Stocks Bear Market Bounce

Stock-Markets / Stocks Bear Market Mar 31, 2009 - 02:38 AM GMTBy: Brian_Bloom

The chart below (courtesy decisionpoint.com) says it all: Based on rolling 12 months historical earnings – adjusted for Generally Accepted Accounting Principles – the Price/Earnings ratio of the Standard and Poor 500 Industrial Index in the USA was 54.51 as at March 27th 2009

The chart below (courtesy decisionpoint.com) says it all: Based on rolling 12 months historical earnings – adjusted for Generally Accepted Accounting Principles – the Price/Earnings ratio of the Standard and Poor 500 Industrial Index in the USA was 54.51 as at March 27th 2009

In simple English, if the SPX Index was to adjust to an historically overpriced level of 20X P/E ratios (the level of red line), it would need to fall by 63% from its current level.

Can underlying earnings in the coming year be “ramped” by the trillions of dollars being rammed into the economy? Well, anything is possible, but the reader needs to focus on the fact that earnings need to more than double across the board in the coming twelve months for the market to merely hold its ground.

Interim Conclusion #1

When the current market bounce is exhausted, the Primary Bear Trend is more likely than not to resume with a vengeance – given that it will be patently obvious to a blind man that the authorities will have thrown everything but the kitchen sink at the economic downturn; and failed to arrest it.

What do we do about it?

From a private investor's perspective, the movements of gold share prices over the past couple of months have been telling a story. Although the gold share index was moving within the confines of what appeared to be a bearish formation on the charts – a rising wedge from which it subsequently broke down – there were some underlying subtleties which led to the conclusion that the average little-guy investor was moving to assume control of his/her own financial destiny.

The chart below – courtesy stockcharts.com – shows that the ratio of the $XAU to the gold price itself, recently gave a “buy” signal when it penetrated above a quadruple top resistance level. Given the scale of this particular Point and Figure chart (viz. 3% X 3 box reversal) this breakout may turn out to be very significant.

Oddly, when one looks at the chart of the gold price itself (see below, courtesy DecisionPoint.com) it appears to have given a “sell” signal as the price has penetrated below the rising trend line. Further, the PMO has failed to break up above its falling trend line and it has also fallen to a lower level than the previous low.

But, if the gold price is giving sell signals, and the gold shares appear to have broken down from a bearish formation, then how is it possible that the ratio of the gold share index to the gold price has given a buy signal?

The answer may lie in the following quote, which appeared in the media on March 30 th , 2009:

“G20 leaders are expected to discuss using proceeds from planned gold sales by the International Monetary Fund (IMF) to double funding available for poor countries which need help dealing with the global economic crisis, a source familiar with the plan said on Sunday.” Source: http://www.mineweb.com/..

This is a well worn story that resurfaces from time to time, with the monotonous regularity of a broken record. Prima facie the evidence suggests that behind the scenes there have been continuing attempts to manage the gold price. We are living in desperate times and it seems that the financial and political authorities are still desperately attempting to preserve confidence in the existing fiat system. But it also seem that they are not fooling everyone. Yes, the gold shares have been weakening – but not in line with the gold price itself. Private investor scepticism is still evident.

Interim conclusion #2

Notwithstanding the apparent weakness of the gold universe, it would appear that the more astute private investors are taking out insurance policies against the consequences of an emergence of the second (and savage) down wave in the Primary Bear Market. They are buying gold related investments.

Separate from the gold universe, the chart below tells another story in respect of the big dollops of investment fund dollars. Clearly, in an attempt to protect themselves and their associates large lenders have also been bailing into so-called “risk free” government bonds – thereby causing a downward pressure on long dated bond yields.

Will bailing into gold and treasury bonds help?

The short answer is that, unfortunately, it won't help. Yes, it may allow investors to protect their own positions for a short while. But – when you peer beyond all the smoke – the reality is that the world economy is approaching a cliff's edge. If the entire system falls over the edge, then treasury bonds and gold related insurance policies will go with them. US treasury bonds are clearly not risk free and the argument that gold has no counterparty risk is naïve if there is insufficient underlying economic activity to maintain economic momentum. We would do well to recall the full story of King Midas.

Finally, in extremis , even cash will become impotent.

Will the entire system fall over the edge?

In context of US Public Debt having risen from $9.4 trillion to $11 trillion in the twelve months from March 27 th 2008 to March 26 th 2009, the falling interest rates on 30 year government bonds appear to be defying the laws of economics. Clearly, the US government needs the money just as badly as the investors need a save haven in which to park it.

But, if a borrower needs to borrow an ever increasing amount of money to keep himself afloat, the risks of default by that borrower will be rising. If the risks of default are rising, then the price of the money he seeks to borrow (the interest rates charged by lenders to that increasingly risky borrower) should be rising, not falling.

The above chart of the 30 year bond yield shows that the price of money has been falling even as the risks of default by the borrower have been rising. Once again, the issue devolves to “management” of market expectations. Given that the US as an economic entity is too big to be allowed to fail, the base assumption of both the US financial authorities and investors in treasury bonds has been that lenders of new money will – in their own self-interests – fall in line and accept a lower price to lend higher risk money. Naively, investors in gold believe that they have been assuming the worst.

Reality Check

The “worst” will be much worse than the gold and bond investors have been imagining. One would have to be intellectually challenged to believe that this state of affairs can continue ad infinitum . Eventually, the stresses will become so large that something will happen. A tear in the fabric of the world's financial system will begin to manifest and, if the forces do not abate, the entire fabric will be ripped asunder.

In fact, something has already happened.

On January 7th 2009, the following was reported:

“ Investors shunned one of the most liquid and safest assets in the world on Wednesday as a German bond auction failed in a warning for governments seeking to raise record amounts of debt to stimulate their slowing economies.” ( http://ukhousebubble.blogspot.com/..)

On March 25 th 2009, the following was reported:

“ Britain suffered its first failed government bond auction since 2002 on Wednesday after bids fell more than £100 million short of the sale of £1.75 billion in securities, temporarily sending prices tumbling.” (source: http://www.iht.com/.. )

Of course, a spin was put on this result, and the same article reported the following:

“Market strategists said the result did not suggest that Britain was facing a funding crisis as it prepared to issue a record amount of government bonds, known as gilts, this year and next to fund extra spending during the recession. Prices of the securities later recovered.”

Instead, analysts blamed the opaqueness surrounding the Bank of England 's plans to buy gilts as part of its new approach to monetary policy.”

Hmm? Really? Perhaps Germany 's approach was also “opaque”? If so, then why did Mrs Merkel make the following statement in anticipation of the up-coming G20 meeting?:

"The issue is not spending even more but to put in place a regulatory system to prevent the economic catastrophe that the world is experiencing from being repeated," Merkel said in a direct rebuttal to US calls for more spending.

With respect, Mrs Merkel is whistling in the dark. Tightening the regulatory system will be like wallpapering over the cracks. Logic dictates that it is only a matter of time before the USA experiences the same result as Germany and the UK . At some point, lenders will just say “no” to the USA when it goes into the market to sell its bonds. At that point the Fed will be faced with the decision as to whether or not it should take up the bonds itself and just pump the new money into the system anyway.

That President Obama is now facing the reality of the USA 's aloneness is evidenced by the following quote:

“Compounding the problem for Mr. Obama is that the route that he has chosen to lead the United States out of the mess — heavy government spending — is not available to many other countries. European governments, for instance, are far more lukewarm about enormous stimulus programs because they already have strong social safety nets, and more fears of inflation, than does the United States .” (Source: http://www.nytimes.com/..)

So, whether the USA can continue with its current strategy of flooding the world markets with US Dollars will be dependent on:

- A continuation of the propensity of the Rest of the World to accept dollars that – even as they are being printed – are losing their value.

- A continuing propensity of the ROW to accept low interest rates on the dollars which they are being expected to re-lend to the USA

- A continuing absence of inflation within the USA 's borders – which, in itself will have very sinister implications. If inflation does not rear its head notwithstanding the injection of trillions of additional dollars then the implication will be that the velocity of money within the US economy is continuing to slow. That, in turn, will evidence an increasing dysfunctionality of the US economy.

Interim Conclusion #3

Evidence is emerging that the fabric of the world's financial system is beginning to tear. If our politicians and bankers continue along this unwise path of treating symptoms rather than causes, then the entire system is in danger of collapsing. The emerging evidence suggests that we are running out of time.

So, once again, what do we do about all this?

The short answer is that we need to recognise that the time for selfish behaviour has passed. The question is not: “What do we need to do to protect ourselves personally?” It is: “What do we need to do to stop the financial system and the economy from tearing asunder?” This is a very different question because it forces us to focus on addressing “causes” rather than “symptoms”. It forces us to focus on factors outside our own personal control and to assume personal responsibility at society level.

The following are the primary causes of our current problems:

- By and large, the bankers and politicians have made the fundamental error of believing that “money” and “interest rates” drive the world economy. In short, they do not. The bankers and politicians need to come to their senses.

- For the past 100 odd years oil and the technologies which oil has spawned (in particular the internal combustion engine) have been driving the world economy. With Peak Oil having passed, the world economy needs a new energy paradigm to become the economic driver. Without the new energy paradigm, the economic momentum will continue to slow.

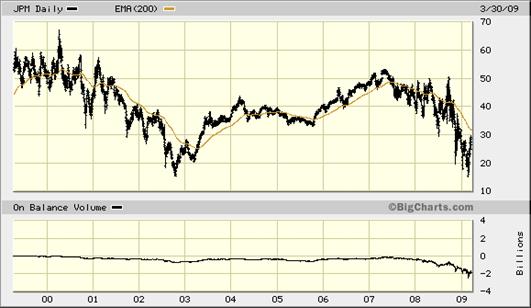

- The primary reason that the people in the banking and political camps have made such a fundamental error of judgement is that their lives are driven by ego and testosterone. Their decisions have been too heavily influenced by their lust for personal power and this lust may well turn out to be the kiss of death for us all. In addition to the debt mountain – which is visible – the world's finance industry is now sitting on an invisible time bomb in the shape of a Derivatives Industry that some argue is around the quadrillion dollar mark. The issue here is “counterparty risk”. For example, it doesn't matter how powerful JP Morgan may be, when the counterparties to their derivatives contracts fall over, JP Morgan will fall over.

The chart below (courtesy BigCharts.com) shows that whilst the price of JPM seems to have bounced up from a double bottom, the On Balance Volume chart shows that, on balance, investors have been exiting this share.

Are there solutions?

The short answer is “Yes, there are solutions.” One possible approach has been outlined in a factional novel entitled Beyond Neanderthal , published by the author hereof in June 2008. Via its light hearted and entertaining storyline, this novel articulates these (and other) causes, explains the historical consequences, anticipates the current financial crisis and sets out a plan of action as to what we might do to address the causes of the problems.

First, we need to humble ourselves. We need to bring our egos and our raging testosterone under control. Suggestions are made as to how this might be achieved. Once we have achieved this we can start to think clearly. We have the technologies to dig ourselves out of this mess and we have the intellectual capacity to apply these technologies in a constructive manner – for the benefit of us all. There is nothing wrong with the notion of “Free Enterprise” but it has its limitations. The current problems are too large and too urgent to be solved by Private Enterprise alone. The role of government should be to manage the limitations of the Free Enterprise system with a mindset of wisdom and humility. Governments should not behave in a way which – fuelled by arrogance and lust for power – challenges these limitations, or merely “assumes them away”.

In this context, we should be examining the agenda for the upcoming G20 meeting with great care. We (each one of us) have a responsibility to act in a way which encourages our leaders to act with integrity. We need to manage upwards. If the US equity market starts to travel south once again, it will be a sign that the trillions of dollars of rescue packages and stimulation will not work – because they have been unfocussed. When America sneezes, the rest of the world catches cold. Going forward, any proposed collaborative government actions need to be focused on addressing the problems and their causes. The rickety financial world is merely a symptom – like the pounding pulse of a long distance runner who has reached his limits.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.