U.S. Dollar Correction Higher Significant Selling Opportunity

Currencies / Forex Trading Apr 07, 2009 - 02:16 AM GMTBy: ForexPros

The USD continued to correct higher trough today’s New York trade reaching the best levels of the day against the majors shortly after the London fix; despite the rise in the Greenback the majors held important S/R levels during the day and remains in two-way action into the close. Technical trade was the rule for the most part as the lack of economic news kept traders focused on near-time price levels with stops helping to drive most of the intraday action.

The USD continued to correct higher trough today’s New York trade reaching the best levels of the day against the majors shortly after the London fix; despite the rise in the Greenback the majors held important S/R levels during the day and remains in two-way action into the close. Technical trade was the rule for the most part as the lack of economic news kept traders focused on near-time price levels with stops helping to drive most of the intraday action.

GBP never traded back to the earlier high seen in late Europe this morning of 1.4961 but retreated finding layers of stops for a low print at 1.4668 before recovering more than a full handle and settling above the 1.4700 handle.

Traders note that cross-spreaders for Yen liquidating Yen crosses as well as weakness in EURO helping to drive the rate lower but Cable still held technical support at the 1.4720 area. EURO also took a dive dropping from the 1.3550 area in early trade for a low print at 1.3356 once again holding tech support ahead of the 1.3330 area; the rate also seeing liquidation from Yen crosses.

EURO recovered back to the 1.3400 area and is trying for a close above the 1.3400 handle suggesting that the dips are being bought. Traders note that volumes were light on the move lower and there was bid interest during the fix today. The rest of the majors all held under tech resistance after trying for highs; traders note that the tech levels seen from last week are back in play across all pairs.

USD/CHF high prints at 1.1409 were under the tech level of 1.1420; the rate failing to hold the 1.1400 handle by the end of the day. USD/JPY held firm making the USD at the highest levels seen since last year but off its highs; high prints at 101.46 never challenged in New York and the rate is unable to hold the 101.00 handle into the close.

USD/CAD rallied to a high print at 1.2443 before dropping back under the 1.2400 handle; a late push back to the 1.2400 handle sees the rate holding around the 1.2405 area in light trade. All the rates either held their respective 100 day MA S/R levels or their recent Fib levels suggesting that all of today’s action was dominated by short-term traders and likely will repeat tomorrow. With a light economic calendar due tomorrow and into mid-week the USD will likely remain two-way for the next 24-48 hours. Look for the Greenback to be subdued overnight and respect current ranges.

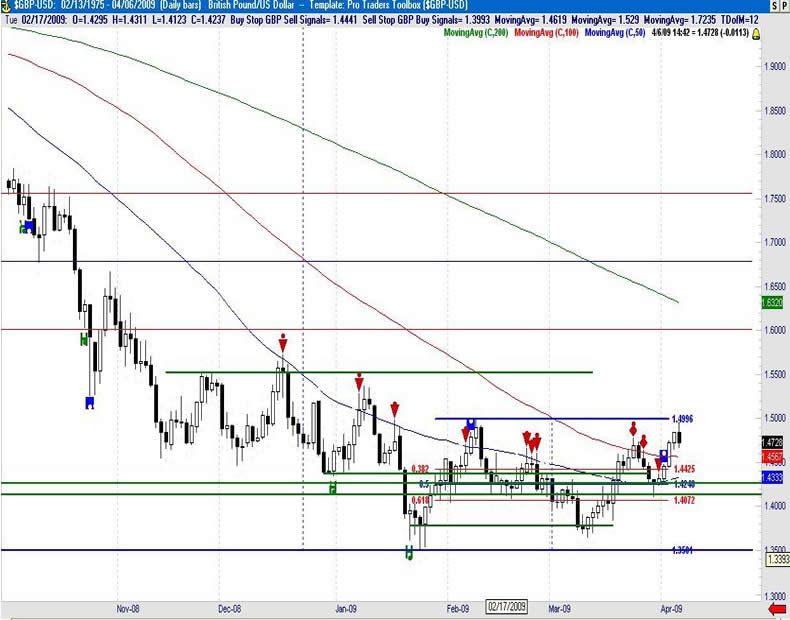

GBP/USD Daily

Resistance 3: 1.5040/50, Resistance 2: 1.5000, Resistance 1: 1.4950

Latest New York: 1.4726, Support 1: 1.4650, Support 2: 1.4580, Support 3: 1.4550

Comments

Rate pressures up to within striking distance of 1.5000 overnight; likely offers will be thick on any further advance. Aggressive traders can look to lighten up on longs above 1.4950 area. Stops noted above the 1.4880 area on the way up with traders noting stops under there on the way down. Rate makes lows after the fix but holds support to bounce back onto the 1.4700 handle. Traders note support is likely firm at the 1.4450 area as expected; offers ahead of 1.4700 easily absorbed keeping the bias to the upside. Close over 1.4900 argues for further gains but tech resistance is firm ahead of 1.5000. Overhead target of the 1.5000 area likely to trade but expect pressure. Traders feel the 23-year lows will likely remain secure. The shorts may have lost control of the market above the 1.4440 area now and if that is the case a test of the 1.5000 area is almost a done-deal. Traders report stops in-range adding for two-way action.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Manufacturing Production m/m

4:30am GBP Industrial Production m/m

7:01pm GBP Nationwide Consumer Confidence

7:01pm GBP NIESR GDP Estimate

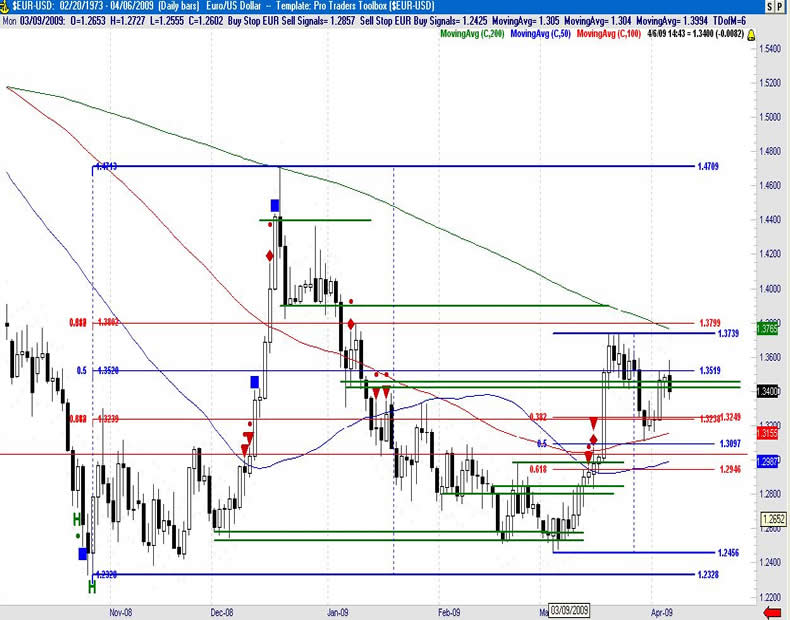

EUR/USD Daily

Resistance 3: 1.3620/30, Resistance 2: 1.3580, Resistance 1: 1.3520

Latest New York: 1.3397, Support 1: 1.3380, Support 2: 1.3350, Support 3: 1.3330

Comments

Rate consolidates but is capped at 1.3580 with stops likely above 1.3600 now. Rate is solid above the 100 day MA. Foothold over the 1.3500 handle fails today but support is solid ahead of 1.3330 area. Rate likely has stops building in both directions; shorts lose control of the market after rate clears stops above the 1.3430 area. Action remains two-way; any move lower is likely supported on dips. Overhead resistance at 1.3330/50 area now support on a pullback; aggressive traders can ADD on a dip. Possibly more official and semi-official bids overnight with traders noting Middle-eastern names on the bid. Long-term bulls are likely still in control of the market and this significant pullback is a buying opportunity in my view.

Data due Tuesday: All times EASTERN (-5 GMT)

NONE

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.