Stock Market Investing, Careful Risk Taking

InvestorEducation / Learning to Invest Apr 01, 2009 - 03:02 AM GMTBy: Richard_Shaw

What is “risk” for investors? We think it is a broader, more important and more perilous issue than most investors have recognized for many years.

What is “risk” for investors? We think it is a broader, more important and more perilous issue than most investors have recognized for many years.

A typical “measure” of risk in stock markets has been standard deviation of return (the variability of returns around a long-term mean). Yet, a typical “measure” of risk in the bond market has been credit quality (the likelihood of payment default or bankruptcy).

In a “normal” market, more risk (volatility) means more return in the long-term. However, “normal” is often defined in terms of the post-WWII period, which is really quite short-term considering the expanse of the history of money and investment, and perhaps not representative going forward.

The world is changing. Economic power and leadership is shifting. New winners and new losers will arise, perhaps unseating former market leaders — some catastrophically.

Situational awareness and adaptive response is necessary. Part of situational awareness is greater attention to the absolute risk of company failure.

In the real world, stock risks must include the absolute risk of bankruptcy, not just the relative risk of volatility and index tracking error.

The fact is that some companies fail. They may fail for many different reasons, such as, among others;

- over-leveraging

- financial product mispricing

- technology change

- fraud

- legal liability

- social legislation

- macro-economic decline

The key is that rather than exhibiting value fluctuation, some company stocks will go to zero and stay there. Even among those that survive, bubble stocks may effectively reset to much lower prices, creating a traunch of absolute value loss.

In the current and near-term environment, it may well prove advantageous when selecting individual stocks to focus on low debt, high cash, free cash flow, dividends and a safe payout ratio.

At a minimum, investors need to pay greater attention to balance sheets and credit quality of companies, not just sales and earnings growth and multiples.

While credit ratings are far from perfect, they are better than none at all.

There are various free or low cost sources of balance sheet perspectives on stocks, including:

- Moody's credit rating

- Standard and Poor's credit rating

- Value Line's company financial strength

- Wright's Investors Service financial strength

You can alternatively use various databases to screen for key solvency ratios, such as debt to equity, cash to current liabilities, earnings interest coverage, free cash flow and other financial strength indicators. Brokerages tend to provide screening tools with some of that data. Inexpensive tools such as “Stock Investor Pro” from the American Association of Individual Investors provides lots of data with both built-in and customizable screening options.

The decades of the 1980's and 1990's created a false sense of certainty about the direction and level of stock market returns. The mutual fund marketing machines helped embed that kind of thinking, as they gathered billions of dollars into their funds. The real, long-term world is much less certain, less hospitable and less accommodating than were those two decades. The real world for US markets in the next few decades will not enjoy the global military, economic and technological supremacy the US experienced after WWII.

Investors, particularly, those near or after the end of their asset accumulation years, should hold more bonds relative to stocks than they might have done five or ten years ago.

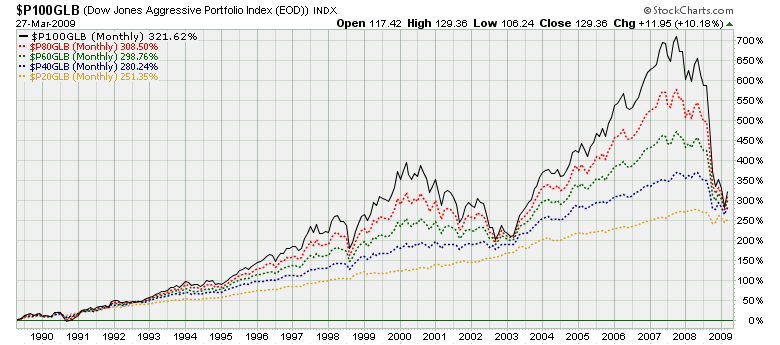

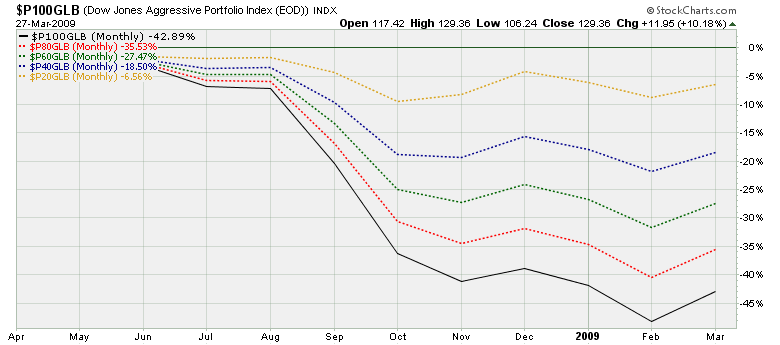

These Dow Jones monthly rebalanced portfolios of stocks versus bonds illustrate the importance of bonds to reduce the volatility component of an overall portfolio. They show the results for 100% stocks, 80%, 60% 40% and 20% stocks.

20-Year Perspective

1-Year Perspective

Our website presents multiple other asset allocation scenarios and outcomes over various time periods.

The mathematics of recovery from losses is challenging. It takes a 100% gain to recover from a 50% loss. It takes a 50% gain to recover from a 33% loss. It takes a 33% gain to recover from a 25% loss. Not losing is part of winning.

Those investors with mature portfolios should carefully parse the generic advice they read and hear, by asking what stage of the investment life cycle they are in, and for what stage that advice is suitable. Suitability distinctions are seldom made in the print and TV business news. One size does not fit all.

You are not a generic person. You are at least in a differentiated category, and within that category you have unique attributes, needs and limits.

What makes sense for someone age 30 may be entirely inappropriate for someone aged 60, for example. What makes sense for someone just starting out with savings, is certainly inappropriate for someone who is depending on portfolio income or capital draw-down to support lifestyle.

(… more on this )

Too much of the off-the-shelf advice about risk taking is flawed by assuming a “normal” world. Recent experience has clearly shown that the world of money is full of uncertainties. Paying close attention to quality, absolute risk of loss due to bankruptcy, and limiting issue selection risk due to over-concentration will greatly benefit those investors who understand that wealth conservation is a key part of wealth accumulation or lifestyle maintenance.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.