Profit Taking Pushes Stock Markets Lower

Stock-Markets / Financial Markets 2009 Mar 25, 2009 - 07:54 AM GMTBy: PaddyPowerTrader

Some profit taking after the stellar gains (panic buying) on Monday was always on the cards. The surprise to this writer was that the correction wasn't a tad deeper, with the S&P holding well above the key 800 level; mind you, financials were down 6.5% as the misplaced euphoria over Geithner's plan wears off. Energy stocks were also weak, as crude prices retreated and air carriers took a big hit on a trade group report predicting a cumulative $4.7bn loss for the industry in 2009.

Some profit taking after the stellar gains (panic buying) on Monday was always on the cards. The surprise to this writer was that the correction wasn't a tad deeper, with the S&P holding well above the key 800 level; mind you, financials were down 6.5% as the misplaced euphoria over Geithner's plan wears off. Energy stocks were also weak, as crude prices retreated and air carriers took a big hit on a trade group report predicting a cumulative $4.7bn loss for the industry in 2009.

Today's Market Moving Stories

- Chinese energy stocks are up strongly overnight, not because of global influences, but because China announced a rise in retail gasoline and diesel prices. Shares in Taiwan were led by the tech sector, where MediaTek reported that it could see record sales in March on Chinese demand for cell phones. Insiders advise selling into this rally as they have a negative view on the company's Blu-ray and 3G prospects.

- Japan's exports plunged a record 49.4% in February as deepening recessions in the U.S. and Europe led to huge falls in demand for the country's cars and electronics. Car exports alone fell 70.9%. The collapse in exports may see Japanese GDP fall even lower than the 12.1% annualised drop posted in the previous quarter. The data also shows that shipments to the US declined 58.4% yoy . Japan's retail investor sentiment index fell to -74 in March from -64 in February. The BoJ's Shirakawa said Japan does not face a deflationary spiral.

- Nobel prize-winning economist Joseph Stiglitz says that the new U.S. bailout plan is very flawed and amounts to robbery of the American people .

- On the subject of the plan, the FT suggests that the large writedowns that will result will require huge capital increases at major US financial institutions.

- After they were badly caught off guard by the Bank of England 's bold move, we have further confirmation yesterday of the isolated ECB softening its stance on quantitative easing . Gonzalez-Paramo said that they are not ruling out other easing measures. The good news for hard pressed homeowners in Spain and Ireland is that most of the recent jawboning by ECB governors strongly suggests that the council has already agreed in secret to cut rates at its April 2nd rendezvous. So yet another U turn from Mr “handbreak turn” Trichet . See the one and only Willem Buiter on the topic.

- Regulation is back in vogue with the idea of broad new government authority to regulate or even take control of financial institutions . Bad news for future bank earnings potential.

Three TARPS And You're Out

While recent moves by the US administration are proving something of a late in the day antidote, they are no panacea. As I have pointed out repeatedly, the bear market rallies we have seen (false dawns) over that last two years plus were official announcement-driven events. The harsh reality remains that the economic and earnings backdrop is not improving one iota. While the majority of the buy side slanted media coverage has focused upon the tailwinds to the consumer of tax cuts and the benefits of lower mortgage rates, the headwinds of the negative wealth effect from collapsing house / stock prices, the huge rise in the savings rate and the 2.5 million job losses far outweigh these.

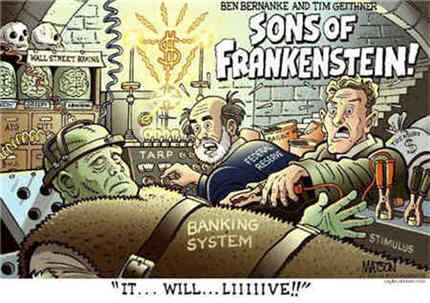

Geithner's latest Frankenstein plan is not the green light to go long financials as it does not encourage the necessary consolidation in the banking sector which should be the fallout from the pricking of a massive assets bubble. In contrast, this over-complicated compromise prevents such rationalisation by over-paying for toxic assets and letting zombie banks live exactly as we saw in Japan's “lost decade”. Leaving excess banking capacity out there in the vague hope that the economy will grow into it is wishful thinking. History suggests that such bright eyed optimism is doomed to failure. In short, the plan sacrifices the longer-term health of the economy and the financial system for a short-term methadone like-fix for the banks.

We will let the “V” shapers have their day(s) in the sun . By late April, the outlook for global growth will yet again flip and morph into a dreaded “L” shape as it dawns on investors that nothing is actually really working and we really do have to cope with the reality of a multi year recession ahead of us. This will trigger the next capitulation leg of the great bear market. See Adam Posen on turning Japanese .

Equities

- HSBC is planning a thousand layoffs . The stock was down 5% in Hong Kong.

- Goldman Sach's is showing some interest in Barclays iShares unit .

- German heavy industrial Siemens is off about 4% early doors after its CEO said that the company was no longer “immune” to the effects of the global crisis stating that things had gotten a lot worse since January.

- Mining stocks are also weaker with the usual suspects i.e. Anlgo American and BHP Billiton seeing some selling after both were cut to a sell rating from RBS.

- Sainsbury's like-for-like sales ex-fuel came in at an impressive 6.2%, compared with 4.5% reported in Q3. The results were no doubt boosted by inflation in UK food (as we saw in yesterday's figures), albeit Sainsbury's are still likely to be at the front of the pack along with Morrisons.

- Tullow Oil have announced mixed drilling results with the offshore Ghana project seemingly going well while the news from their Ugandan operation was a little disappointing.

Date Today

The German IFO for March was released this morning at 09:00 GMT. The business conditions index was expected to fall to a new survey low of 82.2 and came in shade worse than expected at 82.1. All the more reason for the ECB to cut maybe even 50bps on April 2nd.

UK CBI distributive trades survey for March is out at 11:00. Retail conditions remain poor so a fall back to -35 is likely.

February's US durable goods orders will be released at 12:30. Core and headline orders should both show further weakness (expected –2.5%) in investment. US new home sales are out at 14:00. Sales should fall to 300K as new homes find it hard to compete with the big stock of unsold existing homes.

And Finally… Banker's Bailout Ball

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.