Gold Sentiment and Trend Analysis

Commodities / Gold & Silver 2009 Apr 01, 2009 - 10:24 AM GMTBy: Jordan_Roy_Byrne

In recent writings I have forecasted a consolidation or small correction in Gold. It rebounded $300/oz while most markets sputtered. Yet, at $1,000/oz Gold was overbought and meeting technical resistance while stock indices and commodities were in the process of bottoming. As predicted, the Fed's monetization and “reflation” trade has thus far failed to lift Gold past $1,000/oz. Money is moving into other markets at a time when Gold is relatively extended, but extremely extended in relation to these other markets. Various sentiment data provide us with greater confirmation that the ancient metal of kings is in a period of consolidation.

In recent writings I have forecasted a consolidation or small correction in Gold. It rebounded $300/oz while most markets sputtered. Yet, at $1,000/oz Gold was overbought and meeting technical resistance while stock indices and commodities were in the process of bottoming. As predicted, the Fed's monetization and “reflation” trade has thus far failed to lift Gold past $1,000/oz. Money is moving into other markets at a time when Gold is relatively extended, but extremely extended in relation to these other markets. Various sentiment data provide us with greater confirmation that the ancient metal of kings is in a period of consolidation.

First let's take a look at Mark Hulbert's sentiment data based on the attitudes of analysts who “time” Gold. The following is excerpted from Hulbert's 3/31 column: http://www.marketwatch.com/news/..

“Consider the Hulbert Gold Newsletter Sentiment Index (HGNSI), which reflects the average recommended gold-market exposure among a subset of short-term gold timing newsletters tracked by the Hulbert Financial Digest. As of March 30, the HGNSI stood at 30.2%. Two weeks ago, in contrast, it stood at minus 16.5%. So, in just ten trading sessions, during which gold bullion on balance went nowhere, the editor of the average short-term gold timing newsletter has increased his average recommended exposure level by nearly 47 percentage points.”

The Fed's announced monetization caused a surge in Gold and prompted a shift in the attitudes of Gold timers. However, the surge in Gold was the result of short covering. Judging from the previous sentiment reading in the HGNSI, the Gold market was overloaded with shorts that were quick to cover on the bullish news. Yet as I explained in my last editorial, news doesn't make trends, it follows them. The news came after a major rebound of $300/oz or roughly 40%. Since the initial reaction Gold has declined but the bullish sentiment hasn't.

Now let's take a look at the public opinion towards Gold. The following chart and data comes from http://www.sentimentrader.com .

The above marks are my annotations. Prior the major breakout in 2005, the peaks in public opinion (% bullish) actually trended down. We have seen a similar trend since the end of 2007. As can be seen in 2005, a breakout in public opinion is not a bad thing. Also, the initial breakout moves in Gold (in 2005 and 2007) peaked (in terms of public opinion) at what looks to be 80% and then 87%. Corrections within the impulsive advances took public opinion down to about 65% and then 70%. Since Gold has yet to breakout, we would look for a bottom in public opinion at 55% to 60%. It is currently 68% bullish. When Gold breaks above $1,000, we'd look for a range in public opinion from 70% to 90% (during the next advance).

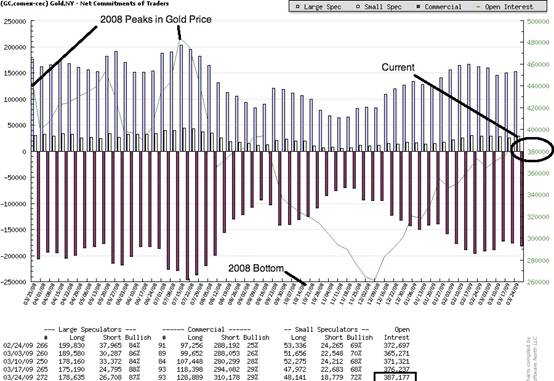

Last but not least, let's take a look at the Commitment of Traders Report and how the various traders are currently positioned. The chart is from http://www.softwarenorth.net .

In the current context lower open interest is better. Lower open interest would indicate, among other things less speculative activity and stronger longs. See how high it was in 2008 at the peaks in the Gold price? Notice where it was just weeks after the bottom? We would like to see some reduction in speculator positions as well as reduction in commercial short positions. It is unlikely that the commercial traders will soon end up back where they were last winter (short less than 100K contracts) but a reduction below 150k contracts would be positive. The same goes for open interest.

Overall, current sentiment readings are no cause for alarm but they are a bit too extended for us to believe that a breakout in Gold is imminent. A correction to $850 or continued consolidation between $880 and $1,000/oz for a number of weeks would likely move these gauges to a more bullish position (in contrary terms). Finally we must remember that analyzing sentiment is more an art form than scientific study. Moreover, sentiment actually follows the trend most of the time. It is best used to predict turning points.

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.