Stock Market Final Bottom When Price Earnings Revert to Below the Mean

Stock-Markets / Financial Markets 2009 Mar 22, 2009 - 12:43 PM GMT CEP News: Fed expands collateral for TALF

CEP News: Fed expands collateral for TALF

“The Fed expanded the securities it will accept for its short-term lending program just hours before the revamped plan was set to begin.

“The program is designed to free up capital for lending by purchasing securities backed by high-quality assets from financial institutions. The Fed plans to spend about $1 trillion through the program.

“In a release on Thursday, the Fed said it will accept securities backed by mortgage servicing advances, securities backed by loans or leases relating to business equipment, and securities backed by floorplan loans.

“‘The additional new asset-backed securities categories complement the consumer and small business loan categories that were already eligible,' the Fed said in a press release.”

Source: Adam Button, CEP News , March 19, 2009.

Bloomberg: Ross says TALF will help end recession “more quickly”

“Billionaire investor Wilbur Ross talks with Bloomberg's Matt Miller in New York about auto supplier aid and the Term Asset-Backed Securities Loan Facility. Auto suppliers will get as much at $5 billion in US Treasury aid to avoid a collapse that would cripple the domestic industry, including federally funded General Motors Corp and Chrysler.”

Source: Bloomberg , March 19, 2009.

BBC News: US deficit “to hit $1.8 trillion”

“The US budget deficit will hit $1.8 trillion this year, a record amount, according to US Congress estimates.

“The White House said the prediction by the Congressional Budget Office (CBO) would not alter President Barack Obama's policy agenda. Nor would it affect its goal to cut the deficit in half by 2013, it added.

“The massive deficit forecasts come after President Obama's $3.55 trillion budget plan for the 2010 financial year, which includes big spending programs to address healthcare, education and curb greenhouse gas emissions.

“The CBO also issued gloomy forecasts for the US economy, projecting that it will contract 3% in 2009 before growing 2.9% next year and expanding 4% in 2011.”

Source: BBC News , March 20, 2009.

CNBC: Meredith Whitney - credit crunch & financials

“Weighing in on consumer credit and why mark-to-market will not really help banks, with Meredith Whitney, Meredith Whitney Advisory Group CEO.”

Source: CNBC , March 17, 2009.

Nouriel Roubini (Forbes): United States of Ponzi - behold the Madoff in the mirror

“A reporter contacted me recently with the following question:

“‘I am a reporter, and I am doing a story on Bernard Madoff's life after pleading guilty. As part of this, I was wondering if you could comment on what significance he will have in the history of this period. Will he represent more than a scamster who stole a lot of money from a lot of people? As Bernie Ebbers and Ken Lay came to embody corporate greed and deceit, what will Madoff symbolize?'

“Here is my answer fleshed out in full:

“Americans lived in a ‘Made-off' and Ponzi bubble economy for a decade or even longer. Madoff is the mirror of the American economy and of its over-leveraged agents: a house of cards of leverage over leverage by households, financial firms and corporations that has now collapsed in a heap.

“When you put zero down on your home, and you thus have no equity in your home, your leverage is literally infinite and you are playing a Ponzi game.

“And the bank that lent you, with zero down, a NINJA (no income, no jobs and assets) liar loan that was interest-only for a while, with negative amortization and an initial teaser rate, was also playing a Ponzi game.

“And private equity firms that did over a $1 trillion of leveraged buyouts (LBOs) in the last few years with a debt-to-earnings ratio of 10 or above were also Ponzi firms playing a Ponzi game.

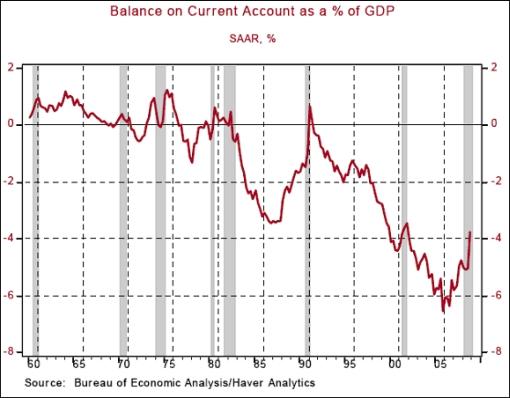

“A government that will issue trillions of dollars of new debt to pay for this severe recession and socialize private losses may risk becoming a Ponzi government if - in the medium term - it does not return to fiscal discipline and debt sustainability.

“A country that has - for over 25 years - spent more than income and thus run an endless string of current account deficit - and has thus become the largest net foreign debtor in the world (with net foreign liabilities that are likely to be over $3 trillion by the end of this year) - is also a Ponzi country that may eventually default on its foreign debt if it does not, over time, tighten its belt and start running smaller current account deficits and actual trade surpluses.”

Click here for the full article.

Source: Nouriel Roubini, Forbes , March 19, 2009.

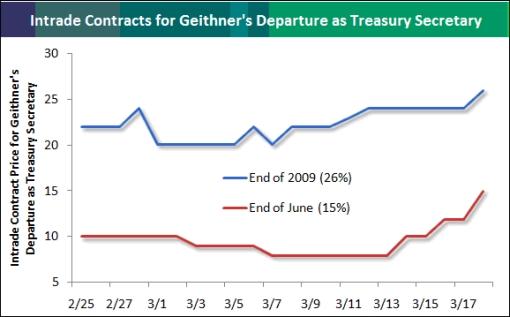

Bespoke: Geithner gone chatter

“Many stories have popped up over the last couple of days about Treasury Secretary Tim Geithner's job security. Of course, leave it up to Intrade to release a contract on the matter that people can trade. Intrade currently has two contracts allowing people to bet on Geithner's departure. One is whether he will depart by the end of June, and the other is whether he will depart by the end of 2009. While the contracts have been ticking up in price lately, traders on Intrade aren't betting big yet that his departure is imminent. The contract for Geithner's departure by the end of June is currently putting the odds at 15%, while the end of the year departure odds are higher at 26%.”

Source: Bespoke , March 18, 2009.

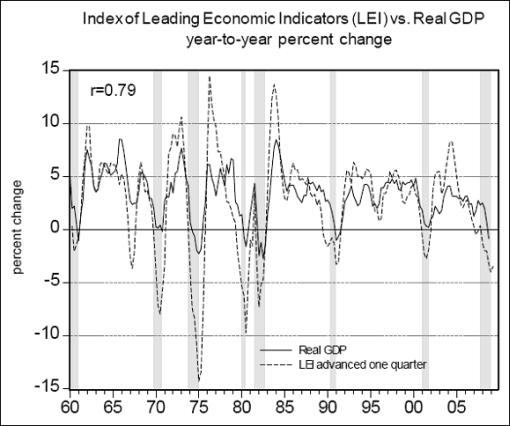

Asha Bangalore (Northern Trust): Index of Leading Indicators - continued contraction of economic activity

“The Conference Board's Index of Leading Economic Indicators (LEI) fell 0.4% in February, after a revised 0.1% increase in January (previously reported as a 0.4% increase). On a quarterly basis, the year-to-year change in the LEI advanced one quarter has a strong positive correlation with the year-to-year change in real GDP. The January-February average, the proxy for the first quarter, declined 3.5% from a year ago, a slightly smaller reduction than the 4.0% drop recorded in the fourth quarter of 2008. We are following this indicator closely to identify a turnaround in economic conditions.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 19, 2009.

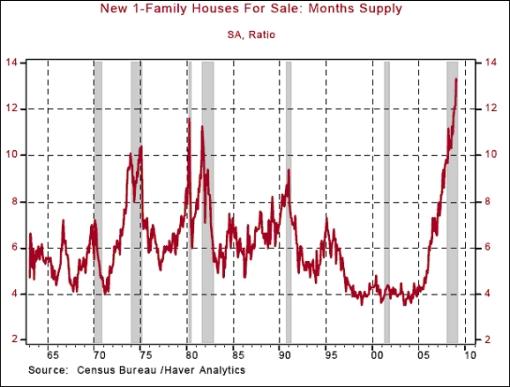

Asha Bangalore (Northern Trust): Multi-family starts lift total housing starts

“Housing starts increased 22.2% to an annual rate of 583,000 during February, after posting double digit declines for three consecutive months. However, the bulk of the increase was from multi-family starts which rose 82.3%, while starts of single-family homes moved up only 1.1% to an annual rate of 357,000.

“Starts of single-family homes are still down 80.5% from the peak in January 2006.

“The surprise strength in housing starts in February, which was largely in the volatile multi-family sector, reduces expectations of a continued recovery of home building because single-family starts are the larger and more stable component of total housing starts. Moreover, the elevated inventory of unsold homes suggests that a robust recovery in home building will be possible only after there is a substantial reduction in the inventory of unsold new single-family homes.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 17, 2009.

Bill King (The King Report): Don't trust housing starts

“The common excuse for Tuesday's rally is the surge in condo construction that boosted housing starts. PUHLEASE! The wicked winter delayed construction. More importantly, from where will the jobs, income and financing to buy all the condos and homes be derived?

“Also, the spring selling season is commencing and we don't know what seasonally adjusted magic was used to craft the numbers.”

Source: Bill King, The King Report , March 18 , 2009.

Asha Bangalore (Northern Trust): Current account deficit shrinks as imports fall

“The current account deficit of the US economy was $132.8 billion in the fourth quarter, down from $181.3 billion in the third quarter. During 2008, the current account deficit narrowed to $673.3 billion from $731.2 billion in 2007. This is the smallest current account deficit since 2004.

“The current account deficit as a percent of GDP was 3.7% in the fourth quarter of 2008, the lowest since the fourth quarter of 2001. On an annual basis, the current account deficit was 4.7% of GDP, the lowest since 2002. In sum, the current account deficit has narrowed to a significant extent.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 18, 2009.

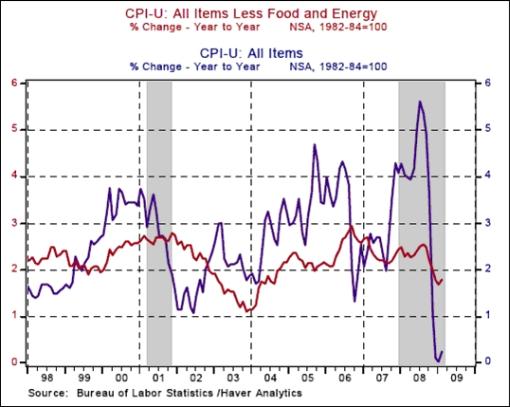

Asha Bangalore (Northern Trust): Higher gas prices mostly responsible for sharp increase in CPI

“The Consumer Price Index (CPI) moved up 0.4% in February, following a 0.3% increase in January. Gains of the energy price index in January (+1.7%) and February (+3.3%) helped to raise the headline readings during these months. The Labor Department has indicated that about two-thirds of the all items increase was from higher prices for gasoline. The gasoline price index increased 8.3% in February after a 6.0% jump in January. The food price measure rose 0.1% in January and was followed by a 0.1% drop in February. Excluding food and energy, the core CPI has recorded gains of 0.2% in January and February. On a year-to-year basis, the CPI rose 0.2% in February after registering readings close to zero in each of the two prior months. The core CPI increased 1.79% in February versus a 1.68% increase in January.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 18, 2009.

Asha Bangalore (Northern Trust): Core wholesale prices show a moderating trend

“The Producer Price Index (PPI) for Finished Goods rose only 0.1% in February after a 0.8% gain in January, as the 1.6% drop in food prices offset the 1.3% jump in energy prices. The core PPI, which excludes food and energy, rose 0.2% in February compared with the 0.4% increase in the prior month.

“On a year-to-year basis, the finished goods wholesale price index fell 1.3% and the core PPI rose 4.0%. The core PPI posted a cycle high of 4.7% in October 2008.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 17, 2009.

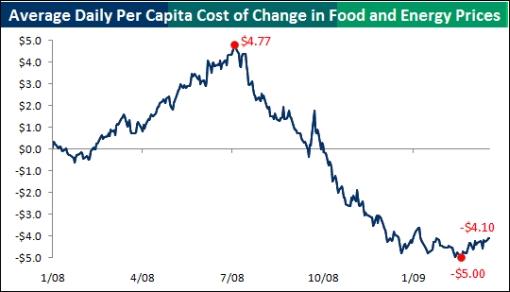

Bespoke: The commodity rebate

“In the chart below we have calculated the cumulative daily price change of the major food and energy commodities in the CRB index (Corn, Soy, Wheat, Cattle, Hogs, Oil and Natural Gas) since the beginning of 2008. We then multiplied the changes by the annual per capita consumption of each item. While this method may oversimplify the actual costs, it provides a good idea of how changes in commodity prices have impacted consumers' wallets over the last 15 months.

“In July, when the price of oil and other key commodities were trading at record highs, the impact of rising prices was translating into an extra $4.77 per American per day versus the start of 2008.

“Ever since then, however, commodities have crashed back down to earth, resulting in an effective rebate for consumers. As a result, even after the recent rebound in oil prices, the average American is saving $4.10 per day due to lower commodity prices. While this may not sound like much, multiplied out over a year, it works out to just under $1,500 per year per individual, and nearly $6,000 per year for a family of four.”

Source: Bespoke , March 18, 2009.

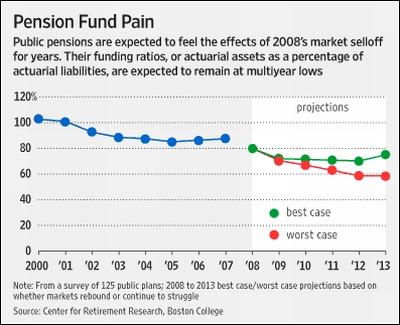

The Wall Street Journal: Pension bills to surge nationwide

“Many state and city governments reeling from financial woes are about to get whacked again, this time by an unforeseen increase in their pension bill thanks to market declines.

“In an effort to stave off tax increases, New Jersey lawmakers on Monday will consider a bill that would allow municipalities to defer payment of half their annual pension bill, due April 1, for one year. Those towns, counties and schools that opt to defer would face a higher pension bill for years to come.

“Other states and municipalities are facing similarly difficult choices. In Pennsylvania, the state employees and public teachers pension funds both have warned that employer contribution rates could surge seven-fold from about 4% of payroll to 28%, starting in 2012. The Detroit police and fire pension plan might have to double employer contribution rates to 50% of payroll by 2011, according to the fund's outside actuary.

“‘It's going to be huge showdown' between taxpayers and public employees, said Susan Mangiero, president of Pension Governance, a consulting and research firm in Trumbull, Conn. ‘The anger is more acute today when people are feeling economic hardship.'”

Source: Craig Karmin, The Wall Street Journal , March 16, 2009.

CEP News: US House passes bill to take back AIG bonuses

“The US House of Representatives passed a bill on Thursday that will recoup the majority of bonuses paid to AIG executives.

“AIG paid out $165 million in bonuses to executives after the company received up to $180 billion, in government aid, many executives whom politicians say were responsible for bringing the company to near-collapse.

“The US government kept the insurance giant on a lifeline by dumping several multi-billion dollar bailouts into it. The US government now owns 80% of the company.

“The bill passed by the House Thursday will impose a 90% tax on any bonuses paid out to executives earning $250,000 a year or more working at companies given more than $5 billion in government bailout cash.”

Source: Megan Ainscow, CEP News , March 19, 2009.

DK Matai (Silicon Valley Watcher): The size of derivatives bubble = $190K per person on planet

“According to various distinguished sources including the Bank for International Settlements (BIS) in Basel, Switzerland - the central bankers' bank - the amount of outstanding derivatives worldwide as of December 2007 crossed USD 1.144 Quadrillion, i.e., USD 1,144 Trillion. The main categories of the USD 1.144 Quadrillion derivatives market were the following:

1. Listed credit derivatives stood at USD 548 trillion;

2. The Over-The-Counter (OTC) derivatives stood in notional or face value at USD 596 trillion and included:

a. Interest Rate Derivatives at about USD 393+ trillion;

b. Credit Default Swaps at about USD 58+ trillion;

c. Foreign Exchange Derivatives at about USD 56+ trillion;

d. Commodity Derivatives at about USD 9 trillion;

e. Equity Linked Derivatives at about USD 8.5 trillion; and

f. Unallocated Derivatives at about USD 71+ trillion.”

Source: DK Matai (via Silicon Valley Watcher ), October 16, 2008.

Fabius Maximus: A look at the new world - after the downturn

1. Far less risk-taking in America.

2. Our financial system swings from disintermediation to re-intermediation.

3. The government becomes obviously insolvent.

4. Government controls not just the risk-free rate of interest, but also risk premia.

5. The end of the US dollar as the reserve currency.

6. The end of the US empire.

7. The US dollar declines in value so that our trade deficit goes away, and we can pay our foreign debts.

Source: Fabius Maximus (via RGE Monitor ), March 19, 2009.

CNBC: Treasurys are “disaster waiting to happen”

“The Federal Reserve has no option but to start buying Treasurys as the government's needs for financing are huge, but the government bond market is a disaster in the making, Marc Faber, editor and publisher of The Gloom, Boom & Doom Report, told CNBC.”

“Federal Reserve policymakers start a two-day meeting on Tuesday, weighing options on how to spur lending to help cash-strapped consumers kickstart the economy.

“Economists expect them to leave rates at zero and look to other ways of boosting liquidity, such as buying government bonds - a measure which has already been taken by the Bank of England.

“‘Well I think other central banks have done it already around the world but basically what it amounts to is money printing and in fact I don't think that it will help the bond market at all in the long run,' Faber told CNBC's Martin Soong.

“‘… I think the US government bond market is a disaster waiting to happen for the simple reason that the requirements of the government to cover its fiscal deficit will be very, very high,' Faber said.

“‘The Federal Reserve will have to buy Treasurys, otherwise yields will go up substantially,' he said, adding that as their reserves were dwindling, foreign investors were likely to scale down their purchases.

“But there will be a time when the Federal Reserve will have to increase interest rates to fight inflation, and it will be reluctant to do so because the cost of servicing government debt will rise substantially.

“‘So we'll go into high inflation rates one day,' Faber said.

“The stock market is likely to continue its bounce at least for a while, but the outlook is bleak, he added.

“‘I think we may still have a rally (in the S&P) until about the end of April and probably then a total collapse in the second half of the year sometimes, when it becomes clear that the economy is a total disaster,' Faber said.”

Source: CNBC , March 17, 2009.

John Authers (Financial Times): Fed's shock and awe

“John Authers on market reaction to the Federal Reserve's decision to buy $300 billion in long-dated Treasury bonds.”

Click here for the article.

Source: John Authers, Financial Times , March 18, 2009.

Bespoke: S&P 500 financial sector approaches November lows

“It's hard to believe, but even after the financial sector's 50%+ rally since March 6th, it is still marginally below its closing low of 2008 on November 20th. As shown below, the sector is currently at levels that have the potential to provide short-term resistance.”

Source: Bespoke , March 19, 2009.

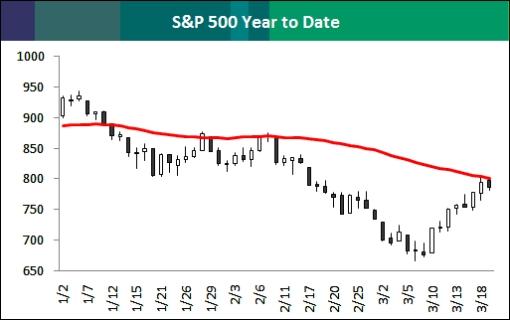

Bespoke: S&P 500 stops dead in its tracks at 50-day moving average

“As shown in the candlestick chart of the S&P 500 below, the index tested and then failed at its 50-day moving average resistance this morning. After a gain of nearly 20% off of its lows, the index is experiencing a bit of a pullback today. The 50-day is right at the 800 level for the S&P, and if the index can eventually break through it, it will then act as support instead of an upside barrier.”

Source: Bespoke , March 19, 2009.

Richard Russel (Dow Theory Letters): What are the signs of a final bottom?

“Will the evidence come from the D-J Averages? I think it might. At the final bear market bottom, we should see:

(1) a dramatic non-confirmation by either the Industrials or the Transports (this is what occurred in 1974).

(2) or we might see an extended ‘line' in the Averages, in which the Averages fluctuate within a 5% zone for many weeks on low volume. At some point both averages will surge higher on increasing volume.

(3) Values - We will see blue chip stocks selling ‘below known values' with P/E ratios at single digits and the yield on the Dow near 6%.

“In the area of the final bear market lows, public attitude towards stocks and the stock market will be black-pessimistic and even angry. Wall Street will be despised and denounced as a scam. Actually, we are beginning to see just a bit of that via the highly-publicized debate between Jim Cramer and John Stewart, in which Stewart literally calls both Cramer and Wall Street a fraud.

“Already the public is turning against Wall Street, and, of course, the Bernie Madoff scheme only adds to the public anger against the ‘crooks of Wall Street'. Already, the ‘buy and hold' creed (religion?) is being denounced along with the image of stocks as wealth-building vehicles. Warren Buffett is being tarred and feathered - Berkshire Hathaway lost billions of dollars over the last year, despite Buffett's cheer-leading role a few months ago when he announced that he was buying stocks.

“Taking it to the present, the big question is whether we have already seen the bottom of the bear market and whether the recent strength in the market is the beginning of a new bull market. My opinion is that the latest rally is part of a bear market correction - not the beginning of a new bull market. The primary trend was recently re-confirmed as bearish when both the Industrials and the Transports broke to simultaneous new lows.

“One hint as to where we are is that prior to a major low, Lowry's Selling Pressure Index (supply) turns down while their Buying Power Index (demand) leads on the upside. This did not occur at or near the recent lows.”

Source: Richard Russell, Dow Theory Letters , March 16, 2009.

Forbes: Barry Ritholtz on whether the stock market is near the bottom

Source: Forbes, March 16, 2009.

Richard Bernstein (Banc of America Securities-Merrill Lynch): The best risk-reward potential

“Small-cap stocks have historically offered the best risk-reward potential to investors, while gold has offered the worst, says Richard Bernstein, chief investment strategist at Banc of America Securities-Merrill Lynch.

“He says: ‘Investors often lose sight of longer-term historical investment results, especially during short-term periods of extreme volatility and trending markets.

“‘We have investigated the true long-term risk/return characteristics of standard asset classes.'

“Instead of defining risk as the standard deviation of returns, Mr Bernstein defined it as the percentage of the historical returns that were negative. If an asset provided a negative return during five of 25 periods studied, the risk measure would be 20%.

“Mr Bernstein says longer time horizons tend to reduce the probability of losing money in an investment - although gold appeared to be an exception.

“He said: ‘Gold was the only asset class that generated a significant proportion of negative returns over 10-year periods.

“‘Small stocks offered the best risk/reward potential, regardless of time horizon.

“‘With the exception of gold, investors had little chance of losing money in our selected asset classes over 10-year time periods.

“‘Only in the current bear market did many equity benchmarks generate their first trailing 10-year losses for the periods we analysed.'”

Source: Richard Bernstein, Banc of America Securities-Merrill Lynch (via Financial Times , March 18, 2009.

Reuters: China and Russia question dollar's reserve status

“China and other emerging nations back Russia's call for a discussion on how to replace the dollar as the world's primary reserve currency, a senior Russian government source said on Thursday. Russia has proposed the creation of a new reserve currency, to be issued by international financial institutions, among other measures in the text of its proposals to the April G20 summit published last Monday.

“Calls for a rethink of the dollar's status as world's sole benchmark currency come amid concerns about its long-term value as the US Federal Reserve moved to pump more than a trillion dollars of new cash into the ailing economy late Wednesday.

“Russia met representatives of China, India and Brazil ahead of the G20 finance ministers meeting last week, as the big emerging powers seek to up their influence on decision-making globally. Their first ever joint communiqué did not mention a new currency but the source said the issue was discussed.

“‘They (China) did not formally put forward their position for the G20 summit but unofficially they had distributed their paper regarding the same ideas (the need for the new currency),' the source told Reuters, speaking on condition of anonymity.

“The source said the Chinese paper envisaged the International Monetary Fund's Special Drawing Rights (SDRs) being first assigned a role of a clearing currency on some transactions and then gradually becoming the main global reserve currency. ‘They said that the role of reserve currency should be given to SDR,' the source said.”

Source: Gleb Bryanski, Reuters , March 19, 2009.

Globalists: Skip Amero, bring on Acmetal

“Nobel Laureate Robert Mundell, the man behind the euro, is backing a proposal by Kazakh President Nursultan Nazarbayev to create a one world currency.

“That's quite an endorsement for Nazarbayev, who is indisputably one of the world's most corrupt dictators (he's been running Kazakhstan since the Soviet era).

“Supporters of the currency, to be called the acmetal (or akmetal), say the proposal ‘holds great promise'.

“But I wonder, as Alan Watt did in his March 12 radio show, ‘Holds great promise for whom?'

“Nazarbayev, speaking at an economic forum in the glitzy new capital he has built on the Kazakh steppe, defended his proposal for the ‘acmetal' world currency saying it might ‘look kind of funny' but was not.”

Source: Mark Baard, Globalists , March 14, 2009.

CNBC: Dr Gloom - choose gold over AIG insurance

“Marc Faber, editor & publisher of The Gloom, Boom & Doom Report, a.k.a. Dr Gloom, would rather own gold as an insurance policy, than an insurance policy from AIG. He tells CNBC's Amanda Drury how else he is investing his money.”

Source: CNBC , March 17, 2009.

Richard Russell (Dow Theory Letters): Why I am bullish on gold

“I started building my gold position in 1999. At the time gold was flat on its fanny well below 300 - what few gold mining shares were still alive were selling under $5. I wrote at the time that many gold shares were so cheap that you could buy them as if they were perpetual warrants. My gold position now is comparable to my market position back in 1958. My gold position represents maybe 30% of my total worth. Why have I done this again?

“For the following reasons:

(1) I believe gold is in a major or primary bull market. I believe the gold bull market is currently in its second phase. This is the phase where sophisticated and seasoned investors and the funds enter the market. I don't believe the public is in the gold market to any extent. They are interested and watching the action, but they do not have the nerve to buy gold. In fact, the public doesn't know how to buy gold, although ads are now appearing telling them of the ‘wonders' of gold and how they can buy the coins (at huge premiums over spot gold).

(2) If there is only one bull market in progress, it will attract broad new coverage and attention - just as Thursday's $70 rise in gold did.

(3) I believe the bear market in stocks will continue erratically and the deflationary trends will persist. This will drive Fed Chairman Bernanke up the wall, and I think he will stop at nothing (including massive printing of dollars) in his effort to halt deflation.”

Source: Richard Russell, Dow Theory Letters , March 20, 2009.

David Fuller (Fullermoney): IMF gold sales not great concern

“While I remain a long-term bull of gold and other precious metals, I have often mentioned in the last two years that we should expect some IMF gold sales to increase their lending capacity.

“Yesterday, I discussed this with a subscriber who used to work for the IMF. In addition to confirming that an additional $500 billion has been agreed for the IMF, he mentioned that each contributing country could pay 75% of their allocation in their own currencies, and the remaining 25% in either another viable currency or gold.

“Clearly, an extra $500 billion will not be sufficient in what is arguably the worst global recession since the '30s. Additional contributions will be required. It is not unreasonable to assume that US, UK and most likely some other countries will print the 75% in their own currencies. Presumably individual Euroland countries cannot print euros but the ECB can and almost certainly will. This reinforces the long-term bullish outlook for gold.

“However, the prospect of IMF sales is a headwind for bullion. There are likely to be more central bank sales of gold under the Washington Agreement, than purchases by creditor nations during the economic slump. I also mentioned that gold had become a crowded trade on the brief look at $1000 in late February, adding that since fear was the most recent motive to buy gold, the yellow metal would be susceptible to a correction once stock markets firmed.

“I think any IMF gold sales would be handled discretely and it could also be a case of: ‘Sell the rumour, buy the news.'”

Source: David Fuller, Fullermoney , March 18, 2009.

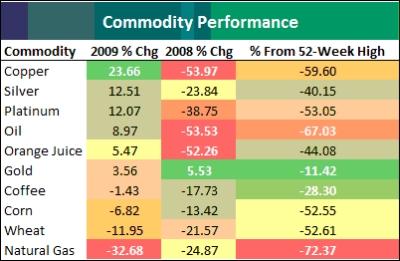

Bespoke: Bespoke's commodity snapshot

“Below we provide a table and chart of the recent performance of ten major commodities. As shown, copper is up the most year to date at 23.66%. Copper is followed by silver, platinum, and oil on the upside. At the start of the year, we pointed out that gold had been significantly outperforming silver, and that a long silver/short gold strategy may be a good play. That trade has worked out well so far this year. A similar trend has been happening with oil and natural gas lately, where oil has been rallying and natural gas has continued its decline. From their peaks last year, gold is still the commodity that has held up the best.”

Source: Bespoke , March 17, 2009.

Money News: Gartman - oil headed higher, sooner

“Economist Dennis Gartman, editor of the Gartman Letter, says oil is headed higher, possibly to $50 or $55 per barrel within the next three months.

“‘A huge sum of oil has been put in storage,' Gartman told Bloomberg TV. ‘Over many months, when the contango was extraordinarily wide, you could make almost 30% or more.'

“Contango refers to the situation when distant-month futures contracts trade at a higher price than front-month contracts. In a wide contango, prices would be much higher in far out months than nearby ones.

“You make money off that ‘by buying front month crude, taking delivery if you had the storage facilities, and then selling deferred futures,' Gartman says.

“‘If you were borrowing money at 5% and lending money via the crude future contango at 35%, you would have locked in profit.'

“But now, Gartman says, ‘we are seeing the inordinately wide contango coming in dramatically. When contango narrows, it is really saying to crude itself, we need you. There's demand; please come out of storage.'

“Bottom line: ‘That's bullish for crude,' he says. “We can trade to $50 maybe $55 over the next two to three months,' Gartman says.”

Source: Money News , March 13, 2009.

CEP News: Euro Zone industrial output falls at sharpest pace on record

“Euro zone industrial production fell at its sharpest pace on record to kick off the year, Eurostat reported on Friday.

“In the 12 months to January, euro zone industrial production fell 17.3%, down from both the 15.5% tumble expected and December's 11.8% contraction.

“On a monthly basis, industrial output fell 3.5% in January, adding to the previous month's 2.7% slide, which was revised down from -2.6%. Economists had expected a more pronounced decline of 4.0% for the month.”

Source: CEP News , March 20, 2009.

CEP News: German investor sentiment rises for fifth consecutive month

“German investor optimism towards the economic outlook continued to gain strength in 2009, according to the Centre for European Economic Research (ZEW).

“In a press release issued on Tuesday, the ZEW reported that investor sentiment rose to a reading of -3.5 in March, despite expectations of a fall back to -8.0 from -5.8 in February.

“While the improvement from February to March has slowed compared to previous months, the impression remains that investors are becoming more hopeful regarding the German economic outlook in six-months time, the ZEW said.

“‘According to the financial market experts, the economic slowdown is gradually phasing out,' ZEW President Dr. Wolfgang Franz said. ‘The bottom of the recession is likely to be reached this summer.'

“Meanwhile, euro zone investor confidence also unexpectedly improved in March, rising to a reading of -6.5 from -8.7 previously. Economists had forecast a fall back to -12.0 for the month.”

Source: CEP News , March 17, 2009.

CEP News: EU leaders agree to stimulus spending, to increase aid to non-EMU members

“European Union leaders have agreed in principal to double the amount of aid allowed to non-euro zone member states and have reached a compromise on infrastructure project spending.

“Speaking to reporters following the first day of an EU summit held in Brussels on Thursday, Czech Prime Minister Mirek Topolanek said that the EU heads of state were close to agreeing on a €5 billion stimulus spending plan.

“Germany had raised concerns, but later compromised when it was agreed that the funds, to be used for infrastructure projects, would be spent by the end of next year.

“‘Substantial parts' of the projects would need to be in progress by then, ‘otherwise it won't contribute to dealing with the crisis, which will be over after a certain period of time,' German Chancellor Angela Merkel said.

“Also speaking to the press on Thursday, European Commission President Jose Manuel Barroso said that the maximum amount of aid available to EU states outside the monetary union could rise to €50 billion from its current €25 billion level.

“The EU also pledged to increase funding to the International Monetary Union. The amount ‘should be quite a large figure', Czech Finance Minister Miroslav Kalousek said to reporters late Thursday evening, adding that the range would likely be between €75 billion and €100 billion.”

Source: CEP News , March 20, 2009.

CEP News: UK house prices higher for second consecutive month

“UK house prices climbed 0.9% month-over-month to an average asking price of £218,081 in March following a 1.2% gain in February, according to property website Rightmove.

“The two consecutive months of gains come after three straight months of losses that saw the average price fall from £229,691 in October.

“On an annualized basis, house prices declined 9.0% in March, slightly less than the 9.1% annual decline in February.”

Source: Adam Button, CEP News , March 15, 2009.

Financial Times: Swiss warn lifting secrecy “will take time”

“Switzerland has warned countries against expecting swift results from its decision last week to water down bank secrecy laws, saying it could take years for the necessary legislation to come into action.

“Hans-Rudolf Merz, Switzerland's finance minister, said renegotiating the country's more than 70 double taxation treaties ‘won't be so fast' as each would have to be approved individually by the country's parliament.

“New treaties could be subject to referendums, he told the Financial Times in an interview, while putting in place the rules prescribed by of the Organisation for Economic Co-Operation and Development would also require negotiations and ‘will take time'.

“The comments from Mr Merz, who is head of state under Switzerland's rotating presidency, came as some of the countries that have pressed hard for greater international tax transparency greeted last week's move with caution.”

Source: Haig Simonian, Financial Times , March 16, 2009.

RGE Monitor: China now expected to grow by 6.5% in 2009

“In a series of downward revisions, the World Bank is the latest to reduce its forecast of 2009 economic growth in China. As with many export-led economies, China has been hit hard by the precipitous decline in export demand, falling 25.7% in February 2009. For this reason, the World Bank reduced its 2009 growth forecast for China 1% to 6.5%. You can watch the World Bank's quarterly update on video here.

“The new World Bank forecast is in line with that of the IMF; the IMF downgraded their forecast of 2009 Chinese economic growth to 6.7% at the end of January.

“The Chinese government recognizes that export-led growth is not sufficient in the current economic environment. In addition to supporting its export sector - the government plans to reduce export taxes to zero - the Chinese government is focusing on the domestic economy with fiscal stimulus measures and promoting domestic consumption. The fiscal stimulus already in place (4 trillion yuan announced in November) is probably passing through to the economy, as China's PMI increased for the third consecutive month in February.

Chinese growth is expected to improve in 2010, where the World Bank forecast is 8.0%.”

Source: Rebecca Wilder, RGE Monitor , March 18, 2009.

China Daily: Slide in reserves reported

“China's foreign exchange reserves slid the most in at least nine years in January, Reuters reported yesterday, citing an unidentified person ‘familiar with the situation'.

“The Reuters report did not disclose the exact amount of declining reserves, but said the decline was partly due to the US dollar's appreciation and withdrawal of capital by foreign companies and investors hurt by the financial crisis.”

Source: China Daily , March 18, 2009.

CEP News: Chinese entrepreneur sentiment improving, says PBOC

“Chinese entrepreneur sentiment is recovering, while firms appear less worried about the economy, the People's Bank of China said on Wednesday.

“According to the central bank's first quarter entrepreneur survey results, sentiment regarding business operations is recovering. Meanwhile, bank lending levels have improved, as reflected in the sharp gain in the bank lending index, the PBOC added.

“Nevertheless, firms' domestic and foreign orders indexes are still deteriorating, pointing to ongoing weakness in overall demand levels, the central bank said.”

Source: Todd Wailoo, CEP News , March 11, 2009.

Herald Tribune: Medvedev announces plan to rearm Russia

“President Dmitri A. Medvedev said Tuesday that Russia would begin a ‘large-scale rearming' in 2011 in response to what he described as threats to the country's security.

“In a speech before generals in Moscow, Mr. Medvedev cited encroachment by NATO as a primary reason for bolstering the military, including nuclear forces.

“Mr. Medvedev did not offer specifics on how much the budget would grow for the military, whose capabilities deteriorated significantly after the fall of Soviet Union.

“Russia has increased military spending sharply in recent years, but with the financial crisis and the drop in the price of oil, the country's finances are under pressure, suggesting that it would be hard to lift these expenditures further.

“Even so, Mr. Medvedev's timing was notable. He is expected to hold his first meeting with President Barack Obama in early April in London on the sidelines of the summit meeting of the Group of 20 industrialized and developing countries.”

Source: Clifford J. Levy, Herald Tribune , March 17, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 19, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.