Fed Hits Panic Button and Signals Trillions of Dollars Will be Printed to Buy Bonds

Interest-Rates / Quantitative Easing Mar 22, 2009 - 10:17 AM GMT Phew - what a week! What an announcement!

Phew - what a week! What an announcement!

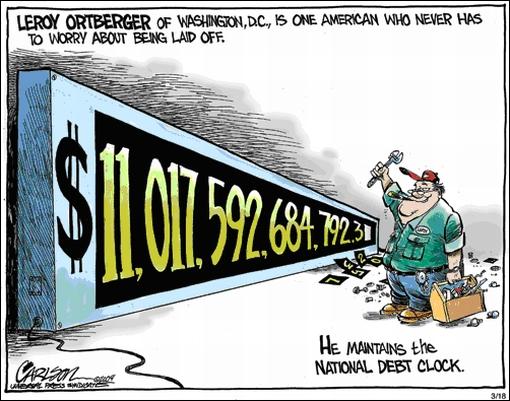

The Federal Open Market Committee (FOMC) on Wednesday left the Fed funds range unchanged at zero to 0.25%, but stunned the financial markets with an announcement that it would purchase up to $300 billion in longer-term Treasuries over the next six months.

Acting boldly in an attempt to get the economy breathing again, the policy board also committed to purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, as well as a further $100 billion in agency debt.

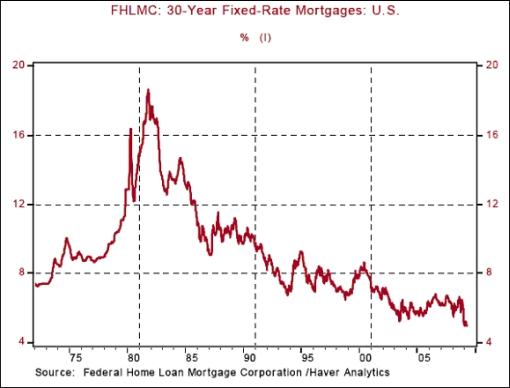

The objective of purchasing Treasuries is to orchestrate a reduction in long-term rates in the expectation that these lower rates would filter through to mortgage rates and other private sector loans. The average 30-year fixed-rate mortgage fell to 4.98% on Thursday, down from 5.47% in early December and a high of 6.46% in mid-October (see Freddie Mac 's weekly survey).

“They're calling it ‘ The Rambo Fed ‘,” said Richard Russell ( Dow Theory Letters ). “Bernanke is not fooling around any longer. He's playing all his cards. He's going to put a floor under housing and boost asset prices in an all-out attack on the bear market. Bernanke will in no way accept deflation. The Fed will go all out in printing Federal Reserve Notes in its massive assault on deflation. Bernanke will accept a collapsing dollar rather than a repeat of the Great Depression.”

“These actions are high-quality bond-friendly and dollar-unfriendly,” commented Bill Gross of Pimco (via Reuters ). “To the extent that they are successful and Treasury efforts match these efforts, certain risk assets may benefit as well, although their ultimate prices will reflect the ability of government to successfully reflate.”

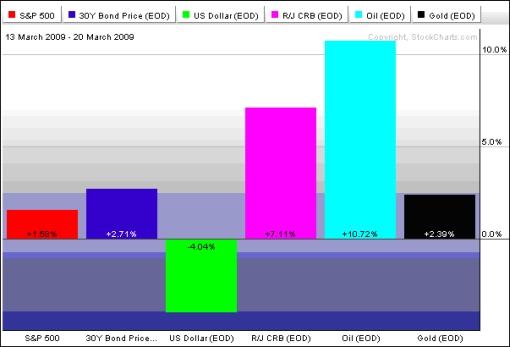

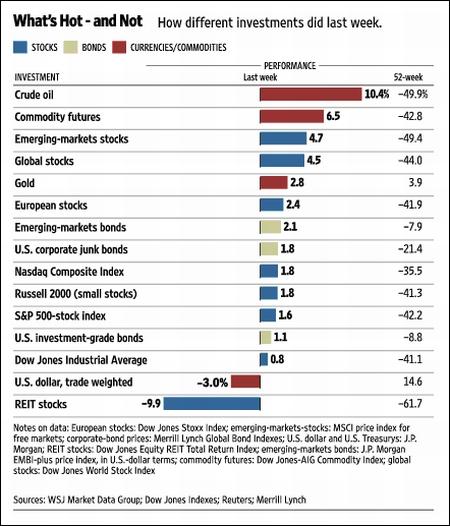

On the announcement, the yield on the US ten-year Treasury Note recorded its sharpest fall since the Wall Street crash of 1987, the US dollar suffered its biggest weekly loss for almost 25 years, gold bullion surged by more than $80 at one stage, and oil and base metals gained handsomely.

The performance of the major asset classes is summarized by the chart below, courtesy of StockCharts.com .

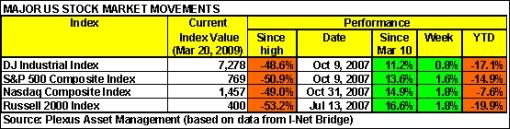

Stock markets initially rose strongly on the Fed's move to revive the economy, adding to the gains of the rally that commenced on March 10. Although stocks succumbed to profit-taking towards the close, indices nevertheless managed to register a second straight week of gains - the first such stretch since May 2008 in the case of the US bourses.

Elsewhere in the world stocks also performed strongly, with the MSCI World Index gaining 4.4% (YTD -14.2%) and the MSCI Emerging Markets Index ahead by 4.7% (YTD -2.5%). Returns ranged from +17.7% in the case of Romania to -5.6% for Bermuda. The Shanghai Composite Index (+7.2%) had another solid week and remains at the top of the field for the year to date with a 25.0% gain in US dollar terms. (Click here to access a complete list of global stock market movements, in local currency terms, as supplied by Emeginvest .)

As far as US exchange-traded funds (ETFs) are concerned, John Nyaradi ( Wall Street Sector Selector ) reports that the strongest sectors this week were energy, commodities and emerging markets. Leaders included SPDR S&P Oil and Gas Exploration (XOP) (+7.6%), PowerShares Commodity Tracking Index (DBC) (+9.4%) and iShares MSCI South Korea Index (EWY) +7.5%. On the other end of the performance spectrum Real Estate Investment Trust (REIT) stocks had a torrid time, with SPDR DJ Wilshire REIT (RWR) losing 12.3% and Vanguard REIT (VNQ) down by 10.3%.

Notwithstanding supply concerns and a US budget deficit expected to hit $1.8 trillion this year, government bond yields around the globe declined as the US central bank joined the Bank of England, the Bank of Japan and the Swiss National Bank in a policy of quantitative easing. Yields of 10-year Treasuries and Bunds were down by 22 and 5 basis points respectively on the week. However, the yield on the 10-year Gilt rose by 7 basis points even as the Bank of England continued to buy long-dated bonds.

“… I think the US government bond market is a disaster waiting to happen for the simple reason that the requirements of the government to cover its fiscal deficit will be very, very high,” said Marc Faber in a CNBC interview. “There will be a time when the Federal Reserve will have to increase interest rates to fight inflation, and it will be reluctant to do so because the cost of servicing government debt will rise substantially.”

Not surprisingly, the US dollar got whacked. According to Bespoke , the US Dollar Index had its third biggest one-day decline (-2.69%) on Wednesday since daily pricing started back in 1970. The greenback broke below its 50-day moving average and short-term uptrend, but is still trading above its 200-day moving average and longer-term uptrend. Given the Fed's “nuclear” strategy, further damage appears likely.

Source: StockCharts.com

In the expectation that the Fed's printing of massive amounts of money will stoke inflationary pressures, Treasury Inflation-protected Securities (TIPS) surged to a level last seen in October 2009, as shown by the performance of iShares TIPS Bond ETF (TIP).

Bernanke's “inflate or die” approach also caused gold bullion to shine. After having traded below $884 prior to the Fed's announcement, the yellow metal rose sharply to $967 before easing back to close the week at $952.

Commodities benefited as the Fed's announcement saw the US dollar nose-diving, with West Texas Intermediate Crude (+10.7%) rising above $50 for the first time since November. Similarly, copper touched a four-month high as the price breached $4,000 a metric ton.

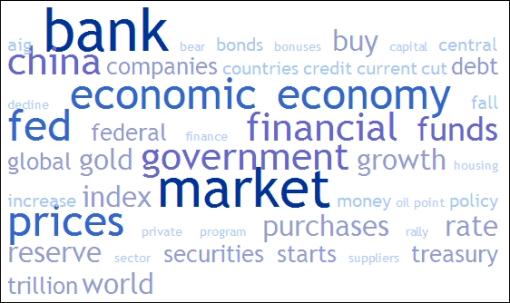

Next, a tag cloud of al the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “bank”, “market”, “economy”, “Fed” and “government” featured prominently, whereas “China” is also attracting more attention by the week.

Turning to the stock market again, the 800 level on the S&P 500 Index needs to be exceeded for stocks to make further headway. It not only represents a 50% retracement of the January/March decline, but is also the resistance level of the two-month downtrend and the 50-day moving average.

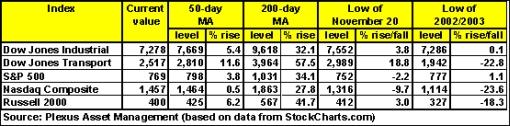

The key chart levels for the major US indices are provided in the table below.

Kevin Lane, technical analyst of Fusion IQ , said: “… we continue to view this current rally as having legs with maybe another 10-15% up from present levels. However, ultimately we think this rally will fade and we will get a retest of the recent lows (check the history books, we almost always get a retest). How the market handles that retest will tell us a lot with regard to the longer-term picture.”

“While our sense is that the rally has more to go on the upside in the weeks to come, we feel it is still too early to say the final bottom has been put in place,” added Jeffrey Saut of Raymond James .

Back to the venerable Richard Russell , who said: “The rally is running into some hesitation. Transports have been down four out of the last six sessions. When the Averages disagree, it's often a sign of distribution. Let the market have its fun. As far as I'm concerned, the primary trend of the stock market remains bearish although the secondary trend has turned up. When a market becomes too oversold, the secondary correction acts like the ‘release valve' in an over-heated boiler. Some of the steam escapes, and they call that an upward correction.

“Often, these explosive corrections look better than the real thing, Furthermore, they can prove costly to both bulls and bears. Corrections in a bear market are always tricky and deceptive, and I've learned not to fool with them.”

In the extreme bearish camp, Nouriel Roubini shared the following caveat emptor (via Tech Ticker, Yahoo Finance ): “Dear investors, do enjoy this dead cat bounce and bear market sucker's rally … don't wait too long until you jump ship while the financial Titanic hits the next financial iceberg: you may get squeezed and crashed in the rush to the lifeboats.”

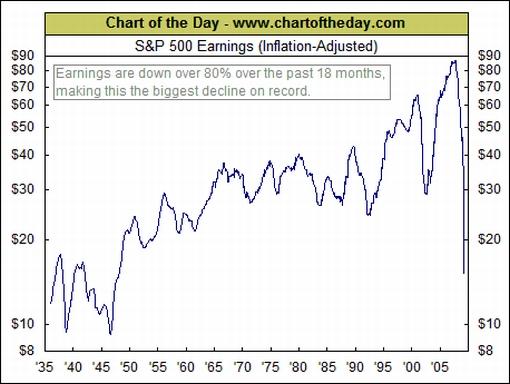

The Achilles heel of the stock market is the uncertainty regarding corporate earnings. The graph below, courtesy of Chart of the Day , illustrates that 12-month, as-reported S&P 500 real earnings have declined over 80% over the past 18 months, making this by far the largest decline on record (the data go back to 1936). “During Q4 2008, the S&P 500 came in with its first negative earnings quarter ever and the amount lost during the quarter was more than the index has ever earned during a single quarter,” said Chart of the Day.

Also, it is important that confidence be restored for the recent gains to be more enduring. The chart below shows the strong historical relationship between the US Consumer Confidence Index and the 12-month change in the S&P 500 Index. One needs to take a view on the direction of confidence, but should it for argument's sake pick up from 30 to 40 by the end of June, the relationship indicates a S&P 500 decline of 30-35% in year-ago terms. Using end-of-quarter prices, this means an Index at between 832 and 896.

Source: Plexus Asset Management (based on data from I-Net Bridge)

Taking one step at a time, the next hurdle is the release of potentially ugly earnings and guidance announcements in April. By then a clearer picture should also start emerging on the results of the Fed's medicine and whether credit markets are thawing and confidence is beginning to improve. Very selective stock picking is in order, but tread carefully otherwise.

For more discussion about the direction of stock markets, also see my recent posts “ Video-o-rama: Fed employs nuclear option ” and “ Technical Talk: Rally continues … “. (And do make a point of listening to Donald Coxe's webcast of March 20, which can be accessed from the sidebar of the Investment Postcards site.)

Invitation

I will again be embarking on a long-haul flight from Cape Town to the US in a week's time. My final destination is San Diego where, amongst others, I will be attending a Richard Russell Tribute Dinner . However, in order to catch up with business associates and “feel” the East Coast economic temperature, I have arranged to connect via JFK and will be spending Tuesday, March 31 in New York City.

I am keen to meet as many of the Investment Postcards readers as possible on the one day I will be in the Big Apple and have scheduled an informal get-together in midtown Manhattan from 17:30 to 19:00 that afternoon. If you are interested in joining me for a drink, and “putting a face to the name”, please get in touch through the “comments” or “contact” sections of the site so that that I can send the details to you.

Economy

“Businesses remain darkly pessimistic across the globe. Sentiment hit a new record low in Asia last week and is close to record lows everywhere else,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Hiring intentions have taken a decided turn for the worse in recent weeks and suggest that there has been no let-up in the massive global layoffs and rising unemployment in March.”

Confidence is very poor across all industries, particularly in manufacturing, where it has never been as bleak. For example, Eurozone manufacturing activity continued to plummet in January, falling by 3.5% from the previous month, when it dropped by a revised 2.7%. In year-ago terms it fell by 17.3% - the steepest fall on record.

Source: Moody's Economy.com

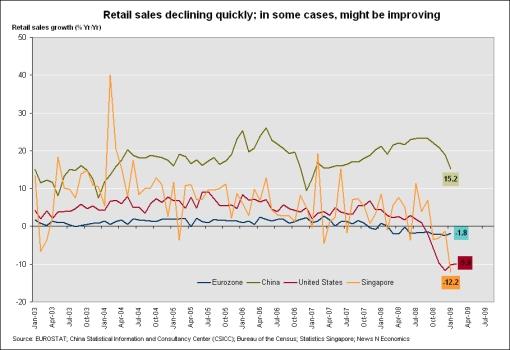

As shown by Rebecca Wilder ( News N Economics ), retail sales are likewise anemic around the world.

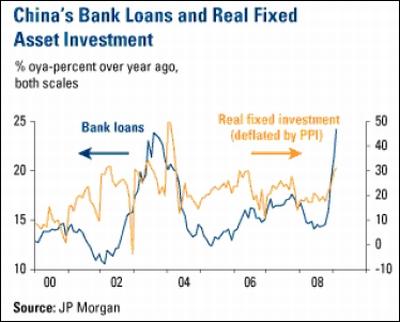

The World Bank has reduced its 2009 growth forecast for China from 7.5% to 6.5%, but indicated that the country's economy was showing “early signs” of stabilization as government-sponsored investment mitigated the negative impact of contracting exports. “In an era when exports may continue to shrink due to an external demand collapse and consumption may prove difficult to stimulate as deflation has arrived, fixed asset investment championed by the government would be vital for China's economic growth this year,” said US Global Investors .

“Although corporate savings played a more important role in financing investment than bank loans in the recent cycle, credit expansion, which has accelerated rapidly since December, remains a key driver for public sector investment which is likely to dominate this year.”

It hardly comes as a surprise that the International Monetary Fund has cut its forecast for global growth this year from +0.5%/-0.5% to -0.5%/-1.0%. According to CEP News , the report said Japan's economy will contract by 5.8% in 2009, that of the US by 2.6% and the Eurozone's by 3.2%. In 2010, the US and Eurozone are expected to see anemic growth, and the Japanese economy is forecast to see a mild annual contraction in GDP.

A snapshot of the week's US economic data is provided below. (Click on the dates to see Northern Trust 's assessment of the various data releases.)

March 19

• Index of Leading Indicators - continued contraction of economic activity

• Jobless claims - new high for continuing claims and insured unemployment rate

March 18

• Fed adopts more aggressive measures to fix the credit machine and facilitate working of the economy

• Higher gas prices mostly responsible for sharp increase in Consumer Price Index

• Current account deficit shrinks as imports fall

March 17

• Multi-family starts lift total housing starts; recovery in home building not there yet

• Core wholesale prices show moderating trend

March 16

• Factory production remains weak, but pace of decline shows moderation

• Home Builders Survey shows flickering signs of stability

“In sum, although the economy remains mired in a severe recession, we have seen nothing of late to dissuade us from our forecast of recovery getting under way in the fourth quarter of this year. In fact, what we have seen of late increases our confidence in the forecast,” concluded Paul Kasriel ( Northern Trust ).

Not disputing the downward momentum in economic data, Binit Panel, economist at Goldman Sachs, asked in a recent research report (via the Financial Times ) “what could go ‘right' for the world economy”. He listed a number of developments that might be potential bright spots.

“First, a stabilization in consumer demand in the US - and an improvement in the UK and Germany.

“Second, an early end to the US housing downturn and a stabilization in the UK housing market.

“Third, the successful operation of the Federal Reserve's term asset-backed securities loan facility, or Talf.

“Fourth, greater international co-operation - for example at the forthcoming G20 meeting.

“Fifth, better signs from the Bric (Brazil, Russia, India and China) emerging market economies - in particular China.”

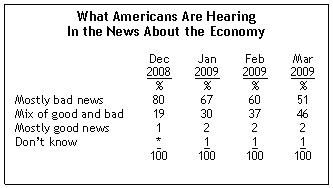

Interestingly, after months of bleak economic news, an increasing proportion of Americans now say they are hearing a mix of good and bad economic news, while fewer say they are hearing mostly bad news. “As has been the case for the last few months, very few say they are hearing mostly good news about the economy,” reported The Pew Research Center for the People & the Press .

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Mar 16 | 8:30 AM | Empire Manufacturing | Mar | -38.2 | -33.0 | -30.80 | -34.65 |

| Mar 16 | 9:00 AM | Net Long-Term TIC Flows | Jan | -$43.0B | NA | $45.0B | $34.7B |

| Mar 16 | 9:15 AM | Capacity Utilization | Feb | 70.9% | 71.1% | 71.0% | 71.9% |

| Mar 16 | 9:15 AM | Industrial Production | Feb | -1.4% | -1.2% | -1.3% | -1.9% |

| Mar 17 | 8:30 AM | Building Permits | Feb | 547K | 500K | 500K | 531K |

| Mar 17 | 8:30 AM | Housing Starts | Feb | 583K | 445K | 450K | 477K |

| Mar 17 | 8:30 AM | PPI | Feb | 0.1% | 0.3% | 0.4% | 0.8% |

| Mar 17 | 8:30 AM | Core PPI | Feb | 0.2% | 0.0% | 0.1% | 0.4% |

| Mar 18 | 8:30 AM | Core CPI | Feb | 0.2% | 0.0% | 0.1% | 0.2% |

| Mar 18 | 8:30 AM | CPI | Feb | 0.4% | 0.2% | 0.3% | 0.3% |

| Mar 18 | 8:30 AM | Current Account Balance | Q4 | -$132.8B | NA | -$137.1B | -$181.3B |

| Mar 18 | 10:30 AM | Crude Inventories | 03/13 | 1942K | NA | NA | +749K |

| Mar 18 | 2:15 PM | FOMC Rate Decision | - | 0.00%-0.25% | NA | NA | 0.00% -0.25% |

| Mar 19 | 8:30 AM | Initial Claims | 03/14 | 646K | 640K | 655K | 658K |

| Mar 19 | 10:00 AM | Leading Indicators | Feb | -0.4% | -0.4% | -0.6% | 0.1% |

| Mar 19 | 10:00 AM | Philadelphia Fed | Mar | -35.0 | -40.0 | -39.0 | -41.3 |

Source: Yahoo Finance , March 20, 2009.

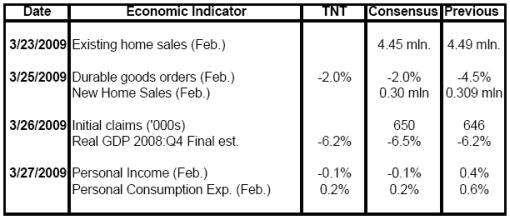

In addition to Fed Chairman Ben Bernanke's testimony to the House Financial Services Committee (Tuesday, 24 March), the US economic highlights for the week include the following:

Source: Northern Trust

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , March 20, 2009.

“You are too concerned about what was and what will be. There is a saying: yesterday is history, tomorrow is a mystery, but today is a gift. That is why it is called the present,” said Oogway ( Kung Fu Panda - hat tip: Charles Kirk ). These words ring especially true as I mourn the sad loss of Bennet Sedacca . He was not only a brilliant strategist and regular contributor to the Investment Postcards site, but also a dear personal friend. Rest in peace, Bennet.

That's the way it looks from Cape Town.

The Wall Street Journal: Obama on The Tonight Show with Jay Leno

“President Obama took to Jay Leno's stage and compared life in Washington to ‘American Idol', where ‘everybody's got an opinion'. The appearance on ‘The Tonight Show with Jay Leno' was itself a sign of just how much the culture has changed in America, where comedy and politics often mix.”

Source: The Wall Street Journal , March 19, 2009.

CEP News: IMF slashes global growth forecast for 2009

“The International Monetary Fund cut its forecast for global growth in 2009. According to the report released on Thursday, global growth will contract between 0.5% and 1.0% this year and expand between 1.5% and 2.5% in 2010.

“The report said Japan's economy will contract 5.8% in 2009, the US economy by 2.6%, and the euro zone economy by 3.2%. In 2010, the US and euro zone are expected to see anemic growth, and the Japanese economy is forecast to see a mild annual contraction in GDP.

“Going forward, the IMF said essential action includes additional easing in monetary policy, and more concerted action to steady markets - namely dealing with toxic bank assets.

“For its part, the US rescue plan was criticized by the IMF for lacking detail.

“Furthermore, there is a serious risk of deflation in some advanced economies, the report said. As for emerging economies, there is a ‘serious risk' they will not have funding, the report added.

“At the G20 meeting on April 2 in London, world nations are expected to consider up to $500 billion in additional funding for the IMF in order to aid emerging economies.”

Source: Megan Ainscow, CEP News , March 19, 2009.

CEP News: FOMC keeps rates unchanged, announces purchase of $300 billion in Treasuries

“The Federal Reserve's monetary policy board left the key interest rate unchanged, as expected, within a target range of zero to 0.25% on Wednesday, but announced it will purchase up to $300 billion in longer-term Treasuries over the next six months.

“The Federal Open Market Committee also committed to purchasing an additional $100 billion in agency debt, and up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year.

“‘Although the near-term economic outlook is weak, the Committee anticipates that policy actions to stabilize financial markets and institutions, together with fiscal and monetary stimulus, will contribute to a gradual resumption of sustainable economic growth,' the statement reads.

“The FOMC said it continues to ‘employ all available tools to promote economic recovery and to preserve price stability', a comment identical to the January statement. The statement also mentioned that ‘economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period', also unchanged from last month.

“Absent from this month's statement is the assessment that ‘conditions in financial markets have improved'.

“The committee said it expects inflation will remain subdued in light of increasing economic slack in the US and abroad. ‘Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term,' the statement said.

“The committee also said it will continue to ‘carefully monitor the size and composition of the Federal Reserve's balance sheet' in light of evolving financial and economic developments.”

Source: Stephen Huebl, CEP News , March 18, 2009.

Reuters: Pimco's Gross - unclear why Fed moved Wednesday

“Pimco's Bill Gross said it is unclear what was behind the Federal Reserve's surprise decision on Wednesday to buy up to $300 billion in Treasuries.

“The move came as the government prepares its latest efforts to resuscitate credit markets with a program aimed at consumer and small business lending.

“But that program faces an uphill battle given the backdrop of public outrage over the fact that taxpayer money will be used to pay $165 million in bonuses for executives at bailed-out insurer American International Group.

“As a result, the shock move by the Fed raises the question of whether the immediate effect of buying Treasuries was deemed necessary in the event these programs fail to produce credit market improvement as quickly as hoped.

“‘It's unclear whether today's policy changes by the Fed are coordinated with the Treasury,' Gross, co-chief investment officer at Pacific Investment Management Co, told Reuters in an interview on Wednesday.

“The uproar over AIG's retention bonuses are seen by many hedge funds, private equity and big money managers as significantly raising the risks associated with partnering with the government on its Term Asset-Backed Securities Loan Facility, or TALF, as well as the Treasury's public-private plan to buy toxic assets from ailing banks.

“An irate US Congress, fuming over AIG's bonus payments to executives after the insurer was bailed out three times using taxpayer dollars, are more likely than ever to change the rules of engagement - possibly retroactively - and that is unnerving money managers at hedge funds, private equity firms and banks on the eve of the long-delayed launch of the government's newest rescue efforts.

“On Thursday, applications from investors are due to participate in the Treasury and Fed's $1 trillion TALF program.

“Gross, who helps oversee more than $800 billion at Pimco, said the economy and, by extension, the financial markets ‘needed a substantial shot of adrenaline'.

“‘The Fed's balance sheet may approach $3.5 trillion - nearly a 100% addition - which will help substitute for the private sector's deleveraging over the past 12 to 18 months,' Gross said.

“‘These actions are high-quality bond-friendly and dollar unfriendly,' Gross said.

“‘To the extent that they are successful and Treasury efforts match these efforts, certain risk assets may benefit as well, although their ultimate prices will reflect the ability of government to successfully reflate.'”

Source: Jennifer Ablan, Reuters , March 18, 2009.

Bill King (The King Report): Why has Ben opted for nuclear option?

“Just a couple days ago, Ben Bernanke said the economy would bottom this year. Citi and GM don't need any more taxpayer funds. Banks have earnings year to date; and stocks are rallying. So why has Ben opted to employ the nuclear option and commence a Weimar Watch? In a word: China

“We thought the main FOMC issue would be its monetization disposition. But we did not think that Ben would play his final option now. Either something systemic is terrifying Ben and the solons or China, as the US's Creditor in Chief, told Hillary the cold hard facts of debtor life.

“And when the US didn't respond fast enough, China publicly expressed their concern about US debt.

“The US cannot jump through the proverbial hoop and buy bonds from China. But it can monetize bonds in the market, which helps China indirectly, and directly if China hits the Fed's syndicate bid.

“However, China cannot be happy that the dollar tanked. This not only nullifies much of the bond market rally in yuan terms, it also strengthens the yuan, which will further crimp China's exports.”

Source: Bill King, The King Report , March 18, 2009.

BCA Research: The Fed gets more aggressive

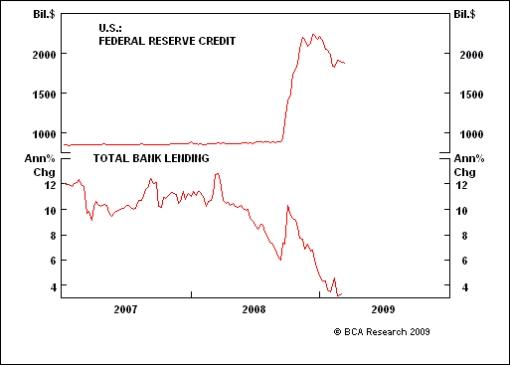

“The FOMC's increasingly aggressive actions highlight a deep concern about the economic outlook. The Fed will run the printing presses until it gets results.

“The FOMC remains very concerned about the economic and financial outlook. The Fed's balance sheet recently has shrunk modestly, but that does not reflect any deliberate actions. The Fed's support of commercial paper has unwound as activity in that market has declined. The Fed's balance sheet should start to grow again as the TALF program ramps up.

“Moreover, the decision to boost purchases of agency debt and mortgages, and to start directly buying Treasurys, suggests that the Fed's balance sheet will mushroom in the months ahead. The key point is that monetary policy will remain highly accommodative and proactive until there are signs that financial intermediation is working more effectively. The Fed's actions should be positive for both stocks and bonds.”

Source: BCA Research , March 19, 2009.

Asha Bangalore (Northern Trust): The Fed's announcement - indicators to track

“The Fed's intention to purchases mortgage backed securities, agency debt, and long dated Treasuries amounting to the sum of $1.15 trillion is an aggressive move. This follows the plethora of programs in place and the $1 trillion TALF program, the first disbursement of funds under TALF will take place next week.

“How would we track the impact of this announcement and other programs in place? The immediate impact should be visible in credit markets as we have seen since the current crisis commenced in August 2007.

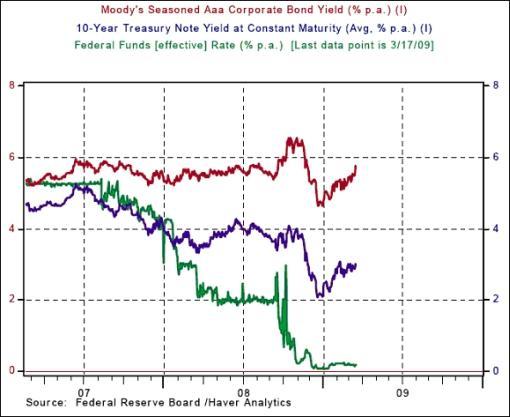

“The chart below illustrates the recent behavior of the federal funds rate, 10-year Treasury note yield and the Moody's Aaa corporate bond yield. The 10-year Treasury note yield closed at 2.51% on March 18 after the FOMC policy statement was published from 3.00% earlier in the day. A statement on the New York Fed's website indicates that the Fed's purchase will focus on the 2- to 10-year sector of the nominal Treasury curve. The purchases will be conducted through the Fed's primary dealers 2-3 times per week. Further details will be available early next week and the plan is to hold the first purchase operation late next week. The objective of the Fed's explicit purchase of long-dated Treasuries is to bring down borrowing costs which in turn should be reflected in lower yields of other private sector securities in the weeks ahead.

“The increase in the purchase of mortgage-backed securities is focused on driving down mortgage rates. The Fed has been successful in this regard since the program was operational from early-January 2009. As of the week ended March 19, the 30-year fixed rate on mortgages was 4.98%, down from 5.47% in early-December and a high of 6.46% in mid-October.

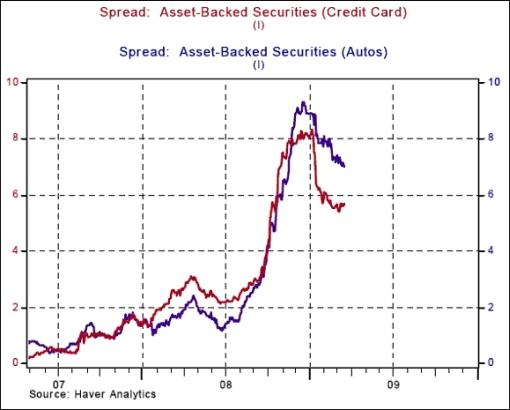

“The TALF program is aimed at unlocking the frozen consumer and small business loan sector. The accomplishments of this program will be visible in the interest spreads with regard to asset-backed securities such as those of credit cards and autos. These spreads have narrowed since their peaks in late-2008. Additional improvements in these spreads would indicate that the Fed's program is working in the desired direction. These actions combined with the fiscal policy stimulus package are expected to get the economy back on track.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 19, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.