U.S. Banks Operating Without Reserve Requirements

Companies / Credit Crisis 2009 Mar 30, 2009 - 06:06 PM GMTBy: Eric_deCarbonnel

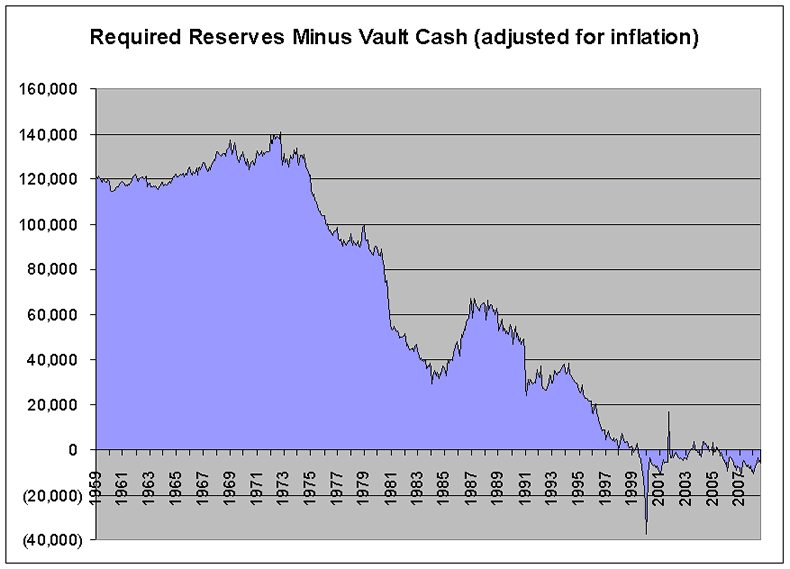

Banks typically have 3% of their assets in cash in order to meet customer needs. Since 1960, banks have been allowed to use this “vault cash” to satisfy their reserve requirements. Today, bank reserve requirements have fallen to the point where they are now exceeded by vault cash, which means lowering reserve requirements to zero would have virtually no impact on the banking system. US banks are already operating free of any reserve constraints. The graph below shows reserve requirements falling to zero over the last fifty years.

Banks typically have 3% of their assets in cash in order to meet customer needs. Since 1960, banks have been allowed to use this “vault cash” to satisfy their reserve requirements. Today, bank reserve requirements have fallen to the point where they are now exceeded by vault cash, which means lowering reserve requirements to zero would have virtually no impact on the banking system. US banks are already operating free of any reserve constraints. The graph below shows reserve requirements falling to zero over the last fifty years.

Although, under current regulations, all depository institutions are required to maintain reserves against transaction (checking) deposits, the reality is they don't. The purpose of bank reserves is to absorb losses and add stability/liquidity to the financial system in times of crisis. The “vault cash” banks use to satisfy reserve requirements is useless in absorbing losses because they are indispencable for banking operations (think ATM cash).

In summary, today most depository institutions are satisfying their entire reserve requirement with this vault cash, which they hold to meet the liquidity needs of their customers and would hold even in the absence of reserve requirements. For these institutions, reserve requirements are effectively non-existent.

-758538.png)

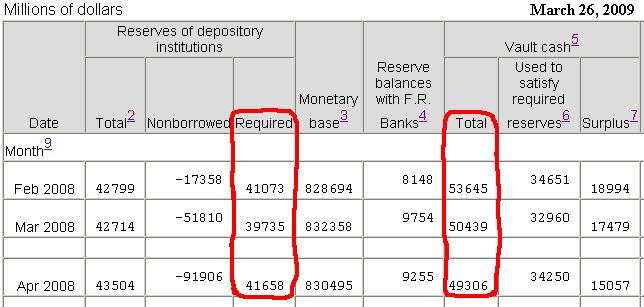

The numbers used to create these charts come directly from the Federal Reserve. The image below shows where they can be found on the current Federal Reserve release .

How did we get to the point where US banks are satisfying “reserve requirements” with ATM cash?

First, the Federal Reserve has cut reserve requirements to the bone over the last thirty years. Below are two images from a 1993 Federal Reserve release exploring the history reserve requirements that show how much these requirements have changed.

In 1990, the reserve requirement on all nontransaction accounts (savings, CDs, money markets, etc…) was reduced to zero. Removing all reserve requirements on non-checking accounts has never happened before in over a hundred years. Meanwhile, the requirement on transaction deposits (checking accounts) is 10 percent, which is near the legal minimum.

However, the lowering of reserve requirements by the fed doesn't explain how reserve requirement fell below “vault cash” (less than 3% of a banks assets). Something more was needed.

Deposit Reclassification

Deposit reclassification is an accounting trick, used by virtually the entire financial sector, which allows banks to eliminate nearly all their reserve requirements . Deposit Reclassification splits a checking account into two separate subaccounts, a transaction (checking) subaccount and a non-transaction (savings) subaccount. This distinction only exists on the bank's books: you will never see these subaccounts on your bank statements.

Deposit reclassification means that, at any point in time, most of the money in American checking accounts sits in invisible savings subaccounts. These savings subaccounts pay no interest, but allow banks to avoid reserve requirements. The public is completely unaware of this financial engineering.

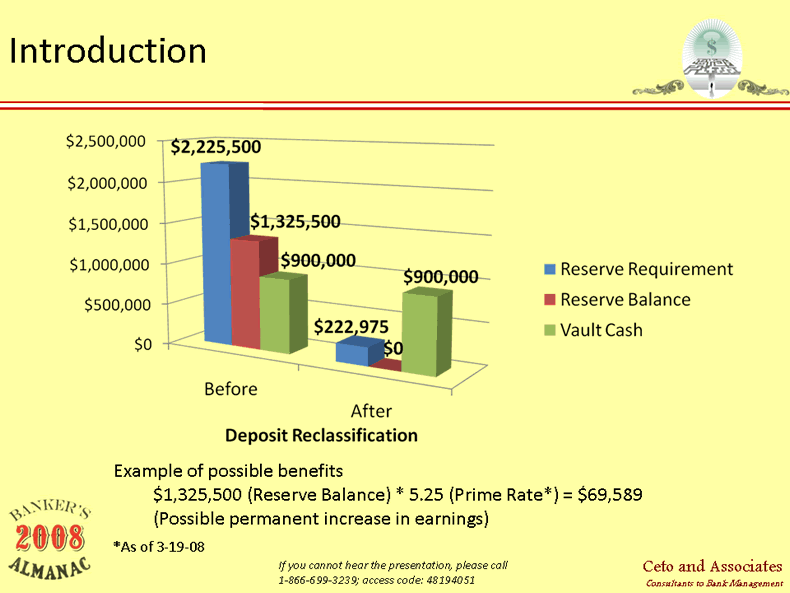

The slide below, part of a presentation on deposit reclassification, should make it obvious that even if the congress lowers reserve requirements to 0%, there would be no impact on the banking system.

By using deposit reclassification, the entire financial sector is already operating without any reserve requirements.

There is only one restriction on deposit reclassification: banks must disclose it to their customers. These disclosures could be in the form of a statement stuffer or buried in the terms and conditions when opening a checking account. As an example of a disclosure about deposit reclassification, Citibank explains how its checking accounts are maintained

How Checking Accounts are Maintained

For accounting purposes, all Citibank consumer checking accounts (Regular Checking, Citigold Interest Checking, Interest Checking and Basic Banking Account) consist of two sub-accounts ; a transaction sub-account to which all financial transactions are posted ; and a holding sub-account into which available balances above a pre-set level are transferred daily. Funds will be transferred to your transaction sub-account to meet your transactional needs. For Regular Checking and Basic Banking Account, both sub-accounts are non-interest bearing. For Citigold Interest Checking and Interest Checking, both sub-accounts pay the same interest rate.

Transfers can occur on any business day. Transfers to the holding sub-account will be made whenever available balances in the transaction sub-account exceed a preset level. Transfers from the holding sub-account to the transaction sub-account will be made whenever transaction sub-account balances fall below a predetermined level. Because banking regulations limit the number of transfers between these types of sub-accounts, all balances in the holding sub-account will be transferred to the transaction sub-account in the sixth transfer in any calendar month.

Both sub-accounts are treated as a single account for purposes of the client's deposits and withdrawals, access and information [ie: your statements] , tax reporting, fees, etc.

JPMorgan, Bank of America, and the rest of the banking sector are also big users of deposit reclassification . Check the terms and conditions of your checking account. Odds are 99 percent that you too have one of these "two sub-accounts" Frankenstein monstrosities.

Systematic Risk

In a banking system with no reserve requirements, everything becomes a systematic risk because financial institution do not any buffer to absorb losses. Even the failure of a small bank becomes enough to bring down the entire financial system.

Impact on the Taxpayer

If you look at the charts above again, you will realize that the savings and loan crisis of the 1980s and 1990s was absorbed in a large part by bank reserves. The buffer provided reserves helped limit the cost of bailouts to 105 billion. Today, no such buffer exists, and the entire brunt of the bank losses is being transferred to taxpayer. The lack of any reserve requirements helps explain why current bailouts seem so enormous compared to those of prior banking crisis.

The Federal Reserve

The Federal Reserve is completely aware and complicit in this scheme. In order for a bank to begin using deposit reclassification, it first has to obtain Federal Reserve's "no objection." So the Federal Reserve not only knows of the practice, but has also OKed every single deposit reclassification program .

The FDIC is aware of the practice too. Below is an extract from the FDIC's Temporary Liquidity Guarantee Program Frequently Asked Questions which it explains that “swept”, “transferred”, and “reclassified” accounts are guaranteed.

What if the funds in a guaranteed low-interest NOW account (with interest rate no higher than 0.50 percent through December 31, 2009) are swept or transferred into (or reclassified as) a low-interest savings deposit account (with interest rate no higher than 0.50 percent through December 31, 2009)? Will the funds lose the benefit of the guarantee?

The FDIC's regulations include the following rule: “[I]n the case of funds swept from a noninterest-bearing transaction account to a noninterest-bearing savings deposit account, the FDIC will treat the swept funds as being in a noninterest-bearing transaction account.” This rule is based upon the premise that the sweep or reclassification of the funds for reserve purposes does not change the basic nature of the funds for other purposes. Thus, if the funds are guaranteed prior to the sweep, the funds should be guaranteed after the sweep.

How could the Federal Reserve knowingly allow deposit reclassification to happen?

The quote below from June 1993's Federal Reserve Bulletin should help make clear why the fed allowed backs to avoid any reserve requirements through financial engineering.

Laws requiring banks and other depository institutions to hold a certain fraction of their deposits in reserve, in very safe, secure assets, have been a part of our nation's banking history for many years. The rationale for these requirements has changed over time, however, as the country's financial system has evolved and as knowledge about how reserve requirements affect this system has grown. Before the establishment of the Federal Reserve System, reserve requirements were thought to help ensure the liquidity of bank notes and deposits, particularly during times of financial strains. As bank runs and financial panics continued periodically to plague the banking system despite the presence of reserve requirements, it became apparent that these requirements really had limited usefulness as a guarantor of liquidity. Since the creation of the Federal Reserve System as a lender of last resort, capable of meeting the liquidity needs of the entire banking system, the notion of and need for reserve requirements as a source of liquidity has all but vanished. Instead, reserve requirements have evolved into a supplemental tool of monetary policy, a tool that reinforces the effects of open market operations and discount policy on overall monetary and credit conditions and thereby helps the Federal Reserve to achieve its objectives.

According to the fed, “the notion of and need for reserve requirements” has “all but vanished”, because the Federal Reserve stands ready "as a lender of last resort, capable of meeting the liquidity needs of the entire banking system.” Sigh… Did it ever occur to anyone at the fed that having to prop up “the entire banking system” with liquidity (as it is doing today) wasn't a good idea?

Why didn't the Federal Reserve just lower reserve requirements instead of allowing checking accounts to be turned into an accounting freak show?

Because it couldn't. The Federal Reserve would have needed an act of congress to lower reserve requirements below 8%.

Why did the Federal Reserve bend the rules so far to allow banks to escape reserve requirements?

June 1993's Federal Reserve Bulletin explains the benefits which the fed was looking for by eliminating reserve requirements.

Requiring depositories to hold idle, non-interest-bearing balances is essentially like taxing these institutions in an amount equal to the interest they could have earned on these balances in the absence of reserve requirements.

There you go. The fed let reserve requirements become a joke to eliminate the unfair “tax” on depositories (ie: the banks now receiving trillions in taxpayer bailouts). It is SUCH a good thing that the fed was on the ball and had its priorities strait about protecting the American people.

Reserve Requirements should be lowered to zero

Congress should pass a bill officially lowering reserve requirements to zero. This would end the farce of deposit reclassification (and hopefully deal a deathblow to this industry which has profited by weakening our financial system). Furthermore, there would be no adverse impact to eliminating reserve requirements of US banks, as they already don't exist.

By Eric deCarbonnel

http://www.marketskeptics.com

Eric is the Editor of Market Skeptics

© 2009 Copyright Eric deCarbonnel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Eric deCarbonnel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.