 97.8 | 76.8 | 29.5 | 29.0 |

| 2000 | 99.5 | 112.5 | 96.5 | 262.8 | 97.8 | 76.8 | 36.0 | 29.0 |

| 2001 | 99.1 | 115.0 | 96.5 | 262.7 | 97.8 | 77.7 | 36.0 | 31.5 |

| 2002 | 130.7 | 115.0 | 96.5 | 262.8 | 97.8 | 77.3 | 36.0 | 34.3 |

| 2003 | 133.3 | 115.0 | 99.0 | 262.7 | 97.8 | 77.2 | 39.1 | 35.3 |

| 2004 | 132.7 | 115.0 | 101.5 | 264.3 | 97.8 | 79.7 | 39.1 | 35.9 |

| 2005 | 137.5 | 115.0 | 101.5 | 264.2 | 97.8 | 80.0 | 41.5 | 36.2 |

| 2006 | 138.4 | 115.0 | 101.5 | 264.3 | 97.8 | 87.0 | 41.5 | 36.2 |

| 2007 | 138.4 | 115.0 | 101.5 | 264.2 | 97.8 | 87.0 | 41.5 | 36.2 |

Dr. Ali Samsam Bakhtiari a former senior expert of the National Iranian oil Company, has estimated that Iran, Iraq, Kuwait, Saudi Arabia and the United Arab Emirates have overstated reserves by a combined 320-390 billion barrels, and "As for Iran, the usually accepted official 132 billion barrels is almost one hundred billion over any realistic estimate". Petroleum Intelligence Weekly reported that official confidential Kuwaiti documents estimate reserves of Kuwait were only 48 billion barrels, half as much as their reported 101 billion barrels. Essentially, the amount of oil reserves in the world is much lower than people think. The good news is that OPEC may have less clout in the future than they have had for the last 40 years.

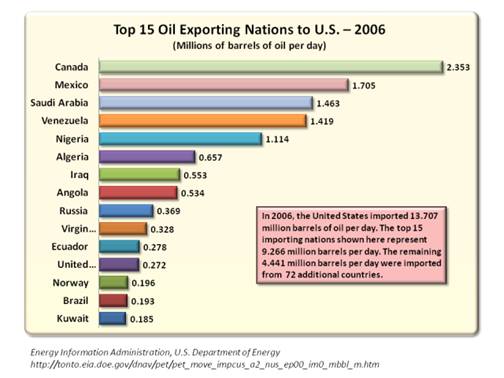

Mexican Hat Dance

I'm sure that not many people in the U.S. realize that we get more oil from Mexico than Saudi Arabia . We are dependent on Mexico to supply us with 600 million barrels of oil per year. Without this supply, there would be shortages and much higher prices. Tijuana , we have a problem. Within five years, we will be getting ZERO barrels of oil per day from our neighbor to the south. Mexico has the distinguished honor of having a government more inept and short-sighted than our own. Hard to do.

Source: Perotcharts.com

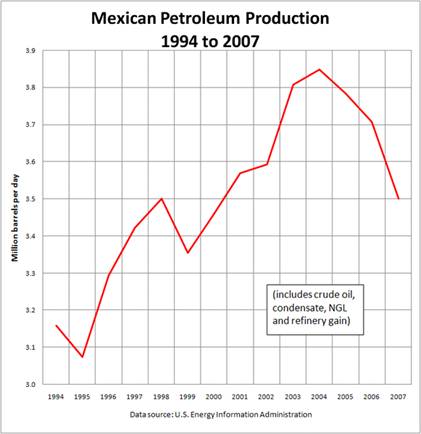

Virtually all of the oil supplied from Mexico comes from the 2 nd largest oil field in the world, Cantarell. It was discovered in the shallow waters of the Gulf of Mexico in 1977. It is run by the state owned oil company, Pemex. It held 17 billion barrels of oil. The Mexican government took the oil revenues and funded their wish list of programs in the country. Pemex has provided 40% of all revenues for the state. The state became so dependent they had Pemex build a nitrogen injection project on top of the well to push the oil out faster. It worked. In 2004, the well was providing 2.5 million barrels per day. It is now in irreversible decline at a rate of 15% per year. By 2012, it will only be producing 500,000 barrels per day.

Mexico has ridden this pony hard. They have not done any serious exploration in the Gulf of Mexico in 30 years. A newly discovered deep water well takes 10 years and billions of investment to bring on line. There is no doubt that Mexico 's oil output will collapse in the next five years. They will not be capable of exporting any oil to the U.S. With the rest of the world having no spare capacity and demand higher than 2008, prices for gasoline in the U.S. will soar. In the meantime, we will ponder higher gas mileage requirements, not allow offshore drilling, and make no effort to convert our transportation fleet to natural gas. Congressmen will be outraged and indignant at the oil companies, when the writing was on the wall for a decade.

Crisis Part II

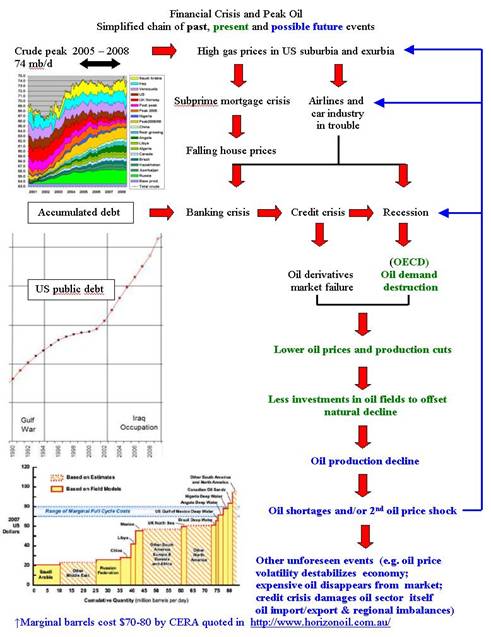

The flowchart below gives an extremely clear picture of what happened in the last year and what will happen in the next few years. The financial crisis and the energy crisis were intertwined and will continue to feed upon each other. Worldwide oil production peaked between 2005 and 2009. This, along with refinery shutdowns, hurricane related issues, and hedge fund speculation led to oil reaching $147 a barrel. This was the straw that broke the camels back and helped accelerate a downward spiral for consumers. The combination of plunging home values, retirement savings being cut in half and gas prices doubling led to the worst recession since the 1930's. The dramatic worldwide slowing caused by American consumers not going to Malls reduced demand enough to make the speculators go running for the hills. Oil prices plummeted 76% in a couple months to $35 a barrel. Now we are about to enter phase two of this comedy of errors. Again, the clueless leaders of our country will be taken by surprise. They've learned nothing.

It may sound like sacrilege, but prices below $50 a barrel are dangerously low. The crash in gasoline prices to below $2.00 a gallon has led to demand in the U.S. rising 6% above the demand in September 2008. Our American twitter society has already forgotten the $4.00 a gallon prices. Hybrids are rotting on car dealership lots. Everything that has happened since the price collapse will contribute to Crisis Part 2:

- OPEC cut supply by 4.2 million barrels per day from levels in September 2008.

- Projects that were viable at $80 a barrel have been scrapped. Ethanol and Tar Sands are only profitable above this level. Natural gas wells are being capped as prices plunged from $13 to $4.

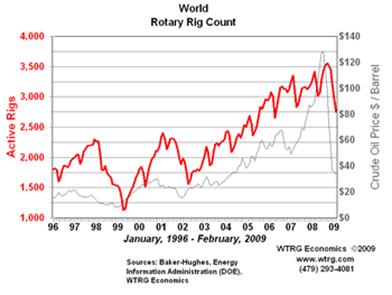

- Worldwide rig counts have plunged from 3,500 to 2,700 in a matter of months.

- Existing wells throughout the world continue to decline at ever increasing rates.

- The Obama administration will restrict the expansion of coal powered plants, construction of new refineries and new drilling in the U.S.

- The enormous stimulus being rolled out throughout the world will generate increased energy demand as supply remains restricted.

- The banking crisis has resulted in no financing for energy projects that could relieve the long-term supply issues.

- Energy companies have been laying off skilled workers as their business has plummeted. When demand resumes, these workers won't be there.

Most people do not understand that all prices are set at the margin. There are 75 million houses in America . Only 4 to 5 million homes are sold per year. Therefore, 5% to 6% of the homes in the U.S. set the price for the other 70 million homes. This same concept applies to the last barrel of oil. When worldwide demand exceeded worldwide supply in late 2007 and early 2008, those last barrels of oil set the price. This explains why those last barrels of oil set the price above $100 a barrel. It wasn't greedy speculators and evil oil companies.

It is clear that supply has stayed in the range of 86 million barrels per day while demand has dropped to the range of 84 to 85 million barrels per day. If oil demand rises by 3%, demand will outstrip supply again.

It is clear that supply has stayed in the range of 86 million barrels per day while demand has dropped to the range of 84 to 85 million barrels per day. If oil demand rises by 3%, demand will outstrip supply again.

Source: International Energy Agency

$200 Oil Will Arrive

When I was ten years old my parents told me to never touch our stainless steel sink and the electric light switch above the sink at the same time. I couldn't resist. I tried it and got knocked on my ass. I never did it again. Americans are a different lot. Last year we got knocked on our ass by $4.00 gasoline. Instead of learning, we have sauntered back to the kitchen sink and we're reaching up for the electric light switch. I wonder what is going to happen this time.

Americans are used to making tough choices. They have made choices between the Hummer H3 (13 mpg) and the Hummer H2 (8 mpg). They've made choices between a BMW 650i (16 mpg) and a Mercedes S600 (13 mpg). The coming energy crisis will lead to choices between food or fuel for many people. The coming crisis is as clear as the housing bubble. Anyone with half a brain could see that home prices would need to fall 30% to 50% to get back to equilibrium. Therefore, no one in Congress, Wall Street, or CNBC saw it coming. Total world oil supply is in a permanent decline. Oil demand will continue to rise. Only a half wit would argue that prices will not rise dramatically in the coming years. Turn on CNBC to get the half wit view of oil prices.

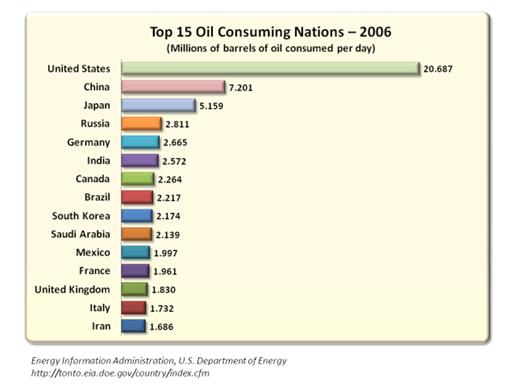

Now the bad news for Americans; we make up 4.3% of the world's population and consume 26% of the world's oil. Europe makes up 6.8% of the world's population and consumes 11% of the world's oil. After the oil shock of the 1970's Europe decided to dramatically increase taxes on gasoline. The high cost of gasoline forced people to buy smaller fuel efficient cars. Today in Germany , their cars average 44 mpg, while in the U.S. our cars average 22 mpg. Whether Europe spent the taxes wisely is another question, but they did change behavior. N o crude oil refineries have been built in the United States since 1976. During that time, hundreds of ethanol refineries have been built. It requires more energy to produce ethanol than ethanol produces. T he United States has between 250 and 300 years of a coal supply. That is more than the amount of recoverable oil contained in the entire world. We will not utilize this resource because environmentalists say it is bad. Congressman Gary Miller describes the U.S. response to the 1970's oil shock.

In 1973, America imported 30 percent of its crude oil needs. Today, that number has doubled to more than 70 percent. Gas prices are as high as they are now in part because we've had no comprehensive national energy policy for the past few decades.

The peak oil shock that is coming will affect the United States more dramatically than any other country. Are you prepared for $5.00 a gallon gasoline? We are 20 years too late to stop this from happening. The American way of kicking all tough issues down the road is about to kick us in the ass, and no one is preparing Americans for the result. Happy talk and confidence building exercises will not solve the problem. We are not in control of our destiny. Our supply is drying up. More drilling will not work. Higher fuel efficiency standards will not work. Congressmen and TV pundits will posture, expound, skewer oil executives on TV, and get red in the face, but they have failed the American public again. The social upheaval that could occur from fuel shortages and outrageous prices will be ugly. Most Americans live in suburbs far from work. Our food supply requires trucks to deliver to our stores. The U.S. military consumes 400,000 barrels of oil per day and spends $13 billion of your tax dollars per year to keep their machines functioning. War for oil becomes more likely in that environment. Is that a farfetched scenario?

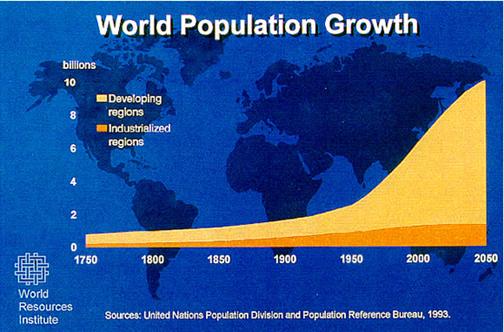

The population of the world will continue to rise. The United States has no control over that fact. Developing countries will grow more prosperous. People utilize more fossil fuels as they become more prosperous. $2,500 cars are now becoming available in China and India and the rest of Asia . In a Chinese car ownership survey, 96% of respondents said they paid cash for their cars. How un-American like. Imagine if GMAC could gain a foothold in China . More than 20,000 new cars per day are being sold to Chinese citizens who have never owned an automobile before. This is massive new demand being created for gasoline. China now has a middle class estimated at nearly 300 million people. 37% of people driving in China today did not know how to drive 3 years ago.

The population of the world will continue to rise. The United States has no control over that fact. Developing countries will grow more prosperous. People utilize more fossil fuels as they become more prosperous. $2,500 cars are now becoming available in China and India and the rest of Asia . In a Chinese car ownership survey, 96% of respondents said they paid cash for their cars. How un-American like. Imagine if GMAC could gain a foothold in China . More than 20,000 new cars per day are being sold to Chinese citizens who have never owned an automobile before. This is massive new demand being created for gasoline. China now has a middle class estimated at nearly 300 million people. 37% of people driving in China today did not know how to drive 3 years ago.

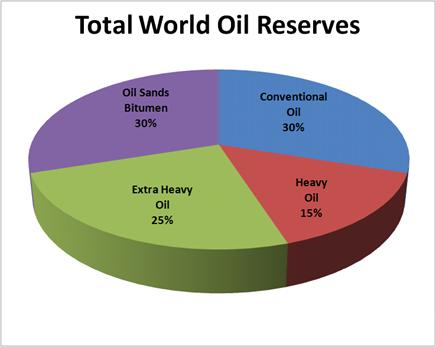

Oil will continue to be discovered, just not enough to keep up with demand. The pie chart below paints a disturbing picture. Only 30% of total oil reserves are light sweet crude. The other 70% is difficult and costly to bring to market. Few U.S. refineries can convert heavy crude into gasoline. Oil sands require massive amounts of water and natural gas to convert it into usable oil. The oil remaining to be discovered will be in deepwater wells. It takes at least 10 years to bring a deepwater well online. We are losing the race with time.

The only two people sounding the alarm have been Matt Simmons and T. Boone Pickens. Mr. Simmons warns that the best energy geologists and engineers are now retiring, with no one to take their place. The global oil and gas system infrastructure is rusting away and falling apart. The cost to rebuild our global energy infrastructure would be close to $100 trillion and would require 10 to 20 million workers. This would not be wasted money. Mr. Pickens argues that by investing $1 trillion to build wind facilities in the corridor from Texas to North Dakota we could produce 20% of the nation's electricity by 2020. This would free up our vast natural gas resources to be used as fuel for truck fleets and ultimately automobiles. The ideas of both men would create jobs in America and make us less dependent on Middle East oil.

The only two people sounding the alarm have been Matt Simmons and T. Boone Pickens. Mr. Simmons warns that the best energy geologists and engineers are now retiring, with no one to take their place. The global oil and gas system infrastructure is rusting away and falling apart. The cost to rebuild our global energy infrastructure would be close to $100 trillion and would require 10 to 20 million workers. This would not be wasted money. Mr. Pickens argues that by investing $1 trillion to build wind facilities in the corridor from Texas to North Dakota we could produce 20% of the nation's electricity by 2020. This would free up our vast natural gas resources to be used as fuel for truck fleets and ultimately automobiles. The ideas of both men would create jobs in America and make us less dependent on Middle East oil.

If you are seeking the truth, join me at www.TheBurningPlatform.com .

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.