Crude Oil Makes a Sweek Breakout Buy Signal (Part2)

Commodities / Crude Oil Mar 26, 2009 - 01:36 AM GMTBy: Chris_Vermeulen

Crude Oil makes a run higher giving investors some what of a tradable bounce. Although this is great for our long trades, this is a catch 22. Gas prices are starting to rise again and if this trade follows through. we could see $65 per barrel and a possibility of oil retesting $100 level within the next 6-12 months. Not a pleasant thought in the grand scheme of things.

Crude Oil makes a run higher giving investors some what of a tradable bounce. Although this is great for our long trades, this is a catch 22. Gas prices are starting to rise again and if this trade follows through. we could see $65 per barrel and a possibility of oil retesting $100 level within the next 6-12 months. Not a pleasant thought in the grand scheme of things.

Light Crude Oil Makes a SWEET Signal – Part 1 if you want to view my previous post on light sweet crude oil.

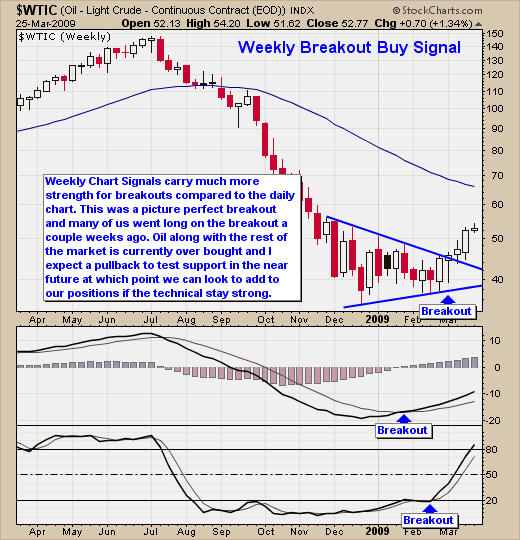

Trading Light Sweet Crude Oil – Weekly Buy Signal

Weekly Chart Signals carry much more strength for breakouts compared to the daily chart. This was a picture perfect breakout and many of us went long on the breakout a couple of weeks ago. Oil along with the rest of the market is currently over bought and I expect a pullback to test support in the near future, at which point we can look to add to our positions if the technicals stay strong.

Trading Light Sweet Crude Oil – Daily Buy Signal

Crude Oil finally posts some gains!

Oil breaks out and pushes higher toward the $55 per barrel price which is resistance level from November of last year. We could see prices test the $50 level, which is our trend line support and a decade number (ex $10, $20, $30 etc...) which act like support or resistance before moving higher.

Light Sweet Crude Oil Trading Conclusion:

The millions of traders and investors world wide, who have been following the price of oil, look to be putting some money to work pushing prices higher. Oil is currently at November's resistance level and over bought on the Stochastics indicator, which makes oil look ready for a test of support before moving higher. I figure we will see a test of the $50 level in the next few trading sessions and if we get a controlled pullback and bounce, we will look to add to our position.

I like to trade XEG.TO and XTR.TO. Those of you who trade on the US markets should be trading USO, XLE or High Beta energy stocks.

Cell Phone & Lap Top Radiation Alert - I came across this product a while back and think everyone should have this on their cell phone and laptop. Its a small sticker that was clinicly proven my Sun Micro Systems (soon to be bought my IBM) to neutralize the harmful radation from cell phones, laptops, portable phones and other harmful devides which cause DNA altering radiation. I have one on my cell phone and 2 on my laptop for safety. If your interested check out this website and learn more about what we are exposed to and how this product works. Website: http://www.the-emf-neutralizer.com/

I have put together a Recession Special package for yearly subscribers which is if you join for a year ($299) I will send you $300 FREE in gas, merchandise or grocery vouchers FREE which work with all gas stations, all grocery stores and over 100 different retail outlets in USA & Canada.

If you interested please act fast before they are gone for good.

If you would like to receive my free weekly market updates please visit my website: www.TheGoldAndOilGuy.com

I look forward to hearing from you soon!

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.