Eggertsson Theory, Armstrong, Timing and the Economic Confidence Model

Economics / Economic Theory Mar 25, 2009 - 07:38 PM GMTBy: Mick_Phoenix

Who's that knocking on the door? Who's that ringing the Bell?

It's time for another visit by your friendly Collection Agency to offer timely advice and to remind you of his previous excellent record. You should all know by now that the Collection Agency doesn't pull any punches and has ensured that subscribers have been well ahead of developments in the global macro economy.

Who's that knocking on the door? Who's that ringing the Bell?

It's time for another visit by your friendly Collection Agency to offer timely advice and to remind you of his previous excellent record. You should all know by now that the Collection Agency doesn't pull any punches and has ensured that subscribers have been well ahead of developments in the global macro economy.

It has been interesting to read current econo-blogging and main stream writing discussing the present situation, something subscribers old and new must read with a feeling of déją vu as the memory of articles and letters written up to 3 years ago came flooding back to the fore. Prior to starting my subscription only service I had a blog. The blog is still available to view as an archive and whilst I didn't get a 100% predictive score, I think 99% is not a bad hit rate.

You don't believe me? Why would I lie to you about a free archive that had articles from 2006 through to mid 2008? The link above will take you to the last article on the blog, it was a summation of the calls since the blog started, with a running commentary written in July 2008. Advert over.

So here we are living with the fallout of a credit collapse, with deflation looming for some and embedded for others. Yet right now we are getting numerous articles looking for those famed "green shoots of recovery". I see nothing but a parched desert. Central Banks are moving into a global Quantitative Easing (QE), Zero Interest Rate Policy (ZIRP) environment as each individual economy adopts the measures tried by Japan in the lost 20 years (the lost decade is too short to describe what Japan is suffering). Even the original trialist has returned to the experiment with the Bank of Japan purchasing bonds, shares and debt to increase liquidity, this after the original attempt failed. Now China has joined the QE Club, along with the US, UK and Switzerland as it stokes the domestic credit bubble to expand liquidity through loans. We all know how that's going to end. Even the Eurozone has adopted some of the measures of a QE / ZIRP plan, it will become a full member soon enough.

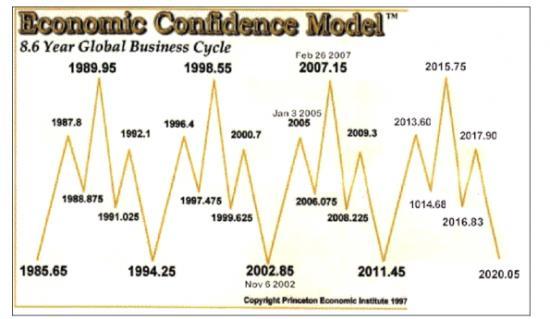

I read a lot, I mean a lot of economic material ranging from papers prepared for Central Banks, IMF, BIS through to bloggers like me. Some of the information I see is too optimistic or just plain wrong, some is insightful and revealing. However there is one chart that I keep close at hand:

The chart was drawn by Martin Armstrong; it does not predict stock market direction but business confidence.

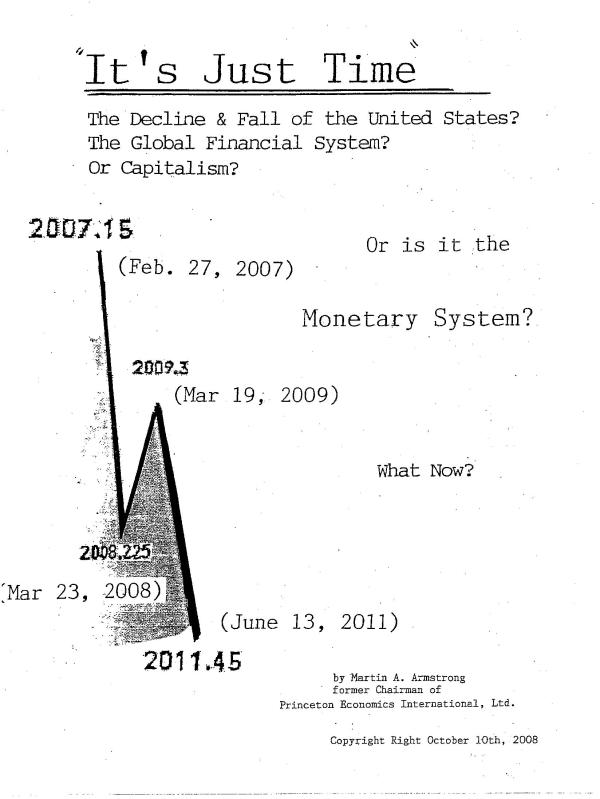

Mr Armstrong is still writing even though he remains imprisoned. A key date passed this week, the 19 march 2009, yet very few will know of it. The predictions of Mr Armstrong, through his work, are truly stunning and make my work look pale in comparison. He has pinpointed the week, the day where we see talk of recovery becoming familiar and the confirmation of massive interference from the State in the bond markets. More importantly Mr Armstrong noted that the 19 March is not in itself "the date" as his work pinpointed another date that will work in conjunction with events that happened last week, that of 19 April. (There is also another lesser cycle date for the 23 April.)

I understand the principles behind Mr A's work and as mentioned I keep it close at hand, it is just too good to ignore. However, if you think I am going "all in" based upon the dates you have missed the point, remember this is not a direct market prediction. Markets reflect the sum of individual responses to outlook, Mr A points out where the inflection points are that affect that outlook. Those of you that have read my work on the Eggertsson Theory written in April 2008 and titled "The future actions of the Federal Reserve and US Govt are known" know how important expectations are in the outcome of the massive re-flation attempt currently under way.

So what happened last week, as if you need me to tell you? The final action needed to turn theory into fact occurred as the Federal Reserve began to put into action the following from The Deflation Bias and Committing to Being Irresponsible :

- "Friedman suggests that the government can always control the price level by increasing the money supply, even in a liquidity trap. According to Friedman's famous reductio ad absurdum argument, if the government wants to increase the price level it can simply "drop money from helicopters." Eventually this should increase the price level-liquidity trap or not. Bernanke (2000) revisits this proposal and suggests that Japanese government should make "money-financed transfers to domestic households-the real-life equivalent of that hoary thought experiment, the "helicopter drop" of newly printed money." This analysis supports Friedman and Bernanke's suggestions. The analysis suggests, however, that it is the increase in government liabilities (money & bonds), rather than the increase in the money supply that has this effect. "

"Since money and bonds are equivalent in a liquidity trap dropping money from helicopters is exactly equivalent to issuing nominal bonds. If the treasury and the central bank coordinate policy the effect of dropping money from helicopters will have exactly the same effect as deficit spending. Thus this paper's model can be interpreted as establishing a "fiscal theory" of dropping money from helicopters. The model can also be extended to consider the effects of the government buying foreign exchange (or any other private assets)."

"It is often suggested that the central bank can depreciate the exchange rate and stimulate spending by buying foreign exchange (and similar arguments are sometimes raised about some other private assets and their corresponding price). Due to the interest rate parity (and similar asset pricing equations for other private assets), however, buying foreign exchange should have no effect on the exchange rate unless it changes expectations about future policy (since the interest rate parity says that the exchange rate should depend on current and expected interest rate differentials)."

"Will such operations have any effect on expectations about future policy? Open market operations in foreign exchange (or any other private asset) would lead to a corresponding increase in public debt defined as money plus government bonds. This gives the government an incentive to create inflation through exactly the same channel as I have explored in this paper and, therefore, leads to a corresponding depreciation in the nominal exchange rate hand-in-hand with the rise in inflation expectations. An advantage of buying private assets, as opposed to cutting taxes, is that it does not worsen the net fiscal position of the government. It only changes the inflation incentive of the government." GB Eggertsson. ( Emphasis mine)

- "The Federal Reserve's third set of tools for supporting the credit markets involves the purchase of longer-term securities for the Fed's portfolio. As we announced this week, we are purchasing up to $300 billion in Treasury debt, $200 billion of the debt of government-sponsored enterprises (GSEs), and up to $1.25 trillion of mortgage-backed securities guaranteed by the GSEs and federal agencies this year. These purchases are intended to improve conditions in private credit markets. In particular, they are helping to reduce the interest rates that the GSEs require on the mortgages that they purchase or securitize, thereby lowering the rate at which lenders, including community banks, can fund new mortgages."

However as subscribers know we are looking for those "expectations of inflation" that are vital to change the spending and investment patterns of consumers, business and banks.

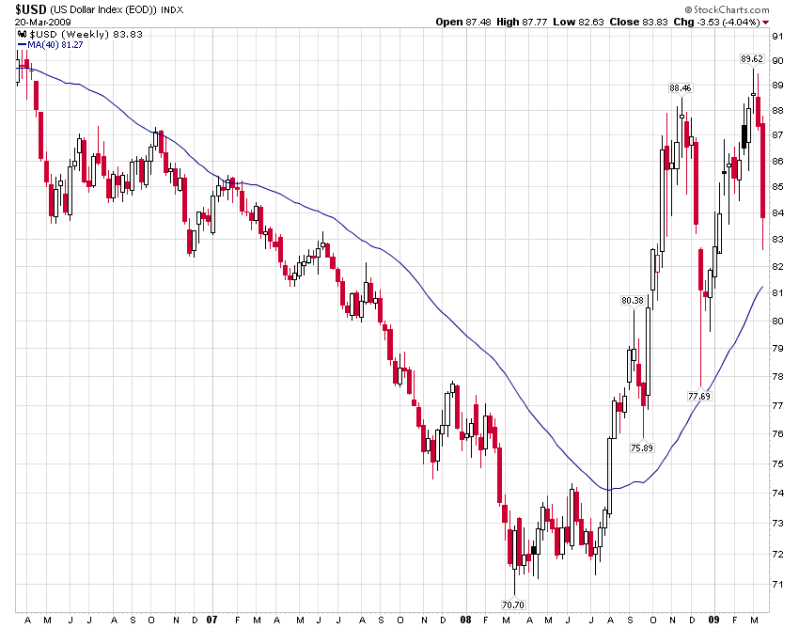

Hello, what do we have here?

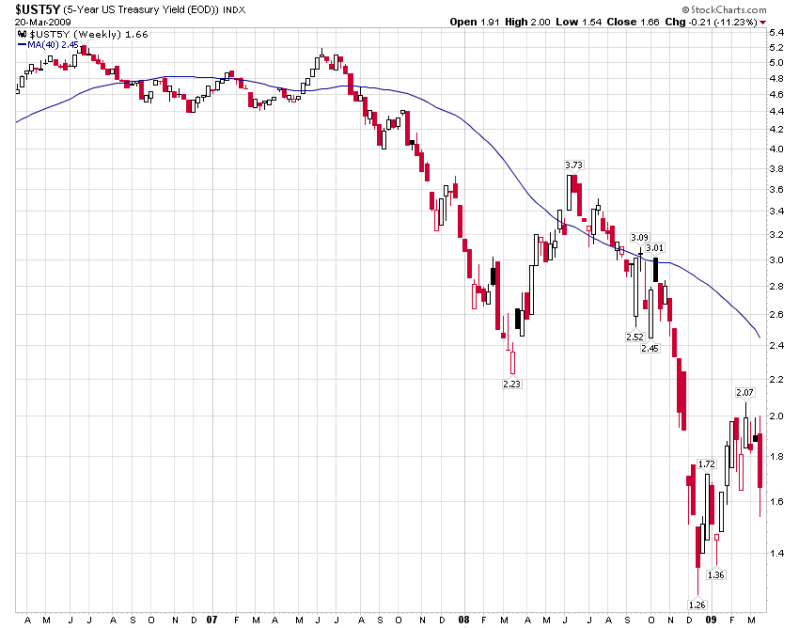

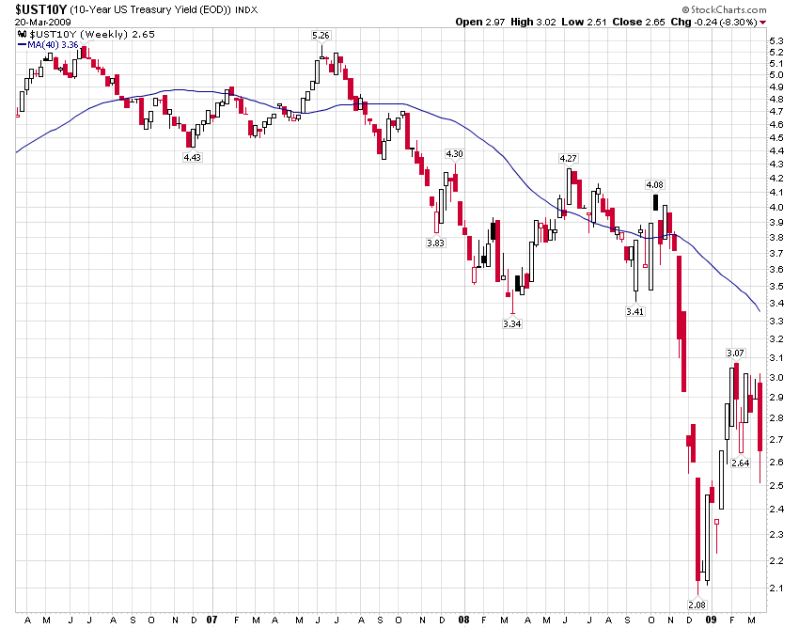

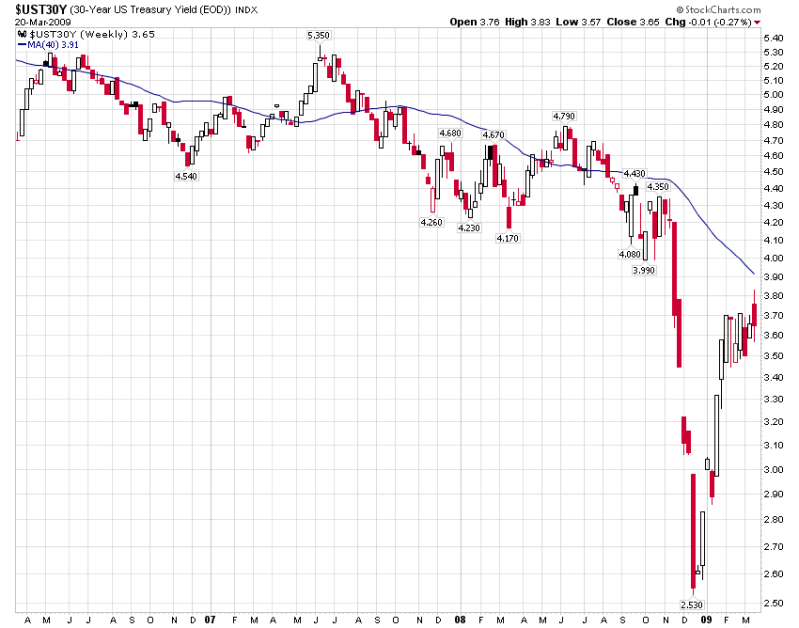

Courtesy of www.stockcharts.com

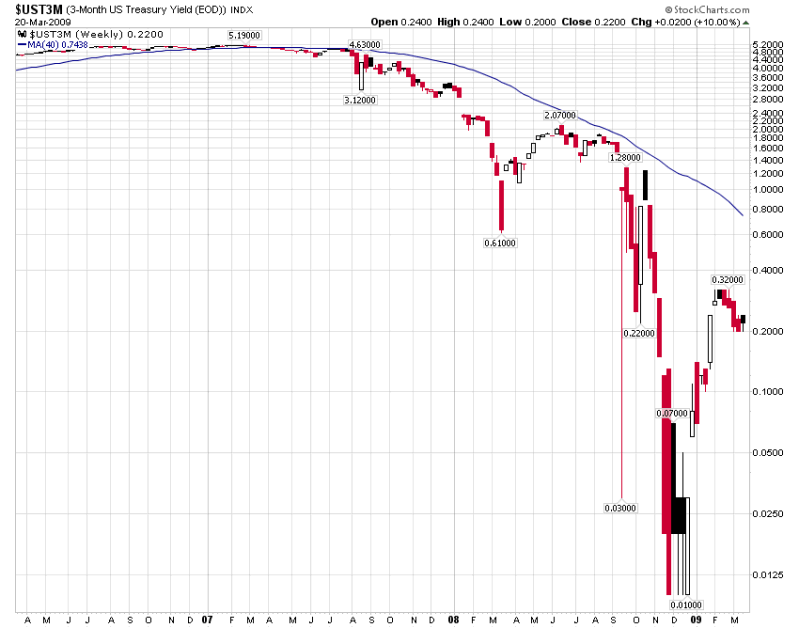

If the US Treasury Bond markets are now artificially priced then logically the future expectations of the masses will be reflected elsewhere. At CALetters.com we have been following yields closely to attempt to divine the range the Fed intends to hold rates within (because we knew it would happen):

In last weeks Report, subscribers were reminded to watch these assets, with the $ as the baseline:

Courtesy of www.stockcharts.com

At the risk of repeating myself, go back and re-read the highlighted part of the last paragraph taken from GB Eggertsson's work. We now get some idea of what it takes to inject an expectation of future inflation, around $1.75Trillion. The big question is how long the expectation will last, will it become embedded or will it fade away without further injections of credit and liquidity?

This is an important window for the Chinese, do they decide to wait for the answer posed above or do they move now and sell whilst the price is supported as the dollar loses value? We get some idea as to how worried the Chinese are from this Reuters article , reported on the 19 March :

- "Russia met representatives of China, India and Brazil ahead of the G20 finance ministers meeting last week, as the big emerging powers seek to up their influence on decisionmaking globally. Their first ever joint communique did not mention a new currency but the source said the issue was discussed.

"They (China) did not formally put forward their position for the G20 summit but unofficially they had distributed their paper regarding the same ideas (the need for the new currency)," the source told Reuters, speaking on condition of anonymity.

The source said the Chinese paper envisaged the International Monetary Fund's Special Drawing Rights (SDRs) being first assigned a role of a clearing currency on some transactions and then gradually becoming the main global reserve currency. "They said that the role of reserve currency should be given to SDR," the source said.

A U.N. panel of experts is also looking at using expanded SDRs, originally created by the International Monetary Fund in 1969, but now used mainly as an accounting unit within similar organisations as a new reserve currency instead of the dollar."

- "I expect attempts to be made to peg smaller currencies to a $/Y basket. These 2 currencies will remain strong for the foreseeable future as long as demand for a reduced supply exists. Eventually there will a centrally controlled orchestrated move to develop regional currencies linked to a peg that is not a currency, such as the IMF SDR's (special drawing rights). The movement of currency from one region to another will be after a conversion to "SDR" and controlled by the Bank of International Settlements."

We can see the systemic strains appearing as Central Banks attempt to manipulate multiple markets, we know from history that such manipulation will not work. We have the Fed supporting the Bond market whilst the dollar is allowed to fall, gold holding a range and the Dow showing a correlation to currency fluctuations. These are not markets that are going to react as we "expect". The Fed truly is "committed to being irresponsible" and the Chinese know it. Worse this knowledge is putting real fear into the Chinese strategy, why should they hold assets that yield single digits if the currency they are denominated in is facing possible large double digit % devaluation? For the US there is a further conundrum, how do you make a capped yield asset attractive if the dollar is dropping in value? Simply put, you don't. Therefore to sell the debt to willing buyers you need to protect the dollar and if the US Treasury is unwilling to do so, they may well find the rest of the world does it for them, buying dollars and selling their own currencies to protect $ priced assets. Competitive devaluation becomes the driving force for national survival in the fight against the US self interest.

We cannot discount the possibility that the US decides that the Fed will buy newly issued US Treasuries, rather than the current cash for debt swap with the Banks, ensuring that the depreciation needed to make the Eggertsson Theory work does not become derailed.

Regardless of which way such actions would affect the global economy it could make the Chinese (well my) idea to switch to a regulated currency market look much more attractive. In the end it might not matter which decisions are made because, as Mr Armstrong would say "It's just time".

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2009 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.