Roadmap to Inflation And How to Protect Your Investments

Economics / Inflation Mar 24, 2009 - 12:54 PM GMTBy: John_Mauldin

What happens when inflation once again returns. As this week's Outside the Box writer, James Montier, writes, we may want to start thinking now about inflation insurance and he mentions a few ways to do so. But this letter is a must read for his bringing to light a speech by Fed chairman Ben Bernanke in 2000 given to the Japanese, where he suggest inflation targeting:

What happens when inflation once again returns. As this week's Outside the Box writer, James Montier, writes, we may want to start thinking now about inflation insurance and he mentions a few ways to do so. But this letter is a must read for his bringing to light a speech by Fed chairman Ben Bernanke in 2000 given to the Japanese, where he suggest inflation targeting:

"In the speech, he laid out a menu of policy options that are available to the monetary authorities at the zero bound. First, aggressive currency depreciation, as per Romer's analysis of the end of the Great Depression. Second on Bernanke's list is the introduction of an inflation target to help mould the public's expectations about the central bank's desire for inflation. He mentions the range of 3-4%!"

I think you will find this week's OTB to be exceptionally thought provoking. Montier is one of my favorite economic thinkers (and a good friend). He works for Societe Generale in London in their Cross Asset Research group.

John Mauldin, Editor

Outside the Box

Roadmap To Inflation And Sources Of Cheap Insurance

by James Montier

As Albert and I regularly point out during meetings, we have never been more unsure on the inflation/deflation outlook. I have previously said I was torn between the deflationary impact of the bursting credit bubble, and the inflationary pressures of the policy response. When we read something by the deflationists we sit there nodding our heads in agreement, then we pick up something by the proponents of a return of inflation and we find ourselves agreeing with that as well. The respective sides seem deeply entrenched in their positions.

In contrast, we are trying to keep an open mind on the subject. Albert is biased towards a Japanese style outcome, and I am biased towards an inflationary outcome, but neither of us has any strong conviction.

Fisher and the debt-deflation theory of depressions

In the face of this uncertainty I decided to return to history and see what it has to say about the way out of a depression. My first point of call was Irving Fisher's "The debt-deflation theory of Great Depressions" published in 1933 1 . Fisher is probably most infamous to those in finance for his pronouncements of a new era of permanently high stock prices in 1929. But in the wake of his disastrous calls he turned to trying to understand the experience of the depression. Incidentally, he also invented the Rolodex.

In his debt-deflation theory, he posits "two dominant factors" in driving depressions "Namely over-indebtedness to start with and deflation following soon after... In short, the big bad actors are debt disturbances and price-level disturbances". He continues "Deflation caused by the debt reacts on the debt. Each dollar of debt still unpaid becomes a bigger dollar, and if the over-indebtedness with which we started was great enough, the liquidation of debt cannot keep up with the fall of prices which it causes. In that case, the liquidation defeats itself. While it diminishes the number of dollars owed, it may not do so as fast as it increases the value of each dollar owed." That is to say, debt-deflation spirals can easily become self-reinforcing.

The good news is that Fisher is also very clear on how to end a debt-deflation spiral: "It is always economically possible to stop or prevent such a depression simply by reflating the price level up to the average level at which outstanding debts were contracted by existing debtors and assumed by existing creditors... I would emphasize... that great depressions are curable and preventable through reflation and stabilization". The irony of Fisher's route out of deflation is that, probably only the Fed - after helping lead us into this mess 2 - can now get us out of it.

Romer's lessons from the Great Depression

After reading Fisher's analysis of the 1930s, I came across a recent speech given by Christina Romer, who is now the head of the Council of Economic Advisers, and who made her name in academic circles studying the events which ended the Great Depression. In the speech, Romer offers six lessons from the Great depression for the current juncture.

Lesson 1 - Small fiscal expansion has only small effects

Romer wrote a paper in 1992 3 arguing that fiscal policy was not the key driver in the recovery from the Great Depression. Not because fiscal expansion is ineffectual per se, but rather because the fiscal stimulus that was conducted wasn't large. As Romer notes "When Roosevelt took office in 1933, real GDP was more than 30% below its normal trend level... The deficit rose by about one and a half percent of GDP in 1934".

Lesson 2 - Monetary expansion can help heal an economy even when interest rates are near zero

Romer notes that actually it was the Treasury rather than the Federal Reserve that drove the monetary expansion (a peculiarity of the system under the Gold Standard). In April 1933, Roosevelt suspended convertibility to gold on a temporary basis, and the dollar depreciated. When the US returned to gold at the new higher price, gold flowed into the US, allowing the Treasury to issue gold certificates which were interchangeable with Federal Reserve notes. As Romer notes "The result was that the money supply, defined narrowly as currency and reserves, grew by nearly 17% per year between 1933 and 1936". Romer argues that this "Devaluation followed by rapid monetary expansion broke the deflationary spiral" - empirical evidence to support Fisher's hypothesis outlined above.

Lesson 3 - Beware of cutting back on stimulus too soon

The monetary expansion seems to have produced remarkable results in terms of real growth: the US economy grew by 11% in 1934, 9% in 1935 and 13% in 1936 in real terms. This lulled the authorities into thinking that all was well with the system again. Hence, in 1937, the deficit was reduced by approximately two and half percent of GDP. Monetary policy was also tightened, as Romer notes "The Federal Reserve doubled the reserve requirement in three steps in 1936 and 1937". She concludes "taking the wrong turn in 1937 effectively added two years to the Depression".

Lesson 4 - Financial recovery and real recovery go hand in hand

Romer points out the inseparable nature of the real and financial recoveries. This meshes with our analysis that the banks aren't really the problem in a debt-deflation environment, rather they are a symptom of the problem. The current policy in the US seems to be aimed at "fixing the financial system", witness Bernanke's recent comments "Recovery is not going to happen until the financial markets and the banks are stabilized". This appears to be a misperception, as, Romer notes "Strengthening the real economy improved the health of the financial system. Bank profits moved from large and negative in 1933 to large and positive in 1935, and remained high through the end of the Depression".

Investors seem to be rather excited about banks posting profits at the moment. Frankly, if a bank didn't post a profit in this environment it should be shot out of kindness. The environment for profitability from banks has rarely been better, but that doesn't make them solvent. If you were starting a business today, then setting up a bank would be a very attractive option. However, history - as represented by the balance sheet - cannot simply be ignored when it is inconvenient. As John Hussman noted "The excitement of investors last week about Citigroup posting an operating profit in the first two months of the year simply indicates that investors may not fully understand the term "operating profit." Citigroup could burst into flames while Vikram Pandit sells lemonade in the parking lot, and Citi would still post an operating profit. Operating profits exclude what happens on the balance sheet."

Lesson 5 - Worldwide expansionary policy shares the burdens

Given the worldwide nature of the current slump, Romer makes an interesting point on the effectiveness of competitive devaluations, "Going off the gold standard and increasing the domestic money supply was a key factor in generating recovery... across a wide range of countries in the 1930s... These actions worked to lower world [real] interest rates... rather than just to shift expansion from one country to another".

This is something that Albert and I have been discussing of late. We have been pondering the possibility of competitive devaluation (obviously ultimately a zero sum game in terms of exchange rates) having enough of an impact on local monetary creation to increase inflationary expectations, thus helping countries reflate. It appears as if Romer has sympathy with this view.

Lesson 6 - The Great Depression did eventually end

The final lesson that Romer offers may be of use to investors at the current juncture. She makes the point that the Great Depression did finally end. As Romer puts it "Despite the devastating loss of wealth, chaos in our financial markets, and a loss of confidence so great that it nearly destroyed American's fundamental faith in capitalism, the economy came back. Indeed, the growth between 1933 and 1937 was the highest we have ever experienced outside of wartime. Had the U.S. not had the terrible policy-induced setback in 1937, we, like most other countries... would probably have been fully recovered before the outbreak of World War II" This is a reminder that the current obsession with no scenario being too pessimistic is probably ill advised.

Bernanke and the policy options

The final source for signposts to watch comes from a speech given by Bernanke in 2000 to Japanese policy makers. As I wrote in Mind Matters 6 January 2009 , in this speech Bernanke clearly acknowledged the greater threat that deflation poses in a highly leveraged economy, "Zero inflation or mild deflation is potentially more dangerous in the modern environment than it was, say, in the classical gold standard era. The modern economy makes much heavier use of credit, especially longer-term credit, than the economies of the nineteenth century."

Bernanke clearly believes that monetary policy is far from impotent at the zero interest rate bound. In essence his argument is an arbitrage based 4 one as follows "Money, unlike other forms of government debt, pays zero interest and has infinite maturity. The monetary authorities can issue as much money as they like. Hence, if the price level were truly independent of money issuance, then the monetary authorities could use the money they create to acquire indefinite quantities of goods and assets. This is manifestly impossible in equilibrium. Therefore money issuance must ultimately raise the price level, even if nominal interest rates are bounded at zero."

In the speech, he laid out a menu of policy options that are available to the monetary authorities at the zero bound. First, aggressive currency depreciation, as per Romer's analysis of the end of the Great Depression. Second on Bernanke's list is the introduction of an inflation target to help mould the public's expectations about the central bank's desire for inflation. He mentions the range of 3-4%!

Third on the list was money financed transfers. Essentially tax cuts financed by printing money. Obviously this requires co-ordination between the monetary and fiscal authorities, but this should be less of an issue in the US than it was in Japan. Finally, Bernanke argues that non-standard monetary policy should be deployed. Effectively, quantitative and qualitative easing. Bernanke has repeatedly mentioned the possibility of outright purchases of government bonds - as the UK is now doing.

This menu should provide us with a roadmap of policy options to watch for. If (and when) the deflationary pressure builds, we should expect to see more and more of these options wheeled out. Note that we aren't talking about trying to 'fix the system', to reflate the bubble (which would be the equivalent of giving crack cocaine to a heroin addict trying to deal with withdrawal). Rather, the suggestion from Fisher is that inflation erodes the real value of debt; it is the most painless way out of our current mess. Whether the authorities can create just a little inflation remains to be seen, as does their ability to actually create inflation in any way. Such imponderables are beyond my ken.

Investment implications - Cheap insurance

Howard Marks recently suggested that today's investment decisions must focus on "value, survivability and staying power". These factors lie at the heart of the three-pronged approach that I have been suggesting since the end of October last year.

The first prong is cash. This is a legacy from the lack of opportunities that characterised markets in the last few years. But it is also a hedge against outright deflation. The second prong is deep value opportunities in both debt and equity markets (as detailed for the equity markets most recently in Mind Matters, 4 March 2009 ). The third element is sources of cheap insurance. The idea behind this element of the portfolio is to prepare for a wide variety of outcomes by buying cheap insurance (which ideally, although not always, pays off in multiple states of the world). Of course, it should be noted that the purchase of cheap equities also contains an inflation hedge element.

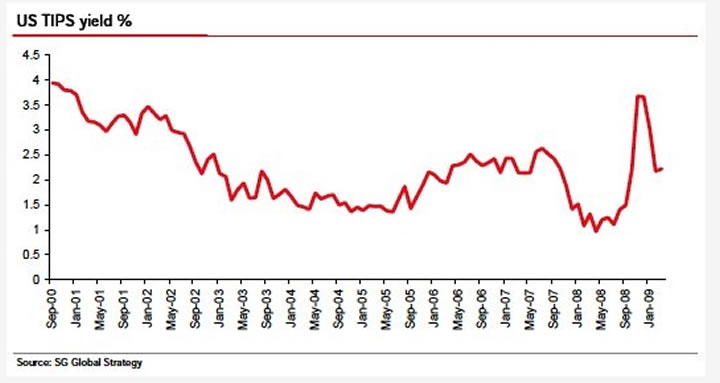

Inflation/deflation insurance I - TIPS

The first and most obvious source of inflation/deflation protection when I first started thinking about this subject was US TIPS. These bonds have a deflation floor on the principal, so in the event of deflation I receive my cash back - representing a real rate of return equivalent to whatever the deflation rate is. In the event of inflation, I get whatever the yield is on the TIPS when I purchase them plus the inflation, of course (buying the new issue TIPS avoids the problem of accrued inflation).

When I started looking at TIPS, the yield was over 3.5%. This has dropped since then, resulting in the 10 year TIPS delivering a 9% return since the end of October. The 10 year TIP is currently yielding 2.1%, against the 10 year nominal bond yield of 3%. This implies that the market expects US inflation to be a mere 1% p.a. over the next decade - this strikes me as an exceptionally low rate.

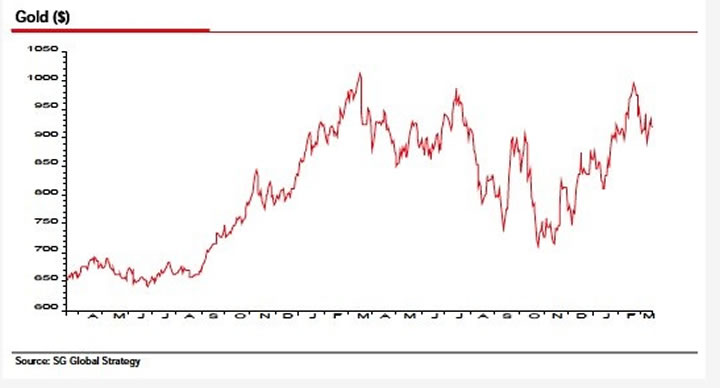

Inflation/deflation insurance II - Gold

The second inflation/deflation hedge I suggested in late October was gold. Now, gold concerns me for a variety of reasons, not least of which is that it has no intrinsic worth: I can't really value gold - beyond extraction cost.

However, it has some attractive features from an insurance point of view. Most obviously, in a world of competitive devaluations, gold is the one currency that can't be debased. Thus it provides a useful hedge against the return of this sort of beggar-thy-neighbour policy. In the event of significant prolonged deflation, what is left of our financial system is likely to collapse, thus holding a money substitute isn't such a bad idea against this cataclysmic outcome.

Of course, recently everyone has been talking about gold (not hugely surprising given that it is up some 30% since late October) - something that makes me nervous. However, gold is institutionally massively under-owned, so whilst it may have been moving up the list of attractive assets of individual investors (if the EFTs are anything to go by) and sensible hedge funds (such as the likes of Greenlight, Paulson, Third Point, Eton Park and Hayman), the mainstream institutional appetite for it has remained depressed.

Inflation insurance I - Dividend swaps

As we noted in Mind Matters, 2 February 2009 the European and UK dividend swap markets are pricing in an outcome that implies greater dividend declines than witnessed in the US during the Great Depression. The pricing then implies that essentially the dividends won't recover, pretty much forever. This strikes me as excessively pessimistic.

In addition, dividends have a relatively close relationship with inflation (as detailed in the aforementioned Mind Matters). Thus dividend swaps look like a deeply distressed asset fire sale, with the added advantage of offering inflation insurance if I buy the longer dated swaps (up around 7% from my original note in February). The most common rebuttal to my fondness for dividend swaps is counterparty risk. However, the European dividend swaps have an exchange listed future, which obviously doesn't have any counterparty issues.

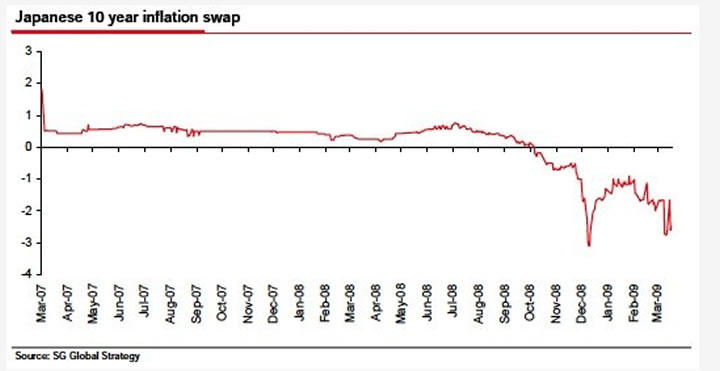

Inflation insurance II - Inflation swaps

The second of the pure inflation hedges comes via the inflation swap market. The charts below show the zero-coupon fixed rate necessary to build a swap against zero-coupon CPI appreciation over 10 years. When I first looked at the US version in January (see Mind Matters, 6 January 2009 ) the rate was a mere 1.5%. Today it has risen, although not dramatically, to 2.3%.

However, the cheapest inflation swaps in the world seem to be Japanese swaps. They are available for -2.5%! Both the US and Japanese inflation swaps strike me as cheap ways of buying inflation insurance at the moment. Although counterparty risk is obviously a significant factor in these long duration swap transactions.

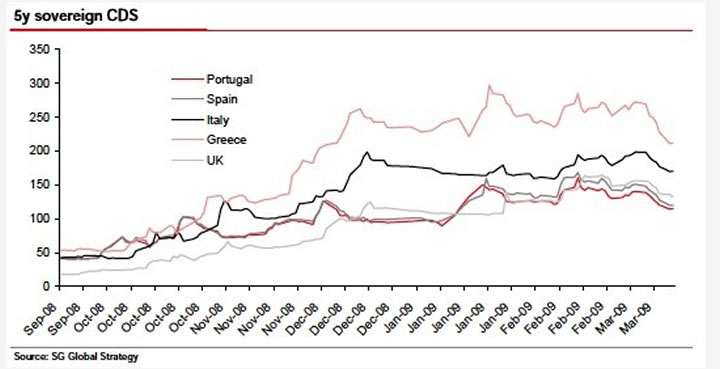

Eurozone break-up insurance: Spanish and Portuguese CDS

The final element of the insurance policy concerns the risk of a euro break-up. In a world of competitive devaluation, it isn't clear that the Eurozone will be able to stand the pressure. The one area of the world which has anything like the gold standard in place is the Eurozone. As Albert opines during our meetings with clients, this is less a function of economic realities and more a function of political expediency (I'll leave a detailed exposition of this logic to Albert in a future note).

To protect against this risk (or even rising perceptions of this risk) the natural insurance is provided by the CDS market. If even one country was to publicly contemplate leaving the Eurozone then these CDS spreads would explode. I find it hard to believe that Portuguese and Spanish CDS are below those of the UK - where we have the ability (and have used it) to print our own money.

Footnotes:

1 Available from http://www.fraser.stlouisfed.org/docs/meltzer/fisdeb33.pdf This is one of few articles published in Econometrica that I have ever read!

2 See Bill Flecksenstein's excellent book, Greenspan's Bubbles or John Taylor's insightful paper The Financial Crisis and the Policy Responses: An empirical analysis of what went wrong, available from http://www.stanford.edu?~johntayl/FCPR.pdf , or any of Albert Edwards' myriad of rants on Greenspan.

3 Romer (1992) What ended the Great Depression?, The Journal of Economic History, Vol 52

4 As Stephen Ross once said, to turn a parrot into a learned financial economist it needs learn just one word: arbitrage. To my mind economists are far too happy to rely on arbitrage assumptions to rule out solutions. Indeed the second chapter of my first book, Behavioural Finance is spent detailing failures of arbitrage (both causes and consequences thereof, including the ketchup markets!).

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.