U.S. Dollar Rallies on Flight to Quality as Fundamentals Continue to Weaken

Currencies / Forex Trading Mar 30, 2009 - 07:25 AM GMTBy: ForexPros

The USD firmed up overnight as follow-on selling found stops in the majors. Overnight news that Spain will offer its first bailout during the current financial crisis pushed EURO into stops under the 1.3200 area and below keeping the rate under pressure throughout the evening. Bids ahead of 1.3150 offered initial support but traders note more stops under the 1.3150 area are building. High prints in Asia at 1.3287 were offered by a US bank traders say. Adding weight are lower equities; markets reacting to news that the US government will not support the current plans by GM and Chrysler and may be looking for a bankruptcy. Traders note that investor confidence will likely take a hit on the news and expect further declines in equities during the day.

The USD firmed up overnight as follow-on selling found stops in the majors. Overnight news that Spain will offer its first bailout during the current financial crisis pushed EURO into stops under the 1.3200 area and below keeping the rate under pressure throughout the evening. Bids ahead of 1.3150 offered initial support but traders note more stops under the 1.3150 area are building. High prints in Asia at 1.3287 were offered by a US bank traders say. Adding weight are lower equities; markets reacting to news that the US government will not support the current plans by GM and Chrysler and may be looking for a bankruptcy. Traders note that investor confidence will likely take a hit on the news and expect further declines in equities during the day.

GBP fell through stops layered under the 1.4200 handle with low prints at 1.4109; high prints at 1.4300 and the rate is holding 1.4150 area at the New York open. Traders note that UK mortgage approvals hit the highest levels since May of 2008 and are providing a bit of support from larger names.

USD/JPY is lower as high prints at 98.33 went offer from exporters; low prints at 95.94 before finding bids. Traders note stops at 96.60/80 were in size suggesting the rate was heavily long from recent trade.

USD/CHF continued to firm into the 100 day MA with high prints at 1.1517 just under the resistance level around 1.1520/30 area; low prints at 1.1439 in early Asia.

USD/CAD rounds out the firmer USD this morning with high prints at 1.2539 and is holding firm around the 1.2490 area; low prints at 1.2382 above support around 1.2380 area.

Attention now turns to the Thursday G-20 meeting this week and the ECB meeting. Traders are expecting a 25-50 BP cut from the ECB but do not expect any real help from the G-20; technical factors are likely to drive trade ahead of US data this week as well. Stops are noted below the current levels in the majors suggesting that the USD will remain bid into the end of the week. Aggressive traders can sell rallies in the USD but it is advisable to wait 24 hours to see how initial bulls react to the start of the week when the USD has firmed to start.

In my view, the markets are still trading on news and potential flight-to-quality as the underlying fundamentals continue to favor a weaker USD. Regardless of how likely the Greenback is to weaken over time the market continues to price in fear enough that the USD is continuing to trade in a wide topping range. Look for the majors to remain under pressure today and into US data on Tuesday.

GBP/USD Daily

Resistance 3: 1.4440/50, Resistance 2: 1.4380, Resistance 1: 1.4300

Latest New York: 1.4204, Support 1: 1.4100/10, Support 2: 1.4050, Support 3: 1.4020

Comments

Rate falls through stops into support around the 1.4100 handle overnight; traders report more stops waiting under 1.1400 with bids around 1.4050 for the day. Bulls need to be on the sidelines at this point. A close back under the 1.4250 area argues for more losses. Traders report large names on the dips last week but they may have been whipsawed out to start this week. Overhead resistance now drops to 1.4380 to 1.4440 area; overhead target of the 1.5000 area likely to be on hold with a test of the lows first possibly creating a range. Traders feel the 23-year lows will likely remain secure. The shorts have taken control of the market above the 1.4440 area for now and if a range is forming a test under the 1.3900 handle is likely; traders report stops in-range adding for two-way action.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Index of Services 3m/3m

9:00am GBP MPC Member Tucker Speaks

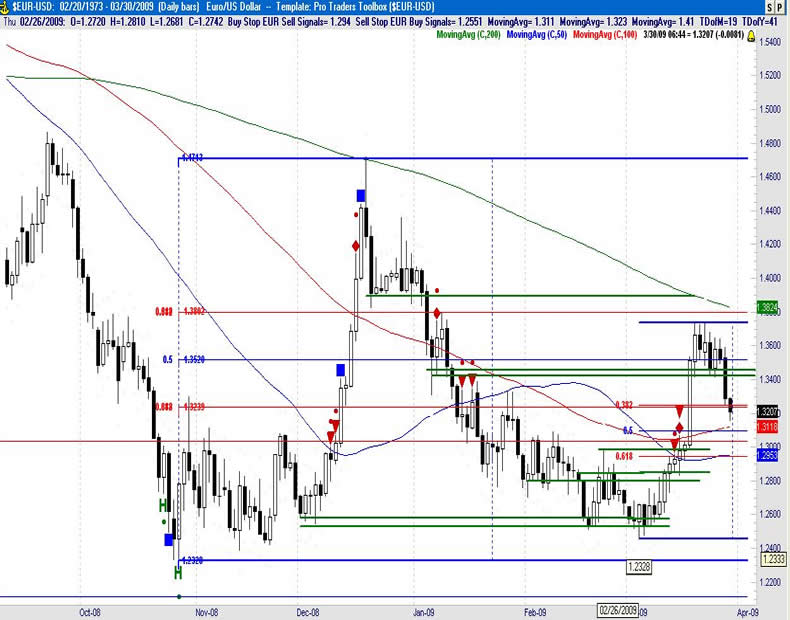

EUR/USD Daily

Resistance 3: 1.3380, Resistance 2: 1.3330, Resistance 1: 1.3280

Latest New York: 1.3207, Support 1: 1.3150, Support 2: 1.3100, Support 3: 1.3080

Comments

Rate fails at support and clears large stops under 1.3200; rate likely has stops building in both directions but shorts have taken control of the market as the rate gives back gains over the 1.3400 area last week late. Action remains two-way; stops under 1.3150 area said to be building in size suggesting the rate has another leg lower coming near-term. That dip would be a buy opportunity in my view. Overhead resistance of 1.3350 area now back in play; expect sellers in that area on a rally. Asian sovereigns seen selling rallies last week and a US bank seen leaning on the rate at the open; no doubt momentum traders from Friday’s close. Long-term bulls are likely still in control of the market and this significant pullback is a buying opportunity in my view but the timing needs another day or two to work through. Expect two-way action.

Data due Tuesday: All times EASTERN (-5 GMT)

3:55am EUR German Unemployment Change

4:00am EUR Italian Retail Sales m/m

5:00am EUR CPI Flash Estimate y/y

5:00am EUR Italian Prelim CPI m/m

Join us for the Morning FOREX Briefing daily at 7:45 AM Central/Chicago time (GMT -6)

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.