U.S. Dollar More Downside Action Expected This Week

Currencies / Forex Trading Apr 06, 2009 - 08:29 AM GMTBy: ForexPros

The USD is two-way to start New York after opening mixed in Asia overnight; follow-on selling of the Greenback pushed the majors to their best levels of the day in early Europe with the exception of the USD/JPY. USD/JPY continued to advance reaching a high print at 101.46, its best levels since October of last year. Traders note that the weekend launch of a ballistic missile by the North Koreans created light FTQ buying of the USD against some

The USD is two-way to start New York after opening mixed in Asia overnight; follow-on selling of the Greenback pushed the majors to their best levels of the day in early Europe with the exception of the USD/JPY. USD/JPY continued to advance reaching a high print at 101.46, its best levels since October of last year. Traders note that the weekend launch of a ballistic missile by the North Koreans created light FTQ buying of the USD against some

Asian currencies and with the underlying strength recently in the USD/JPY traders saw reason to bid the rate over the 101.00 handle; offers were said to be thick from exporters above the 101.00 area and more layered every 50 points or so suggesting that offers will continue to show up on further strength making upside progress difficult. Option-related offers likely on the approach to 101.50 also noted and the rate is currently holding firm around the 101.20 area in two-way action.

Yen weakness helped the GBP and EURO as traders bought the Europeans for Yen lifting both pairs against the USD; GBP high prints at 1.4953 triggering stops over the 1.4920 area. Low prints at 1.4838 with traders noting that after the highs in Europe the rate has stops in range putting the potential for a reversal on the board. Upside resistance at 1.5000 now expected to cap near-term with offers said to be resting above the 1.4980 area.

EURO high prints at 1.3583 were under stops said to be around the 1.3600 area; low prints at 1.3498 area still above the tech support area of 1.3480 from last week suggesting that the EURO has more upside to go but traders need to be cautious as a drop in Cable may take EURO with it; two-way action in the Yen pairs may also pressure the rate. USD/CHF is holding the 200 day MA once again; low prints at 1.1240 missing stops under the market said to be around the 1.1240/50 area. High prints in the rate at 1.1316 making a weak start to the week for Swissy. A close below the 200 day MA will likely attract technical selling from shorts and more rhetoric from the SNB.

USD/CAD remains pressured as well, low prints at 1.2223 again missing stops said to be layered under the 1.2200 area. High prints at 1.2306 make for a narrow range in the rate and with USD weakness elsewhere the rate is expected to break lower during the day. With no economic news on the boards for the US today all the majors are expected to remain two-way and technical; stops are likely in range in all pairs and ranges likely will extend once New York gets underway in earnest. In my view, the USD will remain two-way for the next few days as traders continue to address how to price the cost of the financial crisis in light of potential new actions by the G-20; after the meeting last week traders are seeing a better coordinated effort coming from the governments involved. Look for the USD to get off to a slow start this week with more downside coming.

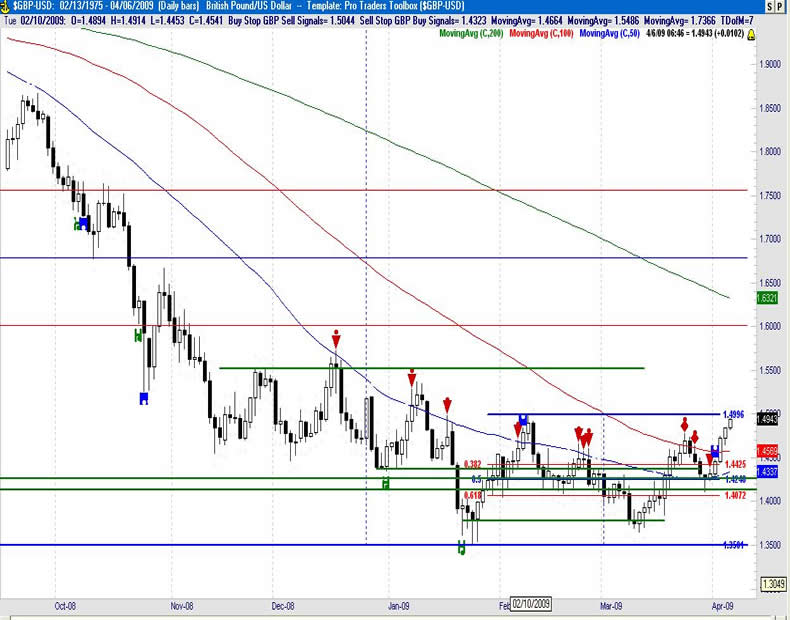

GBP/USD Daily

Resistance 3: 1.5040/50, Resistance 2: 1.5000, Resistance 1: 1.4950

Latest New York: 1.4942, Support 1: 1.4650, Support 2: 1.4580, Support 3: 1.4550

Comments

Rate pressures up to within striking distance of 1.5000 overnight; likely offers will be thick on any further advance. Aggressive traders can look to lighten up on longs above 1.4950 area. Stops noted above the 1.4880 area on the way up with traders noting stops under there on the way down. Traders note support is likely firm at the 1.4450 area as expected; offers ahead of 1.4700 easily absorbed keeping the bias to the upside. Close over 1.4900 argues for further gains but tech resistance is firm ahead of 1.5000. Overhead target of the 1.5000 area likely to trade but expect pressure. Traders feel the 23-year lows will likely remain secure. The shorts may have lost control of the market above the 1.4440 area now and if that is the case a test of the 1.5000 area is almost a done-deal. Traders report stops in-range adding for two-way action.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Manufacturing Production m/m

4:30am GBP Industrial Production m/m

7:01pm GBP Nationwide Consumer Confidence

7:01pm GBP NIESR GDP Estimate

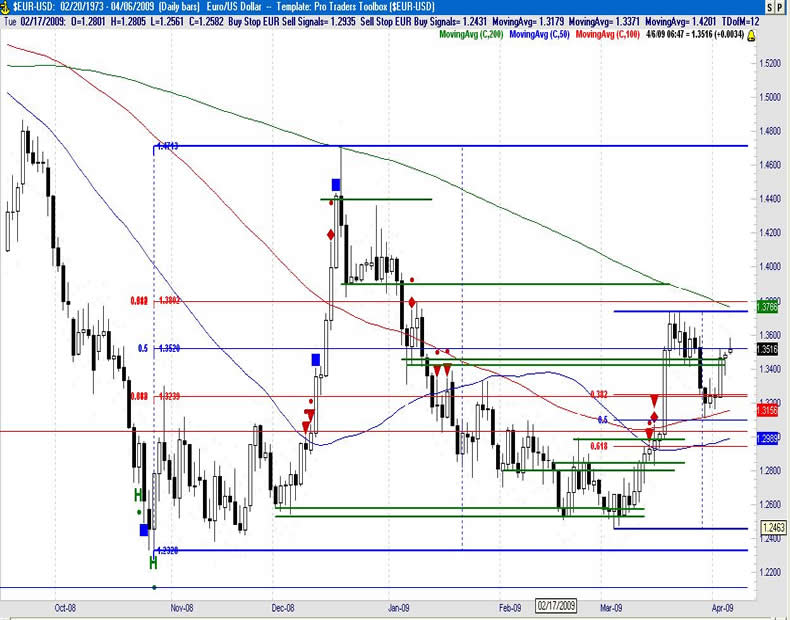

EURO/USD Daily

Resistance 3: 1.3620/30, Resistance 2: 1.3580, Resistance 1: 1.3520

Latest New York: 1.3516, Support 1: 1.3480, Support 2: 1.3420, Support 3: 1.3380

Comments

Rate consolidates and holds gains but is capped at 1.3580 with stops likely above 1.3600 now. Rate is solid above the 100 day MA. Traders note offers above the 1.3630 area but bids continue to support ahead of 1.3480; foothold over the 1.3500 handle likely to encourage a short-squeeze. Rate likely has stops building in both directions; shorts lose control of the market after rate clears stops above the 1.3430 area. Action remains two-way; any move lower is likely supported on dips. Overhead resistance at 1.3330/50 area now support on a pullback; aggressive traders can ADD on a dip. Possibly more official and semi-official bids overnight with traders noting Middle-eastern names on the bid. Long-term bulls are likely still in control of the market and this significant pullback is a buying opportunity in my view.

Data due Tuesday: All times EASTERN (-5 GMT)

NONE

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.