U.S. Dollar Index Stabilizes in April and Sell off in May

Currencies / US Dollar Mar 30, 2009 - 12:47 AM GMTBy: Donald_W_Dony

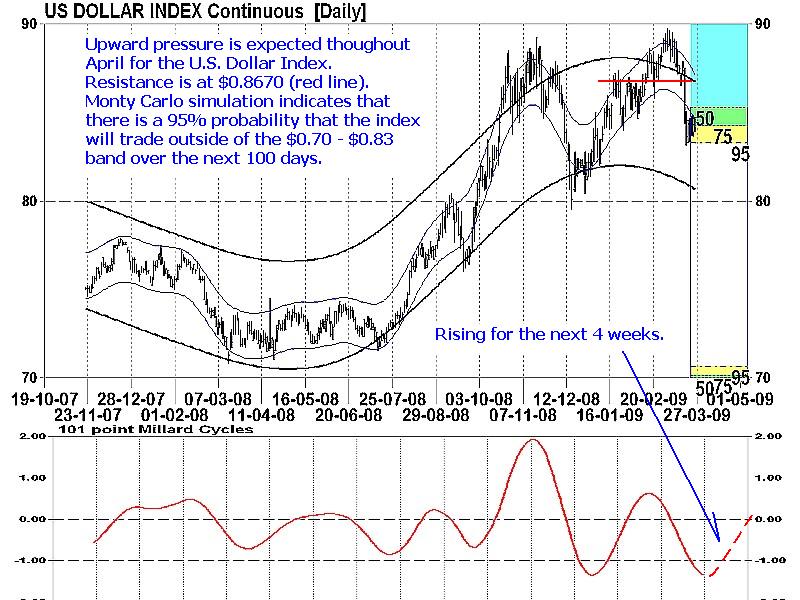

Though the longer-term picture for the U.S. Dollar Index appears bleak, with a downside target of $0.80 to $0.81 by June, models suggest the short-term outlook indicates some upward pressure building in April. Resistance is set at $0.8670 during this expected advance. Monty Carlo simulation supports the models outlook with a 95% probability that the currency will trade outside of the $0.70 to $0.83 band over the next 100 days.

Though the longer-term picture for the U.S. Dollar Index appears bleak, with a downside target of $0.80 to $0.81 by June, models suggest the short-term outlook indicates some upward pressure building in April. Resistance is set at $0.8670 during this expected advance. Monty Carlo simulation supports the models outlook with a 95% probability that the currency will trade outside of the $0.70 to $0.83 band over the next 100 days.

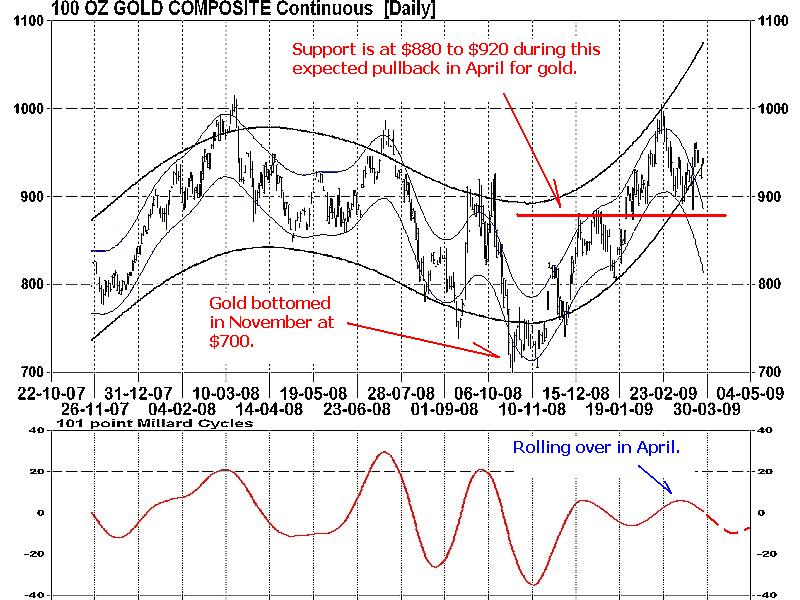

This advance during the next four weeks is part of a broader rolling over of the currency which began in November 2008 (Chart 1). The continual weakness from the dollar, however, is having a very positive influence on commodities and in particular gold. For example, the precious metal (Chart 2) reached a bottom in November at $700 after nearly eight months of declining and moved up to retest $1000 in February.

As increasing downward pressure should start weighing on the dollar by early May, raw material prices are anticipated to react favourably. Gold is expected, once again, to advance to $1000 and oil should continue to firm in price and move upward to the first target of $59-$60.

Investment approach: Gold traders may wish to remain on the sideline in April as downward pressure is anticipated to keep the metal pinned. Pricing is expected to be more favourable by late April.

More information about commodities will be in the up-coming April newsletter.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.