Quantitative Easing Begins; "Operation Twist" Revisited

Interest-Rates / Quantitative Easing Mar 26, 2009 - 01:58 AM GMTBy: Mike_Shedlock

Quantitative easing in the US has begun. The Fed Buys $7.5 Billion of Debt to Cut Borrowing Costs .

Quantitative easing in the US has begun. The Fed Buys $7.5 Billion of Debt to Cut Borrowing Costs .

The Federal Reserve bought $7.5 billion of Treasuries in the first outright purchase of U.S. government debt by the central bank to keep consumer borrowing costs low since the 1960s. It is the first step in a six-month program to buy up to $300 billion in Treasuries.

The Fed joins central banks in the U.K. and Japan in extraordinary purchases of government debt, broadening efforts to unfreeze credit and end the recession after cutting the benchmark interest rate close to zero. Policy makers announced the decision to buy the debt last week along with a plan to more than double purchases of housing debt to $1.45 trillion, hoping to reduce rates on home loans.

The largest purchase today was $2.8 billion of the so-called on-the-run seven-year note, or the 2.625 percent coupon note maturing on Feb. 29, 2016.

The central bank's latest efforts may help swell its balance sheet to more than $4 trillion this year. The last time the Fed had a targeted program of purchasing longer-dated Treasuries was in the 1960s, in a joint initiative with the Treasury called Operation Twist , which attempted to narrow the gap in yields between short- and long-term debt.

Central bankers and the Treasury haven't been able to meet Fed Chairman Ben S. Bernanke's goal of reducing consumer interest rates along with the borrowing costs paid by banks. The difference between rates on 30-year fixed mortgages and 10-year Treasuries was 2.24 percentage points, according to data compiled by Bloomberg. That's up from an average of 1.75 percentage points in the decade before the subprime mortgage market collapsed.

“If the Fed is to accomplish $300 billon of purchases over the next 6 months, it will need to buy approximately $12 billion per week -- with $4 to $6 billion per coupon pass,” George Goncalves, Treasury and agency strategist in New York at Morgan Stanley, wrote in a note to clients yesterday.

The Fed will target Treasuries maturing from August 2026 to February 2039 on March 30, longer maturities than traders expected. Fed's Open Market Committee announced on March 18 that Treasury purchases would be concentrated in the two- to 10-year maturity area as well as including Treasury Inflation Protected Securities, or so-called TIPS.

Let's Twist Again

After 48 years, the Fed says " Let's Twist Again ".

The Federal Reserve on Wednesday flashed back almost 50 years to a campaign code-named "Operation Twist", as it announced the purchase of longer-dated Treasury securities to help end a deepening U.S. recession.

The move to purchase longer-dated U.S. government debt, on top of regular purchases of short-term Treasury bills, marked the first time it has done so since Operation Twist, which ran from 1961 until 1965. But that is where the similarities end.

In the 1960s, in an effort to flatten the yield curve to simultaneously tackle a recession and a lingering trade deficit, the Fed bought long-term bonds and sold short-term bills.

As a result, the operation was sterilized in terms of its impact on the money supply and was not an expansion of monetary policy. This time, the intervention will not be sterilized and should help ease monetary conditions.

" We see this as equivalent to a 75 basis point cut in the (fed) funds rate," said Ethan Harris, co chief U.S. economist at Barclays Capital in New York. A basis point is one one-hundredth of a percentage point.

"A combination of monetary, credit and fiscal easing will slow the recession in the second quarter and spark a modest recovery by year-end," he said.

Volker On Operation Twist

Inquiring minds are no doubt asking "Was Operation Twist Successful?"

Here is the answer from Volker Addressing a Conference on Financial Innovation April 2002:

"Well, to the extent that Operation Twist worked at all – and I must confess I was a little skeptical about it, given the fluidity of the markets even then – it too depended on some degree of market imperfection. And I think it became apparent fairly quickly that the market imperfection was not as great as had been assumed."

That sounds to me like a resounding "No".

$TNX 10-Year Treasury Daily Chart

Bernanke got an oversized reaction on his option expiry announcement, but the market's reaction has been a big yawn since then. Treasuries even sold off the first day the bazooka was actually fired. But let's put this all in perspective by looking at longer time frames.

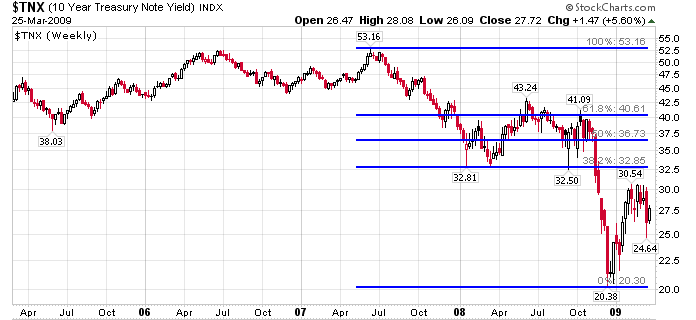

$TNX 10-Year Treasury Weekly Chart

Are Yields Going Up Or Down From Here?

Yes they are. I guarantee it. If you want to know which way short term, I do not know, nor does anyone else.

One thing I am quite certain of is that Ethan Harris' statement " We see this as equivalent to a 75 basis point cut in the (fed) funds rate " is complete nonsense. This is not the equivalent of interest rates at negative .5%, something that has never happened before in history.

Technically, the extremely pervasive "bottom in yields is in" sentiment seems a bit misguided. Yes there was a big treasury selloff (rising yields), but the chart has not even hit the 38% retrace level yet. It's quite possible the bottom is in, but that does not mean yields are blasting sky high. Look at how long yields stayed low in Japan. It can happen here.

Treasury Counterforces

- Seasonality is negative through May (think tax season and refunds).

- Obama has a potential budget deficit of $1.8 trillion , 13% of GDP.

- There are few signs of economic recovery. A downward spiral or economic collapse is not out of the question.

Notice I do not even have quantitative easing on the list. Other than producing "one day wonder" candles as in the first chart above, the odds that quantitative easing works as planned are nonexistent. Please see Krugman's $200 Billion Lunch for details.

Here is one pertinent snip.

For starters the Fed cannot force long term interest rates down without committing an unlimited amount of purchases, and perhaps not even then. Simply put, the Fed cannot change the primary trend. If long-term interest rates are headed higher there is little the Fed can do about it.

Japan proved that currency manipulation does not work, and I see little reason for open intervention in the treasury market to work either.

Yes, there was a huge treasury rally on the announcement. Was this because of the news or was the market ready to rally anyway? I think the latter. The long bond rallied as did the 10-year treasury, the latter right at a 50% retrace of the move down from mid-October. It was an oversized move but treasuries have sold off three consecutive days since the announcement.

Appearance vs. Reality

Yields may drop. If they do it will not be because quantitative easing is working. If yields drop from here, in spite of the massive supply of treasuries stemming from Obama's sky high budget, it will be because the economy is in worse shape than anyone thinks.

Those hoping for a second half economic recovery should be hoping yields rise, not sink.

"Operation Twist" failed. So will "Operation Twist Again" in one way or another, or perhaps multiple ways. For example there is no specific reason mortgage rates will drop even if yields do. Default risk is simply too high.

Clap Your Hands And Sing Along

Come on everybody!

Clap your hands!

All you looking good!

I'm goona sing my song

It won't take long!

We're gonna do the twist

and it goes like this:

Come on let's twist again,

like we did last summer!

Yeaaah, let's twist again,

like we did last year!

Do you remember when,

things were really hummin',

Yeaaaah, let's twist again,

twistin' time is here!

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.