Stock Market Betting on a Global Economic Rebound

Stock-Markets / Financial Markets 2009 Apr 05, 2009 - 12:13 PM GMT

Unemployment rate officially at 8.5% - The U.S. unemployment rate jumped in March to the highest level since 1983 as the economy lost 663,000 jobs, threatening to keep spending subdued for months and delay any recovery. The Department of Labor reports, “Nonfarm payroll employment continued to decline sharply in March (-663,000), and the unemployment rate rose from 8.1 to 8.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.1 million jobs have been lost, with almost two-thirds (3.3 million) of the decrease occurring in the last 5 months. In March, job losses were large and widespread across the major industry sectors.”

Unemployment rate officially at 8.5% - The U.S. unemployment rate jumped in March to the highest level since 1983 as the economy lost 663,000 jobs, threatening to keep spending subdued for months and delay any recovery. The Department of Labor reports, “Nonfarm payroll employment continued to decline sharply in March (-663,000), and the unemployment rate rose from 8.1 to 8.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.1 million jobs have been lost, with almost two-thirds (3.3 million) of the decrease occurring in the last 5 months. In March, job losses were large and widespread across the major industry sectors.”

The numbers would have been far worse if the CES Birth/Death Model hadn't added 114,000 hypothetical persons to the non-farm payrolls. This model was originally used as a smoothing mechanism to lower the monthly volatility of the unemployment numbers. However, the Department of Labor has been adding unusually large numbers to such sectors as Leisure & Hospitality (41,000) and Construction (23,000) that often get adjusted back down when the figures are revised at a later date.

Don't count your chickens before they're hatched!

-- Stocks turned lower but clung to most of their recent gains Friday after a report showing a new round of big job losses throughout the U.S. economy. Though grim, the latest jobs report was roughly in line with Wall Street expectations. Participants have been betting that the global economy is due for a rebound, even if that scenario hasn't quite arrived yet.

-- Stocks turned lower but clung to most of their recent gains Friday after a report showing a new round of big job losses throughout the U.S. economy. Though grim, the latest jobs report was roughly in line with Wall Street expectations. Participants have been betting that the global economy is due for a rebound, even if that scenario hasn't quite arrived yet.

Treasury bonds still hold up.

-- Treasuries rose, trimming yesterday's losses, on speculation a government report will show the U.S. unemployment rate climbed in March to the highest level in 25 years.

-- Treasuries rose, trimming yesterday's losses, on speculation a government report will show the U.S. unemployment rate climbed in March to the highest level in 25 years.

Deflation is the biggest risk in the economy, and government notes are poised to reverse some of this year's drop, strategist Mike Turner at Aberdeen Asset Management Plc wrote in a report. Yields indicate inflation forecasts among traders fell this week for the first time in a month.

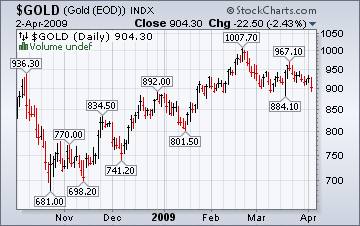

Gold has made a retracement, ready to decline.

( Bloomberg ) -- Gold traded little changed in Asia, heading for a second weekly fall, as investors shifted more funds into shares amid growing optimism that the worst of the global economic slump may be over.

( Bloomberg ) -- Gold traded little changed in Asia, heading for a second weekly fall, as investors shifted more funds into shares amid growing optimism that the worst of the global economic slump may be over.

Many investors are trend followers. They see the rally in equities and the decline in gold, so they rotate out of gold into what appears to be more profitable. I have been urging caution in gold for some time and still do, regardless of the direction of stocks.

Japanese market approaching nosebleed territory?

( Bloomberg ) -- Japanese stocks extended a fourth weekly gain on optimism efforts to halt the global recession are taking effect, helping send the yen to a five-month low. The Nikkei has climbed 24 percent from a 26-year low on March 10 amid optimism central banks can tame the financial crisis and Japan's government will buy stocks to bolster the market. The gauge's estimated dividend yield has fallen to 1.9 percent, smaller than 2.8 percent on the Standard & Poor's 500 Index in the U.S. This is not sustainable.

( Bloomberg ) -- Japanese stocks extended a fourth weekly gain on optimism efforts to halt the global recession are taking effect, helping send the yen to a five-month low. The Nikkei has climbed 24 percent from a 26-year low on March 10 amid optimism central banks can tame the financial crisis and Japan's government will buy stocks to bolster the market. The gauge's estimated dividend yield has fallen to 1.9 percent, smaller than 2.8 percent on the Standard & Poor's 500 Index in the U.S. This is not sustainable.

Chinese investors having second thoughts, too.

-- China's stocks fell for the first time in four days, led by power producers and automakers, after reports of declining corporate profits raised concerns that the government's stimulus may fail to revive the economy. The Shanghai Composite Index , which tracks the bigger of China's stock exchanges, retreated 5.51, or 0.2 percent, to 2,419.78 at the close, after changing direction about nine times. Three stocks declined for each that gained.

-- China's stocks fell for the first time in four days, led by power producers and automakers, after reports of declining corporate profits raised concerns that the government's stimulus may fail to revive the economy. The Shanghai Composite Index , which tracks the bigger of China's stock exchanges, retreated 5.51, or 0.2 percent, to 2,419.78 at the close, after changing direction about nine times. Three stocks declined for each that gained.

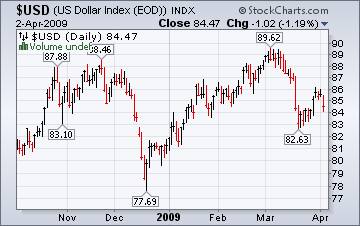

The dollar is still the reserve currency.

-- The dollar's role as a reserve currency won't be threatened by a nine-fold expansion in the International Monetary Fund 's unit of account, according to UBS AG, ING Groep NV and Citigroup Inc. The Dollar Index rallied 17 percent in the past year as the bankruptcy of Lehman Brothers Holdings Inc. in September caused credit markets to freeze, prompting investors to dump riskier assets and hoard dollars.

-- The dollar's role as a reserve currency won't be threatened by a nine-fold expansion in the International Monetary Fund 's unit of account, according to UBS AG, ING Groep NV and Citigroup Inc. The Dollar Index rallied 17 percent in the past year as the bankruptcy of Lehman Brothers Holdings Inc. in September caused credit markets to freeze, prompting investors to dump riskier assets and hoard dollars.

Mortgage insurance on shaky ground .

Imagine paying full premium for an insurance contract, and receiving only 60 percent on any claim you make — that's the unsavory situation now being faced by both Fannie Mae and Freddie Mac. Freddie's and Fannie's mortgage insurer had received a corrective order from its regulator, the Illinois Director of Insurance, limiting its payout on claims to 60 percent. The remaining 40 percent of a claim will essentially take the form of an IOU.

Imagine paying full premium for an insurance contract, and receiving only 60 percent on any claim you make — that's the unsavory situation now being faced by both Fannie Mae and Freddie Mac. Freddie's and Fannie's mortgage insurer had received a corrective order from its regulator, the Illinois Director of Insurance, limiting its payout on claims to 60 percent. The remaining 40 percent of a claim will essentially take the form of an IOU.

Maybe..maybe not!

Energy Information Administration Weekly Report suggests that, “ With the U.S. average retail price for regular gasoline now above the $2 per gallon mark, many Americans may be wondering if even higher gasoline prices await this summer. …EIA does not see gasoline prices climbing to (last year's) levels this year. It does seem likely, however, that gasoline prices will average more than $2 per gallon this summer.”

Energy Information Administration Weekly Report suggests that, “ With the U.S. average retail price for regular gasoline now above the $2 per gallon mark, many Americans may be wondering if even higher gasoline prices await this summer. …EIA does not see gasoline prices climbing to (last year's) levels this year. It does seem likely, however, that gasoline prices will average more than $2 per gallon this summer.”

A price increase that couldn't stick.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices continue to show considerable weakness, decreasing at nearly all market locations in the Lower 48 States since Wednesday, March 25, and reversing the previous week's gains. Despite cold temperatures in many areas of the Lower 48 for much of the report week, spot prices fell in tandem with the futures prices.”

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices continue to show considerable weakness, decreasing at nearly all market locations in the Lower 48 States since Wednesday, March 25, and reversing the previous week's gains. Despite cold temperatures in many areas of the Lower 48 for much of the report week, spot prices fell in tandem with the futures prices.”

Do whatever it takes…or leave well enough alone?

The U.S. government and the Federal Reserve have spent, lent or committed $12.8 trillion, an amount that approaches the value of everything produced in the country last year, to stem the longest recession since the 1930s.

New pledges from the Fed, the Treasury Department and the Federal Deposit Insurance Corp. include $1 trillion for the Public-Private Investment Program , designed to help investors buy distressed loans and other assets from U.S. banks. The money works out to $42,105 for every man, woman and child in the U.S. and 14 times the $899.8 billion of currency in circulation. The nation's gross domestic product was $14.2 trillion in 2008.

“The president and Treasury Secretary Geithner have said they will do what it takes,” Goldman Sachs Group Inc. Chief Executive Officer Lloyd Blankfein said after the meeting. “If it is enough, that will be great. If it is not enough, they will have to do more.”

Now see what Nicholas Taleb has to say.

Our Investment Advisor Registration is on the Web .

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.