The Stock and Commodity Market Rally's Million Dollar Question

Stock-Markets / Financial Markets 2009 Mar 27, 2009 - 09:41 AM GMTBy: Chris_Ciovacco

The battle between current economic weakness and the Fed's programs are playing out in the currency, commodity, and stock markets around the globe. Since history tells us stocks tend to bottom before the economy, we should remain open to all possible outcomes, bullish or bearish, even in the face of serious systemic problems. In Reflation: Déjà Vu All Over Again? , we commented that the S&P 500's move through 806 sends a signal the markets are paying attention to all the Fed's "liquidity facilities".

The battle between current economic weakness and the Fed's programs are playing out in the currency, commodity, and stock markets around the globe. Since history tells us stocks tend to bottom before the economy, we should remain open to all possible outcomes, bullish or bearish, even in the face of serious systemic problems. In Reflation: Déjà Vu All Over Again? , we commented that the S&P 500's move through 806 sends a signal the markets are paying attention to all the Fed's "liquidity facilities".

The Million Dollar Question: Are the current moves in commodities and stocks due solely to an aversion to currency debasement, or is the market also forecasting a better economy in the coming months? If the move is solely based on the Fed's actions, then many of the current rallies may fail relatively soon. If markets are moving because of the Fed and an improved economic outlook, then we could be on the cusp of some bullish breakouts for numerous markets (see charts below).

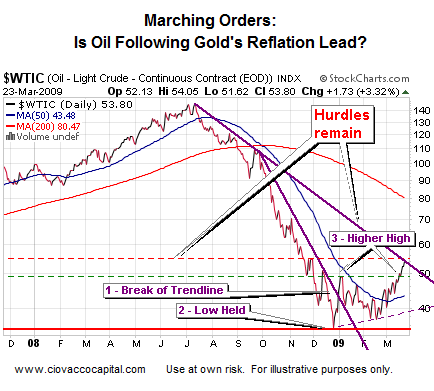

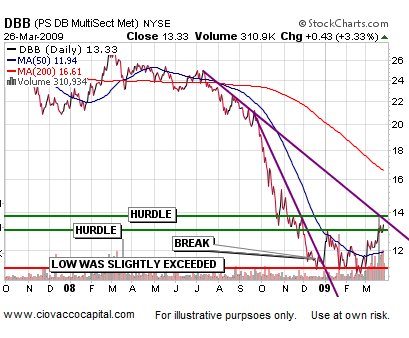

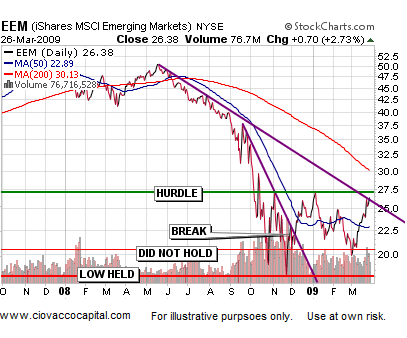

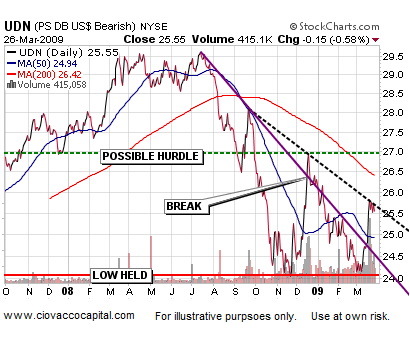

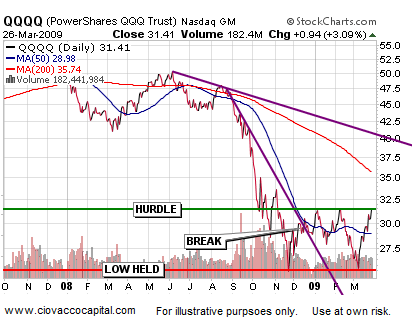

Reasons To Pay Attention: On March 24, 2009, we presented the chart of oil below showing some positive characteristics that can be indicative of an emerging trend. You can find similar early-stage, "it pays to keep an open mind" characteristics in many asset classes - most of which have some connection to a weak dollar.

NOTE: The chart below is from 3/23/09 close

While it is understandably difficult to comprehend significant bullish breakouts possibly occurring given the state of the world, we know:

- Markets look forward and will move before the headlines get better (see 1974 headlines at the bottom of this article)

- We can't argue with the charts below – they are what they are.

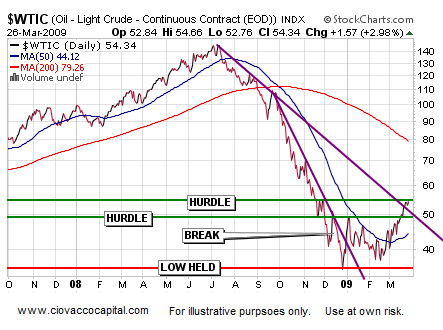

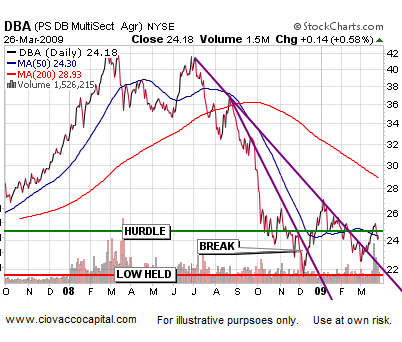

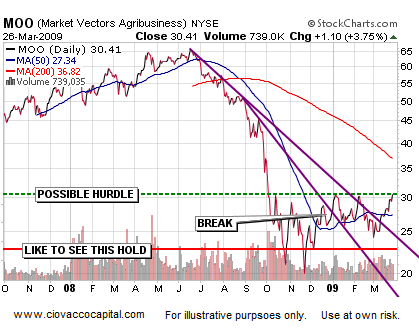

Successful breakouts of the charts below would be a positive development for all risk assets. A successful breakout ultimately means a lasting breakout - it pays to be careful near inflection points. It is worth our time to monitor their progress or lack thereof in the coming days and weeks.

Remaining charts are as of Thursday's (3/26/09) close.

Dollar Still Holding Up: When reviewing all these markets, it is important to keep in mind, the U.S. dollar has held above its recent upward sloping trendline (bullish). So at this moment, all the talk of weak dollar assets may be premature. The bearish dollar ETF (UDN - shown below) has not cleared enough hurdles to become blindly bearish on the dollar (as we would expect). Our guess is most of these charts will follow a similar path in the coming days and weeks - they will all break through meaningful levels or they will all bounce off meaningful levels. We can afford to be patient and see how it plays out. When "the shift" occurs from risk aversion to willingness to accept risk, it will be not be all that hard to see on the charts. Understanding the fundamental side of the ledger helps as well - obviously, significant bullish breaks in the commodity markets is a positive signal for the global economy. The five hundred thousand dollar question is if we get breakouts, will they hold? Time will tell.

The Headlines Will Continue To Be Worrisome: The following is an excerpt from an October 20, 2008 article Stocks Will Bottom Well Before Economy . It is not presented again to imply a bottom is in place, but to illustrate the importance of remaining open minded to the possibility a bottom is in place.

Investors need not wait for the headlines to become more positive before allocating some of their capital to stocks. The headlines below were on the front page of major U.S. newspapers between late September 1974 and late March 1975. Stocks bottomed on October 2, 1974, which means while the headlines were still very negative, stocks were looking forward to better times. All the headlines below graced the front of newspapers after the market had bottomed.

- Nixon's Chief Aids Go On Trial

- Ford's Ban on Wage and Price Controls Draws Criticism

- Nixon Tapes Open Pardon Question

- Arab Oil Nations Warned

- Inflation Spurts 1.3%

- Fed Pledges End to High Interest Rates

- Senate Joins Efforts to Get Nixon Tapes

- Spending Cuts Urged

- Ford Defends Action, Made No Pardon Deal

- Police Stop School March

- Terrorists Hold French Embassy

- Police Escort School Buses

- Nixon Likely to Resign From Bar

- Ford May Pardon Others

- Big Energy Taxes Next?

- West Must Change Ways, Iran Warns

- Terrorists Cut Demands

- President Opposes Gas Tax, Rationing

- U.S.-Soviet Talks Fall Apart

- Tax Hike Heads New Ford Plan

- Energy Crisis to Change Americans

- President Hopes to Cut Inflation by Next Year

- Tapes Reveal Nixon Knew Facts Early

- $3 Billion OK'd For Housing Aid

- Ford Says He Will Prove Polls Wrong

- Mileage Boosted in '75 Cars

- Anger at Watergate Trial

- Ted's Night of Anguish for Mary Joe

- Economic Index Takes Plunge

- U.S. Investigates Food Price Fixing

- Jobless Rate HitsThree-Year High

- Ford Pleads for Inflation Fight

- Financial Crisis Faces Sympathy

- Coal Strike Seems Inevitable

- Stores Ask Voluntary Rationing of Sugar

- Kent State Shooting Guardsman Acquitted

- Skyjacker Dies in Shootout

- 15,625 More Autoworkers Jobless

- Hijackers Hold off Executions

- Recession Hits Auto Plants

- Chrysler May Halt December Production

- Watergate and Hush Money

- Threat of Gas Lines – We're Using Too Much

- U.S. Economy Flashes New Distress Signals

- Real Wages Nosedive

- HUD Accused of Mortgage Bias

- Watergate Case Goes to Jury

- Gloomy Jobless Rate

- Big Economic Plan Pledged

- A $16 Billion Tax Cut

- Oil Price Batter Balance of Trade

- Ford's Jobless Forecast Grim

- Highway Funds Low, Projects Cut

- 9.3% Unemployment Hits California

- U.S. Rolls of Unemployment Climbs to 8 Million

- FBI Works On Hearst Case

We can expect the headlines to look quite bleak in the coming quarters, but we must keep in mind that it is not unusual for stocks to bottom well before the economy and social mood. An investor who held stocks while the headlines above appeared in his daily paper was rewarded with a nice profit.

The Most Important Concept In Investing: The charts represent the collective thoughts of all market participants, the same participants that ultimately determine if and when we are going to transition from a bear market to a bull market. Regardless of any individual's personal opinion or forecast, when all market participants collectively decide we are moving into a sustainable bull market, we are going to move into a sustainable bull market. If you disagree, you will be left behind. Conversely, if an individual is bullish and the market collectively does not have the will to produce positive breakouts, the market will reverse and the individual will be on the wrong side of the trade. The previous four sentences should enable us to better understand the dangers of forecasting. Understanding these concepts is extremely important in investing.

The market can remain irrational longer than you can remain solvent."

John Maynard Keynes

Let’s assume you have in your hand a flawless research report that has accurately depicted everything that should influence market behavior in the next six months. Now, assume you are the only person who has access to that report. If the market collectively does not know what you know, you can bet the market is not going to be influenced by your report or opinion. It does not matter what individuals or entire organizations think or forecast, it matters what the market collectively thinks and forecasts. The statements above apply to all of CCM’s research reports and opinions as well. It pays to pay attention - it is dangerous to forecast or use the expressions "I think" or "they forecast". The concept of fundamental and technical alignment says the fundamentals are your "research report", which may be 100% accurate. You need the technicals (charts) to align with your research report before you can profit from your research report. Both are important - fundamentals and technicals. When you have fundamental and technical alignment, the odds of being successful are in your favor.

In the current environment, weak dollar investments have tremendous fundamental support – we need technical alignment – it may or may not be coming soon to a chart near you. Technical analysis is not about forecasting – it is about observing the collective mood of the market and assigning probabilities to numerous possible future outcomes. When markets are near possible inflection points, the best thing to do may be to wait and see what happens. We have numerous possible inflection points in the markets above – a little patience is in order.

The charts and commentary above are for illustrative purposes only and are not recommendations to buy or sell any security.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.