Housing Market Collapse: America's Abandoned Cities

Housing-Market / US Housing Mar 25, 2009 - 02:16 AM GMTBy: Mike_Shedlock

Flint Michigan typifies the plight of inner city urban decay. Inquiring minds are wondering what if anything can be done. MLive explores that issue in an article discussing what to do with abandoned neighborhoods in Flint .

Flint Michigan typifies the plight of inner city urban decay. Inquiring minds are wondering what if anything can be done. MLive explores that issue in an article discussing what to do with abandoned neighborhoods in Flint .

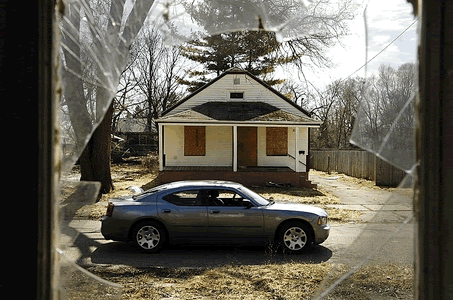

The view through an abandoned house's broken window looks out on a boarded-up house across the street on East Russell Avenue in Flint.

Look in any direction from Bianca Bates' north Flint home, and you'll see graffiti-covered siding, boarded-up windows and overgrown lots.

About half of the homes on her block are burned out or vacant magnets for drug dealers and squatters. It isn't where she thought she'd end up, but it's all she can afford to rent.

Property abandonment is getting so bad in Flint that some in government are talking about an extreme measure that was once unthinkable -- shutting down portions of the city, officially abandoning them and cutting off police and fire service.

Temporary Mayor Michael Brown made the off-the-cuff suggestion Friday in response to a question at a Rotary Club of Flint luncheon about the thousands of empty houses in Flint.

City Council President Jim Ananich said the idea has been on his radar for years.

The city is getting smaller and should downsize its services accordingly by asking people to leave sparsely populated areas, he said.

"It's going to happen whether we like it or not," he said. "We'd have to be creative about it, but it's something worth looking into. We're not there yet, but it could definitely happen."

The concept of "shrinking cities" isn't new to urban areas similar to Flint.

Last year, the city of Youngstown, Ohio, proposed incentives to encourage people to move out of nearly empty blocks and relocate to more populated areas closer to the heart of the city. Some people were offered upward of $50,000, according to news reports.

The idea was to shut down entire streets and bulldoze abandoned properties so the city could discontinue services such as police patrols and street lighting, according to a CNN report.

Razing sections of Flint, Detroit, Youngstown, and anywhere else where abandoned buildings blight neighborhoods arguably makes more sense than Obama's idea of pouring money into schools to make them more energy efficient. Moreover, this is something that could easily start today, without a lot of effort or planning. However, it might require changes in state law for cities to take over such properties.

Isolated lots would be of little commercial use but at least the gangs and drug pushers would be kicked out. Larger areas would have commercial use and could be sold to the highest bidder. Even the small lots would be of use for the neighboring houses as vegetable gardens. Anything to get the properties back on the tax rolls would be a good thing.

Bear in mind I am not a proponent of the broken window fallacy . Rather, I am proposing that razing these buildings is a better thing to do with money, and will have a better stabilizing effect on neighborhoods than most of the housing plans coming from Washington and elsewhere.

Cleaning up blight will do more to raise home prices in a non-artificial way than any plan I have seen to date.

What's interesting to me is the number of plans already on the books to take care of this blight but nothing seems to get done. The reason nothing gets done is these are not the homes banks or the wealthy care about.

Banks are far more interested in reinflating the price of $500,000 homes now fallen to $300,000 than taking care of urban blight. However, reinflating home prices cannot work because home prices needs to fall to levels that are affordable.

Homes in Flint and other such areas, have indeed fallen to their true value (less than zero). No one wants them at any price. Moreover there's little incentive for anyone to do anything about this. Thus the discussion involves "shutting down portions of Flint, officially abandoning them and cutting off police and fire service."

Our throw-away society has effectively reached a new level of efficiency : the throw-away city.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.