Credit Crisis Easing and Signs of Economic Recovery

Economics / Recession 2008 - 2010 Mar 29, 2009 - 03:20 PM GMT

CEP News: US Treasury unveils PIPP

CEP News: US Treasury unveils PIPP

“The US Treasury announced Monday morning it will spend up to $1.0 trillion in a bid to provide support to the balance sheets of financial institutions and support the ‘toxic debt' market, which includes mostly mortgage-backed securities.

“The US Treasury will invest between $75 billion to $100 billion from its existing Troubled Asset Relief Program, and it plans to set up a separate initiative which will use the Federal Reserve's Term Assets Backed Securities Lending Facility and FDIC funding to finance the highly anticipated Private Public Investment Program (PPIP).

“Five different private public funds will bid on toxic assets and sell them to the broader public. Meanwhile, the Federal Deposit Insurance Corporation will guarantee private-sector loans for these purchases, while the US Government will invest side by side with private equity using taxpayer capital.

“In a press conference following the official announcement, Treasury Secretary Timothy Geithner said he expects significant interest from the private sector, a sentiment which was confirmed by PIMCO's Bill Gross following the announcement.

“Geithner said that while there is no doubt that the US government is taking risk with the PPIP, the taxpayer stands to make substantial returns on the investments. He also said that the Treasury should be able to implement the PPIP quickly.”

Source: CEP News , March 23, 2009.

BCA Research: Some hope for the US bank sector

“The Public-Private Investment Program (PPIP) is a significant positive step forward in restructuring the troubled US banking sector.

“The Treasury confirmed earlier this week its intention to remove toxic ‘legacy' assets from bank balance sheets in order to improve the health of financial institutions and restore the flow of credit throughout the economy.

“Perhaps the most nagging issue facing policymakers in their efforts to solve the credit crisis has been what price to pay banks for their toxic assets. Too low a price would prompt further significant writedowns and could lead to additional bank failures. Too high a price would cheat taxpayers and reinforce previous bad investment decisions. The Treasury's plan attempts to solve the issue by creating a public-private partnership, which determines asset prices using an auction process, while at the same time ensuring adequate financing (backed by the FDIC) and allowing the taxpayer to share in some of the upside.

“The plan does not directly support home prices, but it may stem the slide in real estate assets held by the banks. Even if the purchase of legacy assets leads to further writedowns, the government stands ready to contribute additional equity capital through its Capital Assistance Program (CAP) to maintain the bank as a going concern. Thus, creeping nationalization remains a possibility for those banks with a high proportion of legacy assets. Bank bonds, however, would seem to be well supported under this plan.”

Source: BCA Research , March 25, 2009.

The Wall Street Journal: Will the removal of assets make them any less toxic?

“Barrons Bob O'Brien talks about how the government will try to help the ailing economy by helping banks with toxic assets. This raises many questions including whether government help will chill public-private initiative.”

Source: The Wall Street Journal , March 23, 2008.

Nouriel Roubini (RGE Monitor): Obama's toxic-asset plan shows promise

“So to clarify my view point: I see the Geithner plan as being relevant to banks that are solvent. For those that are found - after stress tests - to be insolvent I see as the proper solution to nationalize them and clean them up to prepare them for reprivatization.

“The stress test should do a triage between banks that are illiquid and undercapitalized but solvent given the provision of capital and liquidity and those that, under a reasonable stress scenario are effectively insolvent.

“Those that are insolvent should be nationalized.

“Those that are solvent will still have many toxic assets that need to be disposed of; and the Geithner plan provides a way to properly dispose of the toxic assets of solvent banks.

“So my partial support of the Geithner plan - with all the appropriate caveats - is consistent with the complementary idea of nationalizing the insolvent financial institutions. The bad assets of insolvent banks that are nationalized could be separated from the good assets and then worked out by the government; or they could be sold to private investors through an auction mechanism along the lines of the Geithner plan; or they could be sold - together with the good assets - to the investors purchasing a privatized bank that was temporarily privatized (along the lines of the Indy Mac deal where the investors purchasing the bank received a government guarantee on the bad assets after a first loss).”

Source: Nouriel Roubini, RGE Monitor , March 24, 2009.

Tech Ticker (Yahoo Finance): James Galbraith - Geithner plan “extremely dangerous”, banks “massively corrupted”

“Professor James Galbraith didn't pull any punches on TechTicker this. He hates the Geithner plan, calling it ‘extremely dangerous'. He says the banks may game the plan to bid up the prices for their own crap assets and that getting bad assets off their books won't get them lending again. Like Paul Krugman, Galbraith thinks the FDIC should just put the banks into receivership and have the banks' subordinated bondholders pick up some of the cost of restructuring them.”

Part 1: Getting crap assets off bank books won't save economy

“Aaron Task, TechTicker: Like it or not, many people seem to be resigned to the idea there's no alternative to the public-private investment fund scheme Treasury Secretary Geithner detailed this morning.

“That's hogwash, says University of Texas professor James Galbraith, author of The Predatory State. Of course there's an alternative: FDIC receivership of insolvent banks.

“So why isn't the Obama administration pushing for FDIC receivership? ‘Political influence of big banks,' the economist says.”

Part 2: Massive corruption

Source: Tech Ticker, Yahoo Finance , March 23, 2009.

Bloomberg: Nobel Prize winners clash on prospects of Geithner's plan

“Treasury Secretary Timothy Geithner has a good chance of succeeding with his plan to cleanse banks of toxic assets, says Michael Spence, co-winner of the 2001 Nobel Prize in economics. Paul Krugman, the newest laureate, is so sure Geithner will fail that he's full of ‘despair'.

“Even winners of the highest awards in economics can't always be right. Which prediction proves correct depends in part on whether private investors can be enticed to bid on as much as $1 trillion of illiquid loans and securities that banks are now stuck with.

“‘This program is crucially dependent on the private sector as participants and price setters,” said Spence, who shared the Nobel Prize with George Akerlof and Joseph Stiglitz for a theory that found some government intervention can make markets more efficient. ‘It could work,' Spence said in a telephone interview yesterday.

“That's not an opinion shared by 2008 Nobel laureate Krugman. ‘The real problem with this plan is that it won't work,' Krugman, said in his New York Times opinion column yesterday.

“Geithner appears to be going back to the ‘cash for trash' approach of his predecessor as Treasury Secretary, Henry Paulson, Krugman said. ‘This is more than disappointing. In fact, it fills me with a sense of despair.'

“Instead of financing the purchase of illiquid assets, the government should guarantee many bank debts, take control of ‘insolvent' firms and clean up their books, similar to what Sweden did in the 1990s, Krugman said.

“While Spence, a Stanford University professor and former business-school dean, has more confidence in Geithner, even he isn't positive the Treasury secretary can pull it off.

“The Treasury plan ‘is a little complex to implement,' Spence said. ‘I assume the Treasury has done its homework, and has people lined up' to commit private capital to Geithner's public-private partnerships, he said.

“Stiglitz, speaking at a conference in Hong Kong today, said the plan ‘risks a major increase in our national debt.'

“‘You can take the bad assets off the banks, but where are they going to go?' said Stiglitz, who served as chairman of former President Bill Clinton's Council of Economic Advisers. ‘The one place for them to go is to the taxpayers.'”

Source: Scott Lanman and Vivien Lou Chen, Bloomberg , March 24, 2009.

Bill King (The King Report): TAPS - creating a derivative on derivatives

“Geithner's plan effectively creates ‘calls' on banks' toxic assets. The US taxpayer will underwrite losses in this program. The call premium will be the private equity risk; the buyer gets the upside appreciation. The taxpayer provides the funding/leverage.

“Bill Gross sees private investor risk of 4% to 5%. This is the call premium for the toxic assets.

“Let's think through this plan and the probable consequences.

“Everyone knows that solons are trying to engineer massive asset inflation. So if we are running a bank why would we sell any asset that has a chance to reflate?

“We would only sell assets that we deem hopeless. Are there enough private equity patsies to buy calls on assets that we deem have a low probability of increasing substantively in value?

“Most call buyers do not intend or wish to own the underlying assets. They are interested in a levered gain. So even if the toxic assets are inflated enough in value to produce a gain for the ‘call' buyers, what patsies will appear as a dumping ground for the call buyers?

“Geithner's toxic asset scheme is a repo with a call option. And unless end-user patsies appear at some point, the toxic assets will return to sender and the US taxpayer.

“We are in this mess due to excess derivatives and leverage. Ironically or absurdly, Geither's toxic asset plan & solution (TAPS) creates a derivative on derivatives (toxic paper) and increases the leverage on levered toxic assets! You can't make up stuff like this.

“Unfortunately for solons their expediency just delays the inevitable negatives. Solons have created extremely positive expectation for the TAPS. If the scheme does not go exceptionally well, the consequences will not be pretty … BTW, $1 trillion is not nearly enough.

“The first TAPS auction will probably go well because solons will exert intense pressure on the community to play nice. Entities that are already adjuncts of the Fed or Treasury, like PIMCO and Black Rock, will be subjected to enormous pressure to stand and deliver.”

Source: Bill King, The King Report , March 24, 2009.

CEP News: FDIC's Bair says some US banks could be beyond help

“Federal Deposit and Insurance Corporation (FDIC) head Sheila Bair said Monday that some US financial institutions may be beyond help from US government agencies, and some banks will close.

“In a conference call with reporters, Bair touted the US Treasury's plan introduced this morning to remove toxic assets from banks' balance sheets.

“The public/private partnership to buy these assets and resell them to the public won't necessarily be a 50/50 split, she said.

“Bair said the highest priority will be given to high-risk real estate loans, because the problems are with these assets.

“She said the most difficult part of the program will be to price the assets properly, but that government agencies will find the best possible structure to do so, adding that she expects the program will be profitable.”

Source: CEP News , March 24, 2009.

The New York Times: Battles over reform plan lie ahead

“Outlining a far-reaching proposal on Thursday to rebuild the nation's broken system of financial regulation, the Treasury secretary, Timothy F. Geithner, fired the opening salvo in what is likely to be a marathon battle.

“‘Our system failed in fundamental ways,' Mr. Geithner told the House Financial Services Committee. ‘To address this will require comprehensive reform. Not modest repairs at the margin, but new rules of the game.'

“On the surface, both the lawmakers who listened to the Treasury secretary and the financial industry's lobbying groups made it sound as if they completely agreed with Mr. Geithner's call for what he described as ‘better, smarter tougher regulation.'

“But in fact industry groups are already mobilizing to block restrictions they oppose and win new protections they have wanted for years. Even though Mr. Geithner carefully avoided specific details, laying out mostly broad principles for overhauling the system, financial industry groups are identifying issues they plan to pursue and lining up well-connected lobbyists and publicists to help make their cases.

“If history is any guide, Mr. Geithner's proposals will start an equally intense battle among the regulatory agencies themselves - including the alphabet soup of banking regulators, the Securities and Exchange Commission and the Federal Reserve - to stay in business and enhance their authority.

“Hedge funds and private equity funds, which have been almost entirely unregulated, would have to register with the SEC and tell it about their risk-management practices. Many financial derivative instruments, like credit-default swaps, would come under supervision for the first time.

“Mr. Geithner's most specific proposal, which Democratic lawmakers hope to pass in the next few weeks, would allow the federal government to seize control of troubled institutions whose collapse or bankruptcy might jeopardize the broader financial system.”

Source: Edmund Andrews, The New York Times , March 26, 2009.

News N Economics: Real money supply: surging in some countries, not so much in others

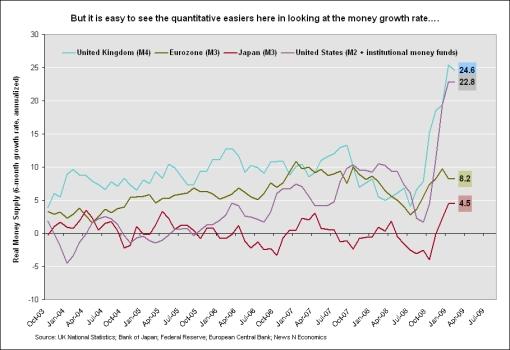

“The Fed's recent and extreme policies have made people nervous about inflation. They should be, but just not right now. Key central banks recently added hydrogen to their engines in the form of quantitative easing, causing high-powered money to surge. However, the multiplier is collapsing, and therefore, the new base is simply a measure to keep the money supply afloat. Some economies, though, are showing worrisome trends in their money growth rates.

“The chart below illustrates the 6-month annualized growth rate of the broad measure of real money in the US, the UK, Japan, and the Eurozone. In spite of the massive surge in the US monetary base, 231% over the last 6 months, the real US money supply grew just 22.6% over that same period. Can you imagine what would have happened had the Fed not eased so substantially? Troublesome deflation. The money multiplier is collapsing as banks hoard cash and consumers and firms pull back.

“Furthermore, like the Fed, the Bank of England (BoE) is engaged in quantitative easing, resulting in a similar 6-month money growth rate, 22.8%. The ECB and the Bank of Japan (BoJ) are still increasing their broader measures of real money on a 6-month basis, but at a much slower rate. Admittedly, the BoJ is engaging in alternative policy measures, but the ECB and the BoJ are not pulling out all of the ‘easing stops' as are the Fed and the BoE.”

Source: Rebecca Wilder, News N Economics , March 24, 2009.

Reuters: Soros - G20 a “make or break” event for markets

“The Group of 20 nations meeting next week is a ‘make or break event' for the global markets, investor George Soros said on Wednesday.

“‘Unless it comes up with practical measures to support the countries at the periphery of the global financial system, markets are going to suffer another sinking spell just as they did on February 10, 2009, when the authorities failed to produce practical measures to recapitalize the United States banking system,' Soros said in testimony to the Senate Foreign Relations Committee.

“Soros said President Barack Obama could help make the G20 meeting a success by raising a possible solution that would involve increasing the amount that developing countries - from Eastern Europe to Africa - can effectively borrow from the International Monetary Fund.

“The urgent task of re-inflating the global economy has to be carried out mainly by the IMF, ‘imperfect and beleaguered as it is, because it is the only institution available,' Soros said.

“While the IMF's resources were likely to be doubled at the G20 meeting of big developed and developing countries, that would not provide a systemic solution for the developing world, Soros said.

“But a systemic solution was readily available in the form of special drawing rights (SDRs), an international reserve asset created by the IMF in 1969 that has the potential to act as a super-sovereign reserve currency.

“In addition to the one-time increase of the IMF's resources, there ought to be substantial annual SDR issues, say $250 billion, as long as the global recession lasts, he said.”

Source: Reuters , March 25, 2009.

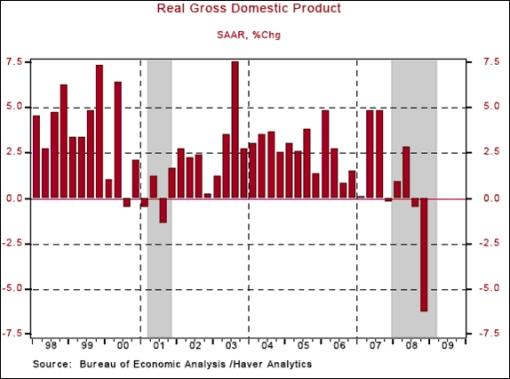

Asha Bangalore (Northern Trust): Minor Q4 GDP revisions, corporate profits plunge

“Real GDP is estimated to have dropped at an annual rate of 6.3% in the fourth quarter of 2008. This is virtually unchanged from the earlier estimate of a 6.2% drop of real GDP. In 2008, real GDP increased 1.1% after a 2.03% increase in 2007.

“On a Q4-to-Q4 basis, the 0.85% drop in real GDP in the fourth quarter is the first decline in real GDP since the 1990-91 recession. The economy is expected to post another sharp quarterly reduction in real GDP in the first quarter of 2009 (-6.1%), with these two quarterly declines chalking up to be the weakest quarters of the current recession.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 26, 2009.

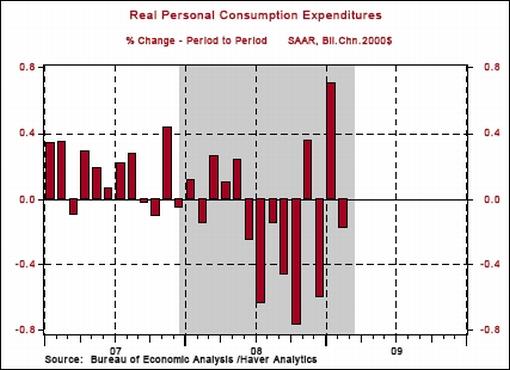

Asha Bangalore (Northern Trust): Consumer spending in Q1 most likely to show increase

“Contrary to our earlier expectations, consumer spending in the first quarter is most likely to show an increase. The sharp upward revision of inflation adjusted consumer spending in January (+0.7% versus +0.4% in the original report) is the main reason for this revision. Nominal consumer spending moved up 0.2% in February after a 1.0% increase in January. However, after adjusting for inflation, consumer spending fell 0.2% in February. A conservative assumption for March results in an overall increase of consumer spending in the first quarter of 2009 of roughly 0.6%-0.8%. This in turn will result in a modification of the headline GDP forecast, which we are working on as of this writing.

“The near term trend of consumer spending is most likely to be weak owing to the severe declines in payroll employment.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 27, 2009.

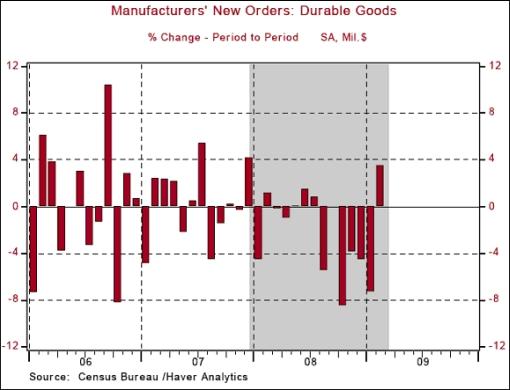

Asha Bangalore (Northern Trust): Durable goods orders - glimmer of strength emerges

“Orders of durable goods increased 3.4% in February after a downwardly revised drop in January of 7.3% (originally estimated as a 4.5% decline). The 35.3% increase in orders of defense items and the 6.6% jump in bookings of non-defense capital goods excluding aircraft stand out in the report. Orders of aircraft (-28.9%) and autos (-0.6%) dropped but that of machinery (+13.5%), computers (+5.6%), and appliances rose (+1.6%) during February. The main message is that the pickup in orders of durables is significant but consistent monthly gains will be necessary to declare that the factory sector has pulled out of the current doldrums.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 25, 2009.

Asha Bangalore (Northern Trust): New home sales - notable pickup but more is necessary

“Sales of new homes rose 4.7% to an annual rate of 337,000, following an upward revision of sales in January and December. On a regional basis, sales of new homes increased in the South (+9.7%) and West (+6.6%) but fell in the Northeast (-3.3%) and Midwest (-9.1%). The fact that sales advanced in February is noteworthy but additional monthly gains will be necessary to reduce the inventory of unsold new homes and bring about stability in this sector.

“Sales of new single-family homes are down 43.8% in February from a year ago, after a 47.7% plunge in January. Sales of new homes have dropped 75.7% from the peak in July 2005. The trough for new home sales appears to be January 2009, for now.

“The median price of a new single-family home declined 18.1% from a year ago in February, the largest year-to-year drop on record. The median price of a new single-family home has fallen 23.5% from the peak in March 2007, also the largest peak-to-trough decline on record.

“Additional declines in prices of new homes are nearly certain given the large inventory of unsold new homes. The good news is that the inventory unsold homes fell slightly to a 12.2-month mark from the record high of 12.9 months in January.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 25, 2009.

CEP News: Fed's Rosengren says programs will lower consumer, business loan costs

“Recent actions by the Federal Reserve should help lower the cost of credit to consumers and businesses, according to Boston Fed President Eric Rosengren speaking before the House Financial Services Committee on Monday.

“While credit availability continues to be a significant source of concern for the Federal Reserve, the Fed has ‘acted proactively and creatively to address these concerns,' said the central banker.”

Source: Erik Kevin Franco, CEP News , March 23, 2009.

Zillow: Federal Reserve announcement drives mortgage rate drop

“Driven by the news that the Federal Reserve plans to spend an additional $750 billion to buy mortgage-backed securities, the weekly average rate borrowers were quoted on Zillow Mortgage Marketplace for thirty-year mortgages fell to 5.06%, down from 5.21% the week prior, according to the Zillow Mortgage Rate Monitor.”

Source: Zillow , March 24, 2009.

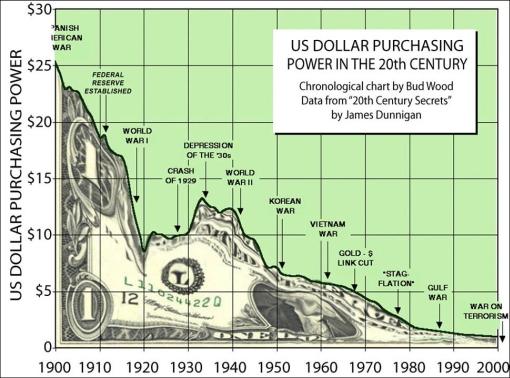

Financial Times: Ron Paul - believer in small government predicts 15-year depression

“Pension trustees and insurance company portfolio managers look away now. Your increased commitment to government bond holdings in recent times is about to blow up spectacularly.

“At least, that is the view of Ron Paul, the US congressman who ran against John McCain in last year's Republican Party presidential nomination.

“His is a minority view. Yields on government bonds worldwide have been falling fast over the past few months and in the UK, the commencement of ‘quantitative easing' this month sent bond prices soaring.

“But the credibility of both western governments and their currencies is waning, and has been ever since the gold standard was abandoned in 1971, says Mr Paul. And that means even ‘safe' investments are far from safe, he claims.

“‘People will start to abandon the dollar as current and past economic policies create a steep rise in interest rates,' Mr Paul says.

“‘If you are in Treasuries, you will need to be watchful and nimble to time your escape.'

“Unfortunately, cashing out will not protect the value of investments, he insists, because ‘fiat' currencies will all decline over the coming years as measures to try to haul the world economy out of recession fail. ‘The current stimulus measures are making things a lot worse,' says Mr Paul.

“‘The US government just won't allow the correction the economy needs.' He cites the mini-depression of 1921, which lasted just a year largely because insolvent companies were allowed to fail. ‘No one remembers that one. They'll remember this one, because it will last 15 years.'”

“And don't even mention shares to Mr Paul: ‘The last place you want to be is in the stock market,' he says. ‘It may not bottom out for 10 years - just look at Japan.'”

Source: Phil Davis, Financial Times , March 22, 2009.

Financial Times: Credit market concerns

“While equities responded strongly to the Treasury's plan to get bad loans off banks' balance sheets, the rally in credit markets was more muted, says FT's Aline van Duyn.”

Source: Aline van Duyn, Financial Times , March 24, 2009.

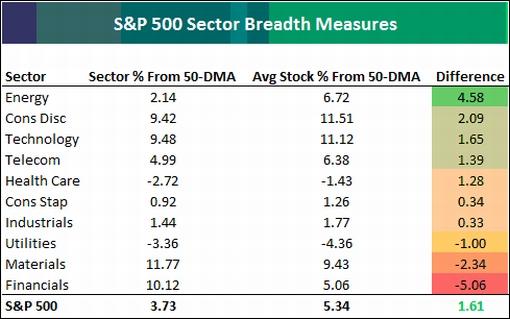

Bespoke: S&P 500 sector breadth measures

“The S&P 500 is currently trading 3.73% above its 50-day moving average, while the average stock in the index is 5.34% above its 50-day. This is a positive breadth measure. Below we provide the same analysis for the ten S&P 500 sectors.

“As shown, the Energy sector has the most positive breadth with a difference of +4.58% between the average stock's distance from its 50-day versus the sector's distance from its 50-day. Consumer Discretionary ranks 2nd, followed by Technology and Telecom.

“On the negative side, the Financial sector as a whole is trading 10.12% above its 50-day, while the average stock in the sector is 5.06% abvoe its 50-day. Only two sectors remain below their 50-days after this significant market rally and they are both defensive in nature - Health Care and Utilities.”

Source: Bespoke , March 26, 2009.

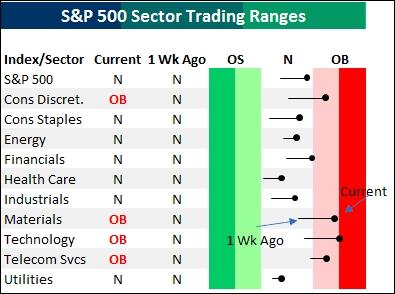

Bespoke: Sector trading ranges - nearing overbought levels

“In the chart below, we highlight the current levels of each S&P 500 sector with respect to their normal trading ranges. Red shading indicates that the sector is overbought (with dark red indicating extreme overbought levels), while green shading is indicative of an oversold reading.

“Over the last week, the S&P 500 and each of its sectors have moved closer to overbought levels. There are currently four overbought sectors, no oversold sectors, and six sectors in neutral territory. Given the Nasdaq's brief push into positive YTD territory yesterday, it's no surprise that the Technology sector is the most overbought one in the market. Health Care, on the other hand, is the furthest from overbought levels. It is currently attempting to recover from the sell off that took place in late February after the release of the Obama budget plan.

“Over the coming weeks, it would not be surprising to see investors rotate out of the tech sector, which is nearing extreme overbought territory, and into the less extended Health Care sector.”

Source: Bespoke , March 27, 2009.

Bloomberg: Mobius says stocks at beginning of a bull market rally

“The next bull market rally has begun and there are bargains in every emerging market following a record slump in stocks, Templeton Asset Management's Mark Mobius said.”

Source: Bloomberg , March 23, 2009.

Bloomberg: Roubini - stocks will drop as banks go “belly up”

“US stocks will fall and the government will nationalize more banks as the economy contracts through the end of 2009, said Nouriel Roubini, the New York University professor who predicted last year's economic crisis.

“‘The stock market is a bit ahead of the real macroeconomic and financial news,' Roubini, a professor at NYU's Stern School of Business and the chairman of consulting firm Roubini Global Economics, said in an interview with Bloomberg Television in London today. ‘We'll have some major banks going belly up that will need to be taken over.'

“The global equity rebound in March that sent the Standard & Poor's 500 Index to its best monthly advance in 17 years is a ‘bear-market rally' and US Treasury yields will ‘remain relatively low' as investors flock to the safest assets, Roubini said. Treasury Secretary Timothy Geithner's new plan to remove toxic debt from financial companies won't be enough for insolvent banks, he said.

“Roubini's outlook contrasts with predictions this week from Templeton Asset Management's Mark Mobius and Traxis Partners' Barton Biggs, who said that equities are poised to rally as government efforts to revive the economy and banking system begin to work. Investors are ‘way too optimistic' about the prospects for a recovery in the economy and earnings, Roubini said.”

Source: Michael Patterson and Maithreyi Seetharaman, Bloomberg , March 26, 2009.

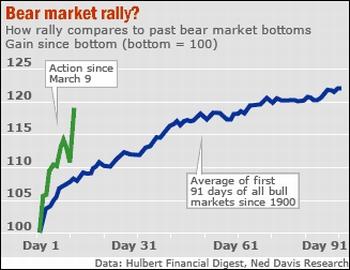

MarketWatch: Keeping hope alive - bear market rally or new bull market?

“Is it possible to have too much of a good thing? Mae West didn't think so, though I have it on reliable authority that she wasn't talking about the stock market.

“And when it comes to rallies off of market lows, it is indeed possible for stocks to overdo it. That at least is the argument being made by at some of the investment newsletter editors I monitor.

“According to them, bear market rallies are almost by their very nature powerful and impressive. If we were to endow the bear market with intent, we would say that the very purpose of a rally is to draw as many gullible investors back into the market before the next leg down commences.

“… whatever else you say about the rally that began two weeks ago, it has indeed been ‘violent' and has occurred with ‘amazing rapidity'.

“To gauge just how violent and rapid it has been, I compared the rally since March 9 to a composite of the stock market's behavior over the first two weeks of all bull markets since 1900.

“To come up with a list of those bull markets, I followed the lead of Ned Davis Research, the institutional research firm. For them, a bull market requires one of three conditions to hold: (1) at least a 30% rise in the Dow Jones Industrial Average in 50 calendar days, (2) at least a 13% rise in the Dow in 155 calendar days, or (3) at least a 30% reversal in the Value Line Geometric Index.

“Since the beginning of 1900, according to the research firm, there have been by this set of criteria no fewer than 34 bull markets.

“It turns out that the recent rally has been markedly more powerful than the average beginning of prior bull markets. Over the last two weeks, for example, the Dow has gained 18.8%. The Dow's average gain over the first two weeks of past bull markets, in contrast, has been 8.4%, or less than half as much.

“In fact, of the 34 bull markets identified by Ned Davis Research, only one of them produced a greater gain in its first two weeks than in the recent rally. That was the one that began on November 13, 1929, and is hardly one that the bulls would want to brag about. That bull market lasted just five months and led to an increase of just 48% in the Dow - making it one of the most modest of bull markets in the sample, despite have one of the most impressive returns in its first two weeks.

“These historical comparisons don't automatically mean that the market's strength over the last two weeks is just a bear market rally, of course. But those comparisons do highlight the possibility that the recent rally, impressive as it otherwise is, will in the end prove to be just a bear market rally.”

Source: Mark Hulbert, MarketWatch , March 24, 2009.

Jeffrey Saut (Raymond James): Bear market rally or something more?

“In recent weeks, copper, steel, and energy prices have crept higher. Additionally, building permits and housing starts have come in better than expected. Meanwhile, tax refunds are up 13.3% when compared to this time last year, which is probably why retail sales have stabilized despite rising unemployment.

“Only time will tell, but it feels like the economic deterioration is no longer accelerating? Could it be that the huge increase in money supply, negative real interest rates (inflation adjusted rates) and the reintermediation we have been speaking about are beginning to have a positive impact on the economy?

“The stock market might just be sensing that, having leaped off of a generational oversold condition into a 20%, ten-session, upside stampede that produced four 90% upside days (March 10th, 12th, 17th, and 18th) within a two week period. Such enthusiastic buying has tended to be associated with the start of new bull markets. Yet as the Lowry's service notes, ‘Our 2002 study of 90% days showed that the start of new bull markets are typically identified by a single 90% upside day, representing a rush of enthusiastic buyers which typically calms down after the first dramatic day. On rare occasions, two 90% upside days have been recorded in the first 30 days of a new bull market.'

“While we are cautious, we remain hopeful and continue to favor the upside until proven wrong, which is why we are still ‘long' various indexes and have selectively been accumulating stocks.”

Source: Jeffrey Saut, Raymond James , March 23, 2008.

Richard Russell (Dow Theory Letters): Get used to bear market rallies

“Moving on to the stock market, subscribers will have to get used to bear market action. In bear markets, counter-intuitively much of the time is spent with stocks rising, due to the frequent upward correction. For instance, during the horrendous 1929-32 bear markets there were no less than nine 15% rallies, the average lasting 15 days.

“During the 1937 to 1942 bear market, there were nine rallies of 15% or more with the average correction lasting 82 days

“During the 1946 to 1949 bear market there were two 15 % or more rallies averaging 57 days each.

“During the recent 2000 to 2002 bear market there were three 15% or more rallies averaging 5 days each.

“From November 2009 to January 2009 there were two rallies, one short and one longer one that stopped just short of 15%.

“So we have to get used to rallies in the bear market. One difficulty in dealing with bear rallies is that they can end as suddenly as they started. This is because bear market rallies don't end with a period of distribution. The buying just stops, and down they go. This is opposite to bull market advances that usually terminate after a period of deliberate distribution.”

Source: Richard Russell, Dow Theory Letters , March 24, 2009.

David Fuller (Fullermoney): Don't look to Wall Street for the lead

“The US stock market is the big elephant in the room, casting a long shadow, but it seldom leads market moves. New bull markets are led by emerging economies, subject to governance, with their better valuations near the lows, competitive currencies, superior GDP growth prospects and comparatively thin markets. … growing list of market indices which bottomed in October and November, and have now broken up out of their trading ranges during the current rally. This is very bullish action and the way new uptrends commence.

“Many other stock market indices tested their lows established last year and found good support near those levels, evidenced by their persistent rallies towards the upper-middle of their ranges. This is consistent with base formation development. Lastly, most of the stock markets that clearly broke beneath last year's lows earlier this month have not maintained those downward breaks. Further rallies by these indices would also confirm base development.

“Long-dated government bond markets are no longer performing. Everyone knows that their yields are not attractive for any economic environment other than a deflationary depression. Some of the money currently in bonds came from stock markets and will return to equities as confidence improves. Corporate bonds are performing and they are a lead indicator for equities.

“Copper is leading industrial commodities higher, as it did in 2003.

“Lastly, the US dollar and yen in particular are weakening against yield / resources currencies such as the Australian and New Zealand dollars. This indicates that carry trade deleveraging has not only ended but is also reversing.

“Returning to global stock markets, I maintain that the bear market mostly ended in October and November. The January to early-March sell-off looks like a successful test of support from last year's lows for most non-Western stock markets.

“I do have some remaining concern over Wall Street and its leash effect. However, technology is a leading indicator and the tech-heavy Nasdaq 100 Index did not break downwards. The S&P 500 Index did not maintain its break beneath the November low and is pushing above psychological resistance at 800. A move above 880 would, in my view, confirm a significant downside failure and resumption of the yearend base formation development.

“Interestingly, stock markets have been extending this month's rally against a background of short-term overbought indicators. This indicates that bears are being squeezed and that bulls are emboldened. I have previously mentioned that a significant rally would be indicated by its persistence. We now have some distance between current levels and the early-March lows, which should provide a cushion of support during the next consolidation.

“In conclusion, if the bear market is not continuing, the new bull market is already underway, although most people do not yet realise it. However this will not be fully confirmed, as I have said before, until the majority of stock markets are trading above rising 200-day moving averages. Moreover, even though the balance of technical evidence increasingly suggests that a new bull market is gradually commencing, this does not mean that all of the developing bases can support uptrends at this time. The leading Asian emerging markets and South American resources markets may actually be commencing uptrends, but many others are likely to extend their bases in coming months.”

Source: David Fuller, Fullermoney , March 26, 2009.

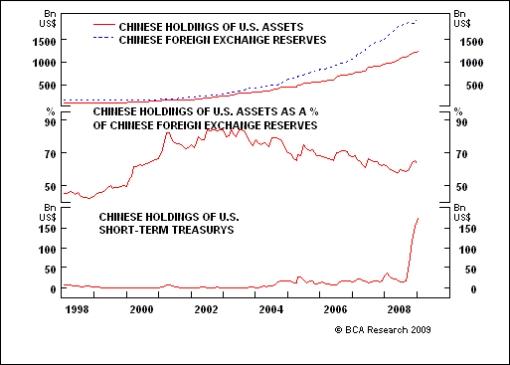

BCA Research: Demystifying Chinese holdings of US assets

“In an unusual disclosure, Chinese Premier Wen Jiabao publicly expressed his concerns about the safety of China's holdings of US assets, putting the country's massive yet largely furtive foreign exchange assets into the spotlight.

“Our research finds that China currently has about 64% of its foreign reserves in US assets, a level that has declined gradually from as high as 84% in 2003. The majority of Chinese holdings of US assets are risk free and long-term in nature, but there has been a clear trend in China's reserve holdings that shows a persistent increase in exposure to risky assets and non-US assets over the past five years.

“Although, China's net purchases of risky US assets have dropped sharply since mid-last year, while its net purchases of Treasurys have jumped. This underscores the authorities' reduced risk appetite amid the ongoing global storm. Their reserve diversification process could accelerate again when global financial markets stabilize. Importantly, China's net purchases of short-term US Treasurys have jumped dramatically over the past year, accounting for the majority of the country's total net purchases of US government paper. This is an unprecedented development and a situation that warrants close attention going forward.”

Source: BCA Research , March 23, 2009.

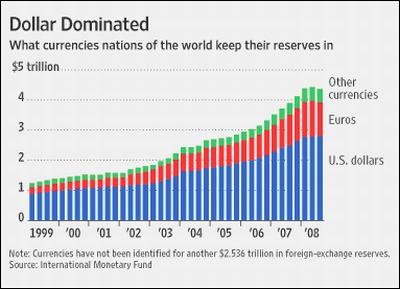

The Wall Street Journal: China takes aim at dollar

“China called for the creation of a new currency to eventually replace the dollar as the world's standard, proposing a sweeping overhaul of global finance that reflects developing nations' growing unhappiness with the US role in the world economy.

“The unusual proposal, made by central bank governor Zhou Xiaochuan in an essay released Monday in Beijing, is part of China's increasingly assertive approach to shaping the global response to the financial crisis.

“Mr. Zhou's proposal comes amid preparations for a summit of the world's industrial and developing nations, the Group of 20, in London next week. At past such meetings, developed nations have criticized China's economic and currency policies.

“This time, China is on the offensive, backed by other emerging economies such as Russia in making clear they want a global economic order less dominated by the US and other wealthy nations.

“However, the technical and political hurdles to implementing China's recommendation are enormous, so even if backed by other nations, the proposal is unlikely to change the dollar's role in the short term. Central banks around the world hold more US dollars and dollar securities than they do assets denominated in any other individual foreign currency. Such reserves can be used to stabilize the value of the central banks' domestic currencies.

“Monday's proposal follows a similar one Russia made this month during preparations for the G20 meeting. Like China, Russia recommended that the International Monetary Fund might issue the currency, and emphasized the need to update ‘the obsolescent unipolar world economic order'.”

Source: Andrew Batson, The Wall Street Journal , March 24, 2009.

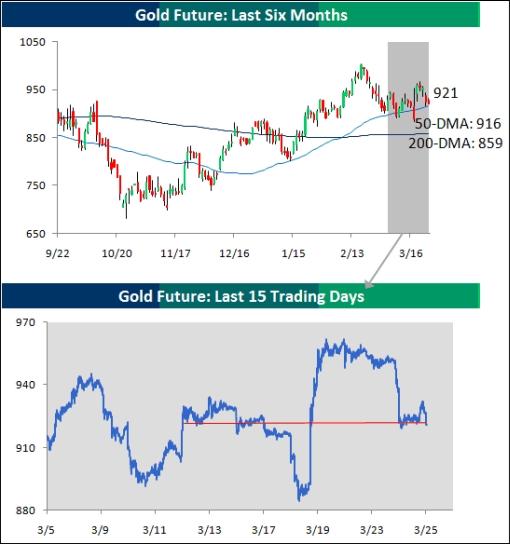

Bespoke: Gold testing downside support

“Just one week after the Federal Reserve devalued the dollar by announcing that they would start buying US Treasuries, one would think gold would be in rally mode and in overbought territory. However, while gold had an initial spike following the Fed's announcement, since then the yellow metal has come back down to earth. Gold is currently close to testing its 50-day moving average, which is a level that has provided reasonable support over the last few months. If that level fails to hold, the next level of support is around its 200-day moving average at 859.”

Source: Bespoke , March 25, 2009.

Platts: Chinese buying spree sparks fears of base metal shortage in Asia

“Robust Chinese demand could result in a supply shortage of base metals in Asia even as the rest of the world grapples with low demand, market sources said this week.

“Japanese copper smelters producing a total 120,000 mt/month of copper cathode have sold out of April-May shipments. Two smelters producing 20,000-40,000 mt/month each said they may be able to offer spot cargoes in June.

“Asia's copper market has tightened as a result, sources said. Premiums for Japanese copper for prompt shipment within 60 days have risen to $150/mt plus London Metal Exchange cash CIF Shanghai this month, from $80-100 mt/plus LME CIF Shanghai in February.

“There is no shortage yet, and no copper consumer in Asia has yet been forced to curtail production of coils or cables due to a shortage of copper feedstock, sources said.

“But if demand in recession-hit Japan does start to pick up unexpectedly, Asia may suffer shortages, impacting smaller consumers in particular that have no protection from long term contracts.”

Source: Mayumi Watanabe, Platts , March 27, 2009.

David Fuller (Fullermoney): Where do oil prices go from here?

“The consensus view is usually a contrary indicator. Near the July 2008 peak at just under $150, many analysts were forecasting $200 and higher. This trend extrapolation was often influenced by their firms' and clients' own speculative positions, not least in tracker funds. Around $40, the consensus was for $25, suggesting sizable short positions.

“Price charts gave a very good signal that crude oil's bull run was over in mid-July 2008 and since December we have interpreted the ranging price action as base formation development centred on $40. I do not assume that the lows will be retested and the base might even have been completed. If so, the next reaction and consolidation, representing the first step above the base, would most likely encounter support at $47 or higher.

“Historically, demand for crude oil has only experienced a small decline during deep recessions. Global consumption of crude continued to rise during the 2001-2002 recession, albeit at a slower rate. We are currently seeing a dip in demand but as Matthew Simmons points out, it is only slight and mostly in terms of consumption in the US.

“Meanwhile, OPEC has reduced supplies, while worldwide exploration and development of oil reserves has been curtailed by low prices and financing difficulties in the global recession. The search for viable alternatives has become a priority for oil-importing countries but it is a slow process.

“Energy is a Fullermoney secular theme and our view is that it has become a bull play once again, in all its various forms. The short to medium-term risk is probably limited to additional base formation development before significant uptrends occur. That will mark the return of commodity price inflation.”

Source: David Fuller, Fullermoney , March 24, 2009.

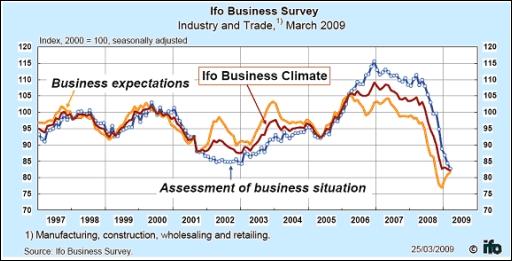

Ifo: Further decline in the Ifo Business Climate Index

“The Ifo Business Climate for industry and trade in Germany has cooled again somewhat in March. The firms have reported a further worsening of their current business situation. With regard to the business outlook for the coming six months, they are again slightly less pessimistic. An economic turning point has not yet been reached, in the opinion of the survey participants.”

Source: Ifo , March 25, 2009.

CEP News: Fall in German PMIs starts moderating

“German manufacturing and services output continued to contract at severe rates in March. However, the pace of contraction unexpectedly eased over the month, Markit Economics noted.

“On Tuesday, Markit Economics reported that the German manufacturing purchasing managers rose to 32.4 in March, up modestly from February's 32.1 level. Economists had expected the PMI to fall back to its record low 32.0 level.

“Output in the services sector also showed unexpected strength, as reflected in the services PMI rising to 41.7 from February's 41.3 level. Expectations had been for a fall to an all-time low of 41.0.

“Taking the two PMIs together, the composite index came to a two-month high of 37.7, up 1.4 points from February's figure.

“‘The rise in the headline composite index provides some tentative hope that the downturn has passed its nadir,' Markit economist Mark Smith said.”

Source: CEP News , March 24, 2009.

CEP News: ECB may turn to “unconventional policy” if rates reach limit

“The European Central Bank may take unconventional measures if its key policy rate hits its lower boundary, ECB Governing Council member Nout Wellink said on Thursday.

“‘The ECB could use unconventional monetary policy, on top of the unusual expansion already implemented, if the interest rate instrument can't be used further because of [almost] reaching the zero-rate limit,' Wellink said in the Nederlandsche Bank's annual report.

“The policy maker also said that months of negative price growth could not be ruled out in the euro zone. ‘[Negative inflation] isn't a problem in itself as long as consumers don't continuously postpone spending in the hope on further price declines,' Wellink said.

“Wellink also said that the global economic environment is unprecedentedly uncertain.' He added, ‘The financial system has been under unprecedented pressure since August 2007.”

“However, the central banker said that it was ‘not unrealistic to expect that the world economy will get going' by next year.”

Source: CEP News , March 26, 2009.

Financial Times: Take-up of City offices at new low

“Take-up of new offices in the City of London has fallen to its lowest for more than 20 years as the slowdown in the economy has reined in financial services businesses from expanding and moving to new buildings.

“There has been just 220,000 sq ft of new occupied space in the Square Mile since the beginning of the year, half the previous lowest office take-up during the last recession, when 500,000 sq ft was let in the third quarter of 1991.

“The economic downturn has hit the City office market hard, with many businesses looking to cut staff and reduce office occupation. Some are also looking to sub-let their own space.

“According to data compiled by Atisreal property consultancy since 1987, the vacancy rate in the City is 12.4%, or 10m sq ft, still significantly less than the last recession, when a fifth of offices were empty.

“Even so, there are a number of new buildings set for completion in the next two years that will add to those figures.

“City rents have also fallen sharply. Dan Bayley, head of national sales and lettings at Atisreal, said that prime rents were now about £45 per sq ft, down about a third from the peak of the market in 2007 when offices were being let at about £67.50 per sq ft.

“Mr Bayley said: ‘With rents continuing to fall, landlords are experiencing further pain. However, the positive factor is that a number of occupiers really are seeing value for money and, like the West End, may start seeing more activity in the coming quarters.'”

Source: Daniel Thomas, Financial Times , March 22, 2009.

CEP News: BOJ minutes reveal steps to buy assets

“The Bank of Japan's minutes from the February 18-19 meeting revealed the bank felt that buying corporate bonds was necessary to stabilize financial markets.

“At the meeting, the central bank held the target rate unchanged at 0.1% as expected, but also announced further measure to boost corporate financing.

“The bank said it would begin purchases of corporate bonds and extend the period of time they will buy commercial paper. The bank has met since then and expanded their purchases of Japanese government bonds.”

Source: Megan Ainscow, CEP News , March 23, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.